In a comprehensive analysis, data.ai's State of Mobile 2024 Report sheds light on the mobile gaming landscape, showcasing a rebound in the market after a brief slowdown in 2022. With a focus on trends, spending patterns, and the emergence of web3 gaming, this deep dive provides valuable insights into the state of mobile gaming as we enter 2024.

State of Mobile Market

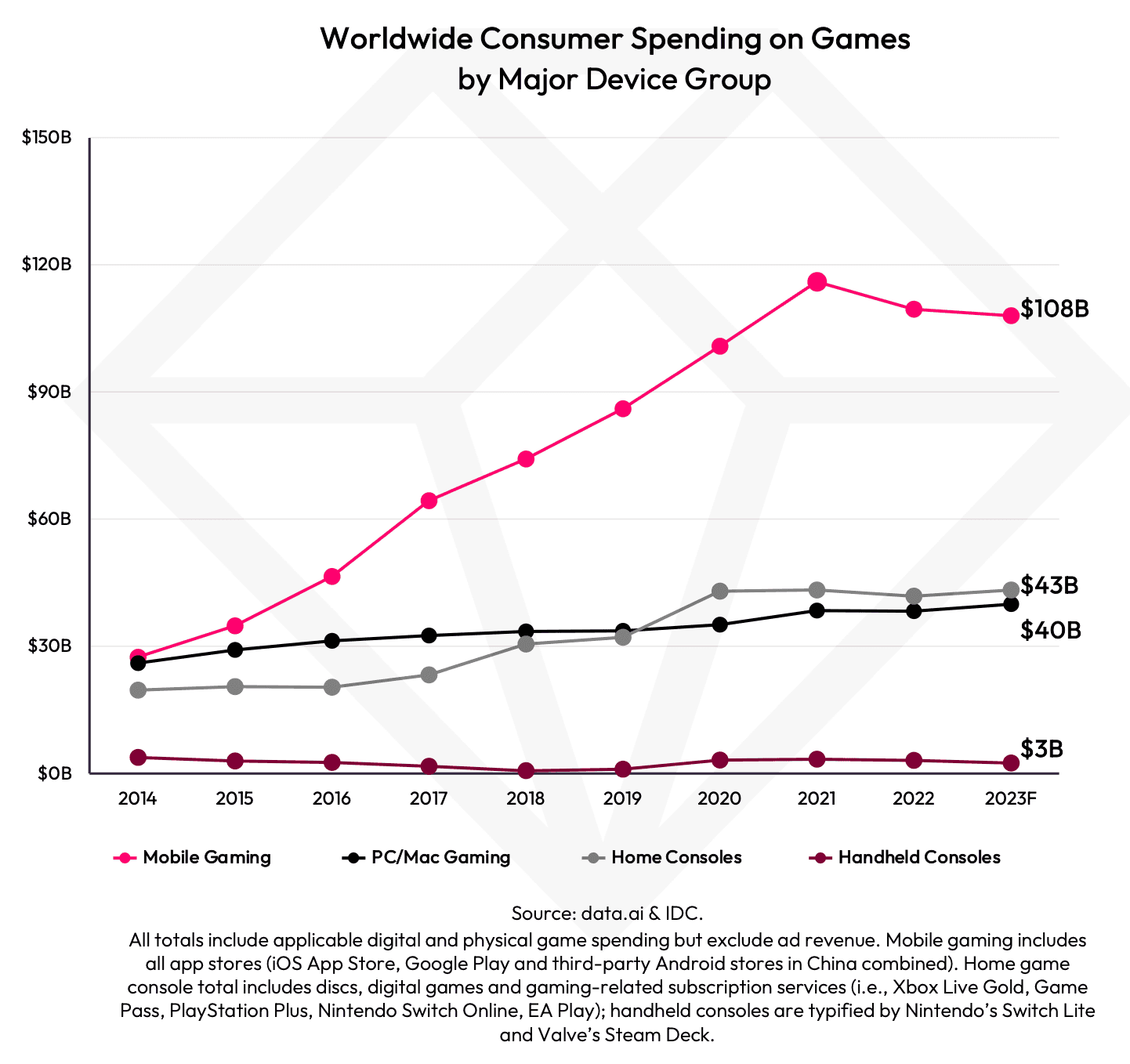

The report reveals a robust mobile market in 2023, with consumer spending hitting a new high at $171 billion, marking a 3% YoY increase. App downloads reached 257 billion, up by 1%, while mobile advertising spending surged by 8% to $362 billion. Users spent a staggering 5.1 trillion hours in mobile apps on Android alone, indicating a 6% increase from the previous year.

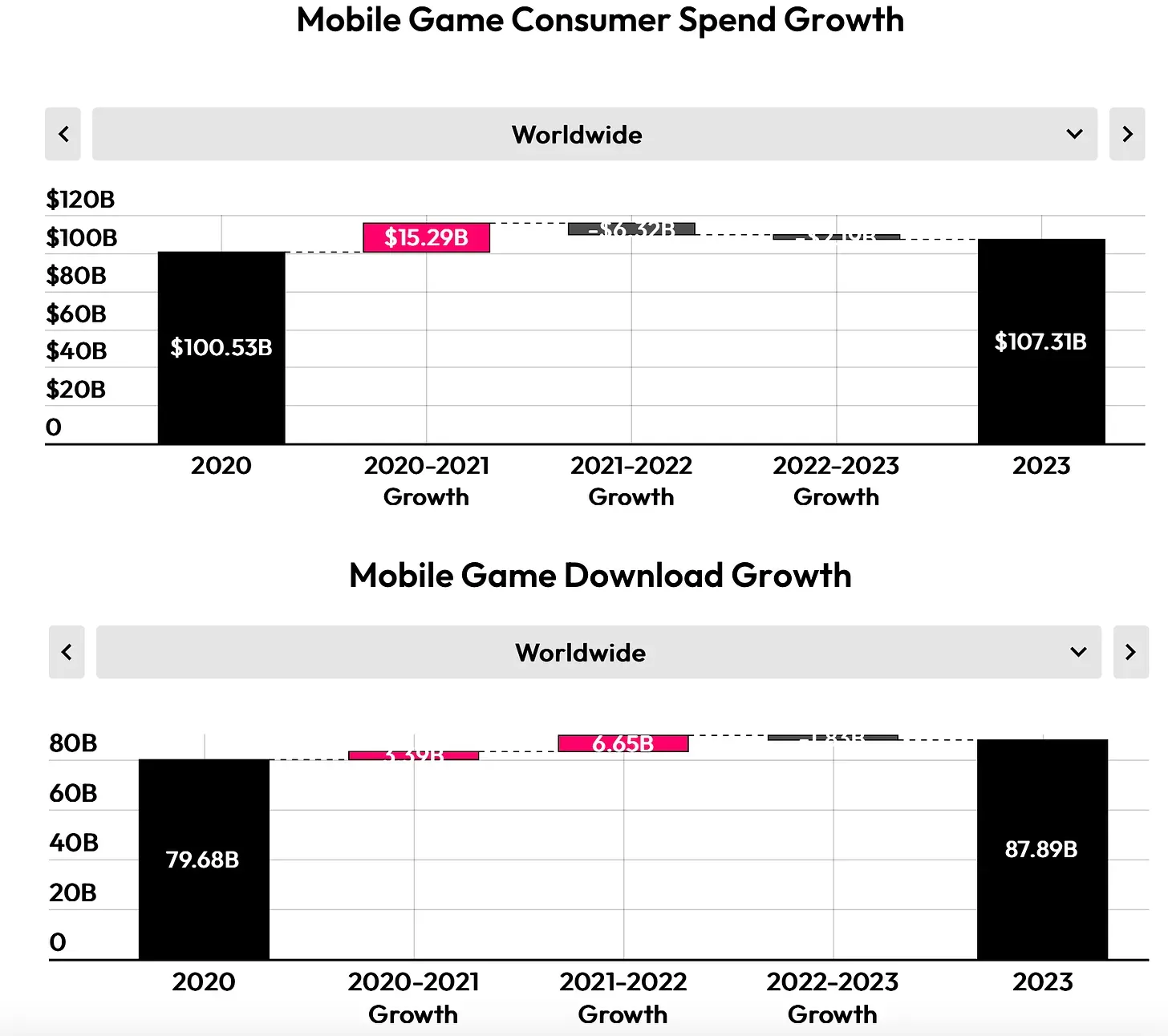

Contrary to the overall mobile market growth, revenue from mobile games saw a 2% decrease, reaching $107.3 billion in 2023. This decline is mainly attributed to a slump in the Chinese market by $4.62 billion. However, positive growth was observed in South Korea, Latin America, and several Western European countries. Notably, a shift in revenue from mobile stores to alternative payment methods and the rise of web and PC gaming contributed to the changing dynamics.

While it is common to talk about a "crisis in the mobile market", it's important to consider a few things. Firstly, part of the revenue has shifted from mobile stores to alternative payment methods. Secondly, an increasing number of games are being released on the web and PC. Thirdly, the decline reported by data.ai is primarily due to the Chinese market, represented only by iOS within the scope of the data.ai research. This does not mean there are no challenges, but examples from miHoYo, Scopely, and Century Games show that great results can be achieved.

Gaming Mobile Market by Downloads

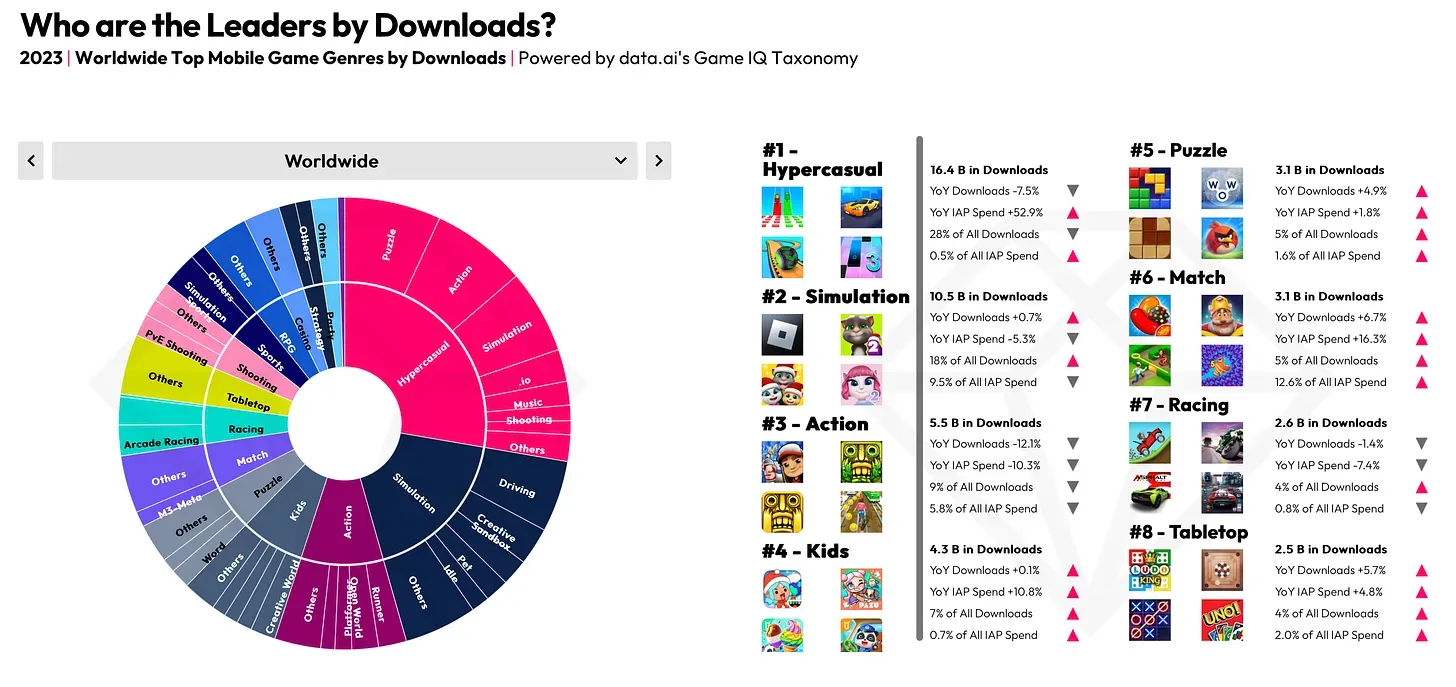

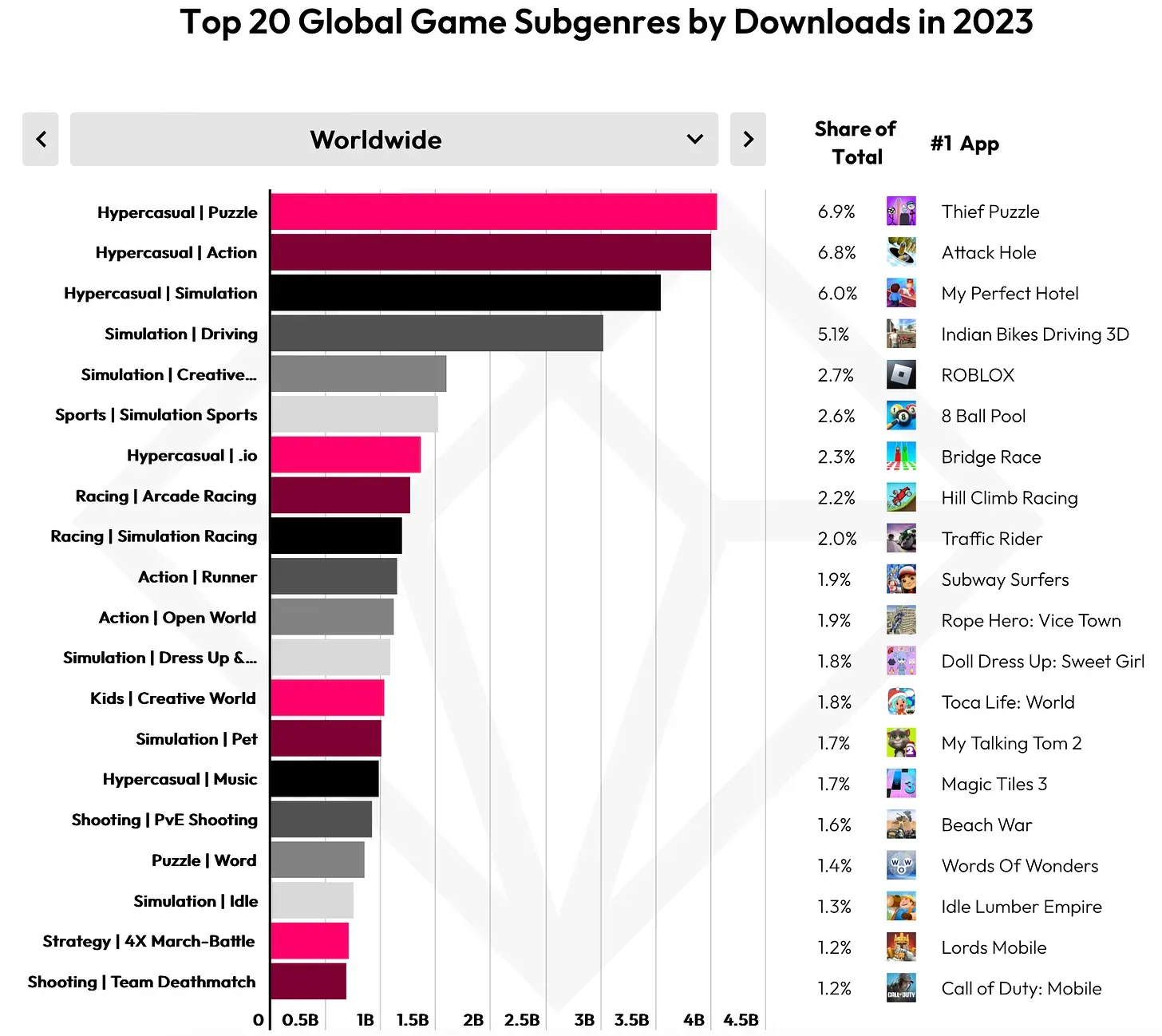

Hyper-casual projects lead in downloads, accounting for 28% of the total volume. In 2023, 16.4 billion hyper-casual projects were downloaded, which is 7.5% less than the previous year. However, the genre saw a 52.9% growth in In-App Purchase (IAP) revenue (now contributing 0.5% of the total IAP market).

Simulation games rank second with 10.5 billion downloads (18% of the total - a 0.7% increase from 2022). This category includes games like Roblox and My Talking Tom. Simulators accounted for 9.5% of the total IAP payments, a decrease of 5.3% from 2022.

Action-adventure games are in third place with 5.5 billion downloads (9% of the total - a 12.1% decrease from 2022). In terms of IAP payments, the genre declined by 10.3% in 2023, now representing 5.8% of the total IAP market with games like Subway Surfers. While a more detailed view is necessary, the fact that new games, on average, are getting more downloads than old ones is a positive sign, indicating people are willing to try new products.

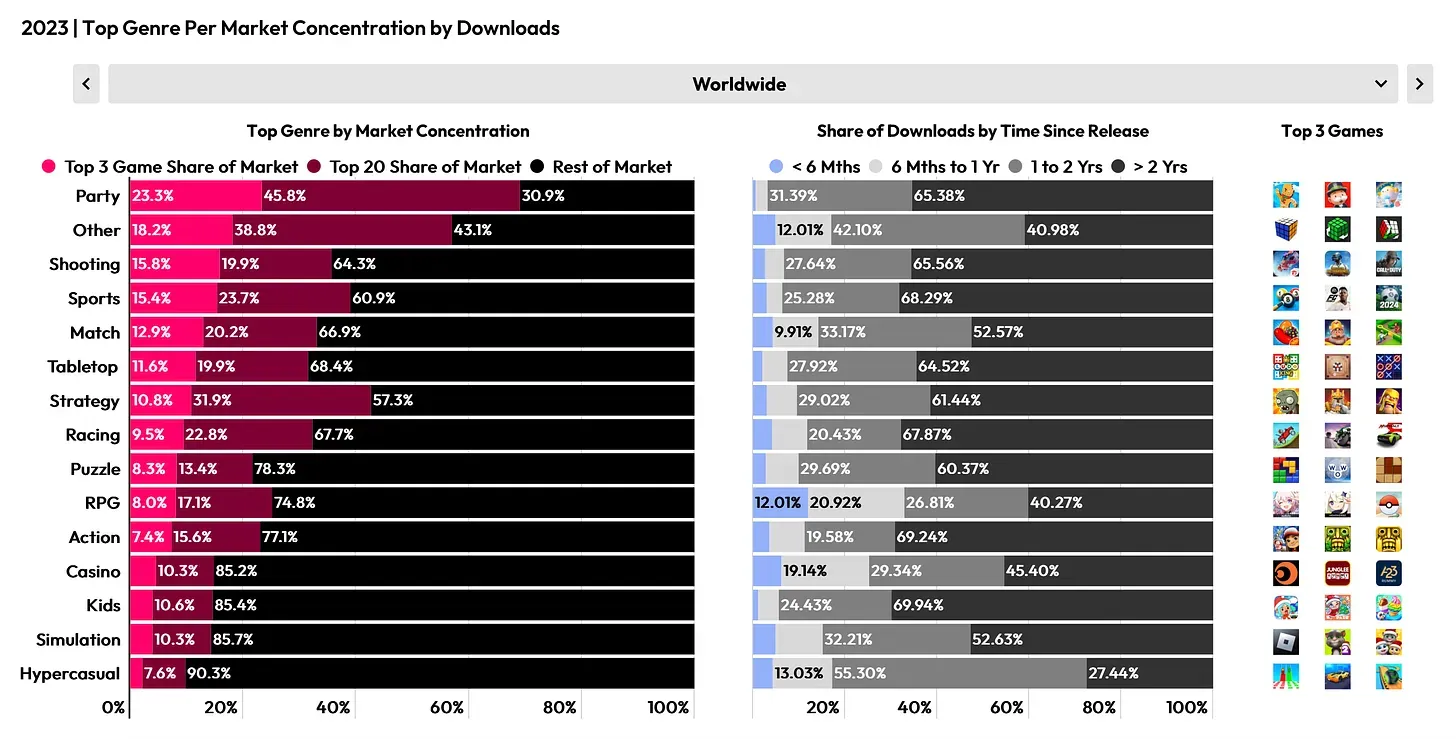

data.ai notes that in 2023, the number of new projects in the top 1000 by downloads was the lowest since 2019. However, until 2020, the average download volume of new games exceeded that of existing projects. In 2021-2022, the situation changed, with older projects generating more downloads on average. But in 2023, this has reversed again, and new games are attracting installations.

Party games (23.3% of top 3 downloads), Shooters (15.8% of top 3 downloads), and Sports games (15.8% of top 3 downloads) are the most challenging genres in terms of competition, if we consider only downloads. Interestingly, in all three genres, 65%+ of downloads are from users who installed games 2 or more years ago. In 2023, RPGs (Team Battle) showed the strongest growth in downloads, thanks to Honkai: Star Rail (+191.98 million downloads).

Gaming Mobile Market by Revenue:

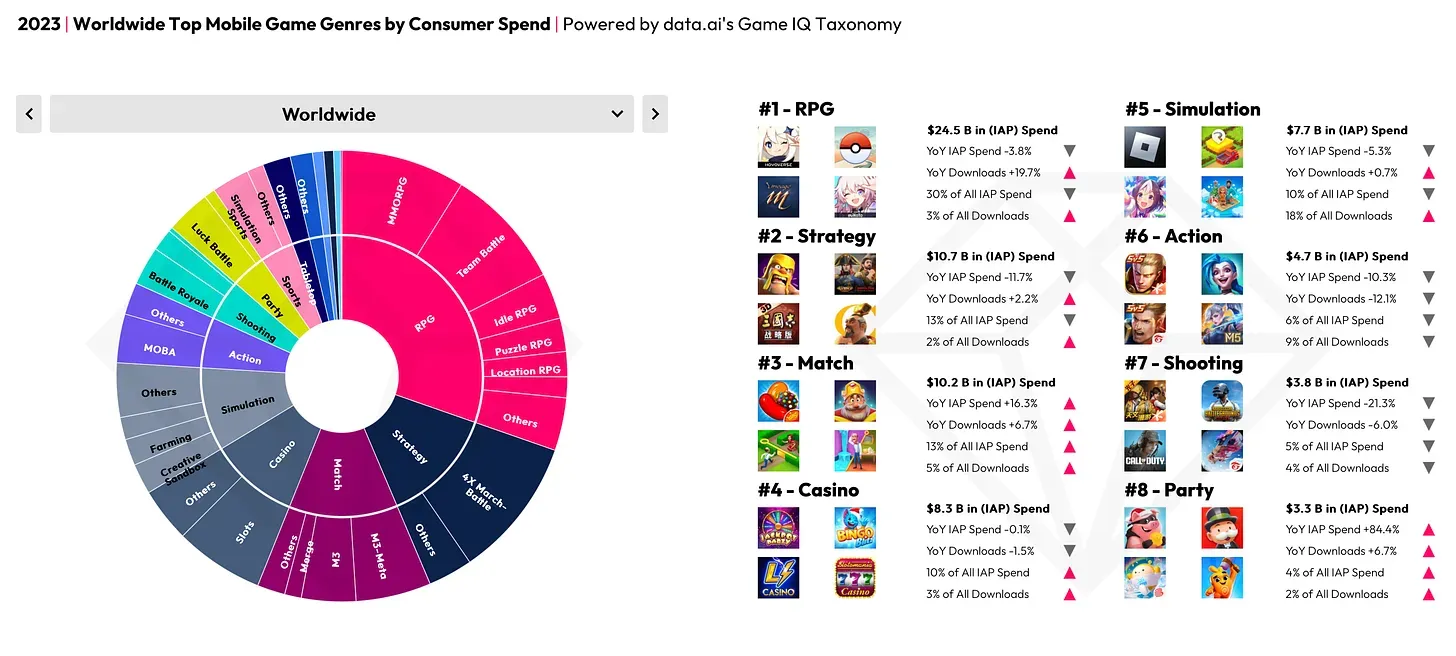

RPG is the most profitable genre globally, bringing in $24.5 billion in 2023. It represents 30% of the entire IAP market, but it experienced a 3.8% decline from the previous year. However, in terms of downloads, the genre grew by 19.7%, accounting for 3% of the market share.

In 2023, Strategy games earned $10.7 billion, securing the second position. The genre accounts for 13% of the total IAP market, with an 11.7% decline in revenue in 2023. Nevertheless, in terms of downloads, the genre grew by 2.2%, holding a 2% market share.

Match projects secured the third position with $10.2 billion. The genre is growing in all aspects; IAP revenue increased by 16.3% (13% of the total volume), and downloads grew by 6.7% (5% of the total volume).

The number of new games entering the top 1000 by revenue in 2023 reached the minimum since 2019, with a slight decline compared to 2022 (and in some markets, no decline at all).

However, the average revenue of new projects compared to old ones shows growth in many markets - the U.S., Canada, the UK, and South Korea. This indicates that new projects entering the top 1000 are approaching the revenue figures of old projects with more content and active Live-ops.

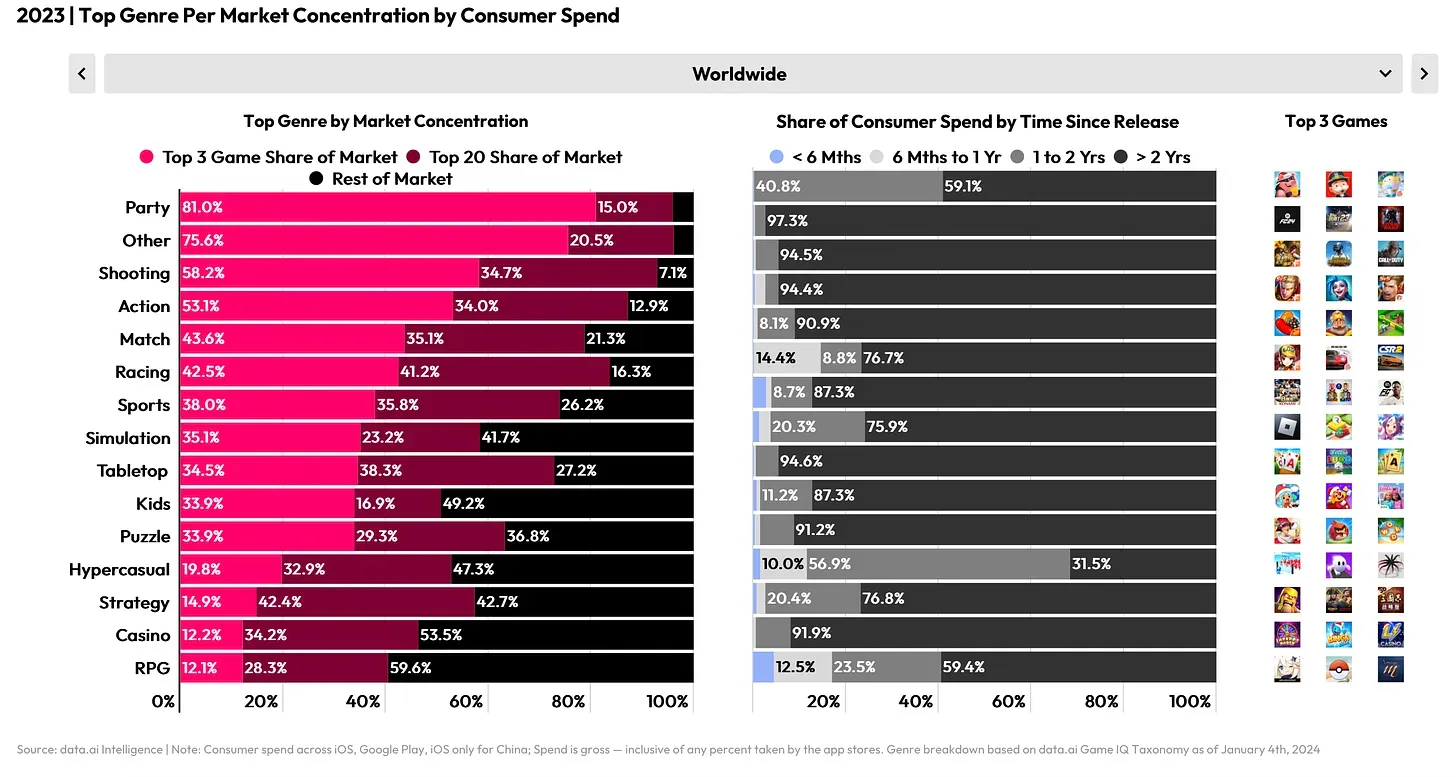

In challenging genres like Party games, Shooters, and Action-adventure games, competition remains fierce, with a significant portion of revenue concentrated among the top three products. The complexity of choosing a genre for a new project is discussed, emphasizing the importance of team expertise and passion. Success stories like Monopoly GO illustrate the potential for newcomers to thrive in competitive categories.

Final Thoughts

As the mobile gaming industry continues to evolve, these findings from data.ai's 2024 report hold particular relevance for the world of web3 gaming. The trends observed in mobile gaming, such as the shift in revenue sources, genre dynamics, and the increasing preference for new gaming experiences, offer valuable insights for developers and investors venturing into the web3 space.

Some examples of web3 mobile games that are currently popular include NFL Rivals, Meta Toy City, Fableborne, Champions Arena, Skyweaver, Axie Infinity, Mighty Action Heroes, League of Kingdoms, Thetan Arena, Genopets, and more.

The challenges and successes documented in the report serve as a roadmap for navigating the intersection of mobile and web3 gaming, emphasizing the importance of user engagement, quality content, and strategic innovation. With the continuous evolution of technology and consumer preferences, the mobile gaming landscape serves as a dynamic precursor, providing valuable lessons for those shaping the future of web3 gaming.

As we move forward, these insights pave the way for a more informed and adaptive approach, fostering growth and innovation in the ever-expanding realm of interactive entertainment.