Hyper-Casual Mobile Games Dominate Korean Market

Explore the nuanced shifts in the 2023 Korean mobile gaming scene. Sensor Tower rankings reveal trends, downloads, and sales dynamics.

In 2023, Korea stood as a powerhouse in global mobile gaming, with the market experiencing a remarkable surge in revenue. According to data from Sensor Tower, mobile game in-app purchase revenue in the Korean market is anticipated to reach nearly $3.6 billion, with overseas manufacturers claiming over 40% of this lucrative sector.

In their latest report, Sensor Tower Store Intelligence highlighted how the Korean mobile gaming sector has witnessed significant changes in 2023. In this deep dive, we examine the data including the download and sales rankings to insights into the trends shaping the industry.

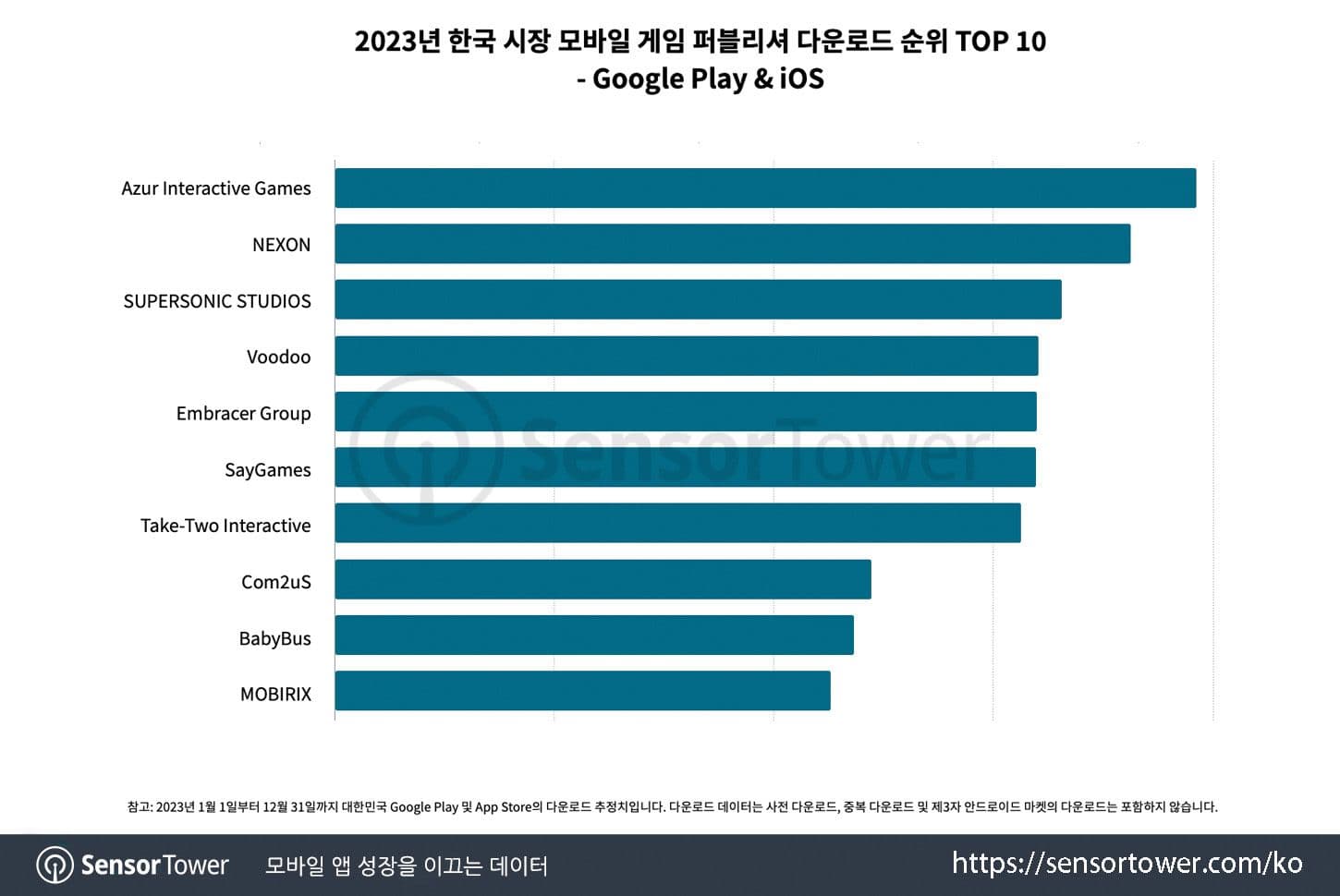

Download Rank

Hyper-Casual Games Prevail

The year 2023 continued to witness the dominance of hyper-casual games, with overseas publishers such as Azur Interactive Games, Voodoo, and SayGames leading the download charts. Korean publishers NEXON, Com2uS, and MOBIRIX made their mark, with NEXON experiencing substantial growth.

NEXON's ascent from 8th to 2nd place was fueled by the sustained popularity of FC Mobile and the successful launch of Kart Rider: Drift. Strategic maneuvers by Voodoo and SayGames in hybrid casual games further solidified their higher rankings.

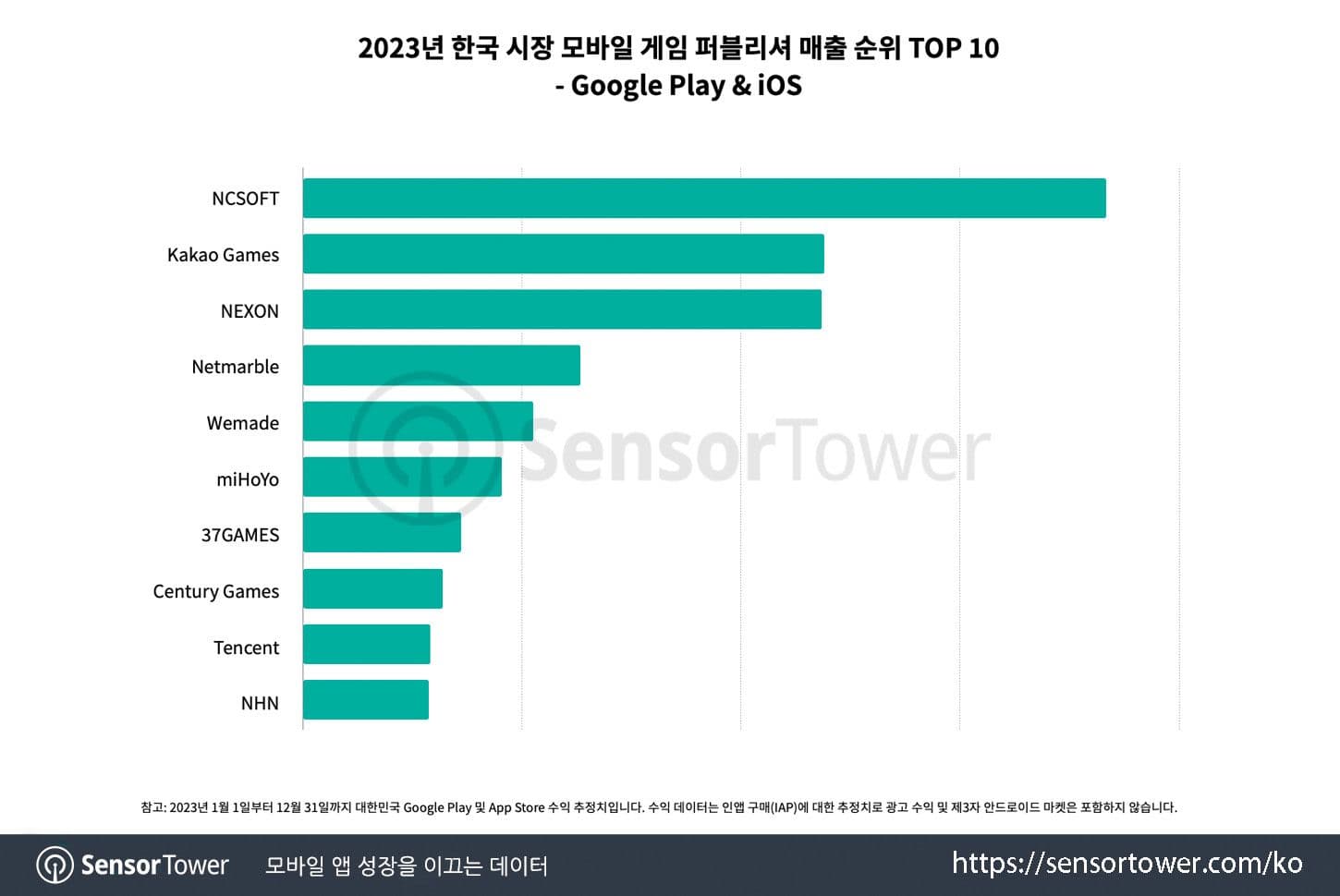

Sales Ranking I

Korean Publishers Maintain Lead

Korean publishers maintained their stronghold in the top 10 sales rankings, with NCSOFT continuing its dominance through the Lineage mobile series. Kakao Games secured the second spot, and NEXON emerged as the sole publisher featured in both download and sales rankings.

Wemade's impressive leap from 25th in 2022 to 5th in 2023, driven by the success of Night Crow, added a noteworthy narrative to the competitive landscape.

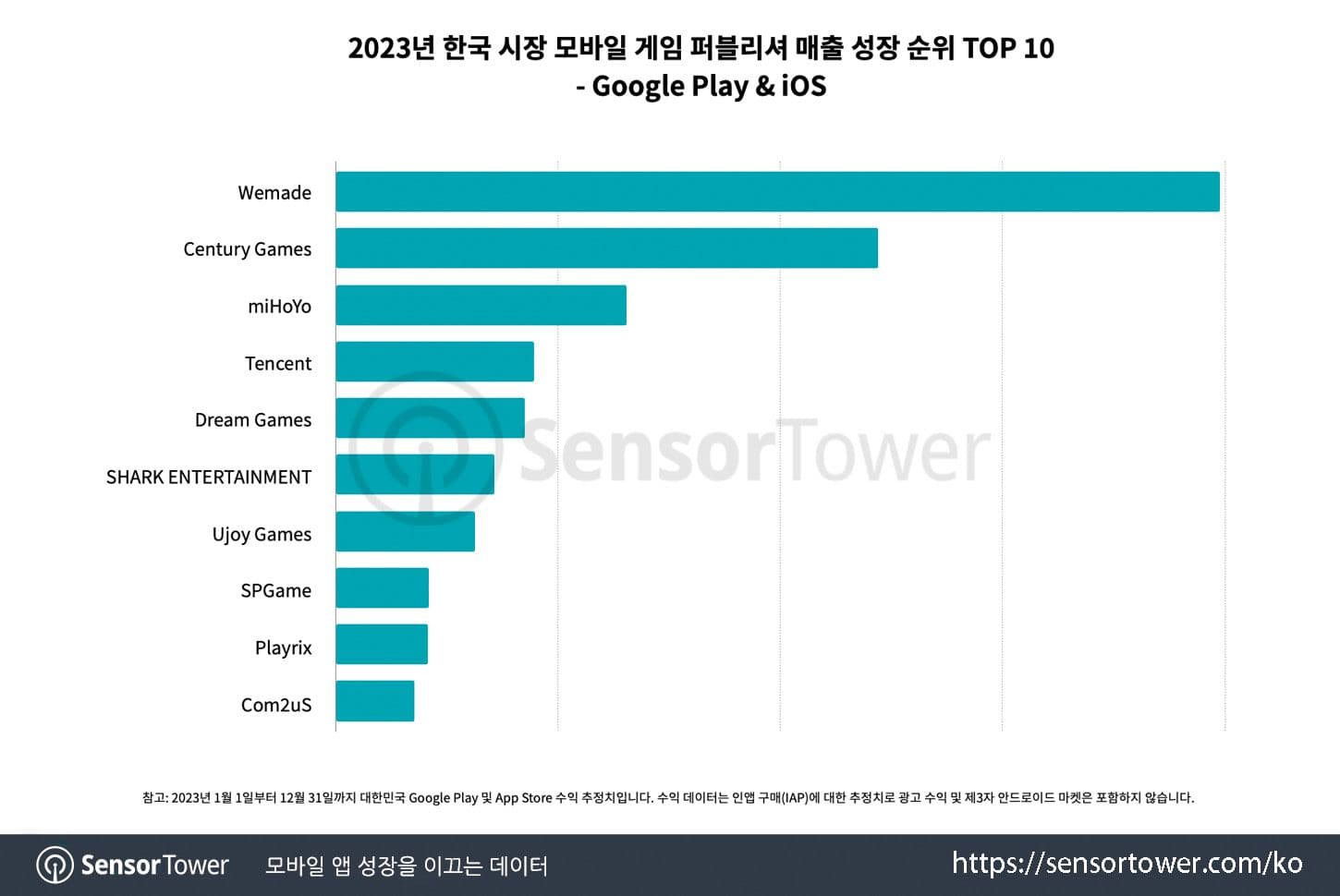

Sales Ranking II

International Publishers Gain Ground

International publishers like miHoYo, 37GAMES, Century Games, and Tencent made significant strides in the Korean market. miHoYo secured the 6th position with Collapse: Starrail and Genshin. The proportion of overseas publishers in sales reached a record 20%, indicating a substantial increase.

Century Games, miHoYo, and Tencent also featured in the Sales Growth ranking, underlining their positive performance in the market.

Relevance to Web3

As the gaming industry embraces the era of web3, the Korean mobile gaming market is not left untouched. Blockchain-based games, decentralized platforms, and NFT integrations are gradually influencing the landscape. While no specific rankings were provided in this report, the increasing discussions around the adoption of web3 technologies, especially in Korea, suggest a potential paradigm shift in the gaming sector.

For example, WEMIX, a subsidiary of the South Korean gaming giant Wemade discussed above, recently announced its partnership with Chainlink Labs. The collaboration signifies Wemade's strategic move to reshape the web3 gaming landscape. At the core of this partnership is the integration of Chainlink's Cross-Chain Interoperability Protocol (CCIP) into the Unagi omnichain ecosystem.

Another example is "MapleStory M”, the MMORPG developed by Nexon and NSC, which achieved remarkable success since its launch in October 2016. Fast forward to September 2023, and this mobile sensation has clocked an impressive $600 million in cumulative sales, with one significant milestone that has the industry buzzing: a staggering $55 million in just 35 days after entering the highly competitive Chinese market.

Nexon is one of the world’s largest game publishers having revolutionized the industry when it pioneered the free-to-play business model over two decades ago. Now, its flagship MapleStory franchise is being ushered into the world of web3.

MapleStory Universe will be a Virtual World ecosystem where various games and applications made in MapleStory interact with NFTs. All NFTs are owned by each user and can be traded and transferred between users within the MapleStory Universe. Here is a breakdown of what players can expect moving forward:

- MapleStory N is the evolution of the original “MapleStory” infused with blockchain technology and NFTs to define a new MMORPG experience.

- MapleStory N Mobile is the blockchain version of “MapleStory Mobile” that allows players to enjoy MapleStory NFTs on their phones.

- MapleStory N Worlds is a sandbox platform where players can participate as creators as well to build various blockchain games.

- MapleStory N SDK is a set of tools that will enable developers and creators to make their own apps and realize new ideas beyond games.

Web3's promise of increased transparency, ownership, and decentralized experiences is gradually finding its place within the Korean gaming ecosystem. Industry stakeholders are keenly observing how these technological advancements will shape the future of gaming, adding an extra layer of anticipation to the vibrant mobile gaming scene in South Korea. These insights from Sensor Tower offer a nuanced understanding of the Korean mobile gaming industry in 2023.

About the author

Eliza Crichton-Stuart

Head of Operations

Updated:

February 18th 2024

Posted:

January 25th 2024