The Drake Star Global Gaming Report for Q2 2024 indicates that private financing deals have remained stable, with 180 deals this quarter, a slight decline from 191 in Q1. Blockchain gaming (also called web3, NFT or crypto gaming) emerged as the leading sector, attracting 40% of the total deals and accounting for 44% of the disclosed deal value.

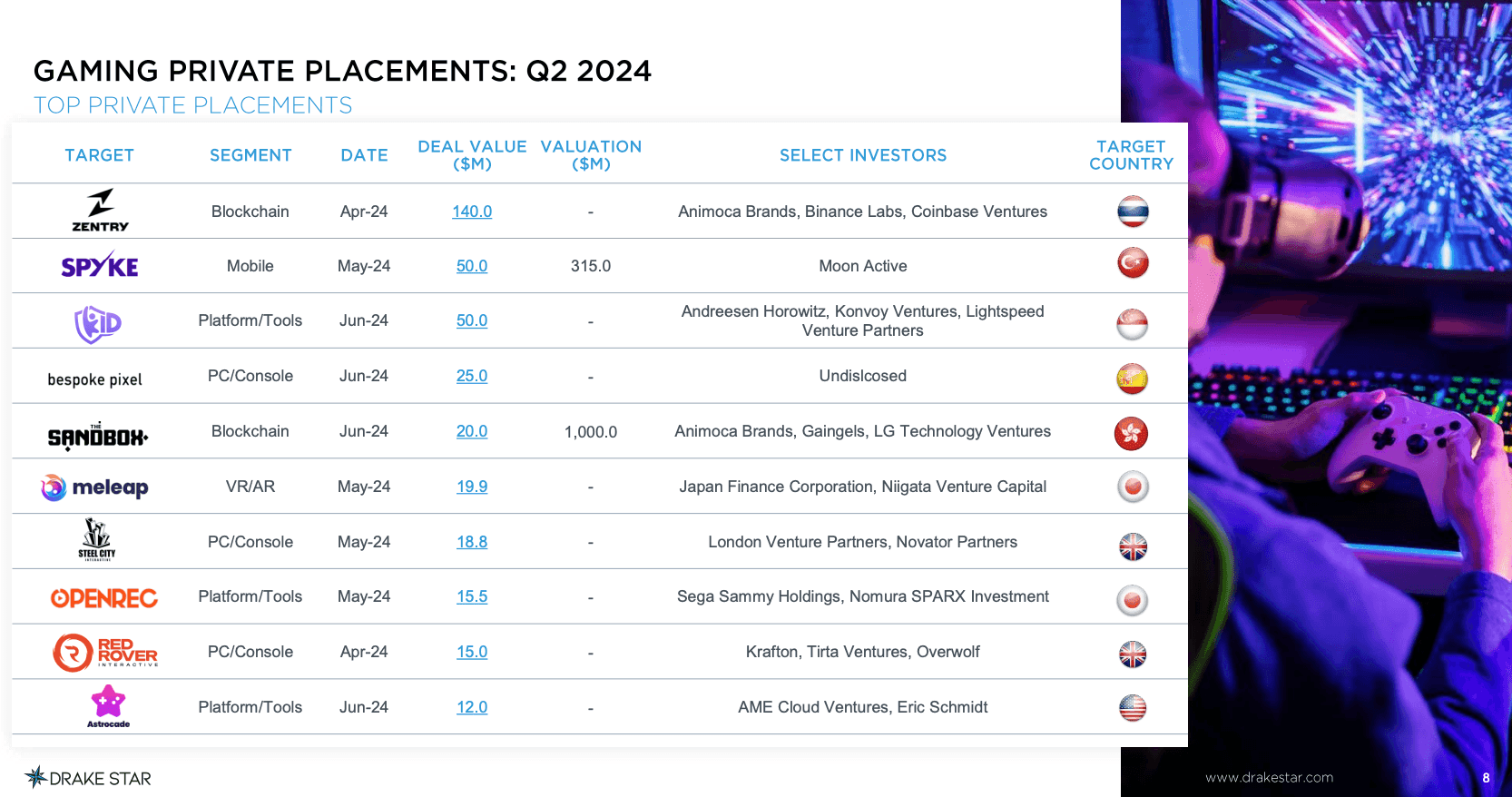

The largest funding round was Zentry's $140 million raise, followed by Spyke and k-ID, each securing $50 million. Early-stage companies dominated the landscape, making up 93% of all deals. Asia led in the largest financings, followed by Europe/UK, Turkey, and the U.S. Active venture capital firms included Bitkraft, Sfermion, Shima Capital, and Play Ventures.

Drake Star Global Gaming Report Q2 2024

Web3 Gaming Dominates in Q2

The report underscores the increasing significance of blockchain gaming within the broader industry. Blockchain gaming attracted a notable 40% of total deals and 44% of the disclosed deal value. This trend highlights growing investor confidence in the potential of blockchain technology to drive innovation and enhance traditional web2 gaming experiences.

The top gaming private placements for Q2 featured three large web3 gaming deals. These included Zentry's $140 million (led by Animoca Brands, Binance Labs, and Coinbase Ventures), k-ID's $50 million (led by a16z, Konvoy Ventures, and Lightspeed Venture Partners), and The Sandbox's $20 million (led by Animoca Brans, Gaingels, and LG Technology Ventures). Further illustrating the sector's appeal.

Regional Insights

Asia led the regions in terms of financing, followed by Europe/UK, Turkey, and the U.S. This geographical distribution of investments indicates a global interest in the gaming sector, with a significant focus on blockchain technology. The strong activity in Asia is particularly notable, as it suggests the region's growing influence and potential as a hub for gaming innovation.

Top Gaming Private Placements: Q2 2024

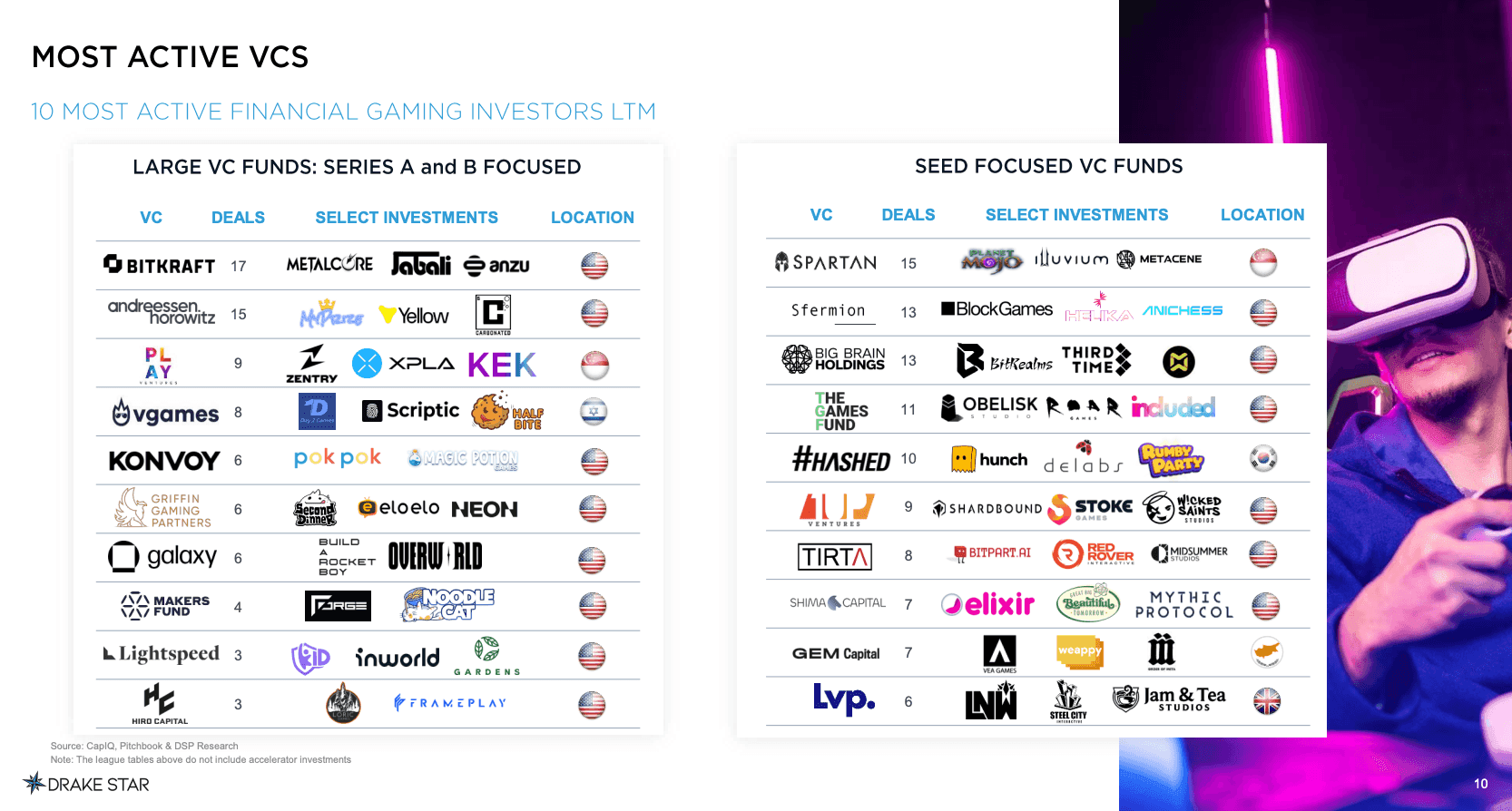

Major Players in Venture Capital

Prominent VC firms played a critical role in this quarter's investment activities. BITKRAFT, with 17 deals including investments in Metalcore and Illuvium, led the charge. A16z followed closely with 15 deals, backing projects like My Prize and Carbonated. Play Ventures secured 9 deals, notably supporting Zentry, XPLA, and KEK. Other active VCs included Vgames and Konvoy, each with 8 deals, and Griffin Gaming Partners and Galaxy, each with 6 deals.

Large VC Funds: Series A and B Focused

- BITKRAFT - 17 deals (Metalcore, Jabali, Anzu)

- A16z - 15 deals (My Prize, Yellow, Carbonated)

- Play Ventures - 9 deals (Zentry, XPLA, KEK)

- Vgames - 8 deals (Day 2 Games, Scriptic, Half Bite)

- Konvoy - 8 deals (Pokpok, Magic Potion Games)

- Griffin Gaming Partners - 6 deals (Second Dinner, Eloelo, NEON)

- Galaxy - 6 deals (Build a Rocket Boy, Overworld)

- Makers Fund - 4 deals (Forge, Noodle Cat)

- Lightspeed - 3 deals (Kid, Inworld, Gardens)

- Hiro Capital - 3 deals (Loric Games, FramePlay)

Who Are The Most Active VCs in Web3 Gaming

Focus on Early-Stage Investments

Early-stage investments were a key trend, with VCs like Spartan, Sfermion, and Big Brain Holdings leading the way. Spartan was highly active, with 15 deals including investments in Planet Mojo and Illuvium. Sfermion also made 13 deals, backing projects like BlockGames and Helika. The emphasis on seed-stage funding suggests a strong belief in the future potential of emerging gaming technologies.

Seed-Focused VC Funds

- Spartan - 15 deals (Planet Mojo, Illuvium, Metacene)

- Sfermion - 13 deals (BlockGames, Helika, Anichess)

- Big Brain Holdings - 13 deals (BitRealms, ThirdTime)

- The Games Fund - 11 deals (Obelisk Studios, Roar Games, Included)

- Hashed - 10 deals (Hunch, Delabs, Rumby Part)

- 1Up Ventures - 9 deals (Shardbound, Stoke Games, Wicked Saints Studios)

- Tirta - 8 deals (Bitpart.AI, Red Rover Interactive, Midsummer Sutios)

- Shima Capital - 7 deals (Elixir, Great Big Beautiful Tomorrow, Mythic Protocol)

- Gem Capital - 7 deals (VEA Games, WeAppy, Order of Meta)

- Lvp - 6 deals (LNW, Steel City Interactive, Jam & Team Studios)

Top Most Active VCs

Final Thoughts

The findings from the Drake Star Global Gaming Report for Q2 2024 underscore the robust and evolving nature of the gaming investment landscape, particularly within the blockchain sector. The substantial interest and capital directed towards blockchain gaming, highlighted by major funding rounds and the active participation of top venture capital firms, signal a significant shift towards innovative technologies in gaming.

As early-stage companies continue to attract the majority of investments and regions like Asia lead in financing, the future of gaming appears poised for transformative growth. The sustained support from prominent VCs indicates a strong belief in the potential of blockchain to redefine gaming experiences globally, setting the stage for continued advancements and industry evolution. For more information, you can read the full report here.