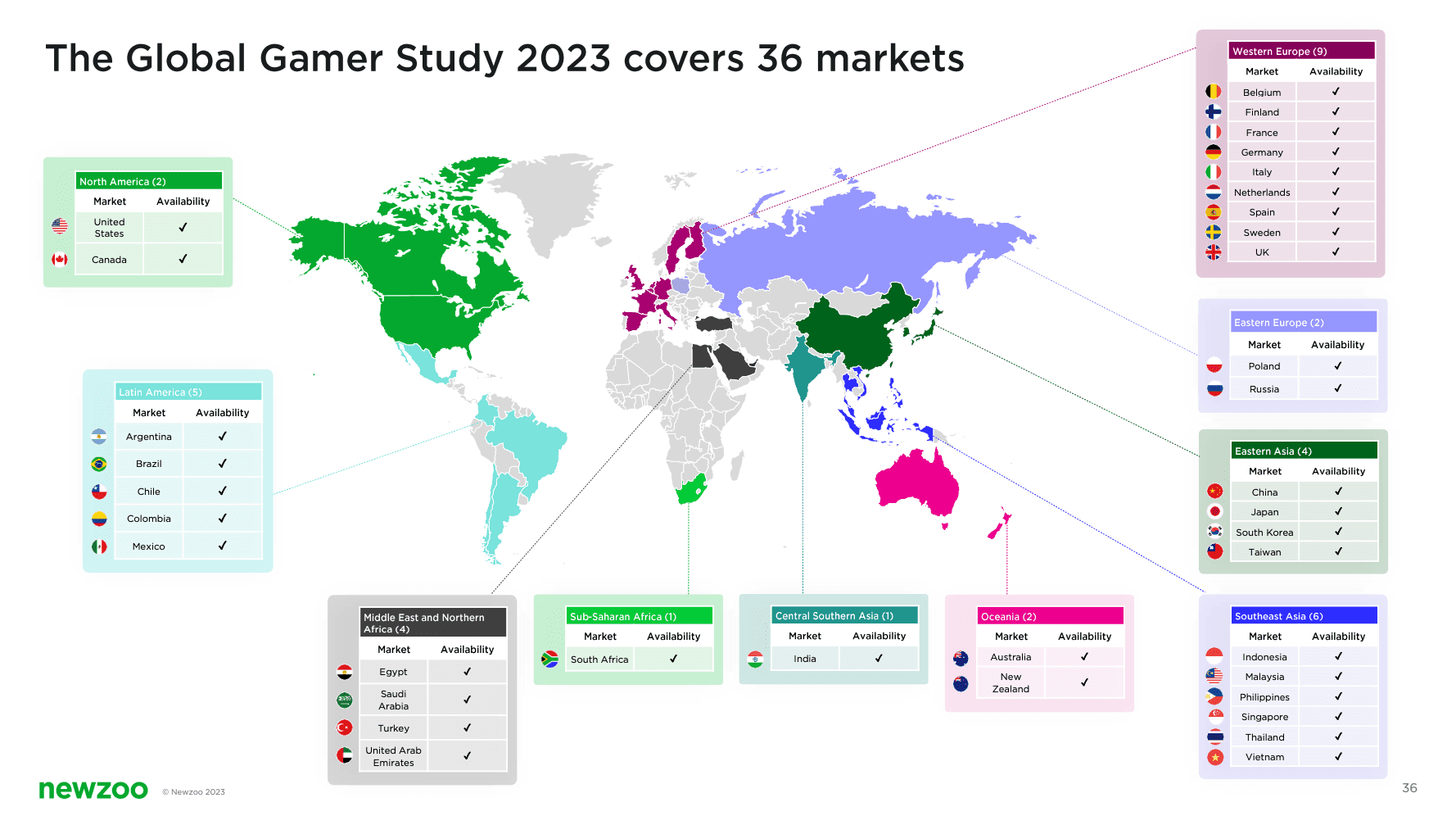

In the fast-paced realm of gaming, 2023 promises to be a big year as Newzoo's latest report unveils the global gaming industry is set to reach unprecedented heights. The user research for the original report is based on a survey of more than 74,000 people spanning 36 countries from around the world aged 10 to 65. In this deep dive, we add insights to a prior article published featuring the newest data from Newzoo. This write-up will summarize the key findings and highlight important insights for the future of web3 gaming.

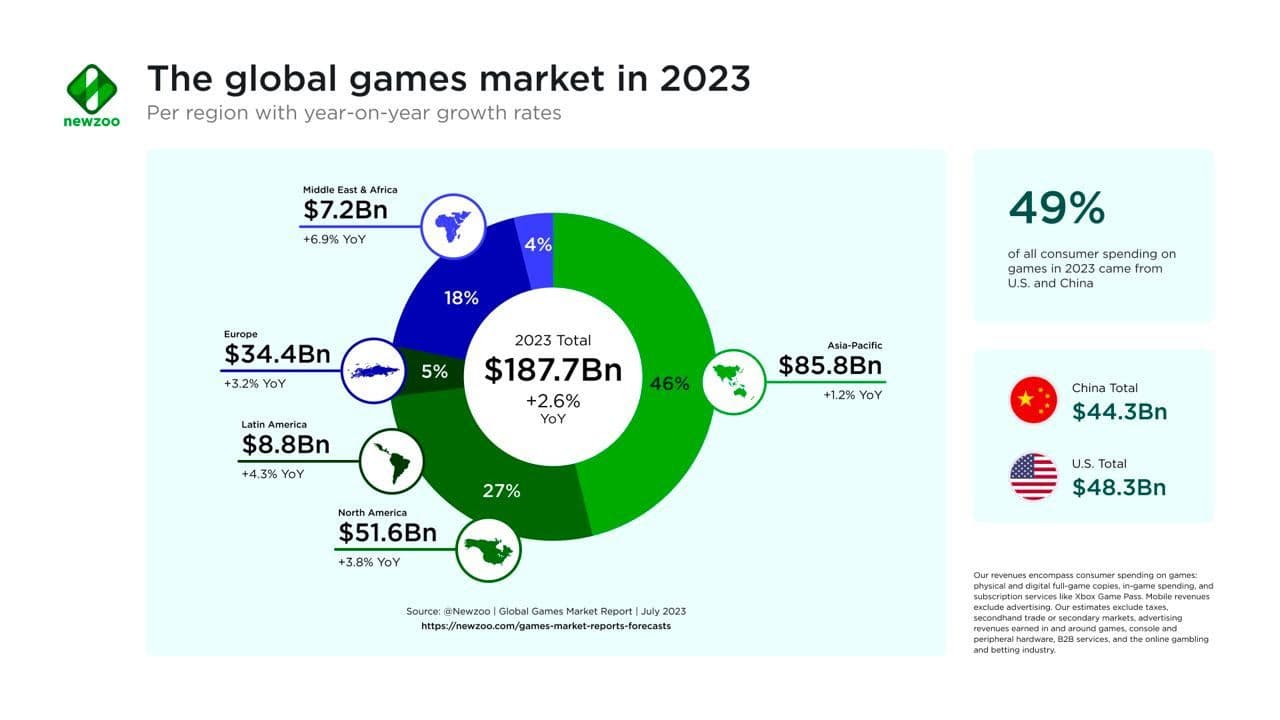

The gaming market is slated to surge to $187.7 billion, a 2.6% increase from the previous year. Diverse revenue streams contribute to this staggering figure, with mobile gaming leading at $92.6 billion, closely followed by the console market, which experienced an impressive 7.4% growth, reaching $56.1 billion. The PC segment shows resilience with $37.1 billion in revenue, overcoming the decline in browser PC games.

The geographical landscape of gaming revenue is equally fascinating. The Asia-Pacific region dominates, comprising 46% of the total revenue, followed by North America at 27%, Europe at 18%, Latin America at 5%, and the Middle East and Africa at 4%. The MENA region emerges as the fastest-growing, exhibiting a remarkable 6.9% annual growth rate. However, Korea stands as a powerhouse in global mobile gaming, with the market experiencing a remarkable surge in revenue. According to recent data from Sensor Tower, mobile game in-app purchase revenue in the Korean market is anticipated to reach nearly $3.6 billion, with overseas manufacturers claiming over 40% of this lucrative sector.

In terms of users, the global gaming community is set to expand to 3.38 billion individuals, marking a 6.3% increase from the previous year. The majority, 53%, is concentrated in the Asia-Pacific region, with notable growth in the Middle East and Africa at 12.3% per year. The number of paying gamers is projected to grow by 7.3% to 1.47 billion, with an expected annual growth rate of 4.7% leading to 1.66 billion paying gamers by the end of 2026.

In a recent deep-dive, we covered key findings from the 2023 Unity report highlighting a notable surge in toxic behavior within multiplayer games. Our detailed analysis explored data collected from the United States, the United Kingdom, and South Korea, involving 2522 players and 407 developers. Our summary of the report uncovered a growing prevalence of toxic encounters and delved into common forms of toxicity, along with the responses from both players and game creators. Player toxicity in games is important for industry leaders to be aware of. As the number of gamers globally grows at unprecedented rates it is vital to learn more about ways to combat toxicity in games, ensuring a more enjoyable experience for players and payers.

When it comes to industry giants, Tencent reigns supreme as the largest public gaming company, raking in a staggering $7.556 billion in 2023. Microsoft and Activision Blizzard combine forces to secure the second position globally with $5.413 billion, while Sony follows closely at $4.38 billion.

The report highlights the dynamic landscape of cloud gaming, anticipating a surge from 43.1 million paying users in 2023 to a projected 80.4 million by 2025. Meanwhile, trends shaping the industry include the persistent success of live-service games, the transformative impact of AI in development processes, and the rising popularity of complementary gaming devices like the Steam Deck and Nintendo Switch. Mobile game studios navigate changing platform regulations, emphasizing the crucial role of user-generated content (UGC), the creative economy, and influential opinion leaders in gaming and studio success. Additionally, the report underscores significant developments, such as Apple's entry into the VR space and Meta's continued belief in the same direction.

As the gaming industry charts new territories and embraces technological advancements, the relevance of these findings to web3 gaming cannot be overstated. The emergence of user-generated content, AI-driven development, and the growing influence of complementary gaming devices align seamlessly with the principles of web3, setting the stage for a more decentralized, interconnected, and player-centric gaming future. Newzoo's report not only provides a snapshot of the present gaming landscape but also serves as a compass guiding the industry toward the promising horizons of web3 gaming.