In the world of web3 gaming, the third quarter of 2023 has proven to be a dynamic and transformative period. While the surface may have appeared relatively calm, beneath it, significant shifts and exciting developments have been taking place. In this deep dive, we unpick the latest data from DappRadar and The Blockchain Game Alliance (BGA), looking at on-chain metrics that have shaped the web3 gaming industry in the past quarter.

Industry Overview

The web3 gaming sector has maintained its influential position within the dapp hierarchy, even as it experienced noticeable fluctuations in momentum. It's important to note that these fluctuations do not signify a decline in the sector's prominence but rather reflect an evolving landscape as other industries start to gain traction.

A noteworthy development this quarter has been the rise of social dapps, which, although they hold a modest 11% market share, have witnessed a surge in user engagement. The incorporation of gamification elements in social dapps has drawn parallels with the world of web3 gaming.

Within the web3 tier, Wax has continued to lead in key metrics, such as Unique Active Wallets (UAWs) and transaction counts. However, this quarter has seen the emergence of Skale and zkSync as rising in the ranks. These web3 platforms have attracted significant interest, particularly from the gaming community. The continued evolution of the web3 gaming industry and the entry of new players like Skale, Base, and zkSync indicate a promising future for web3.

Top Games

The third quarter of 2023 has showcased familiar leaders in the world of web3 games. Alien Worlds and Splinterlands have consistently maintained top positions in rankings. Additionally, the "move-to-earn" concept gained more traction, with Sweat Economy and SuperWalk making their mark based on unique active wallets.

Diving into transaction volumes, it's no surprise that Axie Infinity remains at the forefront. Its ever-increasing popularity, complemented by recent updates, solidifies its position as a leader. Gods Unchained has seen a substantial uptick in trading volume, outshining long-standing NFT collections, and signaling its growing influence.

Notably, Treasure DAO, a casual gaming studio, has gained significant attention. This trend of casual gaming studios infiltrating the top ranks hints at a potential shift in the web3 gaming landscape. The next quarter promises to shed more light on this emerging trend.

Virtual Worlds Overview

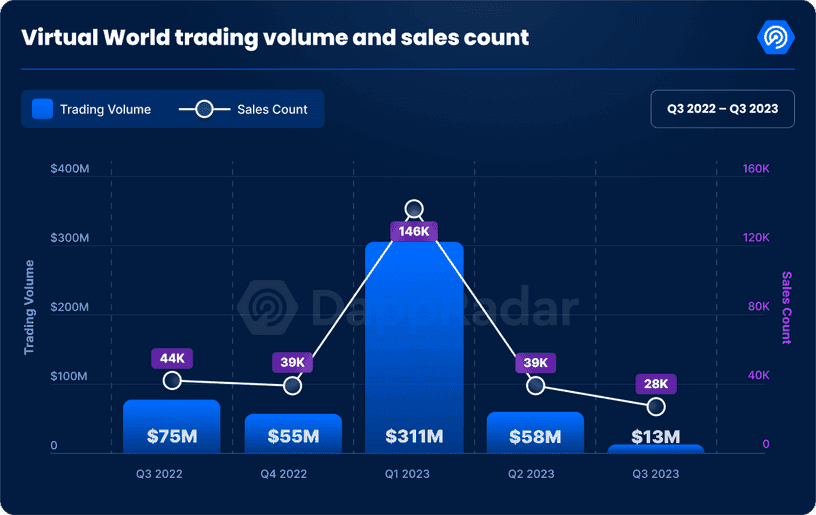

The third quarter brought a dip in trading volume and sales figures for virtual worlds, although the enthusiasm for metaverse and virtual world dapps remains unwavering. Animoca Brands' securing of $20 million in funding for its Mocaverse initiative stands as a testament to the enduring interest in this space.

Mocaverse aiming to become a cornerstone for web3 gaming, metaverse culture, and entertainment, redefining the narrative of virtual worlds. A more comprehensive analysis of the metaverse in Q3 will be provided in BGAs next report.

Investment Overview

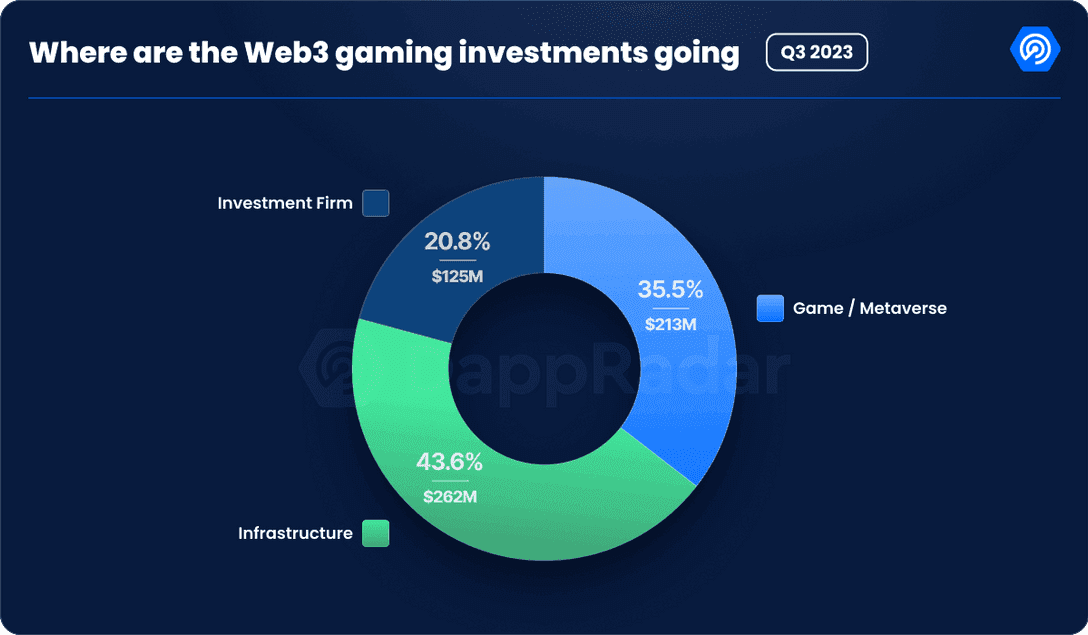

Q3 2023 witnessed a notable accumulation of $600 million in investments for web3 gaming projects, contributing to a year-to-date total of $2.3 billion. While this represents 30% of last year's funding, it's crucial to consider the unique market dynamics of 2023.

A significant highlight this quarter is a16z's Speedrun accelerator, which plans to invest up to $75 million into pre-seed startups blending gaming with cutting-edge technology. A noteworthy trend this year is the substantial allocation towards investment firms, indicating strong confidence in the future of web3 gaming.

Investments made in prior years are expected to yield results in the coming months, with highly anticipated web3 games entering various playtest phases.

Final Thoughts

Q3 2023 provided a nuanced view of the web3 gaming industry. While investments have reached $600 million this quarter and $2.3 billion for the year, the fact that this represents only 30% of last year's funding activity underscores the need to consider external market conditions.

Web3 gaming's landscape is characterized by familiar leaders like Alien Worlds and Axie Infinity, but emerging platforms and concepts are diversifying gamer preferences. The metaverse remains a focal point of interest, with projects like Mocaverse possibly shaping its future.

The web3 gaming industry continues to evolve, and the introduction of new players like Skale and zkSync adds to its dynamism. As social dapps gain traction, the sector must navigate challenges and opportunities in balancing user engagement across different sectors.

In summary, the growth trajectory of web3 gaming remains positive, but adaptability and foresight are crucial in this ever-evolving domain. Stay tuned for further insights and developments in the world of web3 gaming.