In the latest quarterly report by Konvoy, the gaming market landscape for Q4 of 2023 is dissected, showcasing nuanced trends in private market funding, public market data, and pivotal industry themes. In this article, we summarize key findings from the report and highlight important insights for the future of web3 gaming.

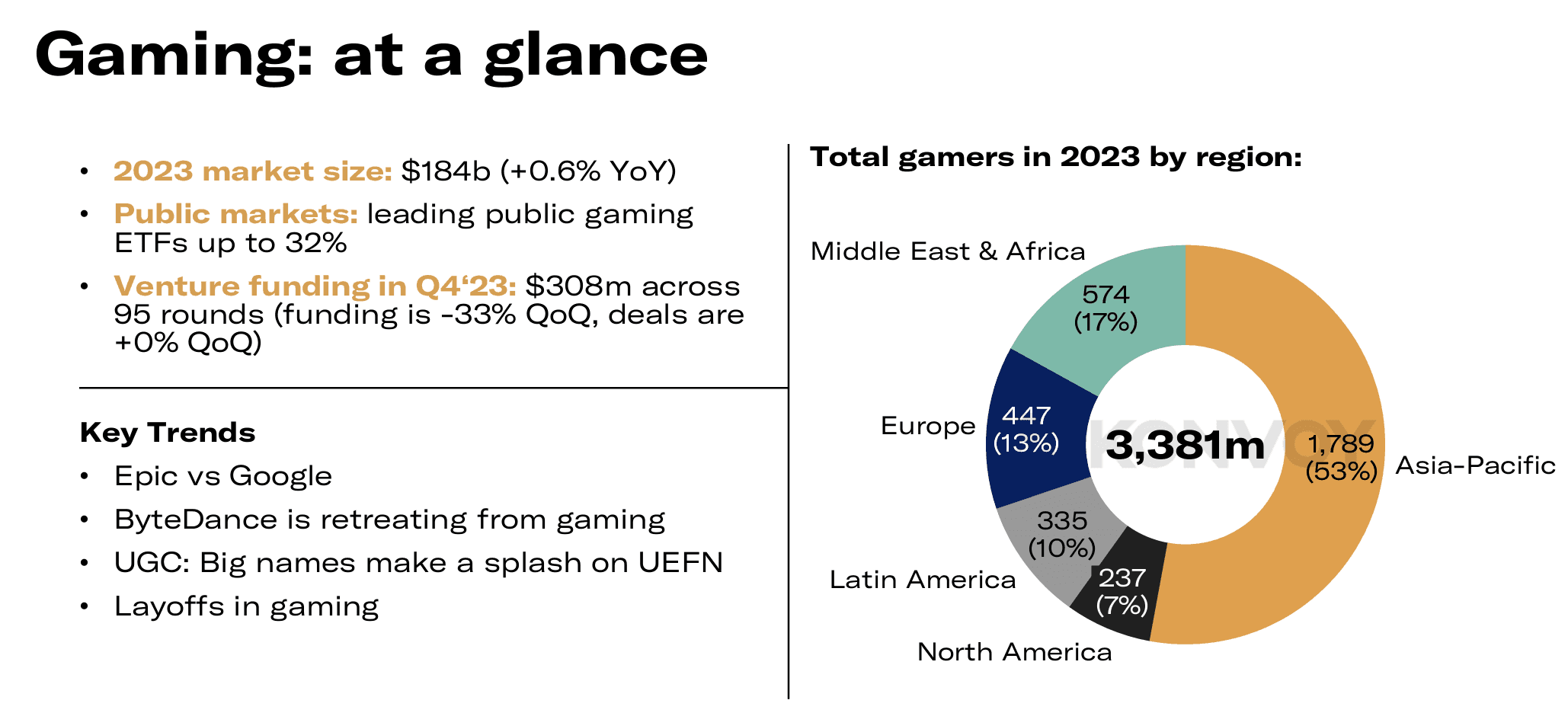

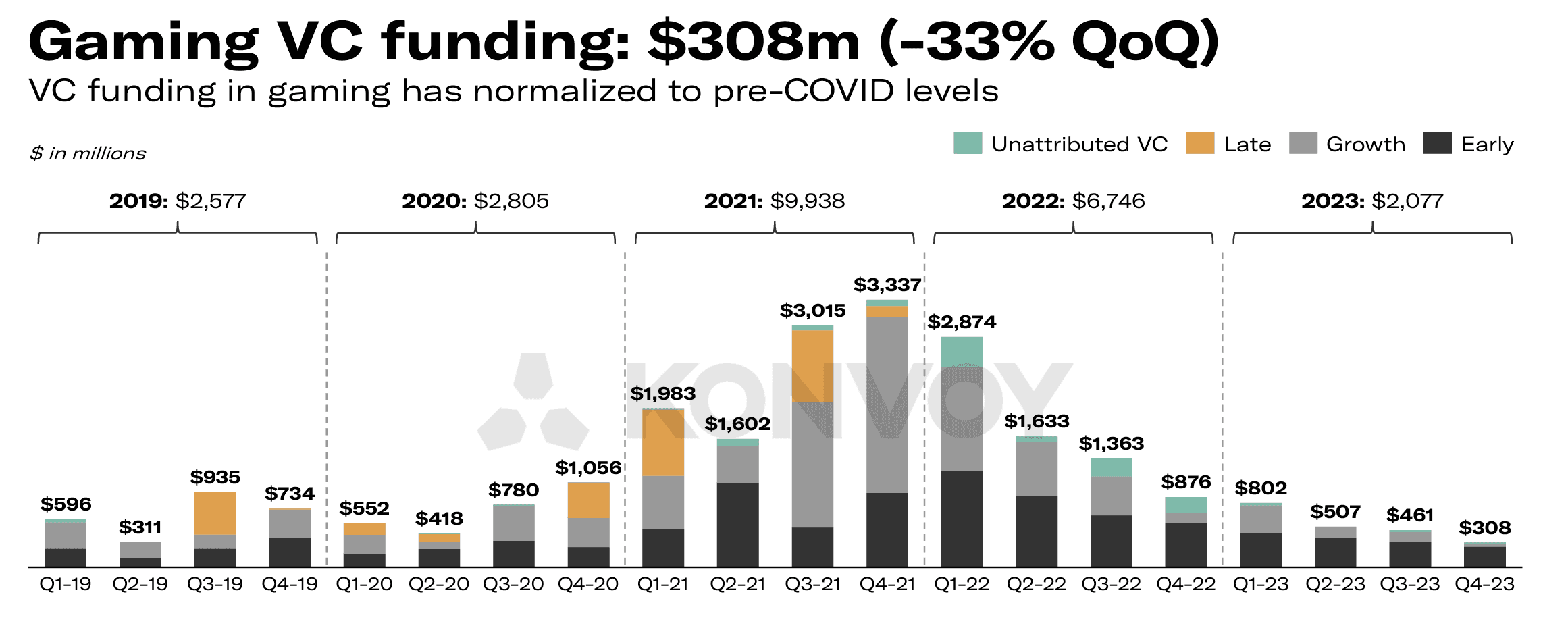

The gaming market has continued its growth trajectory, reaching $184 billion in 2023, marking a modest 0.6% YoY increase. Projections indicate a promising future, with an estimated market size of $226 billion by 2029, reflecting a 3.5% Compound Annual Growth Rate (CAGR). However, the sector experienced a notable dip in Q4 2023, with gaming VC funding declining by 33% QoQ to $308 million. Despite this, deal volume remained steady at 95 deals completed.

Noteworthy is the public market performance of top gaming ETFs, showcasing a commendable 32.4% increase since the beginning of 2023, outperforming the S&P 500's 24.2%. Cash balances held by industry giants, including gaming and big tech companies, reveal significant financial prowess. Activision Blizzard's shift from a public gaming entity due to Microsoft's acquisition finalization is an industry-defining development.

Key Industry Themes

Epic vs Google, ByteDance Retreat, UGC, Big Names on UEFN, Layoffs

Konvoy's report identifies several key themes impacting the gaming industry. The legal showdown between Epic and Google concludes after almost three years, with Epic successfully suing Google for establishing an unlawful monopoly. This verdict not only mandates a $700 million payment from Google but also requires the tech giant to facilitate easier access to third-party app stores, sideloaded apps, and non-Google payment processors.

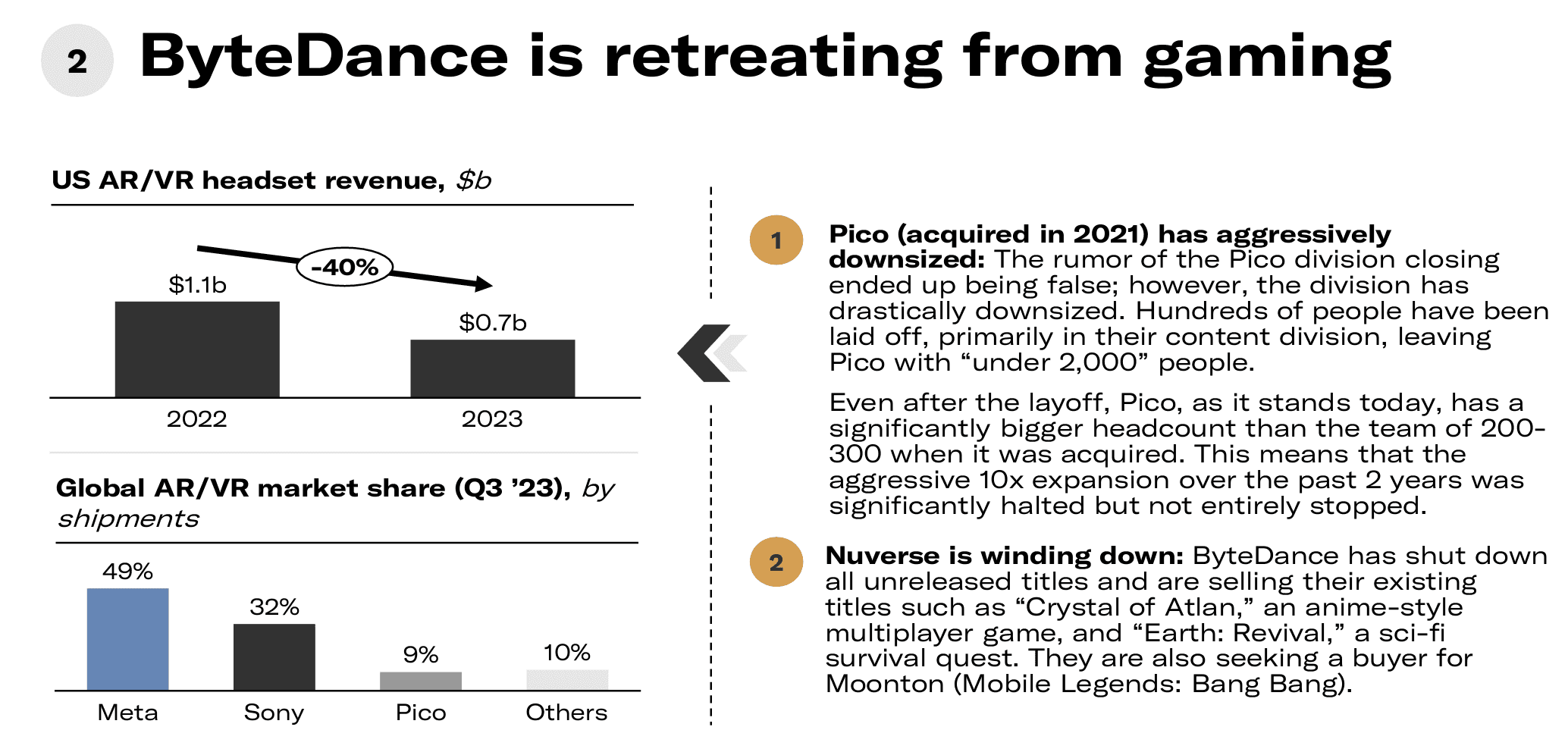

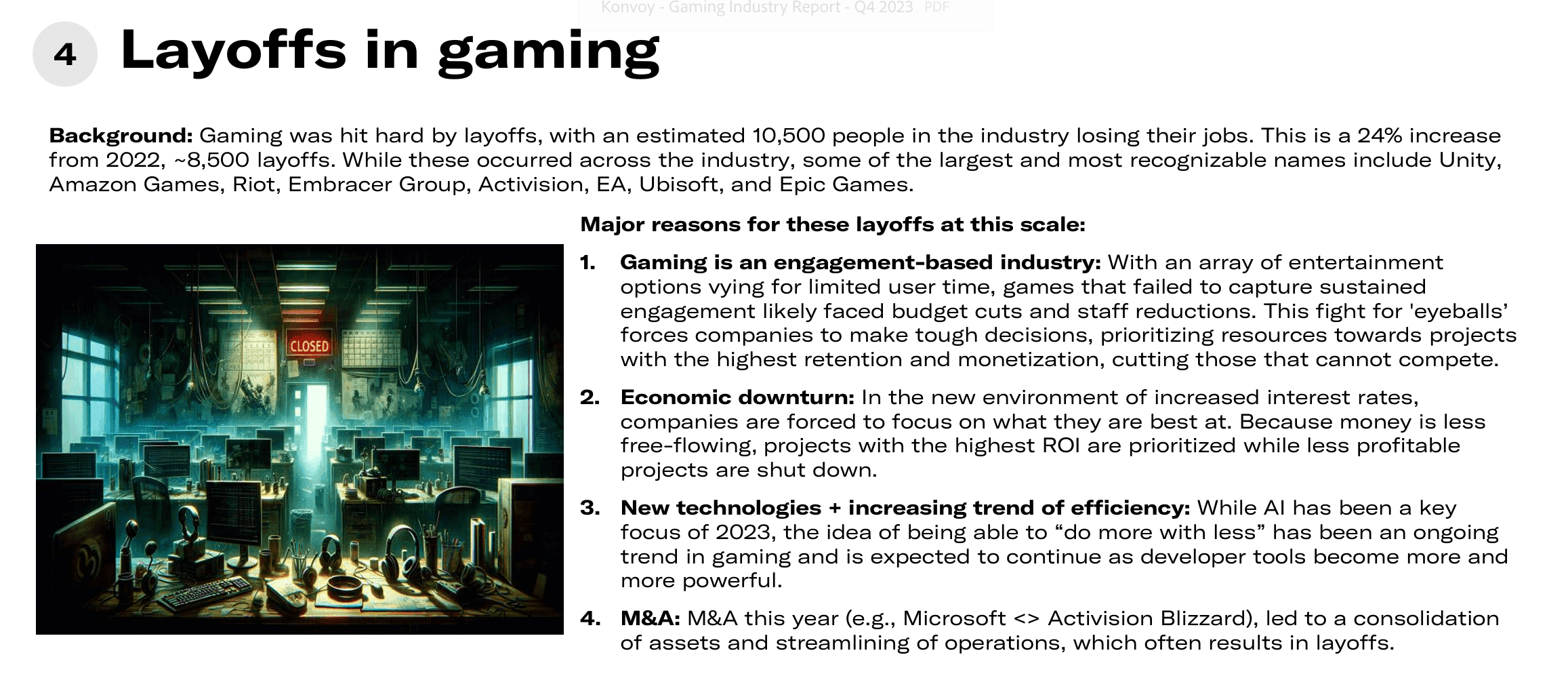

The report also notes ByteDance's retreat from gaming, emphasizing user-generated content (UGC) as a critical trend. Additionally, significant developments in the User Engagement Funding Network (UEFN) see prominent names making substantial contributions. However, layoffs in the gaming sector emerge as a concerning trend, with an estimated 10,500 job losses, a 24% increase from 2022. Recognizable industry names, including Unity, Amazon Games, Riot, Embracer Group, Activision, EA, Ubisoft, and Epic Games, have been affected.

Venture Capital Landscape

Funding Discrepancies and Regional Dynamics

The Q4 report delves into venture capital activity, revealing a 33% decrease in funding between Q3 and Q4. While deal volume remained consistent, smaller deal sizes were predominant, impacting the overall funding landscape.

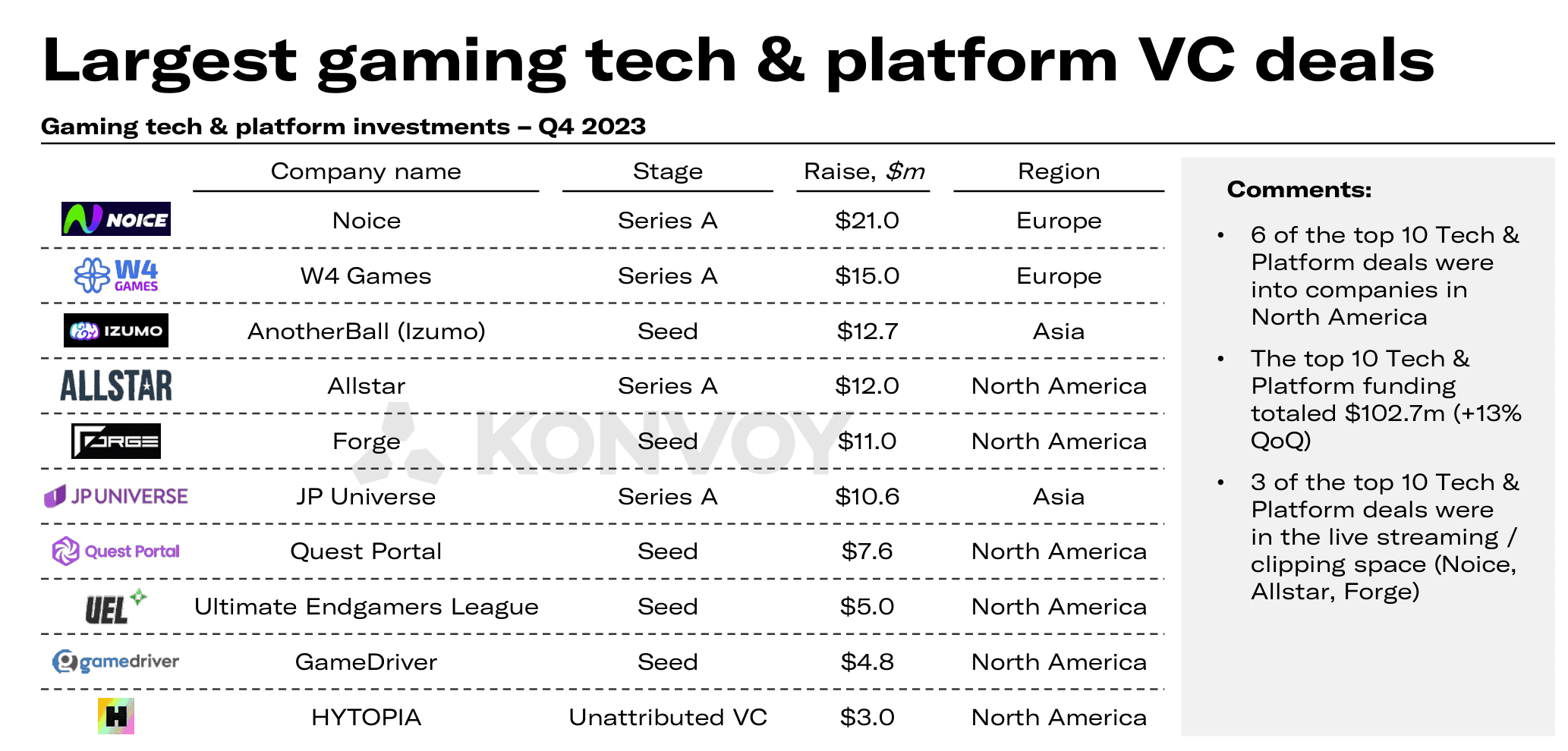

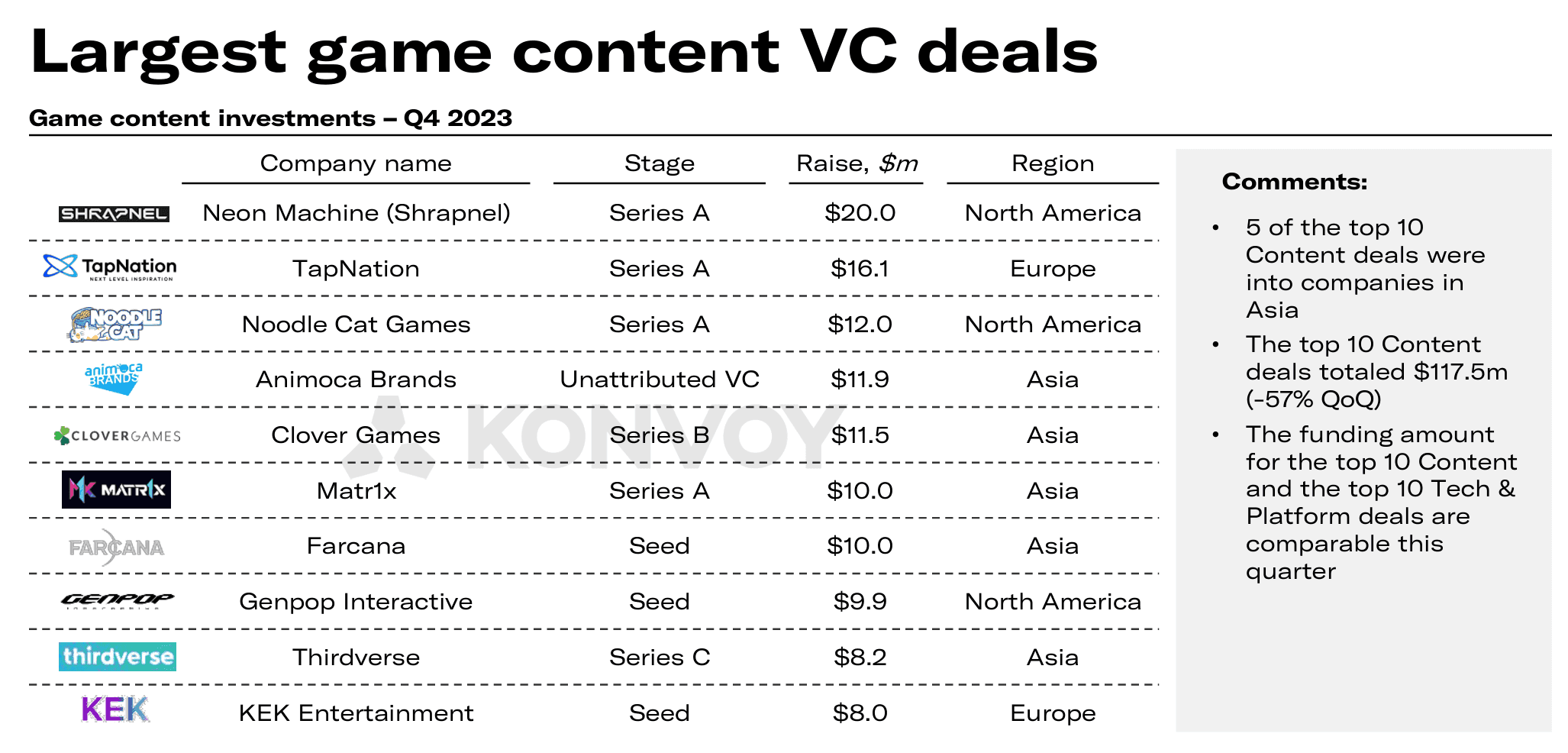

Notably, content development experienced reduced investor interest, with a 57% QoQ decrease in funding, contrasting with a 13% increase in game technology and platform investments. The breakdown of the largest gaming tech and platform VC deals highlights North America's dominance, particularly in the live streaming and clipping space.

Largest gaming tech & platform VC deals: 6 of the top 10 Tech & Platform deals were into companies in North America. The top 10 Tech & Platform funding totaled $102.7 million (+13% QoQ). 3 of the top 10 Tech & Platform deals were in the live streaming and clipping space (Noice, Allstar, Forge). Of note for the web3 gaming space is Forge raising $11 million (North America), and Hytopia raising $3 million to build "web3 Roblox" (North America).

Largest game content VC deals: 5 of the top 10 Content deals were into companies in Asia. The top 10 Content deals totaled $117.5 million (-57% QoQ). The funding amount for the top 10 Content and the top 10 Tech & Platform deals are comparable this quarter. Of note for web3 gaming is Neon Machine, building web3 game Shrapnel, which raised $20 million Series A (North America). Moreover, the well-known VC Animoca Brands raised $11.9 million (Asia). Lastly, Matr1x and Farcana raise $10 million each respectively (Asia).

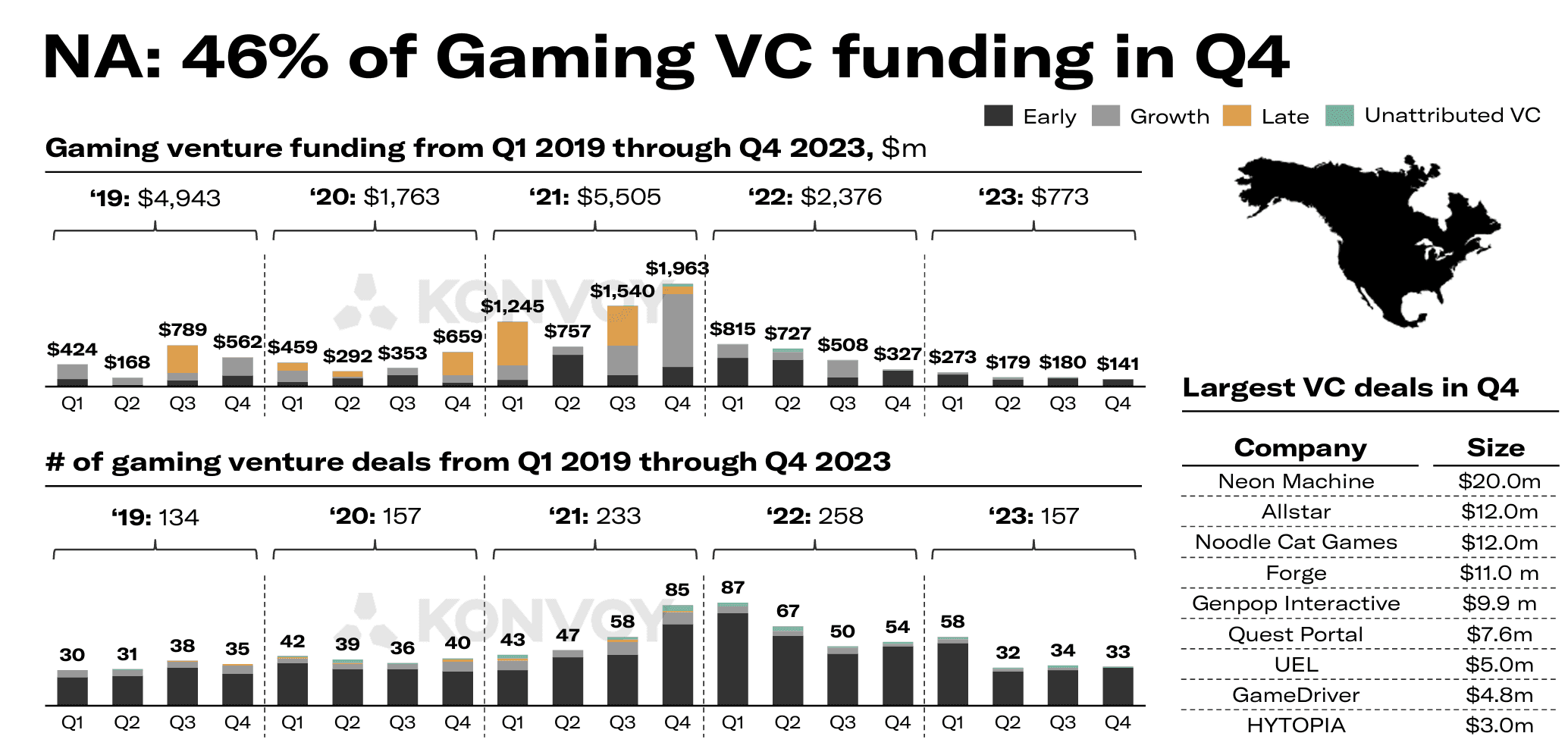

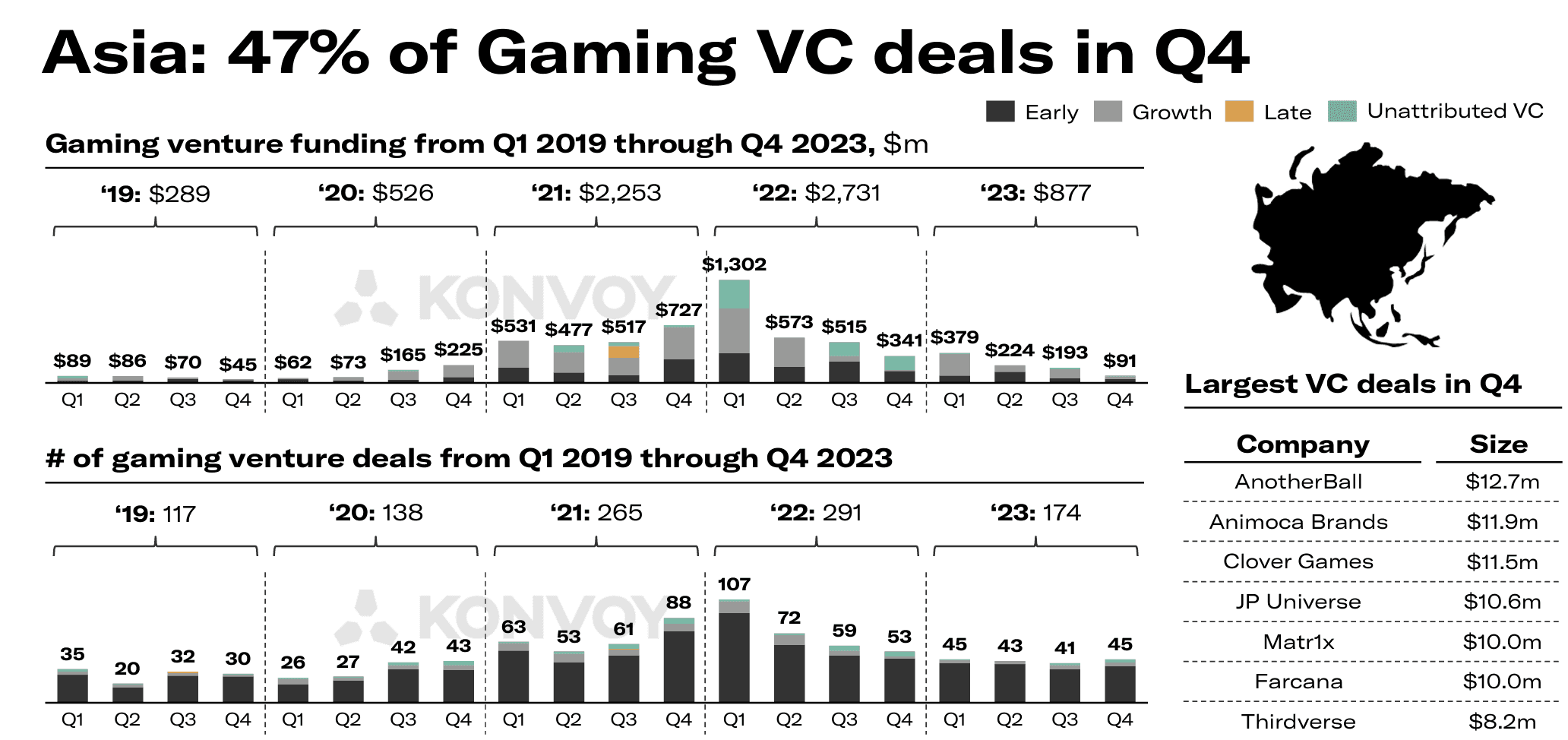

Gaming VC activity by region: While Asia was the most active region of investment this quarter in terms of the number of deals executed, North American startups raised 55% more capital ($141 million) than Asia ($91 million). Each region also had an interest in two different areas of gaming. Asian game content companies garnered stronger fundraising interest than Asian technology and platforms companies, while the inverse was true in North America. Asia had the most even distribution of deals done per quarter in 2023, with very little change QoQ in investment activity. While 3 less (~17%) European companies raised in Q4 vs Q3, there was a 27% increase in funding QoQ, primarily attributable to Noice ($21 million Series A).

M&A Highlights

Major Deals and Industry Landscape

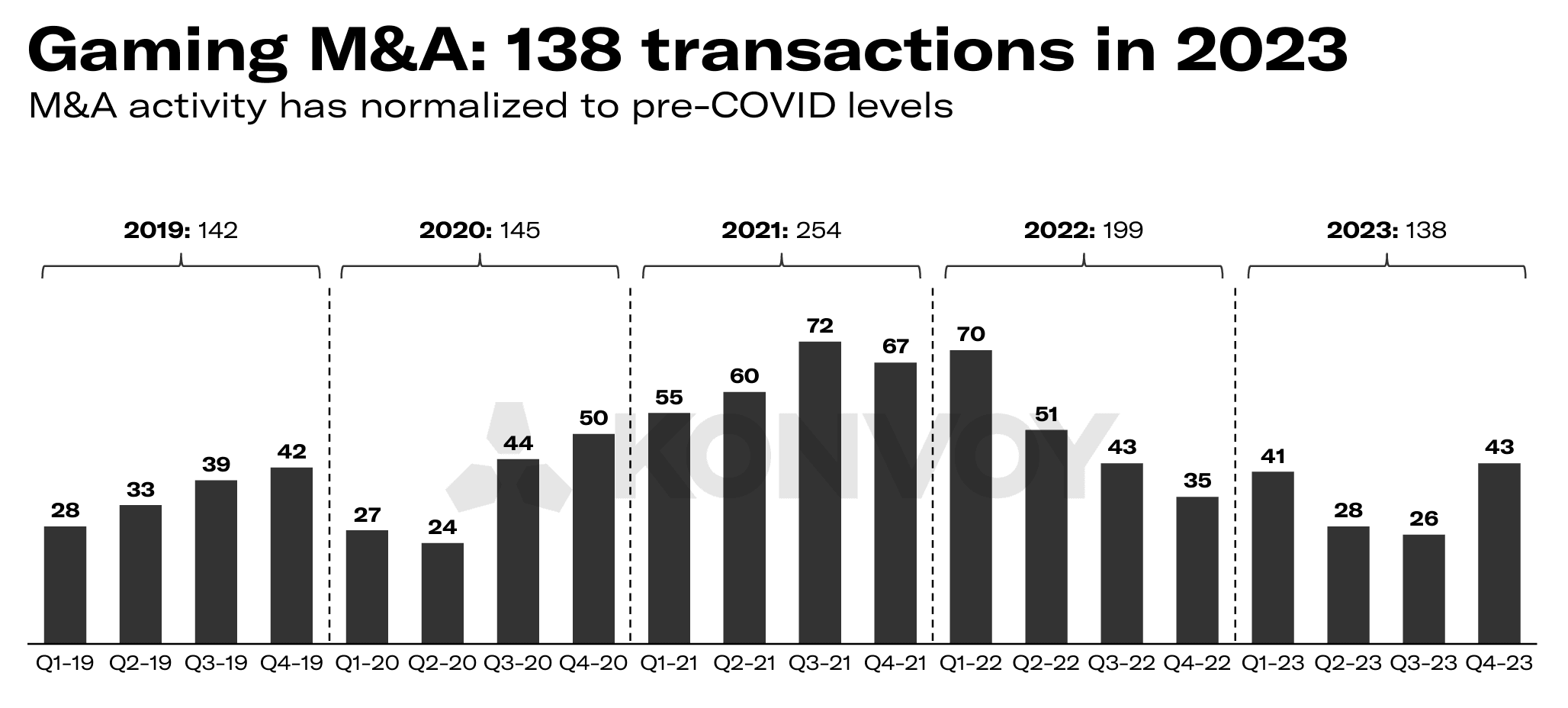

Konvoy briefly touches on M&A activity, noting that despite a challenging macro environment, transactions continued. The completion of the $69 billion Microsoft <> Activision Blizzard acquisition and SciPlay acquiring the remaining 17% of Light & Wonder shares for $484 million stand out as Q4 highlights. However, no M&A transaction surpassed the $500 million mark during this quarter.

Relevance to Web3 Gaming

In the context of web3 gaming, Konvoy's findings bear significant relevance and offer invaluable insights for stakeholders navigating this evolving landscape. As blockchain technology continues to permeate the traditional gaming industry, understanding funding dynamics, market trends, and key themes becomes paramount for web3 gaming developers, investors, and enthusiasts alike.

The fluctuations in venture capital funding, regional investment patterns, and notable M&A activities serve as pivotal indicators for the trajectory of web3 gaming innovations. With ventures like Animoca Brands, Neon Machine (Shrapnel), Matr1x, Farcana, Forge, and Hytopia spearheading web3 gaming initiatives this Q4, the industry is witnessing a transformative shift towards decentralized platforms and immersive experiences.

Konvoy's comprehensive analysis not only sheds light on the current state of the gaming market but also illuminates pathways for harnessing the potential of web3 technologies to shape the future of gaming. As stakeholders embrace these insights, they stand poised to drive innovation, foster collaboration, and propel the web3 gaming ecosystem toward unprecedented heights of success and sustainability.