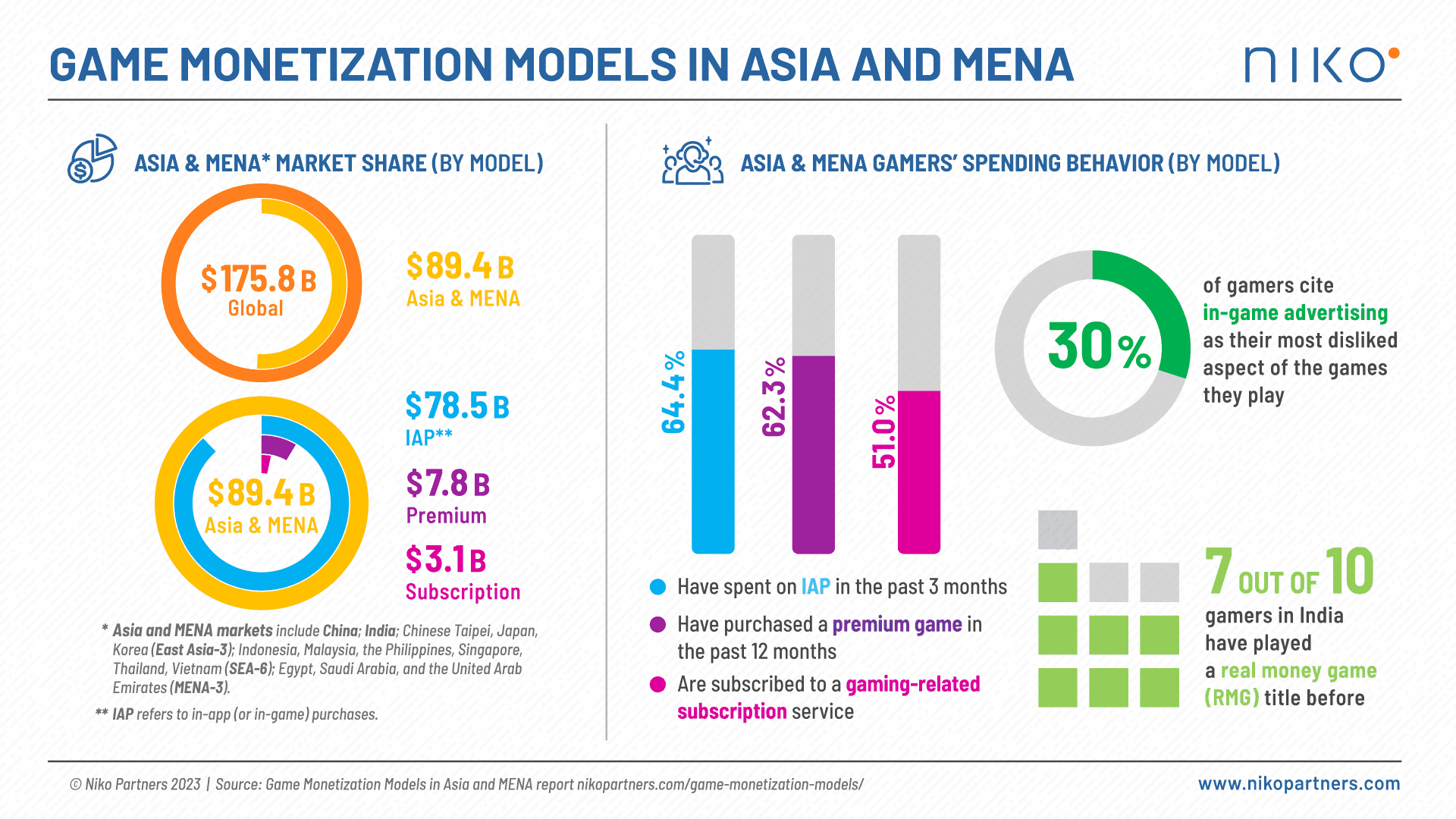

In a recent report by Niko Partners, the gaming markets in Asia and the Middle East & North Africa (MENA) are predicted to have reached a staggering $89.4 billion in payments for the year 2023. This significant figure reflects the growing influence and economic impact of the gaming industry in these regions. It's interesting, that 62.3% of users on predominately Free-2-Play (F2P) mobile markets bought a game within the last year. In this deep dive, we break down the key findings and add insights for web3 gaming.

Note: The company considers the markets of China, India, Chinese Taipei, Japan, South Korea, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam (Asia); Egypt, Saudi Arabia, and the UAE (MENA-3).

The "Video Game Monetization Models in Asia & MENA" report, compiled by Niko Partners, sheds light on five major monetization strategies: Premium Games, Subscriptions, In-Game Purchases, In-Game Advertising, and Real Money Gaming. The comprehensive approach of the report involves primary and secondary data collection, including proprietary gamer surveys, industry interviews, financial reports from companies, official statistics, and macroeconomic data.

Key Findings:

1. In-Game Purchases: In-game purchases (IAP) emerge as the dominant monetization model, constituting a substantial 87.8% (approximately $78.5 billion) of player spending in Asia & MENA. This underlines the significance of microtransactions and virtual goods in driving revenue for game developers.

2. Price Barrier for Non-Spenders: The report identifies the pricing factor as the primary barrier for non-spending gamers in the region, with 39.3% of non-spending mobile gamers and 44.3% of non-spending PC gamers citing it as the major deterrent.

3. Premium Game Purchases: A noteworthy 62.3% of gamers in Asia & MENA have purchased a premium game in the past 12 months across various platforms, emphasizing the continued demand for high-quality gaming experiences. Sales of games distributed through the Premium model brought in $7.8 billion in 2023.

4. Subscription Services: According to the 2023 survey, 30% of paying gamers in the region have opted for monthly subscription services to access video games. This percentage increases to 51% when considering all types of gaming subscriptions, including value-added services like Twitch Prime. Subscriptions contributed an additional $3.1 billion. Niko Partners does not account for advertising in the overall revenue.

5. In-Game Advertising: In-game advertising (IGA) receives mixed reactions, with 30% of mobile gamers in Asia & MENA citing it as their most disliked aspect of the games they play. This highlights the delicate balance required in implementing advertising strategies within games.

6. Real Money Gaming in India: Real Money Gaming (RMG) finds significant popularity in India, where 7 in 10 gamers have engaged with an RMG title. This underscores the diverse preferences within the gaming landscape across different countries.

Relevance to Web3 Gaming:

As the gaming industry evolves, these findings hold particular relevance to the emerging field of web3 gaming. Understanding player preferences, spending behaviors, and potential barriers is crucial for web3 gaming companies to develop effective strategies and maximize profit margins while adhering to existing regulations. The insights from Niko Partners' report provide a valuable roadmap for navigating the dynamic landscape of web3 gaming, ensuring a sustainable and engaging gaming experience for users in Asia and MENA.