Southeast Asian Gaming Market to Hit $7.2 Billion by 2027

Niko Partners latest analysis highlights the robust growth of the SEA-6 PC and mobile game market, offering valuable insights for web3.

Southeast Asia, a region of diverse cultures, languages, and economies, is emerging as a powerhouse in the global video game industry. With a rapidly growing population, a thirst for gaming, live streaming, and esports, Southeast Asia has become a prime destination for game developers, hardware manufacturers, and investors.

In this report, we dissect the latest findings from the SEA-6 Games Market Report by Niko Partners, offering an in-depth exploration of six key Southeast Asian markets (Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam) with insights for web3 gaming.

Southeast Asian Gaming Market to Hit $7.2 Billion by 2027

Gaming Market Insights

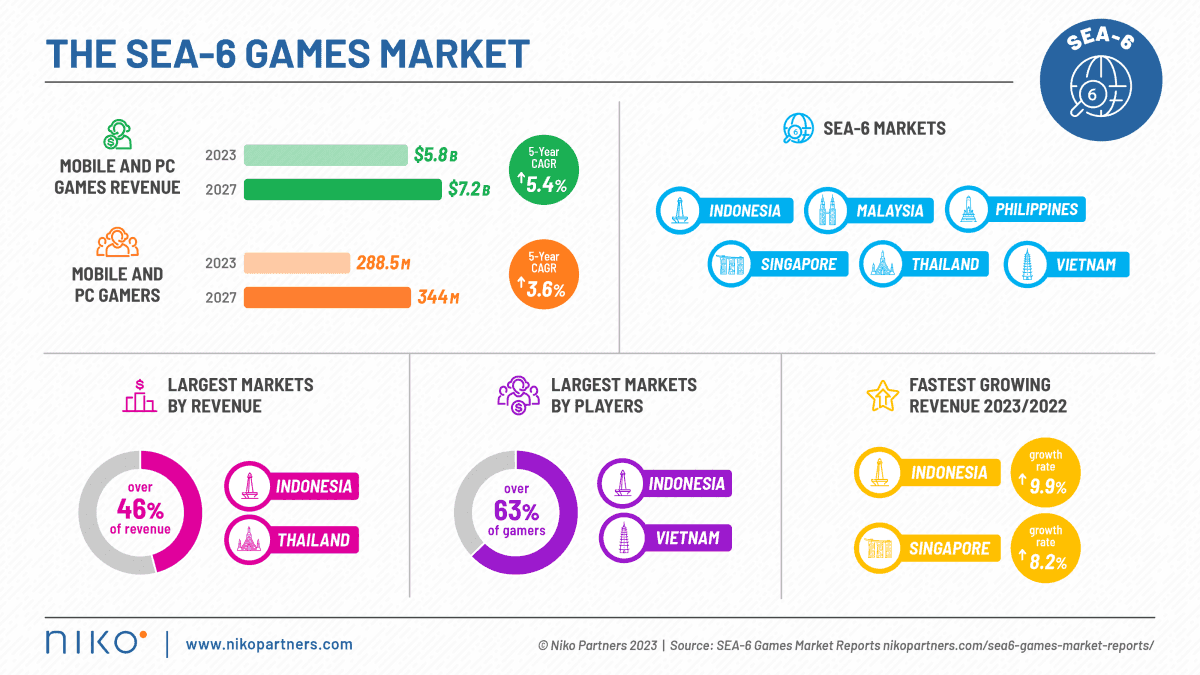

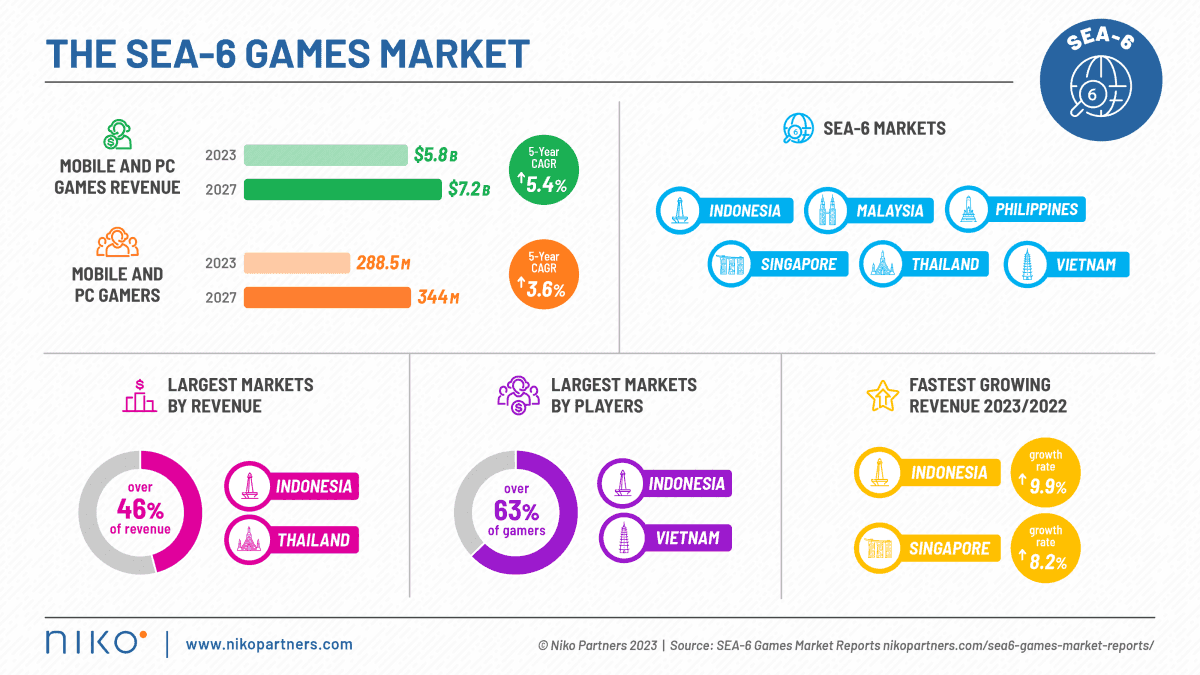

Niko Partners' comprehensive study unveils the staggering projections for the Southeast Asian gaming market. In 2023, the SEA-6 PC and mobile game market is set to generate $5.8 billion, with forecasts exceeding $7.2 billion by 2027. Notably, mobile games continue to dominate, contributing 66.4% of the region's gaming revenue in 2023, a figure expected to rise to nearly 70% by 2027.

Singapore, despite being smaller in population compared to its neighbors, has shown remarkable growth in mobile gaming revenue. It has outperformed more populous countries like Malaysia, the Philippines, and Vietnam in this sector. However, Indonesia and Thailand are the true heavyweights, collectively responsible for nearly half of the SEA-6 gaming revenue. Indonesia and Vietnam also house 63% of the region's gamers, with Indonesia leading the charge in gamer growth. The growth in revenue in Indonesia and Singapore is equally impressive, with yearly increases of 9.9% and 8.2%, respectively.

Driving Forces of Growth

The report highlights several driving forces, foremost among them is esports, which remains a juggernaut in Southeast Asia. The inclusion of esports as a medal sport in the 19th Asian Games in Hangzhou, China, saw teams from SEA-6 countries competing for the coveted esports medals. Thailand and Malaysia emerged as top earners in this event, contributing to an estimated SEA-6 esports market value of $78.6 million in 2023.

Moreover, Southeast Asia has witnessed increased government support to bolster its local gaming industry. Various initiatives, funding programs, and regulatory updates have created a conducive environment for industry growth. Global game companies have also recognized the potential of SEA-6, with many establishing new offices, holding large-scale events, and actively engaging with the gaming community.

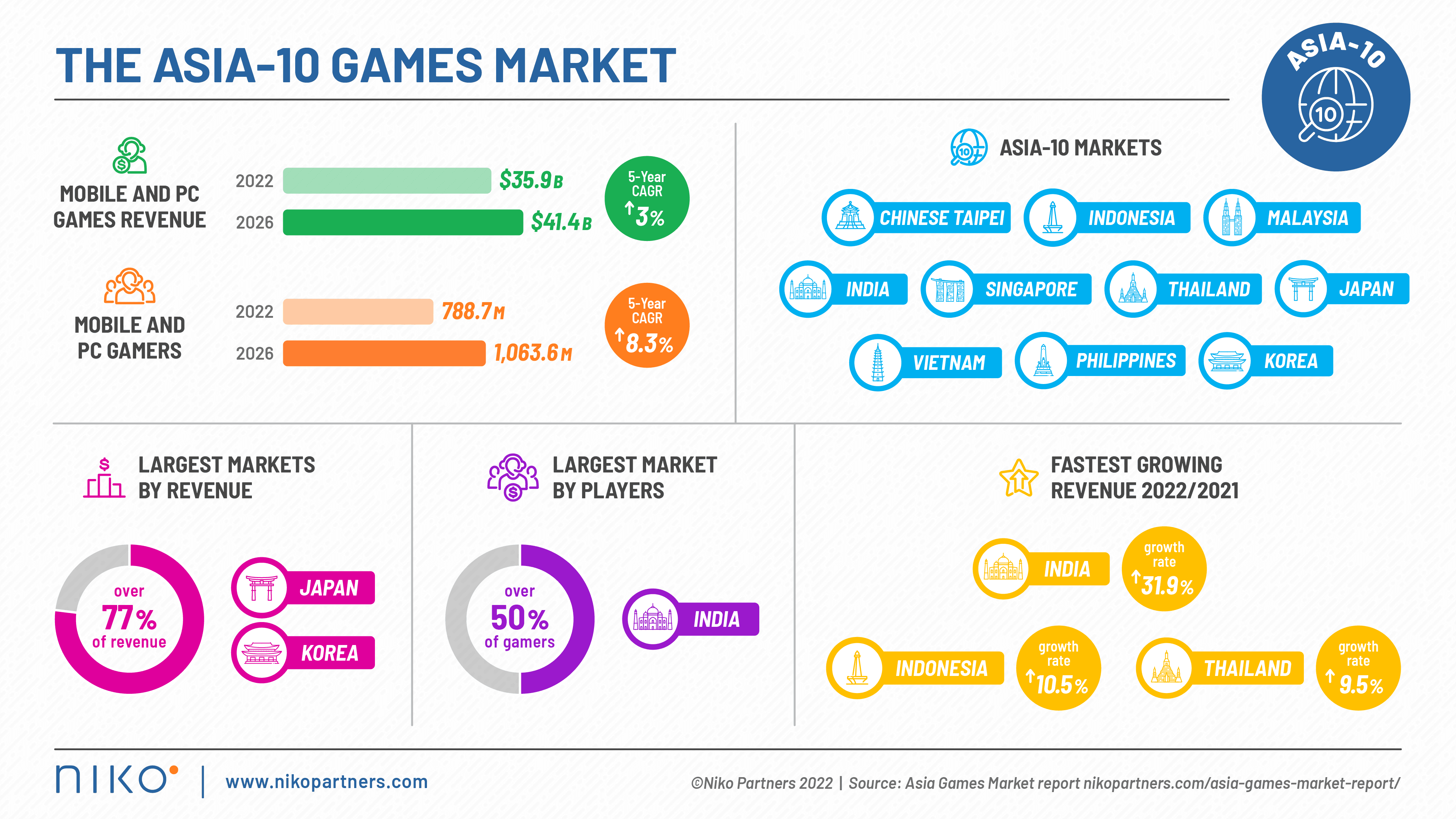

The Asia-10 Games Market

Relevance for Web3

The growth and vibrancy of Southeast Asia's gaming industry have profound implications for the future of web3 gaming. As the region continues to evolve and expand, it offers a fertile ground for blockchain gaming to take root. With a large and engaged gaming community, combined with the region's increasing tech-savviness, web3 gaming could find a receptive audience in Southeast Asia.

The SEA-6 Games Market Report by Niko Partners sheds light on the extraordinary growth and potential of Southeast Asia's gaming industry. As the region's gaming landscape continues to flourish, it paves the way for web3 gaming to leave an indelible mark, offering an exciting future for gamers and developers alike in this dynamic part of the world.

About the author

Eliza Crichton-Stuart

Head of Operations

Updated:

April 20th 2025

Posted:

October 19th 2023