Drake Star Partners released its Q3 2024 global gaming industry report, which highlighted ongoing growth in mergers and acquisitions (M&A) for the fourth consecutive quarter. The quarter saw a disclosed deal value of $2.5 billion, coupled with an additional $1.1 billion raised in private financings. Key contributors to this trend included improvements in the public gaming market and notable initial public offerings (IPOs), such as that of Shift Up, a Tencent-backed gaming studio. However, the report also acknowledged that the industry still faces challenges, including substantial layoffs and a difficult funding environment for growth-stage studios.

Drake Star Global Gaming Report Q3 2024

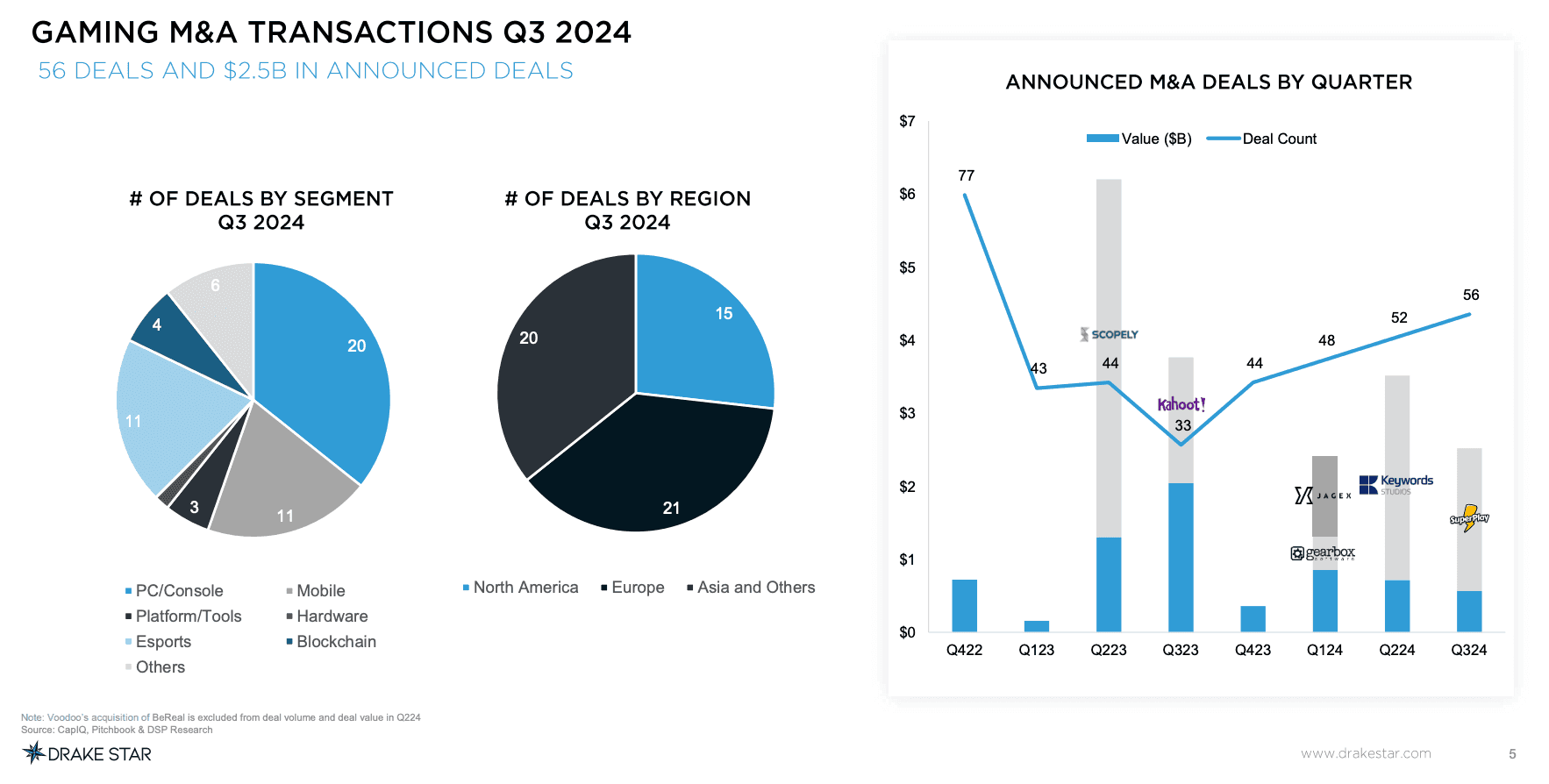

Steady M&A Momentum and Key Deals

In Q3 2024, there were 56 M&A deals announced, marking a 70% increase in deal volume compared to the same period in the previous year (Q3 2023). This trend demonstrates steady investor confidence in the gaming sector. Among these deals, Playtika’s acquisition of SuperPlay for $700 million (with a total potential earn-out of $1.95 billion) was the quarter's largest. Other notable acquirers included Tencent, Warner Bros. Discovery, Krafton, Capcom, Keywords, Nazara, and Infinite Reality, each expanding their portfolios with strategic acquisitions.

Michael Metzger, a partner at Drake Star Partners, commented on the positive trajectory in gaming M&A activity, noting an encouraging recovery in the valuations of leading gaming companies. Metzger also emphasized the role of private equity (PE) firms as major contributors, with several large-scale acquisitions driven by firms such as Jagex/CVC and Keywords/EQT. This momentum, he suggested, could continue into the coming months, especially as PE firms explore new opportunities within the industry.

“We are thrilled to announce that M&A activities have continued to gain momentum for the fourth consecutive quarter. It’s also encouraging to see a rebound in the valuations of the top 30 listed gaming companies,” said Michael Metzger, partner at Drake Star Partners, in an interview with GamesBeat.“This ongoing recovery in valuations is likely to further stimulate M&A activity in the future.”

Gaming M&A Transactions Q3 2024

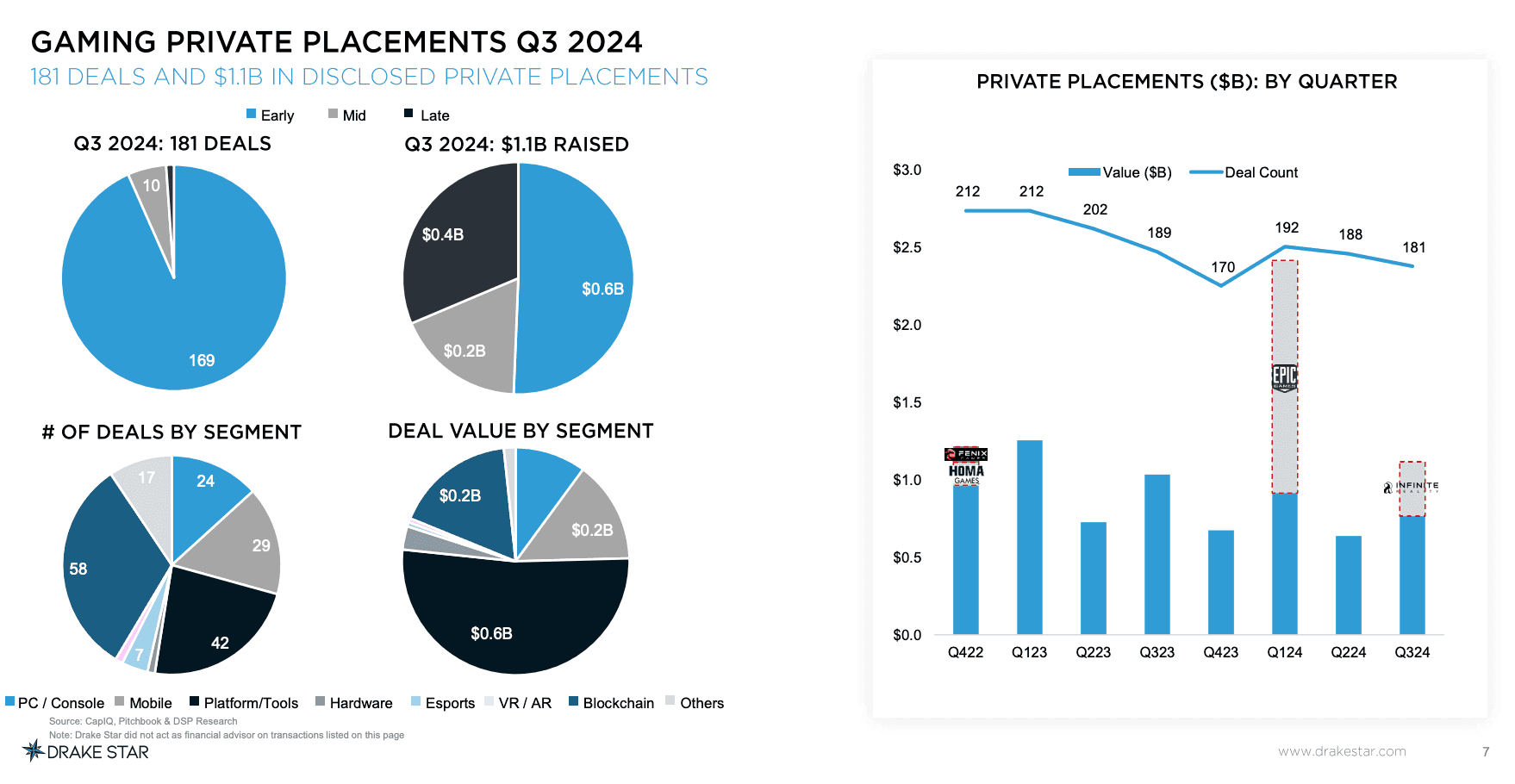

Private Financing Highlights

Private financings in the gaming sector raised $1.1 billion across 181 deals, maintaining similar deal numbers compared to Q2 but with a marked increase in value. Among the largest financings were Infinite Reality’s $350 million, Hybe’s $80 million, and Gcore’s $60 million. Early-stage investments remained the most popular, accounting for over 90% of funding, with blockchain gaming capturing 32% of the total and platform tools around 23%.

While blockchain gaming funding saw a slight dip compared to previous quarters, the technology still represents a significant area of investment interest. Andreessen Horowitz and Bitkraft emerged as the most active large gaming venture capital firms over the past year, followed closely by Play Ventures. Notably, Patron, an early-stage gaming investor, announced a second fund with $100 million aimed at supporting emerging companies.

Gaming Private Placements Q3 2024

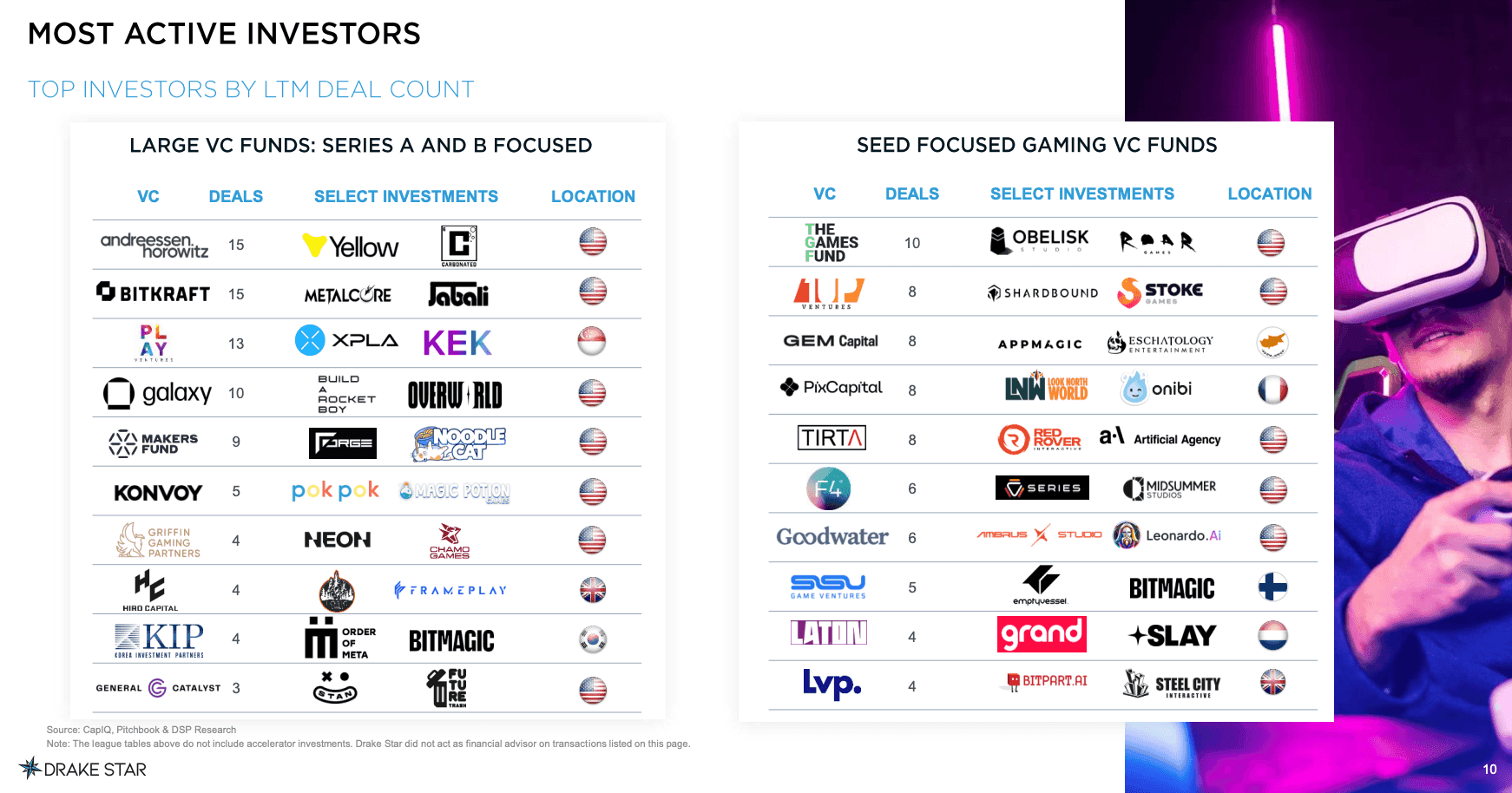

Major Players in Venture Capital

Prominent VC firms played a critical role in this quarter's investment activities. BITKRAFT, with 15 deals including investments in Metalcore and Jabali, led the charge. A16z also made 15 deals, backing projects like Yellow and Carbonated. Play Ventures secured 13 deals, notably supporting XPLA and KEK. Other active VCs included Galaxy (10), Makers Fund (9), Konvoy (5), Griffin Gaming Partners (4) and Hiro Capital (4).

Large VC Funds: Series A and B Focused

- BITKRAFT - 15 deals (Metalcore, Jabali)

- A16z - 15 deals (Yellow, Carbonated)

- Play Ventures - 13 deals (XPLA, KEK)

- Galaxy - 10 deals (Build a Rocket Boy, Overworld)

- Makers Fund - 9 deals (Forge, Noodle Cat)

- Konvoy - 5 deals (Pokpok, Magic Potion Games)

- Griffin Gaming Partners - 4 deals (NEON, Chamo Games)

- Hiro Capital - 4 deals (Loric Games, FramePlay)

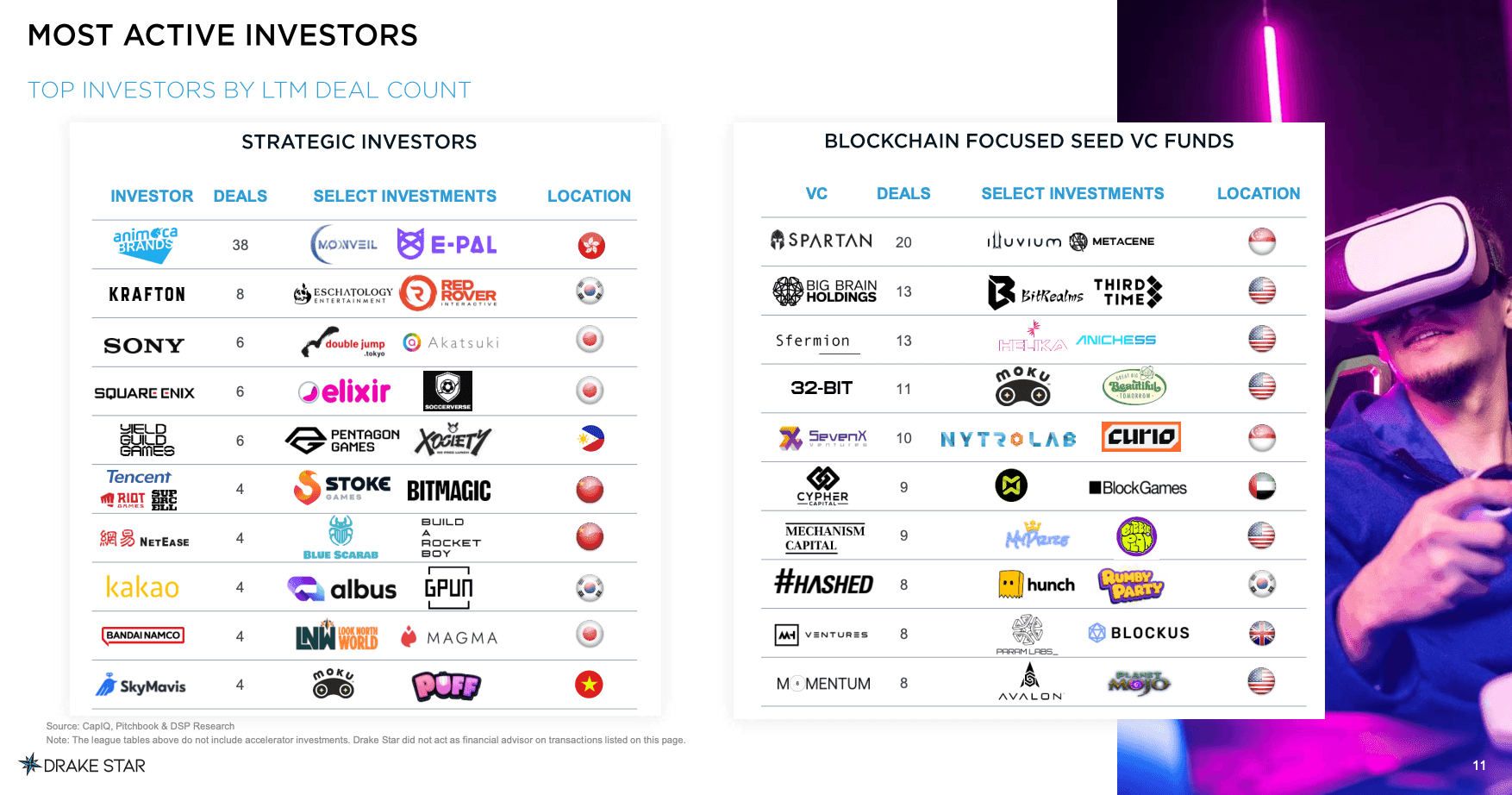

Most Active Investors

Focus on Early-Stage Investments

Blockchain-focused seed investments were a key trend, with VCs like Spartan, Sfermion, and Big Brain Holdings leading the way. Spartan was highly active, with 20 deals including investments in MetaCene and Illuvium. Sfermion also made 13 deals, backing projects like Anichess and Helika. The emphasis on seed-stage funding suggests a strong belief in the future potential of emerging gaming technologies.

Seed-Focused VC Funds

- Spartan - 20 deals (Illuvium, Metacene)

- Sfermion - 13 deals (Helika, Anichess)

- Big Brain Holdings - 13 deals (BitRealms, ThirdTime)

- Hashed - 10 deals (Hunch, Delabs, Rumby Part)

- 1Up Ventures - 8 deals (Shardbound, Stoke Games, Wicked Saints Studios)

- Shima Capital - 7 deals (Elixir, Great Big Beautiful Tomorrow, Mythic Protocol)

Most Active Investors in Blockchain

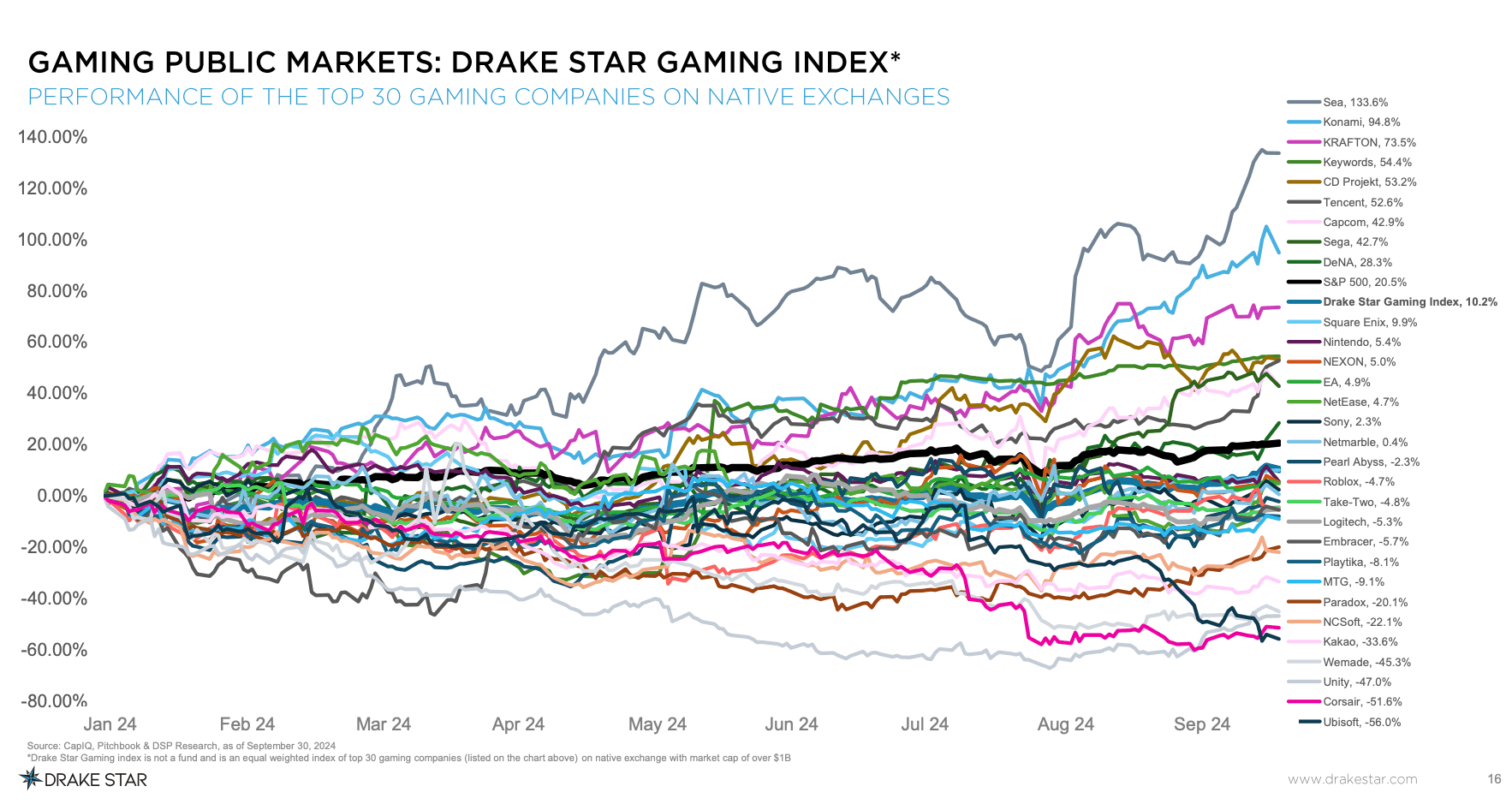

Public Market Performance and Shifts

Public gaming markets showed recovery during the quarter, as evidenced by the 10.2% increase in the Drake Star Gaming Index over the first nine months of 2024. Top performers included SEA, Konami, and Krafton, while Ubisoft, Corsair, and Unity lagged. The IPO of Shift Up, a Tencent-backed studio, was another bright spot; its shares surged by around 50% on the first trading day, raising $320 million. Other financial activity included significant moves by major gaming companies, with Embracer Group securing a $652 million credit line refinancing and Kakao Games raising $198 million in bonds tied to Krafton shares.

Gaming Public Markets

Outlook and Future Prospects

The outlook for gaming M&A remains strong, with Drake Star anticipating further activity throughout the rest of the year and into 2025. Continued declines in interest rates and a gradual public market recovery are expected to support M&A growth. Drake Star also noted the likelihood of additional significant acquisitions by major industry players such as Tencent, Take-Two, Savvy/Scopely, and Playtika.

This trend is expected to include both transformative deals and an increased volume of mid-sized and smaller transactions. Private equity firms are anticipated to continue their role as consolidators, with more acquisitions and potential take-private deals expected. Additionally, Drake Star foresees more divestitures of large gaming divisions, offering further acquisition opportunities.

For private financing, key investment areas are predicted to include artificial intelligence (AI), blockchain gaming, mixed reality, and platform tools, aligning with industry trends toward innovation and technology integration. As public markets continue to stabilize, IPO-ready gaming companies may begin considering public listings by 2025, further signaling the potential for growth in the sector.

Believe in Innovation, Change the World

Final Thoughts

The findings from the Drake Star Global Gaming Report for Q3 2024 underscore the robust and evolving nature of the gaming investment landscape, particularly within the blockchain sector. The substantial interest and capital directed towards blockchain gaming, highlighted by major funding rounds and the active participation of top venture capital firms, signal a significant shift towards innovative technologies in gaming.

As early-stage companies continue to attract the majority of investments and regions like Asia lead in financing, the future of gaming appears poised for transformative growth. The sustained support from prominent VCs indicates a strong belief in the potential of blockchain to redefine gaming experiences globally, setting the stage for continued advancements and industry evolution. You can read the full report here.