We are thrilled to announce a new partnership with Pacific Meta Inc. to bring web3 gaming to the mainstream Japanese gaming ecosystem. Through this partnership, Pacific Meta will not only support the onboarding of Japanese web3 gaming projects to our platform but also provide marketing assistance for our expansion into the Japanese market.

About Pacific Meta Inc.

Pacific Meta Inc. provides comprehensive marketing support for overseas web3 projects in the Japanese market, including strategy development, localization, promotion, and community management. At the same time, they operate in-house media about web3 projects such as blockchain games to Japanese users through webmedia, Twitter, Youtube, Discord, and Instagram.

Why Japan?

The gaming industry is huge in Japan, and with a rich gaming history, it may not be a surprise to hear that it is the third-largest gaming market in the world. Only to be preceded by China and the USA, Japan is an attractive market to tap into. Here are some facts about gaming in Japan and how our new partnership with Pacific Meta Inc. will enable us to help promote web3 game titles in the Japanese market.

Gaming Legacy:

The gaming industry in Japan started in the early ’60s, during the “bubble” economy, where it saw some of the world’s most iconic games developed. Mario, Pac-man, and Sonic the Hedgehog were all born during this era – all of which have impacted the direction of the gaming world. In fact, you can still find these retro games all across the globe today. Furthermore, big players like Nintendo, Sony PlayStation, Sega, Square Enix, Capcom, and Bandai Namco are all Japanese game companies with global users and blockbuster IPs.

Gaming Market

Today, Japan comes in third place in terms of digital game revenues. Even if you combine Germany, the UK, and France’s revenue, it doesn’t account for Japan’s gaming market revenue alone. Here are some jaw-dropping statistics about the booming market in Japan from Statista:

- Revenue in the Video Games market of Japan is projected to reach $25.84 billion U.S. dollars in 2023.

- The market is expected to experience an annual growth rate (CAGR 2023-2027) of 7.17%, resulting in a projected market volume of $34.09 billion U.S. dollars by 2027.

- By 2027, the number of users in the Video Games market is expected to reach over 80 million.

- User penetration is predicted to be 19.0% in 2023 and is expected to increase to 21.8% by 2027.

- The largest market segment within the Video Games market is Mobile Games, with a market volume of $15.59 billion U.S. dollars in 2023.

- In global comparison, the country generating the most revenue will be in China, with $82,060.00 million in 2023.

- The average revenue per user (ARPU) in the Video Games market is projected to be $1,088.00 U.S. dollars in 2023.

Mobile Gaming

Japan has for many years had great mobile data coverage and fast-speed internet access. This has come in handy for the many commuters who travel daily long hours. As you can imagine, these commute times are an excellent opportunity to play mobile games on smartphones. With approximately 107 million mobile internet users, Japanese mobile gaming is growing at exponential rates. The launch of 5G in 2020 was great news for new game developers, allowing low latency connectivity and faster data transmission of augmented and virtual reality. As a result, the industry saw more VR and AR games in Japan, such as Pokemon Go and Dragon Quest Walk.

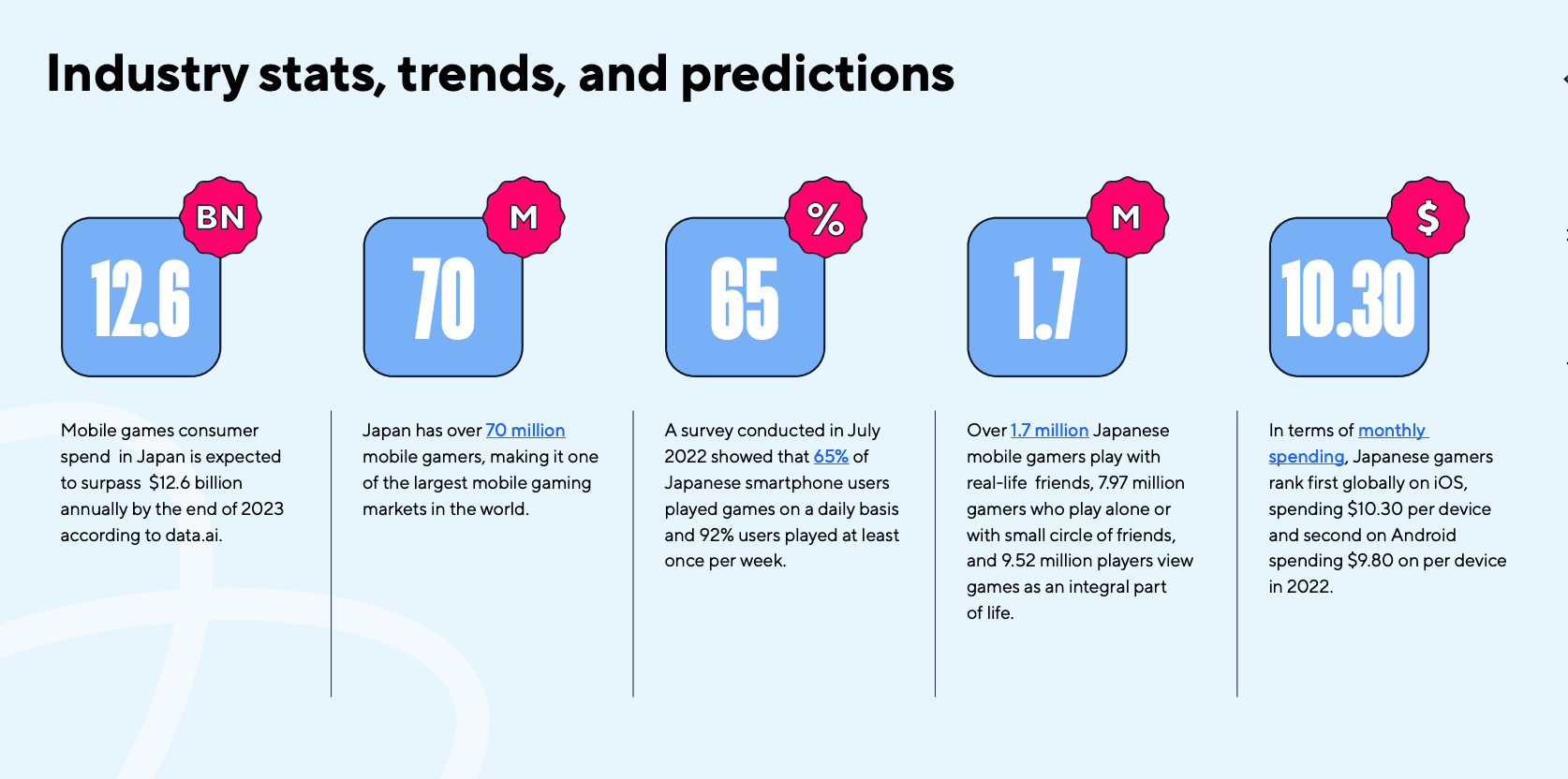

We recently broke down a report by data.ai that shed light on mobile gaming app performance benchmarks and user insights that can guide web3 game studios targeting Japanese markets. The country boasts over 70 million mobile gamers, cementing its position as one of the largest mobile gaming markets globally. Gaming consumer spending for mobile in Japan is predicted to exceed $12.6 billion annually by the end of 2023. A survey from July 2022 revealed that 65% of Japanese smartphone users play games daily, with a whopping 92% playing at least once a week.

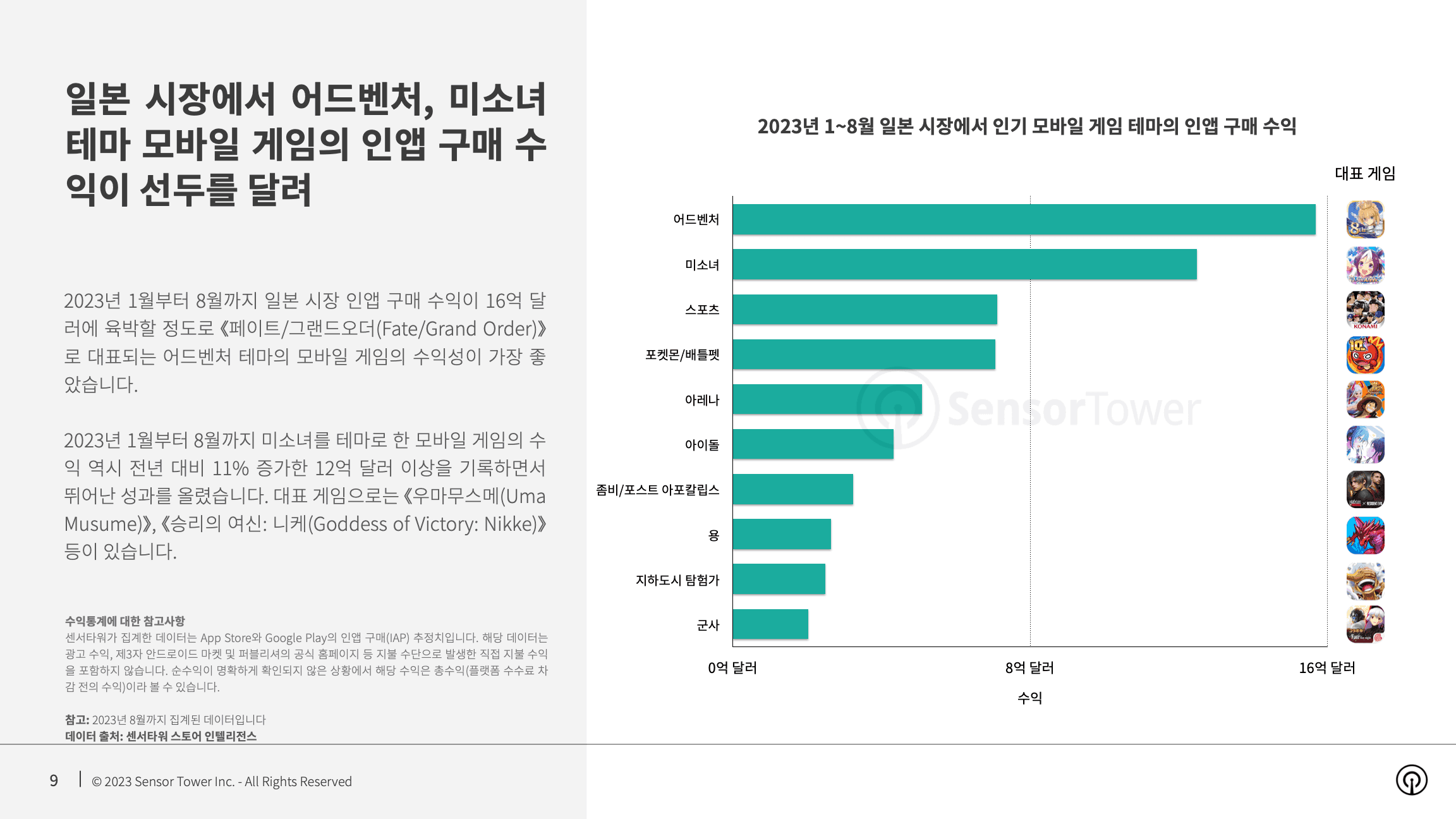

Another report we summarized from Sensor Tower on the mobile game revenue and download trends in the Japanese market in 2023, shows that RPGs continue to dominate, constituting 48% of the revenue structure. These games earned $4.3 billion from January to August. Mobile strategies follow as the second-highest revenue genre, generating over $1 billion during the same period.

Interestingly, adventure-themed mobile games such as “Fate/Grand Order” were highly profitable, with in-app purchase revenue approaching $1.6 billion from January to August 2023. From January to August 2023, revenue from Bishoujo-themed mobile games also performed well, reaching more than $1.2 billion, an 11% increase over the previous year. Representative games include “Uma Musume” and “Goddess of Victory: Nikke.”

What about web3?

Japan's booming gaming industry is represented by major players (as listed above) such as Bandai Namco, Square Enix, Sega, and Konami. All of them have been early adopters of web3 technology, here are some examples:

Bandai Namco: RYUZO (Oasys)

Bandai Namco recently partnered with Oasys to create RYUZO, an AI-powered virtual pet game around a series of NFT-based digital creatures. The web3 game is being developed by Bandai Namco Research alongside Japanese startup Attructure, and published by Double Jump Tokyo.

Square Enix: Symbiogenesis (Polygon)

Gaming giant Square Enix recently joined forces with Polygon to introduce its web3 project, Symbiogenesis. Utilizing the Polygon blockchain network, Symbiogenesis is aiming to offer players fast, secure, and sustainable gaming experiences. The collaboration between Square Enix and Polygon Labs, the team behind the decentralized Polygon protocol, underscores the increasing integration of web3 technology in gaming.

Sega: Battle of Three Kingdoms (Oasys)

Another example is Battle of Three Kingdoms - Sangokushi Taisen - a highly anticipated trading card game (TCG) being developed by Double Jump Tokyo on the Oasys blockchain in collaboration with Sega. Leveraging the Sangokushi Taisen franchise, the game is set to be Sega's first web3 project, offering a unique blend of traditional card gameplay with modern web3 technology.

Konami: Project Zircon (TBD)

Konami, a company with a rich history in the gaming industry, known for popular titles such as Yu-Gi-Oh! and Castlevania, recently made headlines with the announcement of its new web3 game, Project Zircon. Konami’s official statement highlighted their aspiration to offer “a new co-creation experience by utilizing blockchain technology.”

Funding and Government Support

Japan's Prime Minister Fumio Kishida recently reiterated the government's commitment to supporting web3, gaming, and tech startups, expressing optimism about the industry's potential to drive innovation across various sectors. A newly announced 100 billion yen ($661.7 million) fund by SBI Holdings earlier this week aligns with Kishida's vision and compounds Japan's positive sentiments towards web3. The government has also made public statements that it aims to elevate startup investments from 800 billion yen in 2022 to an impressive 10 trillion yen (approximately $66 billion) by 2027, again indicating a robust commitment to fostering the growth of web3, gaming, and innovative tech in the country.

Final Thoughts

Japan's video game market is clearly renowned for its continual innovation and dedication to providing immersive and cutting-edge gaming experiences. As it maintains its dominance within the traditional gaming industry, new technological advancements into web3, blockchain, and AI - as well as a rapidly growing user base - keep the future for web3 gaming looking very promising. We are excited to introduce more web3 games into this rapidly growing and evolving market with our new partners at Pacific Meta!