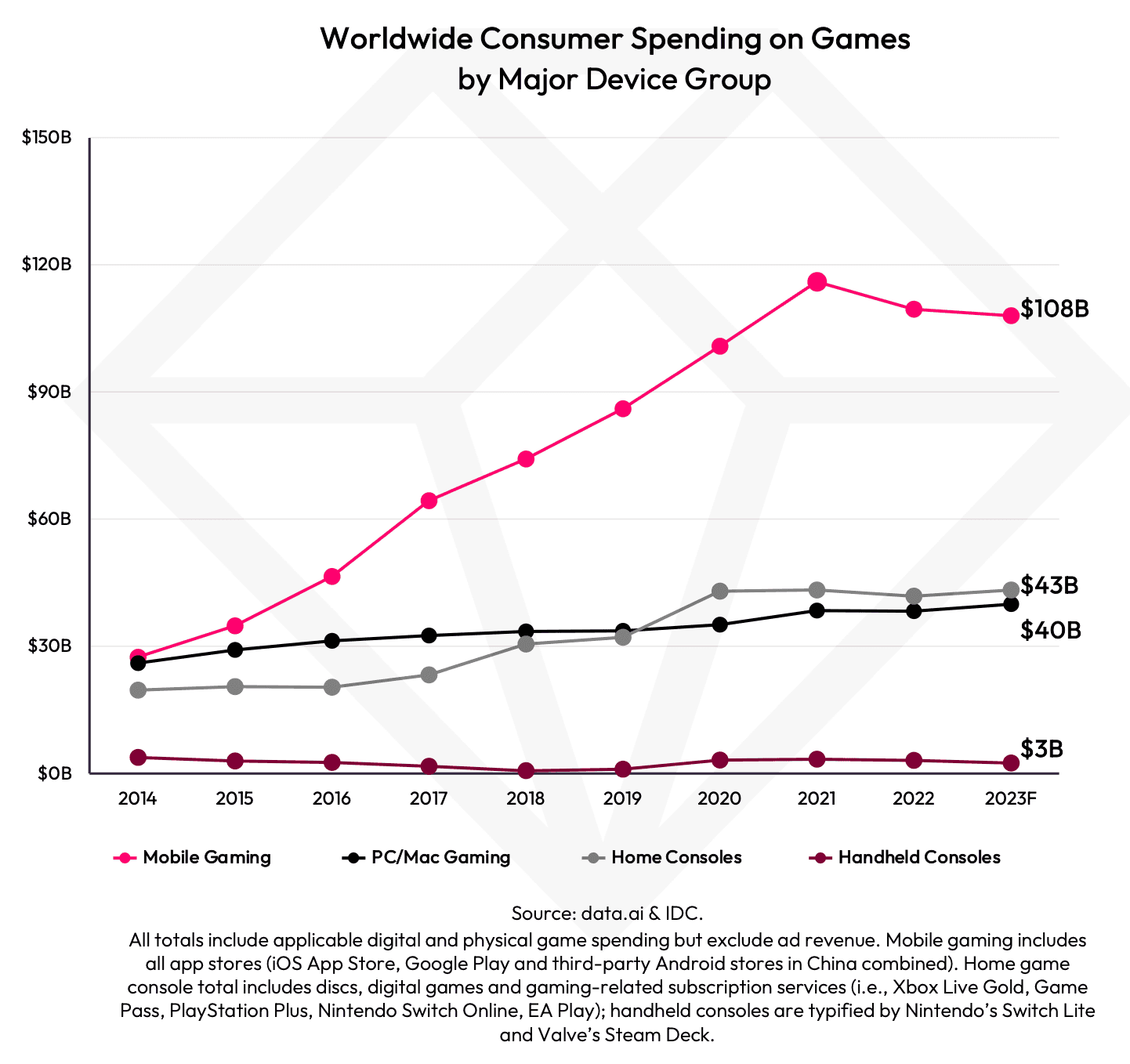

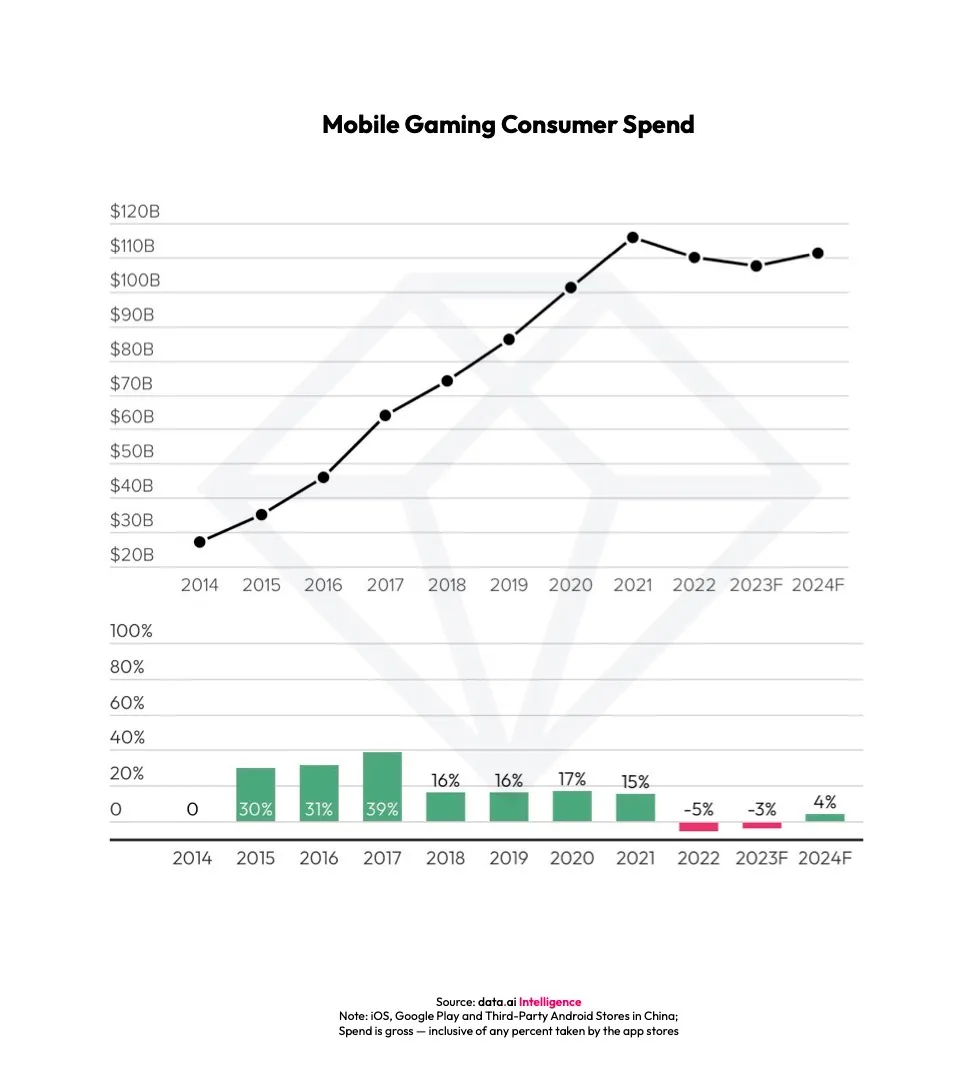

Data.ai, the well-known mobile app analytics firm, foresees a rebound in mobile game spending, with an anticipated global total of $111.4 billion in 2024. This follows a two-year period marked by a decline in consumer spending within the mobile gaming sector. Since its inception in 2015, mobile game spending demonstrated consistent growth until reaching a peak of $115.8 billion in 2021. The subsequent decline, averaging 3.7% annually, is attributed to a correction from the rapid growth observed during the initial stages of the pandemic. Lexi Sydow, Head of Insights at Data.ai, states, "As consumer behavior returns to a 'new normal,' we expect mobile game behavior to align more closely with pre-pandemic trends. The decline has stabilized by mid-2023."

The 2024 projection indicates a 4% global growth in mobile game spending, representing a positive shift for the broader gaming industry. This transition moves away from the surge seen during the pandemic, towards a more moderate and sustainable growth pattern. However, challenges persist, with Data.ai highlighting macroeconomic influences on discretionary spending, advertising fingerprinting crackdowns, the rise of alternative app store distributions, and gaming regulations, particularly in China.

Examining the drivers behind mobile game spending growth, the U.S. leads, contributing 40% to year-on-year aggregate spending growth. This is expected to grow further over the upcoming Winter Holidays - with the latest data from the ESA revealing that 72% of U.S. children are asking parents for video games this holiday season. Sydow explains, "Mobile game spending is closely tied to disposable income, especially in markets like the U.S. As global economic conditions gradually improve, we observe an upward trend in mobile game consumer spending."Japan and South Korea are also pivotal growth markets, contributing 16% and 9% of year-on-year aggregate spending growth, respectively. Additionally, Taiwan, Germany, and the U.K. are expected to play significant roles in fueling spending growth.

In terms of genres, RPG, Match, Party, and Casino games are projected to drive spending gains, distributing growth more evenly than markets. RPG and Match games are anticipated to collectively account for 40% of spending growth, contributing $1 of every $5 in aggregate growth. Data.ai foresees TikTok surpassing Candy Crush Saga's lifetime spending total by the end of 2024. While Candy Crush Saga is set to cross the $14 billion lifetime spending mark shortly before TikTok, the social video app is expected to overtake its spending totals before the start of 2025.

These findings are particularly relevant to the evolving landscape of web3 gaming, where the intersection of mobile gaming trends and blockchain technology is becoming increasingly popular. As mobile game spending experiences a positive trajectory, the implications for web3 gaming could usher in new opportunities and dynamics, shaping the future of the gaming industry in the digital age. Stay tuned for the unfolding narrative as the realms of mobile gaming and web3 technology converge in the coming years. For a comprehensive exploration of Data.ai's 2024 predictions on the broader mobile app market, the full report is now available. Stay informed as the mobile gaming landscape evolves, presenting new opportunities and challenges in the upcoming year.