In 2023, Japan continues to dominate the global mobile app market, with a staggering 85% of its population already using smartphones, and this number is projected to grow even further. The mobile app market in Japan thrives on innovation and fierce competition, making it a vital region for web3 gaming developers to explore.

In this article we break down the key findings from Adjust and data.ai's analysis, shedding light on gaming app performance benchmarks and user insights that can guide web3 game studios targeting Japanese markets.

Japan: A Mobile Gaming Powerhouse

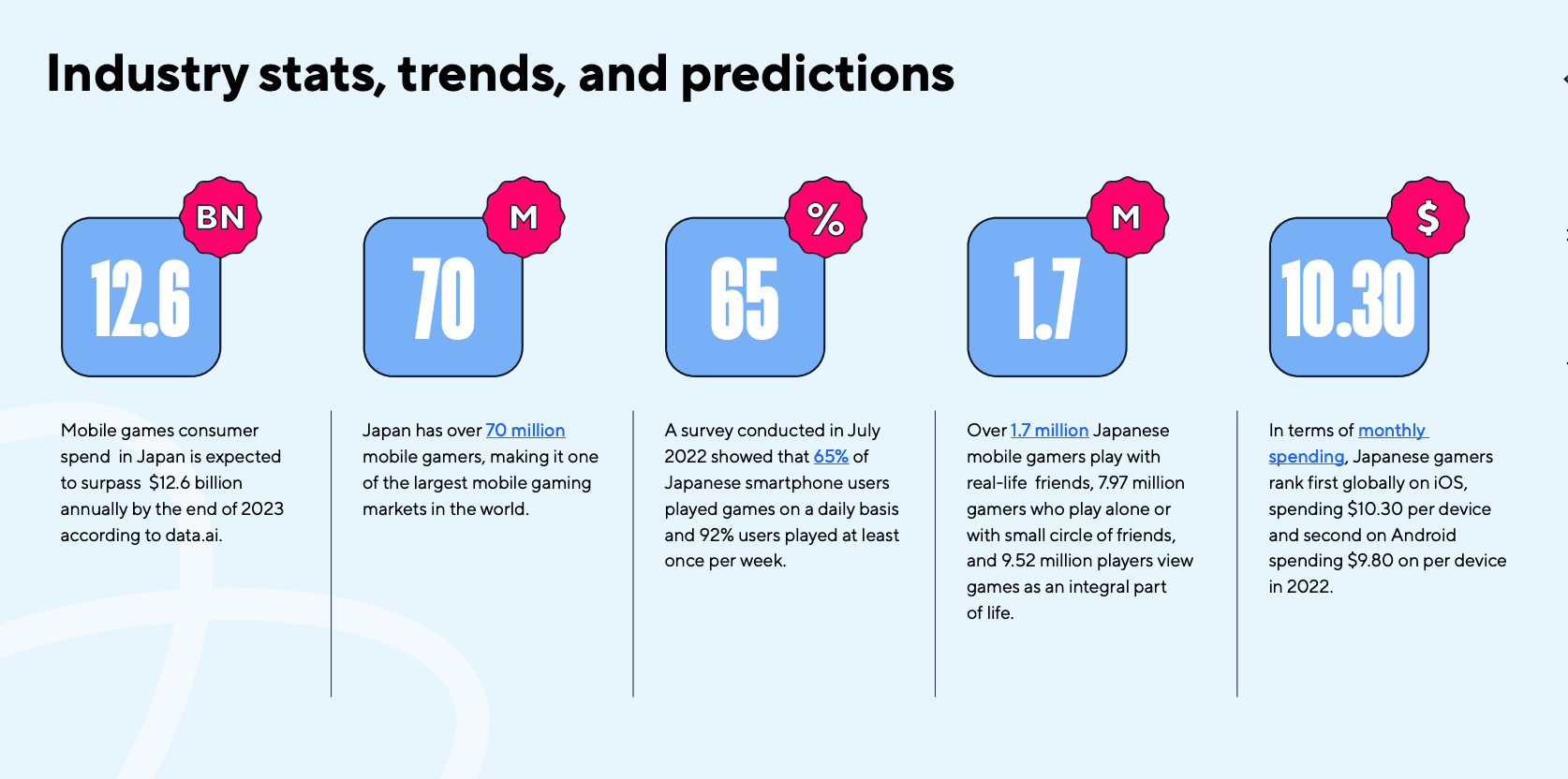

Japan boasts over 70 million mobile gamers, cementing its position as one of the largest mobile gaming markets globally. Gaming consumer spending in Japan is predicted to exceed $12.6 billion annually by the end of 2023. A survey from July 2022 revealed that 65% of Japanese smartphone users play games daily, with a whopping 92% playing at least once a week.

Demographics and Preferences

Gen Z stands out as 233% more likely to engage in party royale games, while younger millennials favor MOBA games, and older millennials lean towards puzzle games. Gen X and baby boomers show a preference for card games like solitaire.

Gaming app preferences also differ by gender, with simulation sports games being popular among men (47% more likely to play) and matching puzzle games attracting more women (42% more likely to play).

Growth and Install Trends

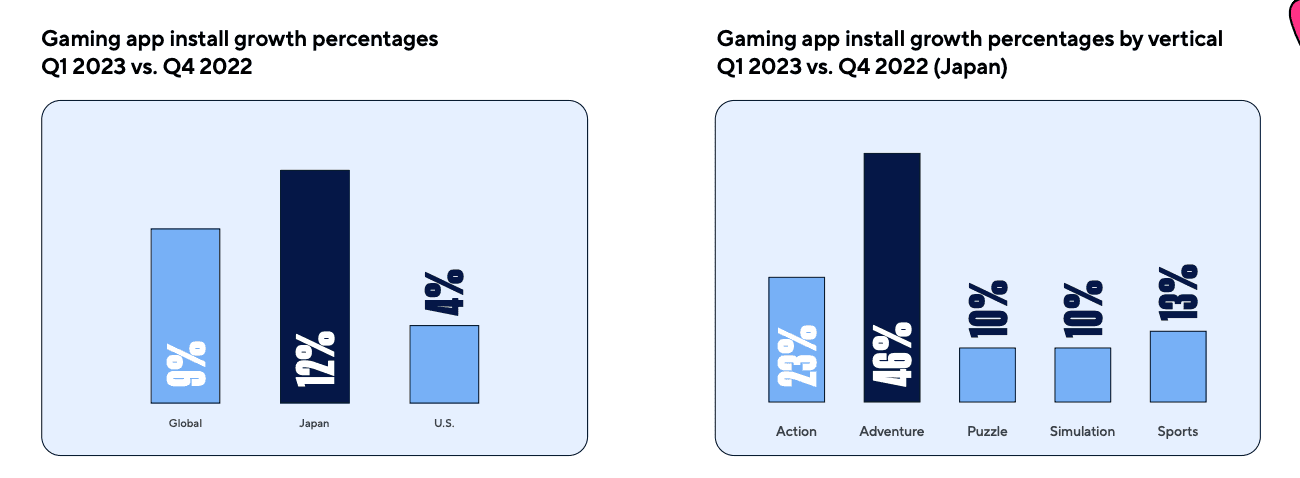

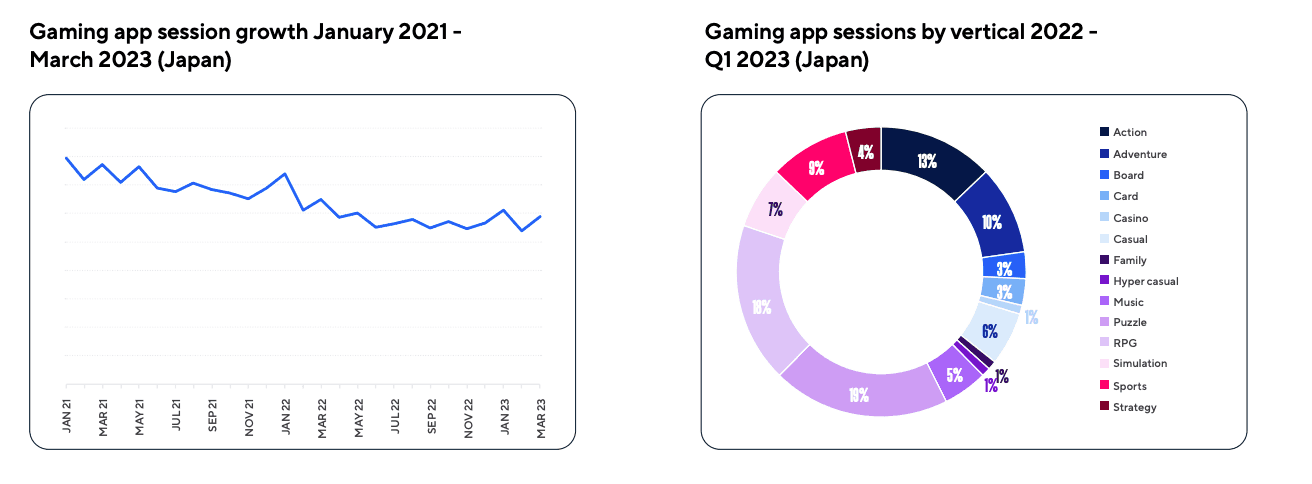

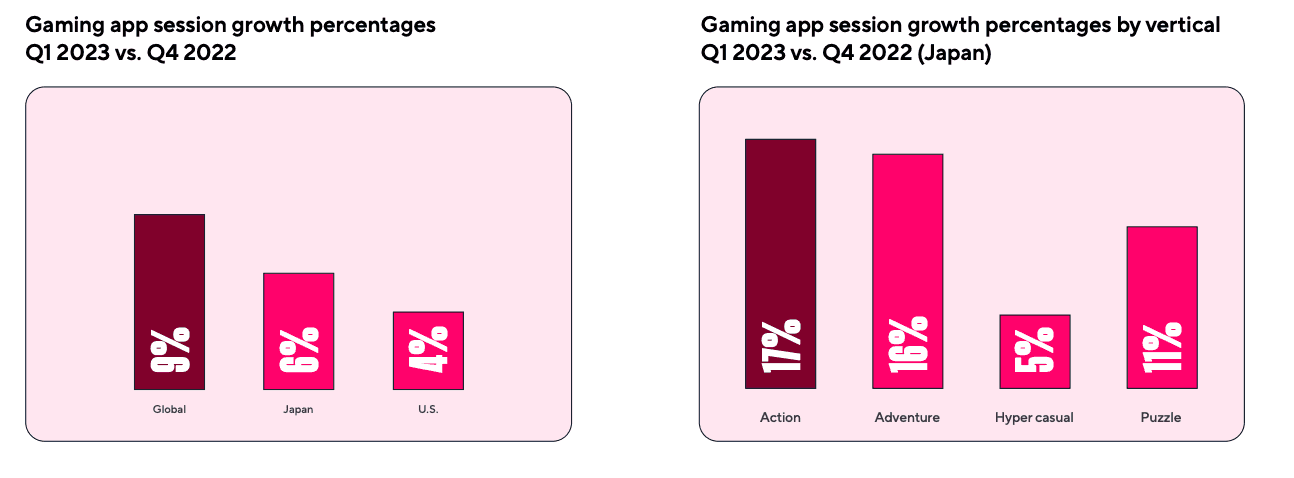

Despite a temporary dip in 2022, gaming app installs are on the rise again in 2023. Japan experienced a notable 12% boost in installs during Q1 2023 compared to Q4 2022. RPGs lead the way as Japan's most popular genre across mobile, console, and PC, accounting for 13% of all gaming app installs.

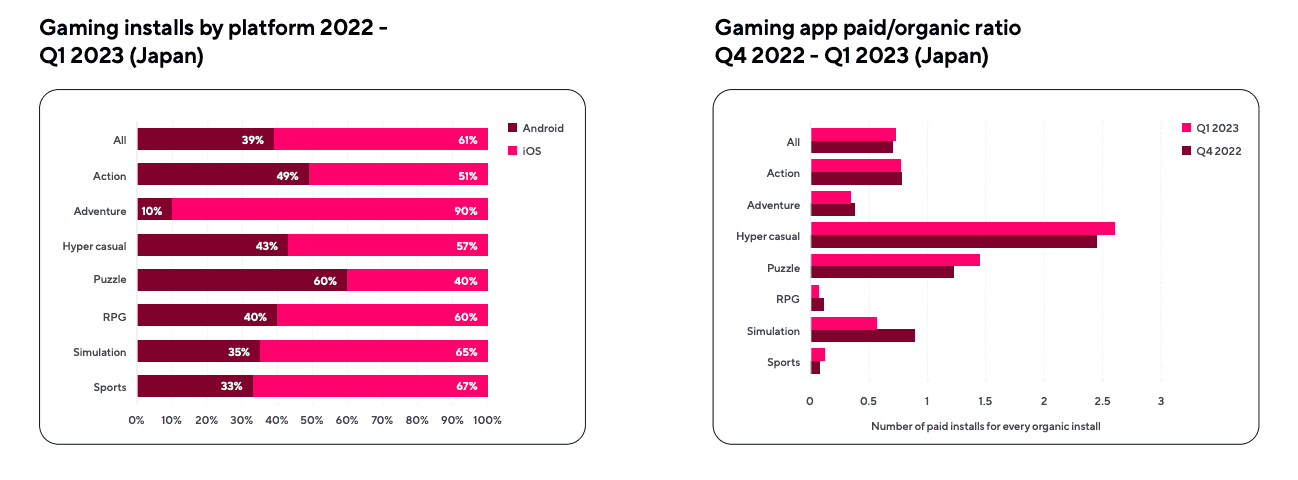

Japanese consumers have a distinct affinity for Apple iPhones, as evidenced by the fact that 61% of the gaming apps tracked by Adjust in Japan are iOS-based. It's also interesting to note how platform preference plays out in the adventure and puzzle game sub-verticals. While iOS dominates in adventure games (90%), for example, Android is the favorite for puzzle games (60%).

Many gaming sub-verticals in Japan also saw considerable install growth from Q4 2022 to Q1 2023. Adventure games took the crown with an impressive 46% surge, followed by action games with a 23% increase, sports games with 13%, and puzzle and simulation games tying with 10% growth.

Session Behavior and Engagement

Japanese gamers showcase a remarkable level of engagement, with session lengths averaging 26.59 minutes in Q1 2023, surpassing the U.S. average of 24.71 minutes.

Hypercasual and action games experienced notable growth in session lengths, indicating a highly engaged user base.

Implications for Web3 Gaming

Web3 game studios should undoubtedly focus more effort on targeting Japanese mobile gamers due to the massive market size and increasing app usage trends. By understanding user preferences, marketers can tailor their strategies to resonate with different age groups and genders effectively.

Creating mobile-friendly games influenced by Japanese culture and preferences could be a winning formula for web3 game developers looking to penetrate the Japanese market. Incorporating elements that cater to the gaming habits and interests of Japanese gamers can significantly enhance user engagement and boost chances of success.

Conclusions

In conclusion, the mobile app trends in Japan for 2023 present a wealth of opportunities for web3 gaming. Armed with the insights and data provided by Adjust and data.ai, developers have the chance to capitalize on this thriving market and cater to the diverse needs of Japanese gamers.

By crafting mobile-friendly experiences that align with user preferences, web3 game studies can elevate their chances of making a significant impact in Japan's lucrative gaming ecosystem.

Share this article and tag us on any of our socials to let us know.