Introduction

Welcome to an in-depth exploration of Latin America's dynamic mobile games market, where players, payers, revenues, and esports are converging to create an exciting ecosystem. This article provides actionable data and consumer insights that shed light on the region's flourishing gaming industry. From the rise of mobile gaming to the impact of 5G and the emergence of esports, let's dive into the key factors that make Latin America a gaming powerhouse.

1. Latin America: A Mobile-First Games Market

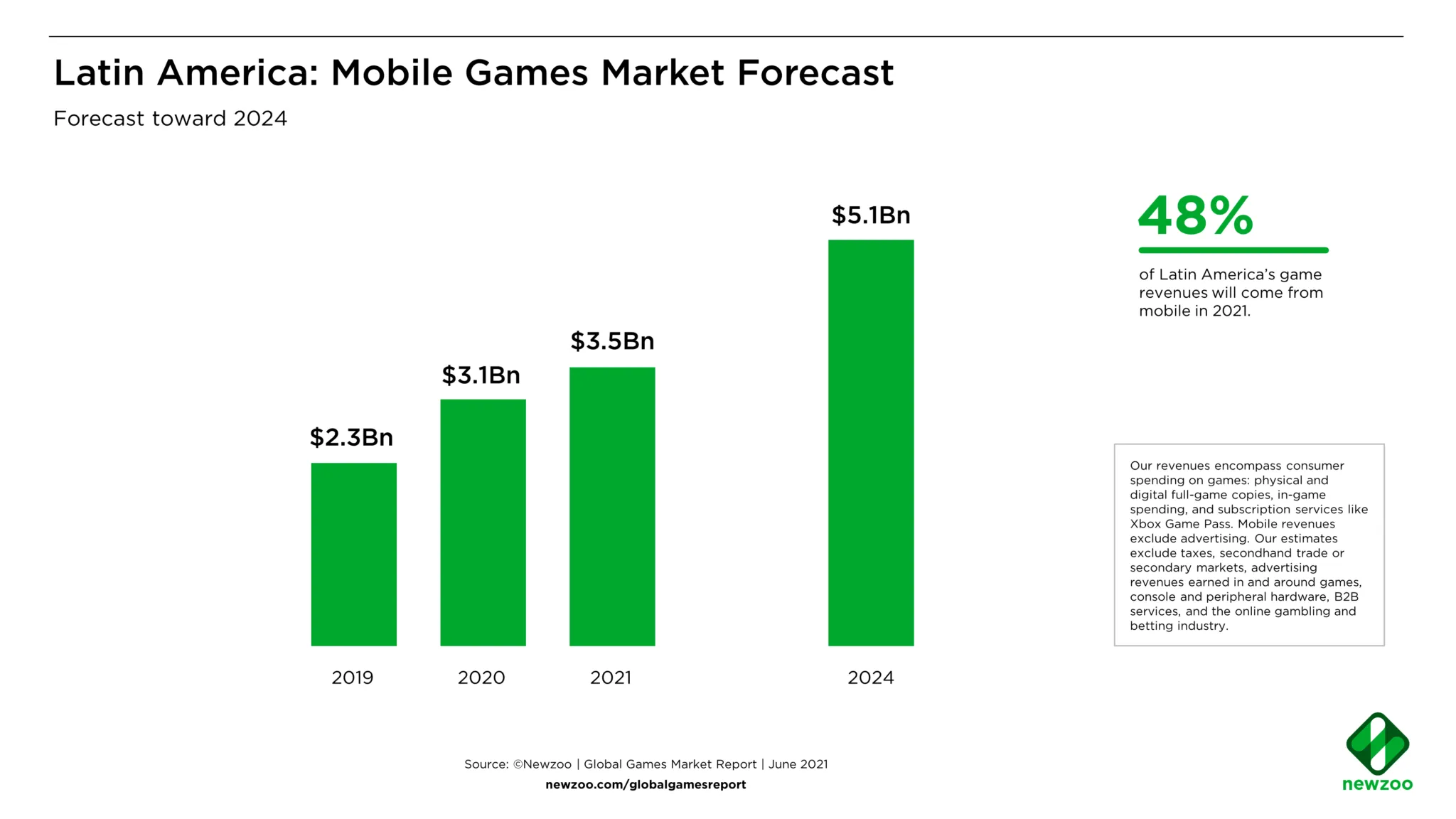

Mobile gaming is the driving force behind Latin America's gaming revolution, accounting for 48% of 2021's market revenues. With a staggering 273.4 million mobile gamers, representing 58% of the region's online population, it's evident that mobile gaming has captured the hearts of Latin American players.

2. Internal Market Dynamics Fueling Mobile Gaming in Latin America

A crucial factor in mobile gaming's impressive growth is its low barrier to entry. With over 351.9 million smartphone users in the region by the end of 2021 (expected to exceed 400 million by 2023), mobile gaming offers a cost-effective and accessible alternative to console and PC gaming.

Moreover, internet access in Latin America is undergoing democratization, connecting and empowering residents across countries. The gradual rollout of 5G is set to further expand internet availability, unlocking new opportunities for the gaming industry. While smaller markets like Colombia, Chile, and Peru are poised for growth, larger markets such as Brazil, Mexico, and Argentina anticipate improved mobile gaming experiences, better multiplayer features, and advancements in mobile esports.

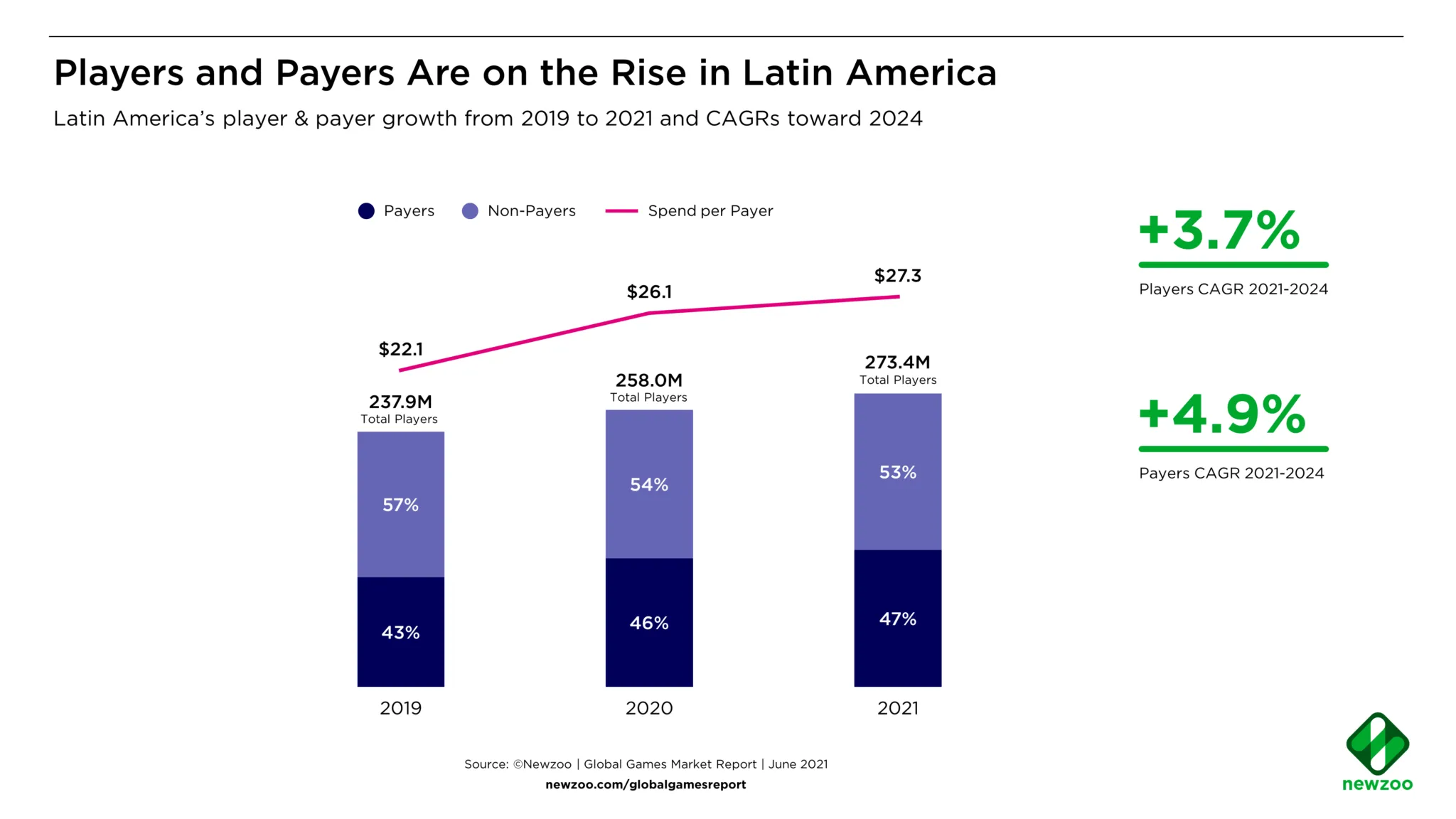

3. Latin America's Mobile Gamers: Payers, Players, and App Stores

Nearly half of Latin America's mobile players are eager to spend on gaming, making mobile the most lucrative segment. Google Play dominates the app store landscape with over 68% of app-store revenues, while iOS and third-party stores hold smaller shares.

4. Competitive and Midcore Genres Rule the Latin American Gaming Landscape

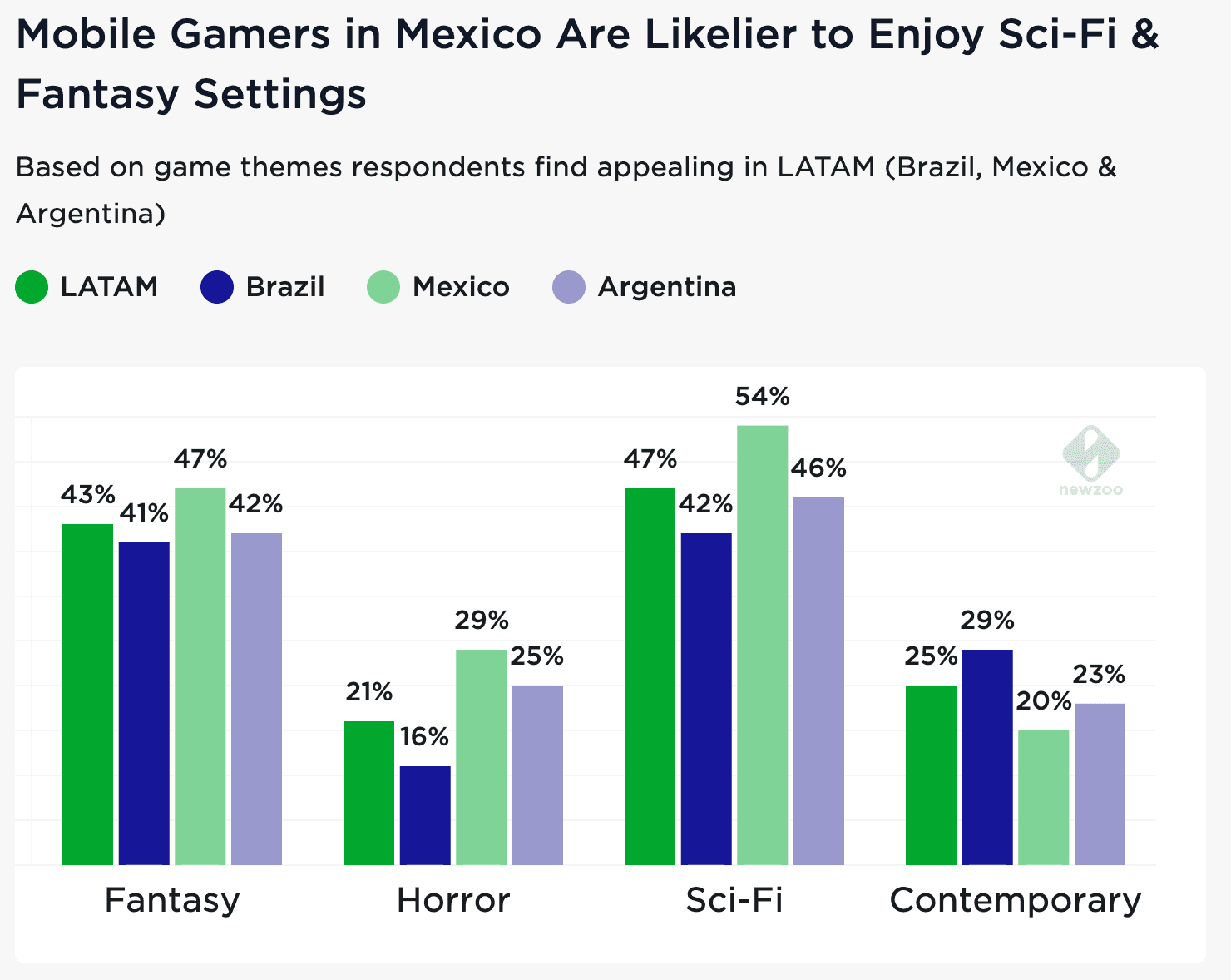

Latin America's mobile gamers have a strong affinity for core and competitive genres. Strategy games top the charts with 35% of players engaging in them, followed by shooters (32%) and racing games (30%). Sci-fi and fantasy themes dominate the preferences, aligning well with core and competitive gaming experiences.

The demand for exploration and open worlds is on the rise (30%), along with a desire for strong narratives (29%), showcasing the region's inclination towards engaging gameplay mechanics.

5. Differing Market Dynamics: Understanding the Unique Traits of Each Latin American Country

Despite a shared passion for gaming, each country in Latin America exhibits distinct player habits and preferences. Brazil's unified language and culture create a more uniform market, while Spanish-speaking countries like Colombia and Argentina showcase varied linguistic and cultural influences.

For instance, preferred streaming platforms differ across regions, creating opportunities for LATAM-focused mobile game streaming. Spanish and Portuguese streams are gaining traction on platforms like Twitch, fostering deeper connections between viewers and streamers.

6. Player Demographics in Latin America

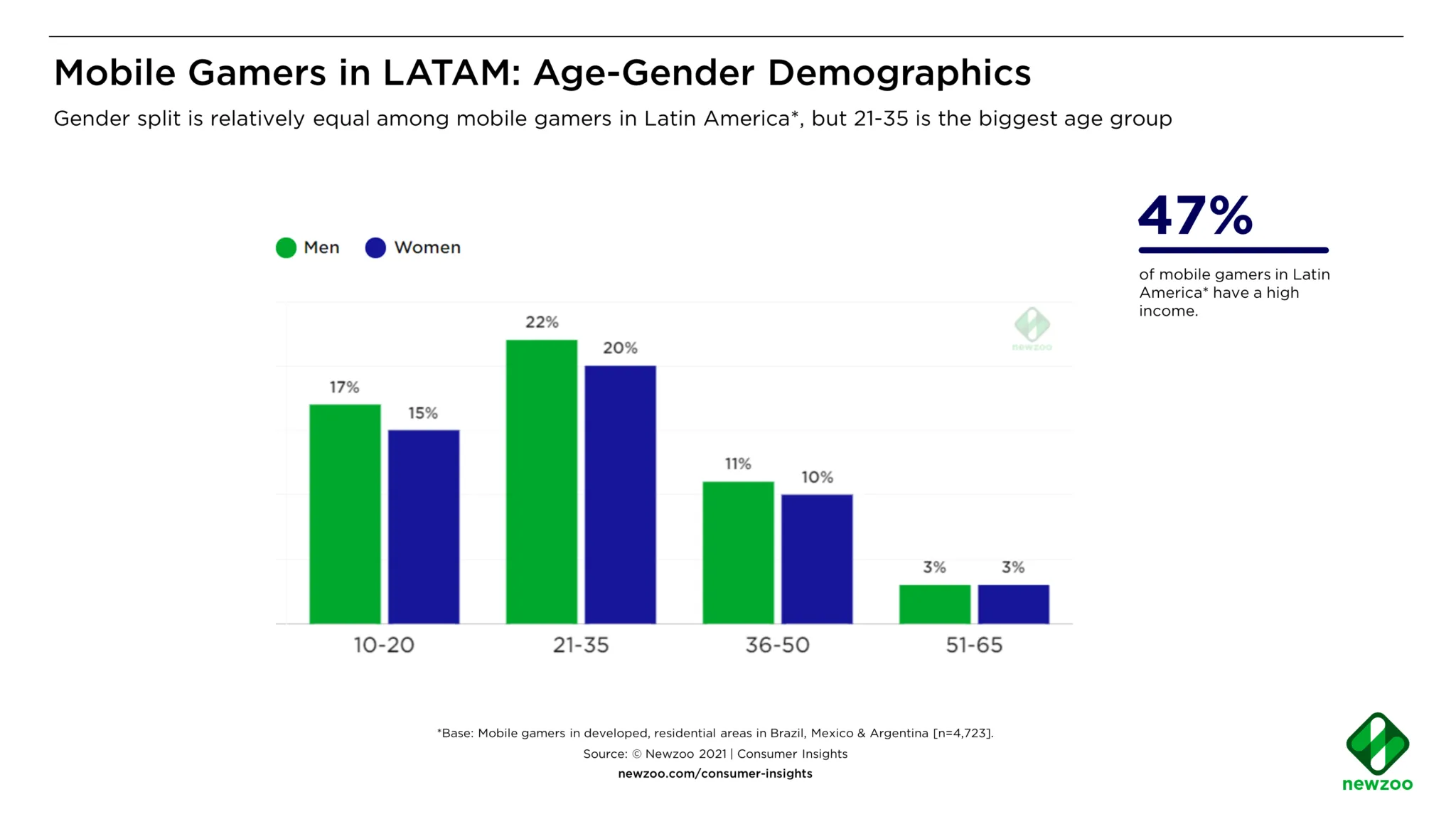

Latin America's mobile gamers are predominantly male, between the ages of 21 and 35, with higher incomes. Interestingly, the split between male and female players is almost 50:50, highlighting the growing inclusivity of gaming.

Conclusion

Latin America's $3.5 billion mobile games market is a hotbed of innovation and growth, driven by mobile-first gaming, internet democratization, and the rise of mobile esports. The region's unique characteristics make it a key market for forward-thinking mobile publishers seeking expansion opportunities.

By harnessing data and understanding market nuances, early movers and innovators can capture the hearts of Latin America's diverse gaming community. As the industry continues to flourish, the potential for growth and revenue generation is limitless for those who embrace the power of data-driven insights.

Source

This article is based on insights from Newzoo and Google, which provide valuable data and analysis for the gaming industry.

Share this article and tag us on any of our socials to let us know.