According to a report by Drake Star Partners, financing for gaming companies has shown a significant upward trend during the first quarter of 2024, with both mergers and acquisitions (M&A) transactions and private placements experiencing modest gains. Most notably, Blockchain gaming companies accounted for a massive 40% of the quarter’s private placements, reflecting an upswing possibly mirroring the recent rally of cryptocurrency markets.

Michael Metzger, managing partner of media & tech investment banking at Drake Star Partners, remarked on this trend, stating: “After a long decline from over 80 deals back in Q3 2022, it seems we’re on an uptick again with 47 M&A deals. It’s a modest uptick, but at least an uptick on the M&A side and very similar if you look at the financing side. There’s obviously still a lot of challenges out there, but I think both of these developments are pretty exciting.”

Global Gaming Report Q1 2024

Gaming M&A in Q1 2024

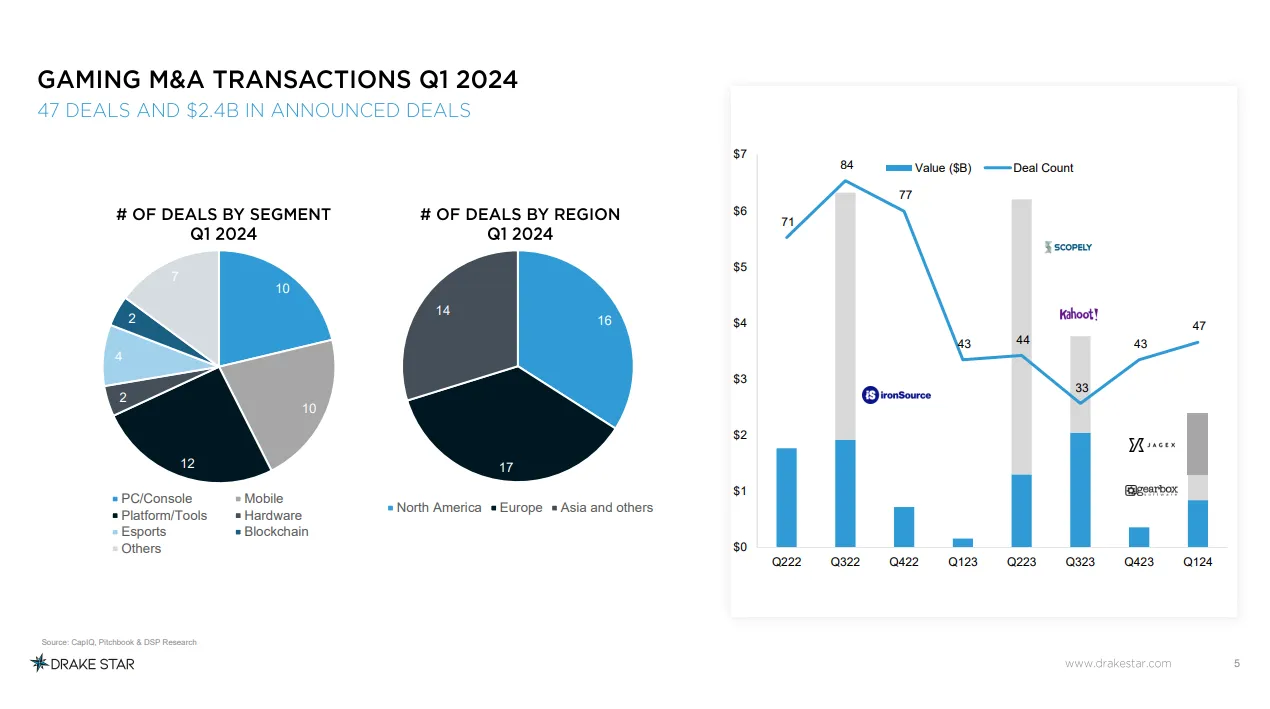

Drake Star Partners' latest report reveals that there were 47 M&A transactions totaling $2.4 billion in disclosed funding during Q1 2024. While this transaction volume falls below 2022’s peak, it represents a 15% increase from the average deals closed per quarter in 2023.

Gaming M&A Transactions Q1 2024

The disclosed deal value remains volatile, with three deals accounting for 75% of the quarter’s total. Notable among these transactions is CVC and Haveli Investments’ $1.1 billion acquisition of Jagex from the Carlyle Group, which contributed 46% of the total M&A deal value. Michael Metzger anticipates that private equity firms like CVC and Haveli will ramp up their activity throughout 2024.

Additionally, Take-Two’s $460 million acquisition of Gearbox Entertainment from Embracer Group and Beacon Interactive's $247 million acquisition of Saber Interactive from the same group further contributed to the M&A deal value in Q1 2024.

Gaming M&A Transactions Q1 2024: 47 Announced Deals

“A lot of companies on the M&A side have been very much inward-focused over the last year with internal restructuring and layoffs. It’s not as easy to acquire other companies at the same time,” said Michael Metzger. “I think a good amount of them feel like they’re done with the internal restructuring and are now looking at growth opportunities again.”

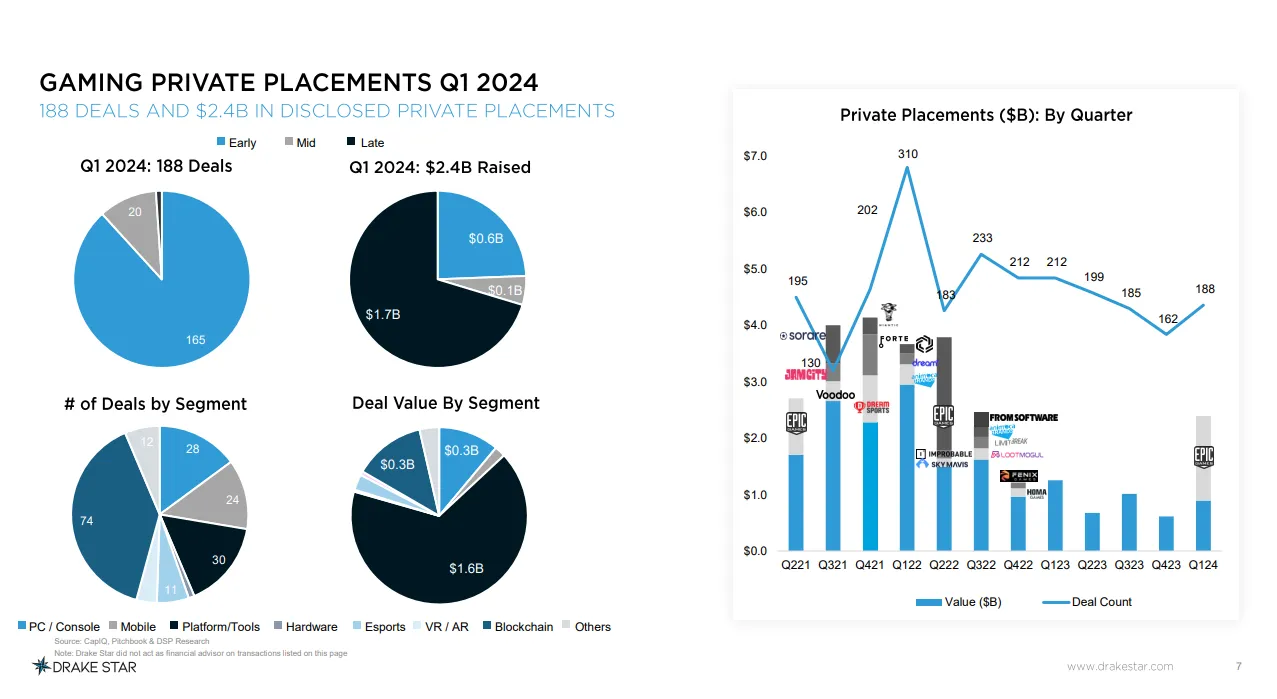

Private Placements

Drake Star's report also highlights a significant increase in the value of private investments made in Q1 2024. However, Disney’s $1.5 billion investment in Epic Games stands out as a major outlier, accounting for 63% of the value of all private placements made in the quarter.

Gaming Private Placements Q1 2024

The majority of private placements were with early-stage startups, with seven out of every eight transactions (88%) going to such companies. Michael Metzger notes that later-stage financing is more challenging due to lower valuations, leading companies to avoid it unless necessary. Blockchain gaming companies notably accounted for 40% of the quarter’s private placements, reflecting an upswing possibly mirroring the recent rally of cryptocurrency markets.

Some notable mentions include (but are not limited to):

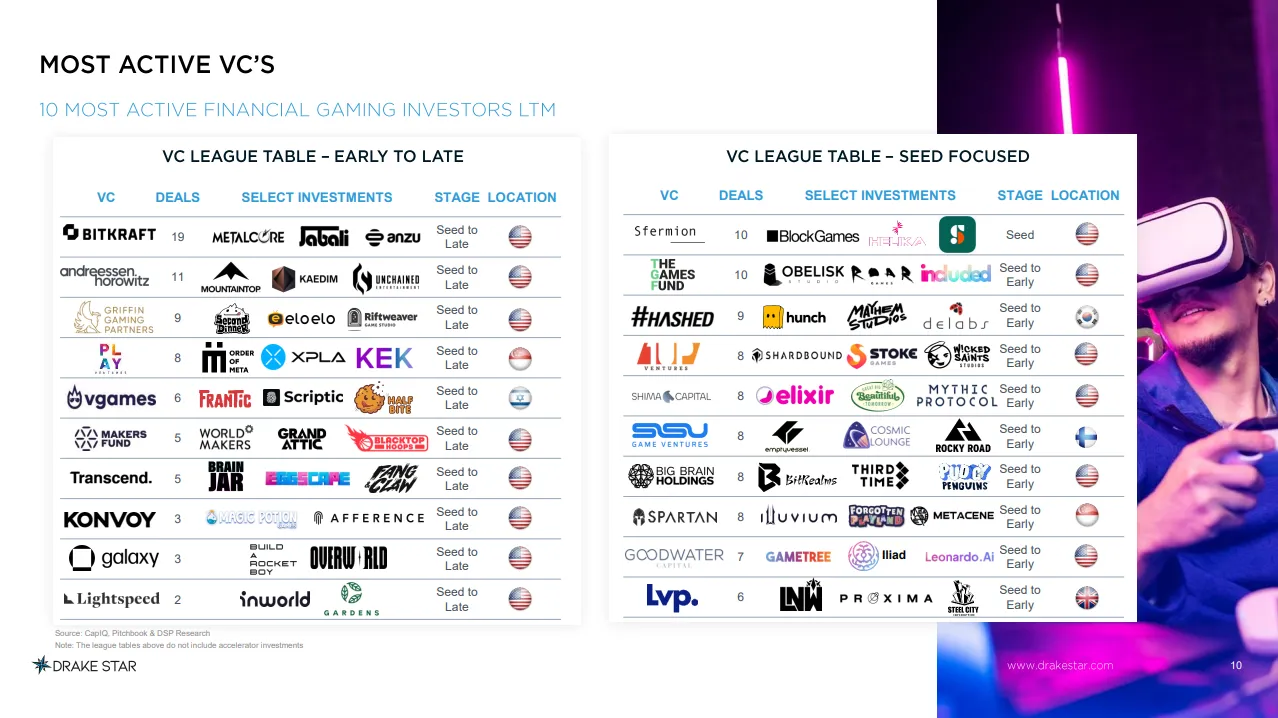

Studio 369's blockchain game Metalcore, XPLA, Xterio's web3 IP Overworld ($10 Million), BlockGames, Helika's web3 analytics platform ($8 Million), Delabs, Elixir, Mythic Protocol, Pudgy Penguins, Immutable's NFT game Illuvium ($12 Million), Vermilion Studio's new crypto game Forgotten Playlands ($7 Million), Metacene's web3 MMORPG ($10 Million) and more. Please see the image below for a more detailed breakdown of which VCs invested in which blockchain gaming companies.

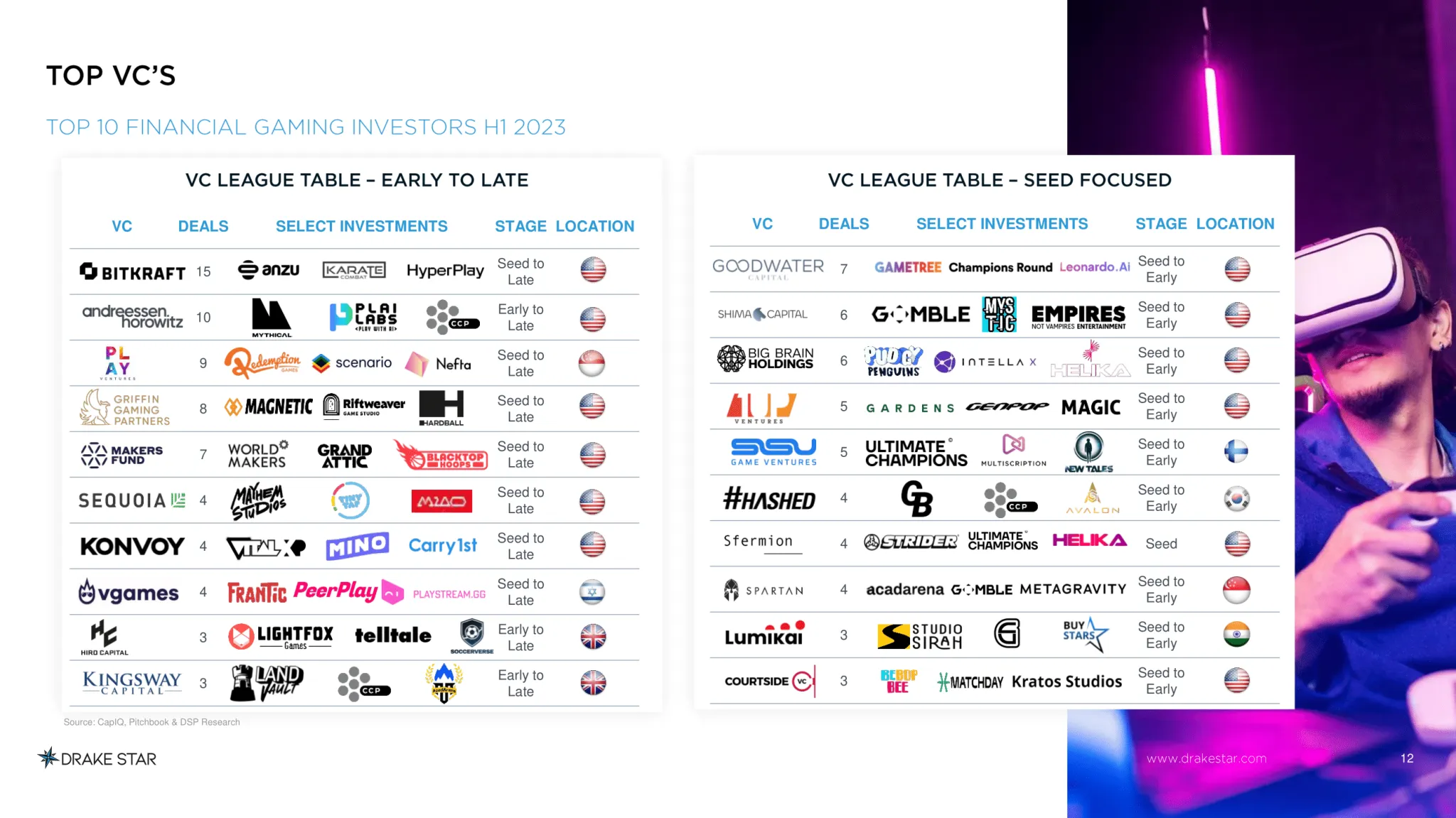

Most Active VCs

“The later stage is more challenging because valuations are down. Companies are trying to avoid later-stage financings unless they absolutely have to. Unless they performed really well, it’s probably a down round,” said Michael Metzger. “It’s much easier for some of those earlier stage funds to write small checks as the risk is much lower. So I would say the VC community is still very cautious, but maybe a bit more optimistic.”

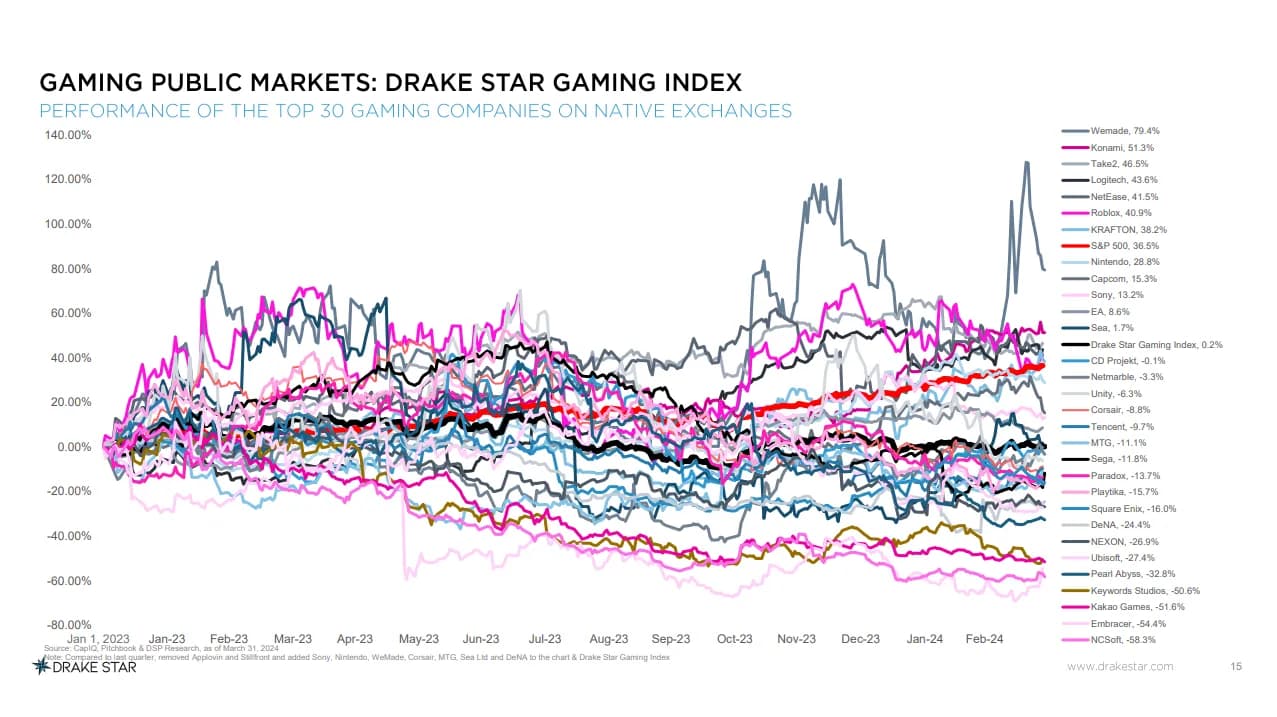

Drake Star Gaming Index

Drake Star also updated its gaming index, adding eight new companies while removing three, for a total of thirty tracked companies in its equal-weighted index. Notable changes include the removal of Activision Blizzard and Stillfront Group, with the addition of companies like Nintendo, Sony, DeNA, Sea, Wemade, MTG, Logitech, and Corsair.

With this new mix of companies, the Drake Star gaming index essentially remained flat from January 2023 through March 2024, with some companies outperforming the S&P 500, but most underperforming its 36.5% growth through this period.

Gaming Public Markets

“With the previous index, it was up quite a bit, but it was heavily driven by Applovin. There are also a bunch of other gaming ETFs out there that are up because they happen to be heavy on Nvidia. It obviously has an important gaming component so it's valid to include them. But at the same time, we felt like Nvidia’s stock increased because of its AI business. We felt like this wasn’t a reflection of reality at least as it relates to gaming,” said Michael Metzger.

Final Thoughts

These findings hold particular relevance to the web3 gaming industry as they underscore the shifting landscape of mergers, acquisitions, and investments within the sector. Furthermore, the dominance of early-stage startups in private placements, coupled with the notable presence of blockchain gaming companies, suggests a growing appetite for emerging technologies and novel gaming experiences.

As established players jostle for position and new entrants vie for attention, these trends paint a dynamic picture of an industry poised for continued evolution and transformation. Drake Star’s full Q1 2024 Global Gaming Market report, providing more details on top transactions and insights, is now available for further analysis.