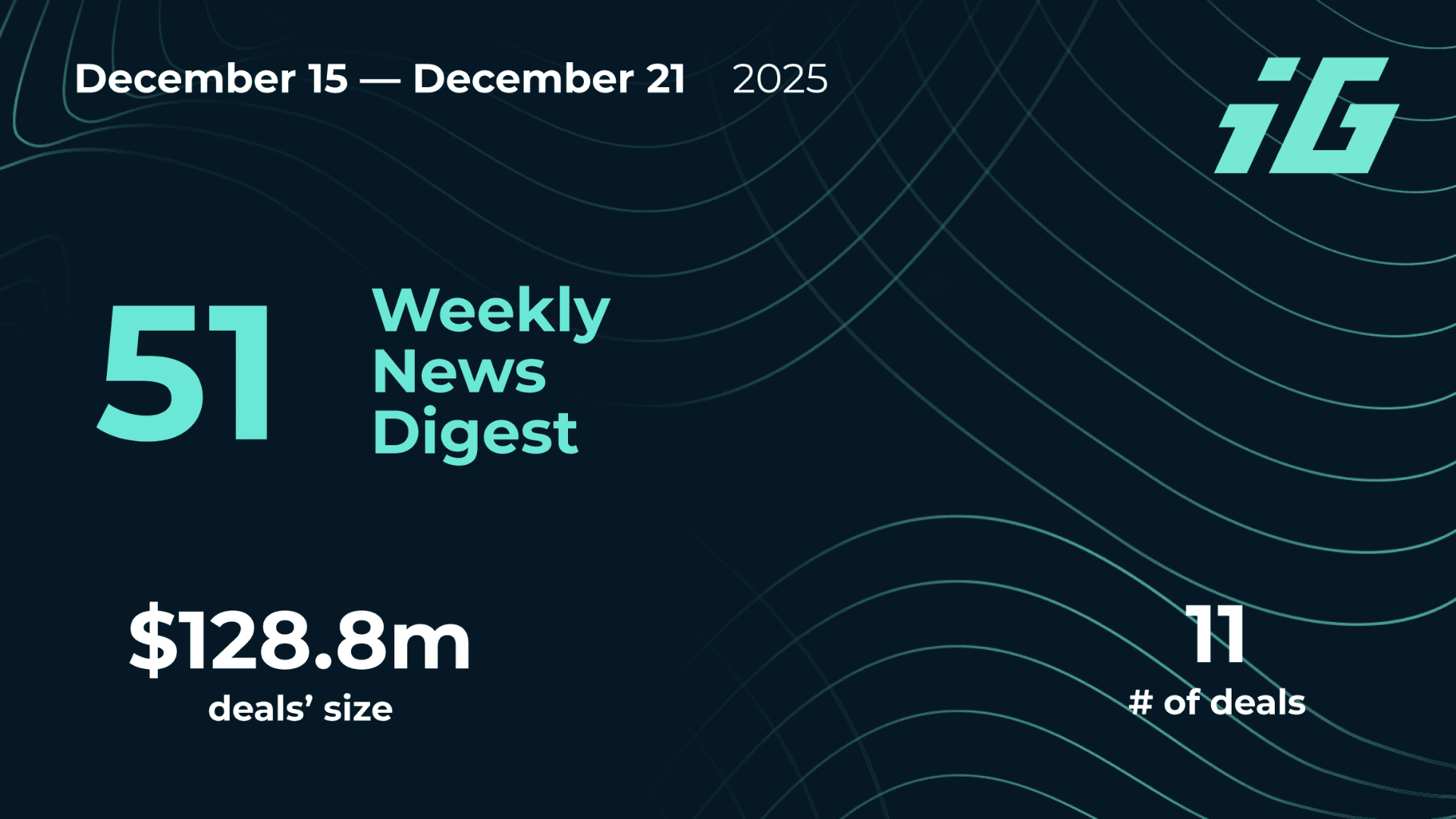

As reported by InvestGame x GDEV, the gaming industry has seen a wave of mergers and acquisitions in recent months, reflecting both strategic expansion and portfolio realignment among major players. Netflix, the US-based streaming entertainment platform, has acquired Estonia-based cross-game avatar platform Ready Player Me for an undisclosed sum. Approximately 20 employees, including co-founder and CTO Rainer Selvet, will join Netflix, while the other founders will not transition to the company. Ready Player Me is expected to discontinue its standalone product in January 2026. The platform had previously raised a total of $72 million, including a $56 million Series B round in August 2022.

Ubisoft Entertainment, the French gaming giant, has acquired March of Giants, including the game’s intellectual property and its Montreal-based development team, from Amazon Game Studios. As part of the agreement, Amazon will provide marketing support for the title via Twitch. March of Giants is a free-to-play 4v4 MOBA that completed a closed alpha earlier in 2025. Following the acquisition, the team will integrate into Ubisoft’s newly established Creative House. The deal comes after layoffs at Amazon Game Studios in October 2025.

In the UK, Mythwright, a PC and console game developer, has acquired the Thronefall intellectual property from Germany-based Grizzly Game for an undisclosed sum. Thronefall, a medieval-themed strategy defense game available on PC, Nintendo Switch, and mobile, has surpassed one million units sold. Doghowl, the studio behind the mobile version, will continue to publish the mobile editions.

Bandai Namco, a major Japanese publisher, has sold Germany-based Limbic Entertainment to a private investor specializing in video games. The divestment aligns with Bandai Namco’s strategy to focus on areas where it has stronger competitive positions. Limbic, known for Tropico 6, will continue operating independently under its current management team and brand. This transaction follows recent corporate activity, including Nintendo’s acquisition of Bandai Namco Singapore in November 2025 and Sony acquiring a minority stake earlier in July 2025.

In esports, US-based organization DarkZero has acquired NRG Esports, including its professional teams and staff, while explicitly excluding Full Squad Gaming, NRG’s casual gaming division. Full Squad Gaming will remain under the ownership of NRG founder and CEO Andy Miller. DarkZero described the acquisition as part of a broader strategy to consolidate esports organizations.

Venture Funding Highlights Across Gaming and AI

Venture financing in the gaming sector continues to support innovation in AI, cloud streaming, and interactive platforms. Japan-based Ubitus has received a $107 million (¥17B) investment grant from the Japanese Ministry of Economy, Trade and Industry to expand its AI-focused computing infrastructure and further develop the NeoCloud platform. Ubitus specializes in cloud streaming for gaming, GPU infrastructure, and AI solutions, with a recent focus on AI data centers.

UK-based Iconic AI raised $13 million in a Seed round co-led by Kindred and Northzone, with participation from Google AI Futures Fund, Conviction Embed, Deepwater Asset Management, Sequoia Capital scouts, and others. The company is developing an on-device AI platform for game development, which uses small language models to enable real-time, voice-driven gameplay without internet connectivity. Iconic AI previously raised $4 million in a pre-Seed round in July 2024.

Wavedash, a US-based PC gaming platform, secured $4.3 million in Seed funding led by Floodgate’s Mike Maples, Jr., with participation from Y Combinator and other investors. The platform allows players to access PC games directly through a web browser and is currently in public beta with the arcade-style racing game Parking Garage Rally Circuit DX.

New Zealand-based XR company StretchSense raised $2.3 million in funding led by PXN Ventures and supported by Scottish Enterprise. The investment will support the company’s global expansion. StretchSense develops motion-capture gloves designed to translate human movement into digital environments for gaming, animation, training, and simulation.

UK-based Ace High Sports raised $800,000 (£600,000) through a combination of equity financing from the South West Investment Fund and a grant from the UK Games Content Fund. The company plans to use the funds to expand its portfolio, including developing sports-themed card games. Its debut title, Touchdown Poker, is scheduled for release in 2026.

China-based Tencent Holdings invested an undisclosed amount in France-based Drama Studios during a Series A round to accelerate development of Unrecord, a body-cam style first-person shooter. Drama Studios had previously raised $2.5 million in Seed funding in September 2024.

Industry Trends and Implications

These recent deals highlight continued consolidation and strategic investment within the gaming sector. Established publishers are acquiring IP and development teams to strengthen portfolios, while venture financing supports innovation in AI-driven tools, cloud platforms, and immersive experiences. The integration of AI, cloud, and web-based gaming technologies suggests that developers and investors are preparing for a future where scalable, on-demand, and cross-platform solutions play a central role in player engagement.

Source: InvestGame x GDEV x Alinea Analytics

Frequently Asked Questions (FAQs)

What was Netflix’s acquisition of Ready Player Me about?

Netflix acquired Estonia-based cross-game avatar platform Ready Player Me, bringing around 20 employees, including the CTO, on board. The platform will discontinue its standalone product in January 2026.

Which companies did Ubisoft and Amazon work with recently?

Ubisoft acquired March of Giants from Amazon Game Studios, including its Montreal development team and intellectual property. Amazon will provide marketing support via Twitch.

What funding rounds were notable for AI gaming startups?

UK-based Iconic AI raised $13 million in Seed funding for its on-device AI gaming platform. Japan-based Ubitus received $107 million in a government-backed grant to expand AI infrastructure for gaming and cloud solutions.

What are the key trends in recent gaming industry deals?

The sector shows consolidation of IP and development teams, increased investment in AI and cloud gaming, and expansion of web-based platforms to support immersive, cross-platform gameplay.

Which companies did Tencent invest in recently?

Tencent invested in France-based Drama Studios as part of a Series A round to support the development of Unrecord, a realistic body-cam first-person shooter.

What is the significance of these mergers and acquisitions?

These transactions allow major gaming companies to strengthen IP portfolios, acquire development talent, and prepare for future growth in AI-driven and cross-platform gaming experiences.