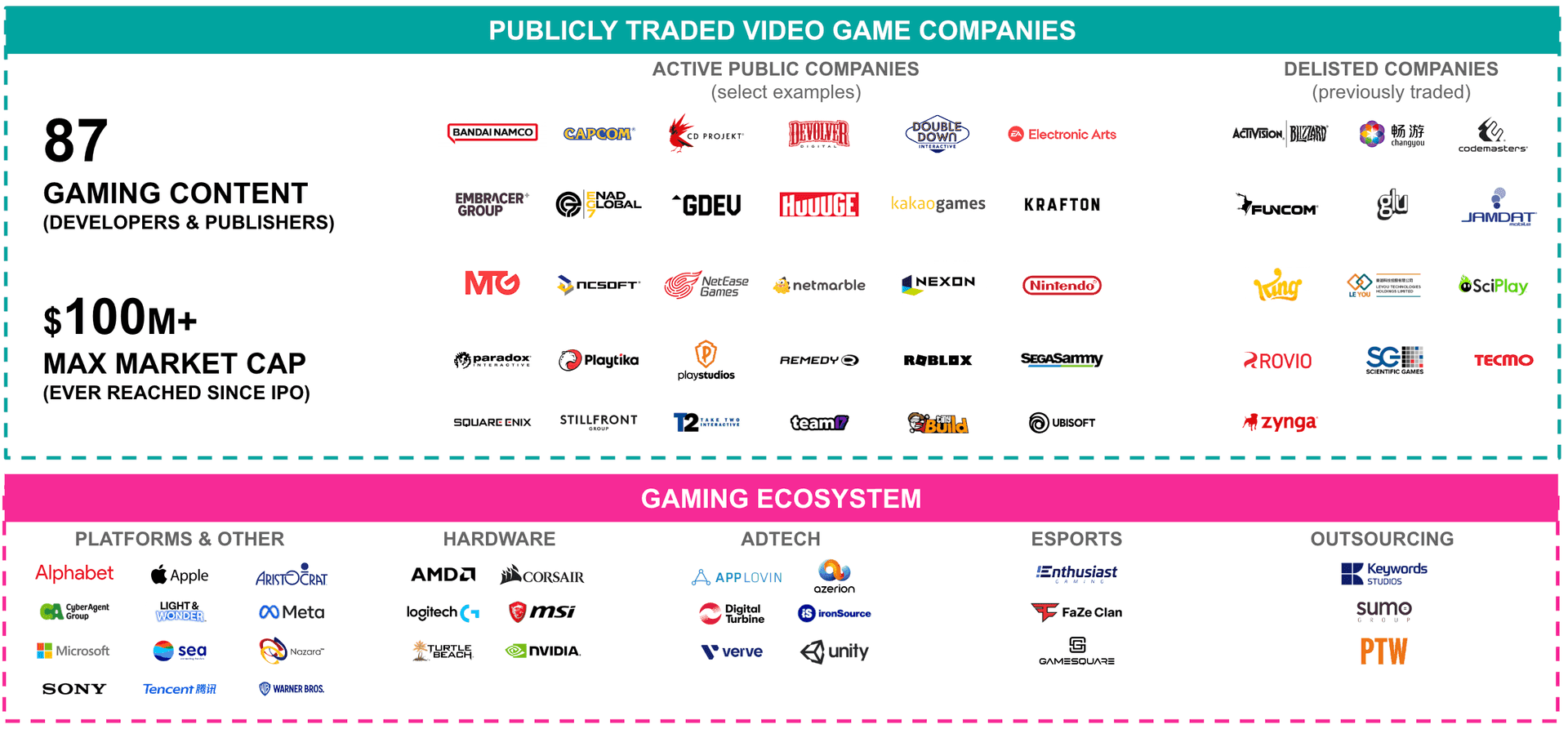

The gaming industry has evolved dramatically over the past few decades, transitioning from a niche hobby into a global entertainment powerhouse. With a peak market capitalization of $535 billion in 2020 and a current value exceeding $365 billion, this sector has experienced remarkable growth. Key developments include the rise of mobile gaming, regional market expansions, and the increasing number of public offerings from gaming companies worldwide.

Recent data from InvestGame shows that although the IPO market has slowed in 2024, the number of publicly traded gaming companies has grown nearly fivefold since 2000. In this article, our analysis explores the shifts in the gaming IPO landscape, regional growth patterns, and platform diversification within the industry.

Gaming IPOs: Report Summary

Evolution of Gaming IPOs

Since 1960, the video game industry has seen a steady increase in initial public offerings (IPOs), with notable milestones shaping its trajectory. Between 1991 and 2000, the industry saw 12 gaming companies go public, driven largely by the growing appeal of home entertainment systems. However, the early 2000s witnessed a slowdown due to the post-dot-com bubble, with only six companies going public between 2001 and 2005.

IPO activity surged between 2016 and 2020, with 25 gaming companies entering the public market, supported by the rapid growth of mobile gaming and the COVID-19 pandemic, which boosted demand for interactive entertainment. The year 2021 alone saw 10 new IPOs. However, as market conditions became less favorable in the following years, the number of IPOs declined, with just one new public listing, Shift Up, in July 2024.

Gaming IPOs: History and Timeline

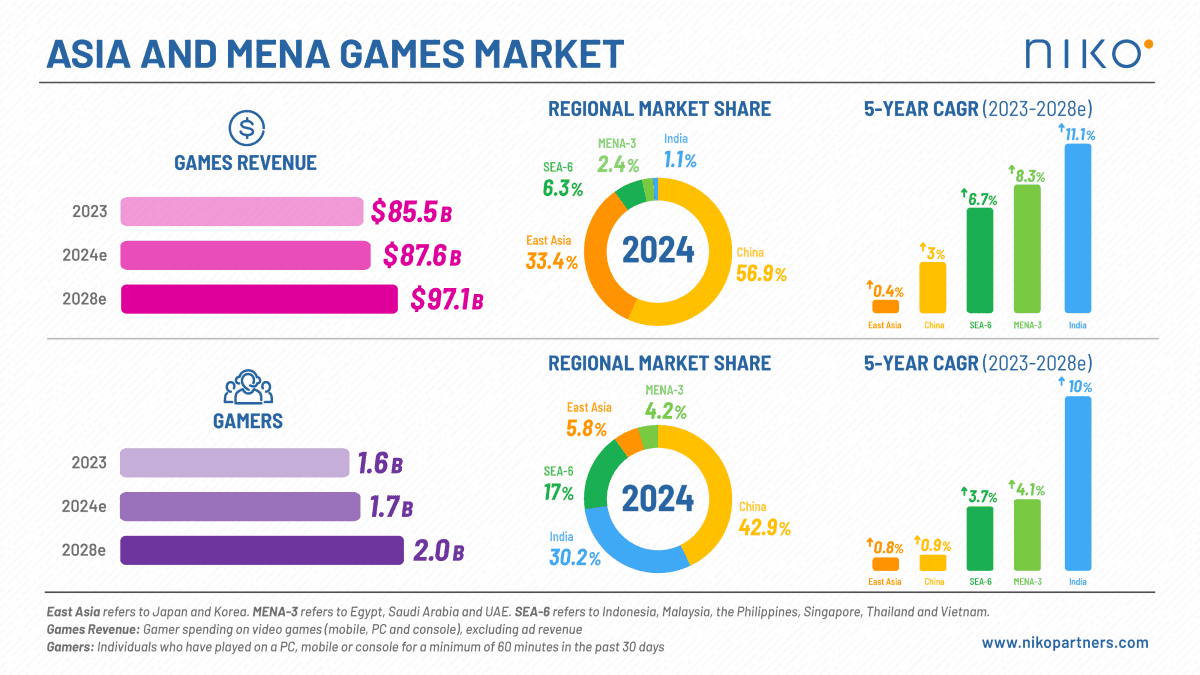

Regional Growth: Asia's Dominance

The gaming market’s regional distribution highlights Asia's dominance, with 46% of all public gaming companies headquartered in the region. Asia’s leadership in this sector is supported by its large player base and expanding market, growing from just seven public companies before 2000 to 36 between 2021 and 2024.

North America, while slower in growth, still holds a significant share, representing 18% of the global market. The number of publicly listed companies in the region has grown from four in the early 2000s to 14 by 2024. Europe also demonstrated impressive growth, expanding its number of public gaming companies by 4.5 times, contributing to 35% of the market. In contrast, the Middle East and North Africa (MENA) region is a newer player, with Playtika becoming the first public gaming company from this region in 2021.

Gaming IPOs: Regional Distribution

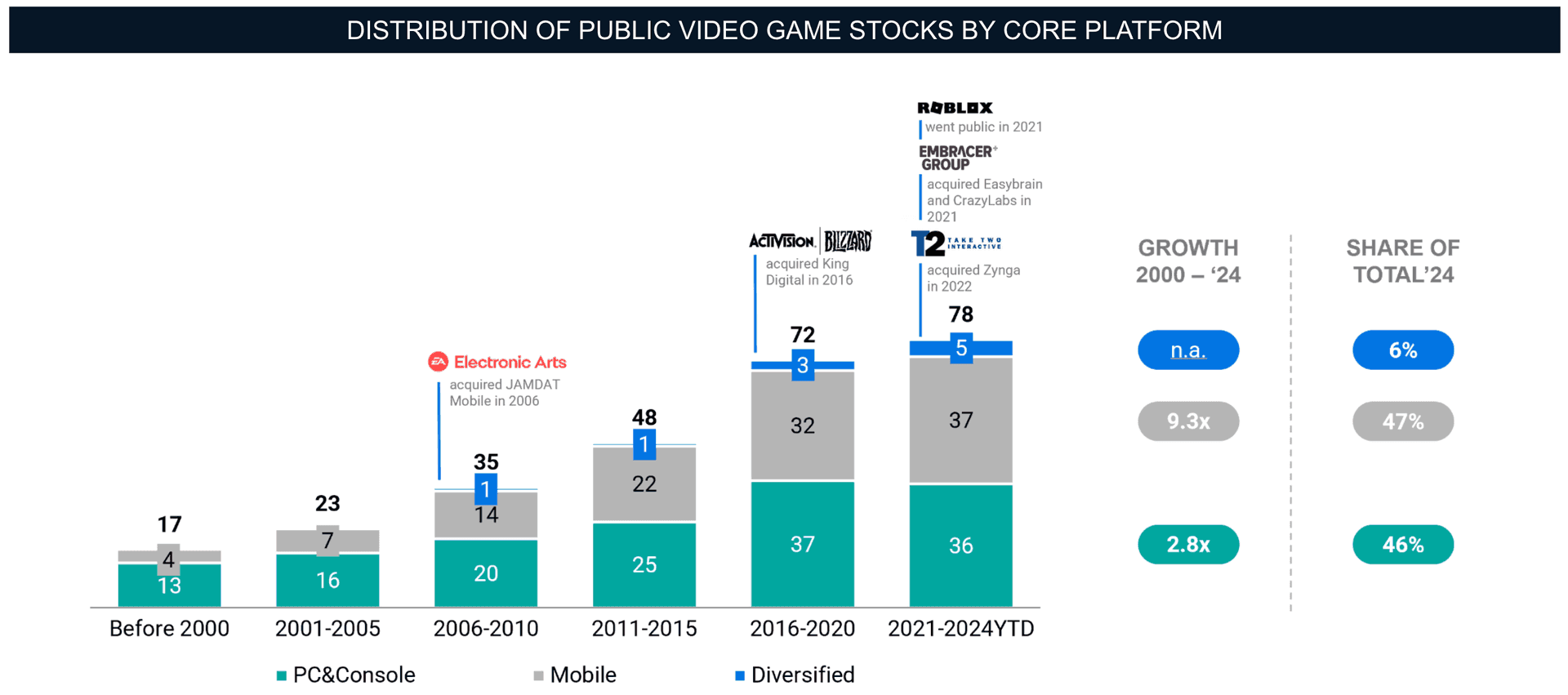

Platform Shifts: Mobile Gaming on the Rise

The distribution of public gaming companies by platform has shifted significantly, with mobile gaming emerging as a dominant force. Prior to 2000, the industry was largely driven by PC and console gaming. However, the introduction of in-app purchases on Apple’s App Store in 2009, combined with the widespread adoption of smartphones, significantly expanded the reach of mobile gaming. Between 2006 and 2024, the number of mobile gaming companies grew 9.3 times, making up 47% of the market by 2024.

Diversification has also played a crucial role in the industry’s evolution. Major PC and console gaming companies expanded into mobile gaming through strategic acquisitions. For instance, Electronic Arts acquired JAMDAT Mobile in 2006 and Glu Mobile in 2021, while Activision Blizzard purchased King Digital in 2016. As a result, companies operating across multiple platforms accounted for 46% of the market by 2024, reflecting a shift toward multi-platform strategies.

Gaming IPOs: Platform Distribution

Market Capitalization: Peaks and Declines

The gaming industry’s market capitalization has fluctuated over the years, reaching $145 billion before the 2007 Global Financial Crisis. Although the market took a hit, dropping to $75 billion post-crisis, it recovered steadily, reaching $122 billion by 2014. Between 2014 and 2020, the market tripled in value, hitting a record high of $535 billion. This growth was driven by favorable macroeconomic conditions and a surge in new public listings.

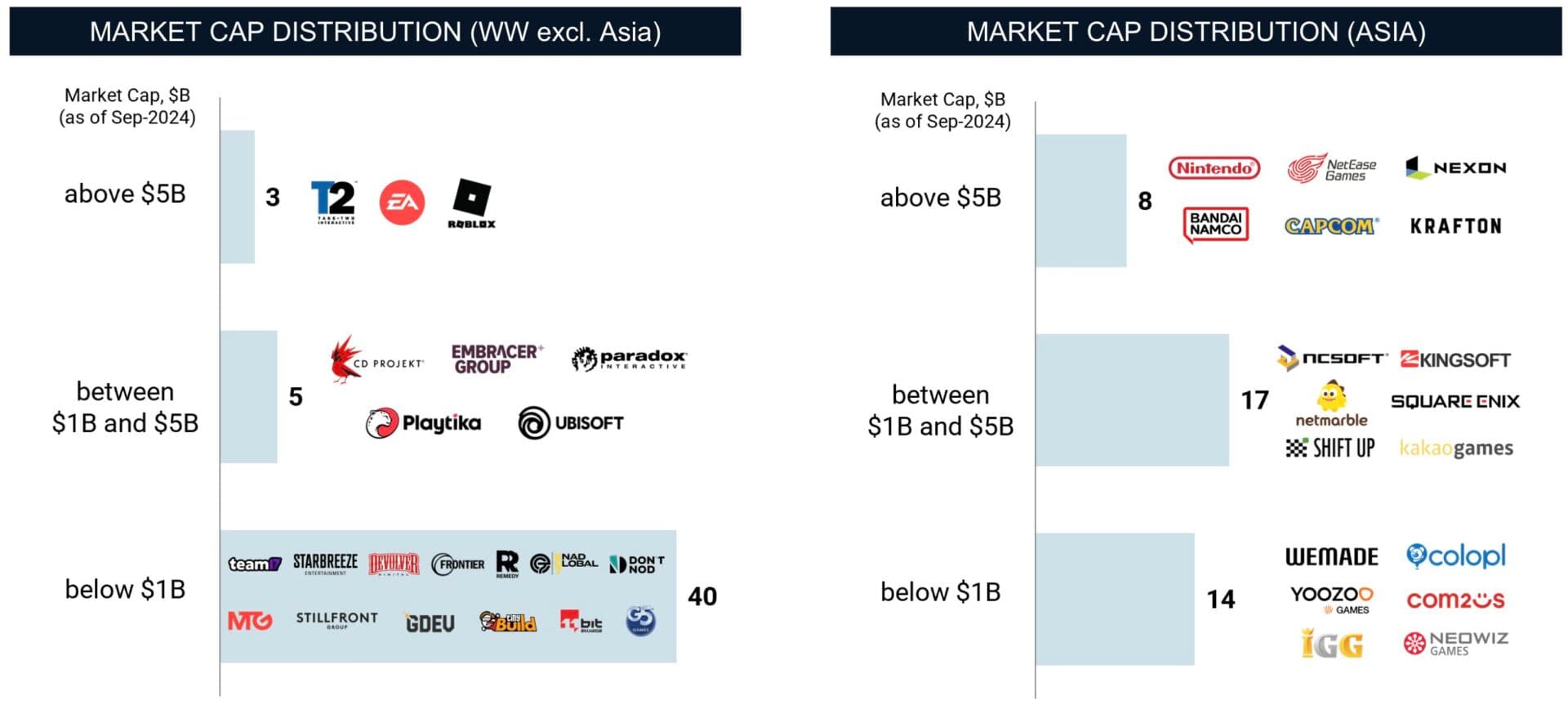

However, recent challenges, including rising interest rates and market downturns, have caused the total market cap to decline by over 30%, standing at $353 billion in 2023. Despite these challenges, the industry remains strong. Asia continues to lead in terms of market cap, with North America and Europe contributing significant portions as well.

Gaming IPOs: Market Cap

Age and IPO Timelines of Gaming Companies

The gaming industry is gradually maturing, with many of its publicly traded companies now more than 20 years old. Industry leaders such as Nintendo, Activision Blizzard, and Electronic Arts have been in operation for over 40 years, showcasing their adaptability over time. On average, Asian gaming companies tend to be older, with an average age of 28 years compared to their global peers, which average 23 years.

Regarding the time taken for companies to go public, most gaming firms list their shares between five and twelve years after being founded. This group represents 48% of all publicly listed gaming companies. A smaller group of companies, such as Take-Two Interactive and Starbreeze, took a faster route to IPO, going public in under four years.

Gaming IPOs: Age Distribution

Future Outlook

The gaming industry’s rapid expansion over the past two decades has been driven by technological advancements, new monetization models, and a broader audience base. As the industry matures, platform diversification and regional growth will continue to shape its future.

Asia, in particular, is set to remain a key player, with ongoing growth in the number of publicly traded companies. Although the number of gaming IPOs is expected to slow in the near future due to market conditions, the industry's foundational strength, built over decades of innovation and expansion, positions it for continued long-term growth.

Gaming IPOs: Market Cap Asia

Relevance to Web3

These findings are particularly relevant to blockchain gaming, as the industry's shift toward platform diversification and Asia's market dominance align with trends in the blockchain sector. The rapid growth of mobile gaming and multi-platform strategies offers valuable insights for blockchain gaming’s future.

Additionally, the timeline from startup to IPO seen in traditional gaming mirrors the fast growth of blockchain gaming companies, which are quickly moving toward public listings. These trends highlight the potential for blockchain gaming to follow similar patterns of expansion and innovation. You can read the full report by InvestGame on their website here.