Konvoy just released its Gaming Industry Report for Q3 2023. In this deep dive, we unpick the data, uncovering the shifts in private market funding, M&A activities, and the exciting evolution in web3 gaming.

Venture Capital Funding Trends

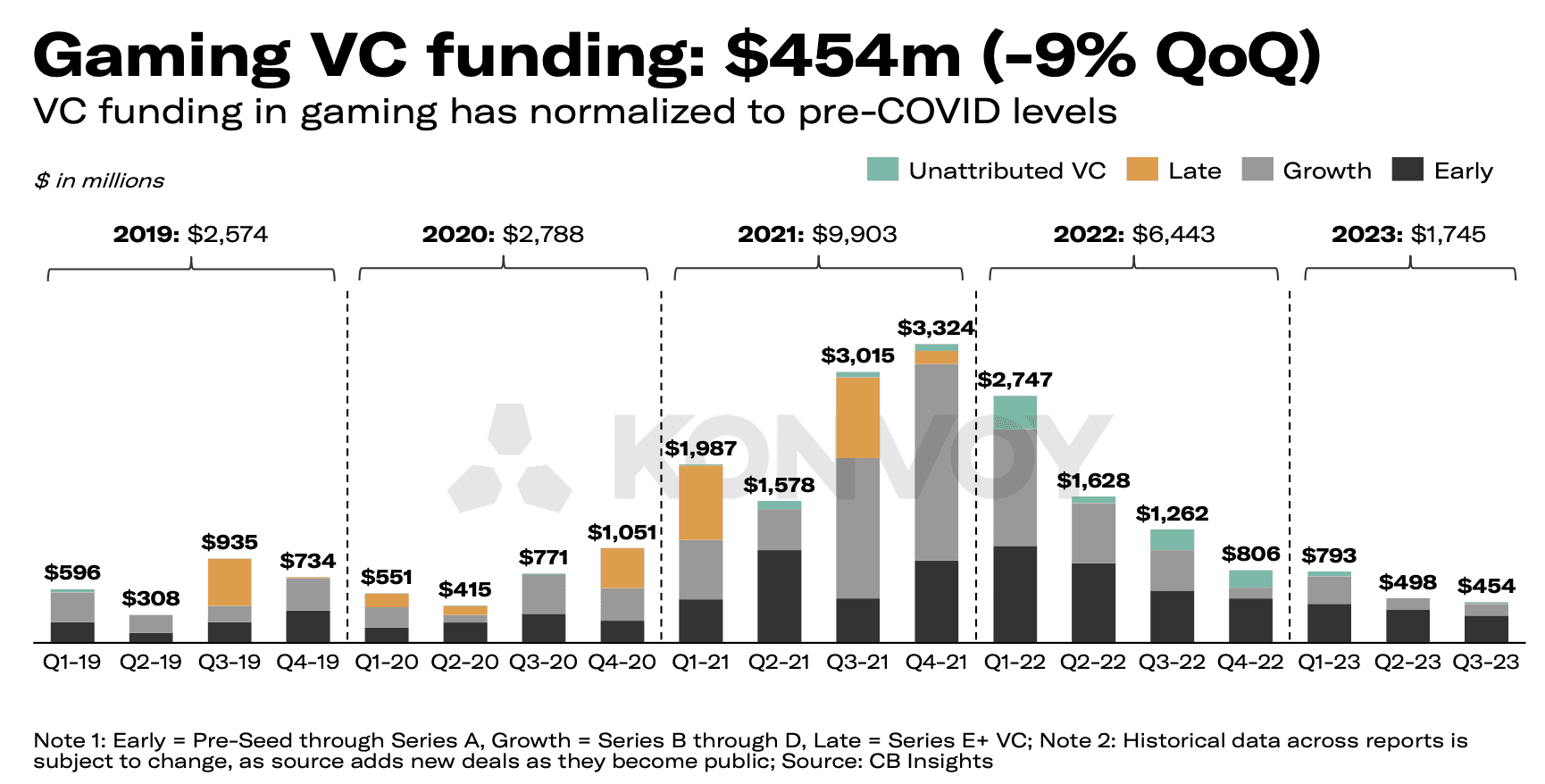

Q3 2023 witnessed a 9% decrease in venture funding for gaming, totaling $454 million, down from $498 million in the previous quarter. Interestingly, the allocation of these funds deviated from the pattern observed in the Q2 2023 report. This time, venture capital investments primarily flowed into content development, including game studios, with approximately $275 million invested. In contrast, game tech and platform companies secured around $90 million.

The number of VC deals also experienced a slight dip, down 5% compared to Q2, with a total of 87 transactions. However, this decline aligns with pre-pandemic levels, signaling industry resilience.

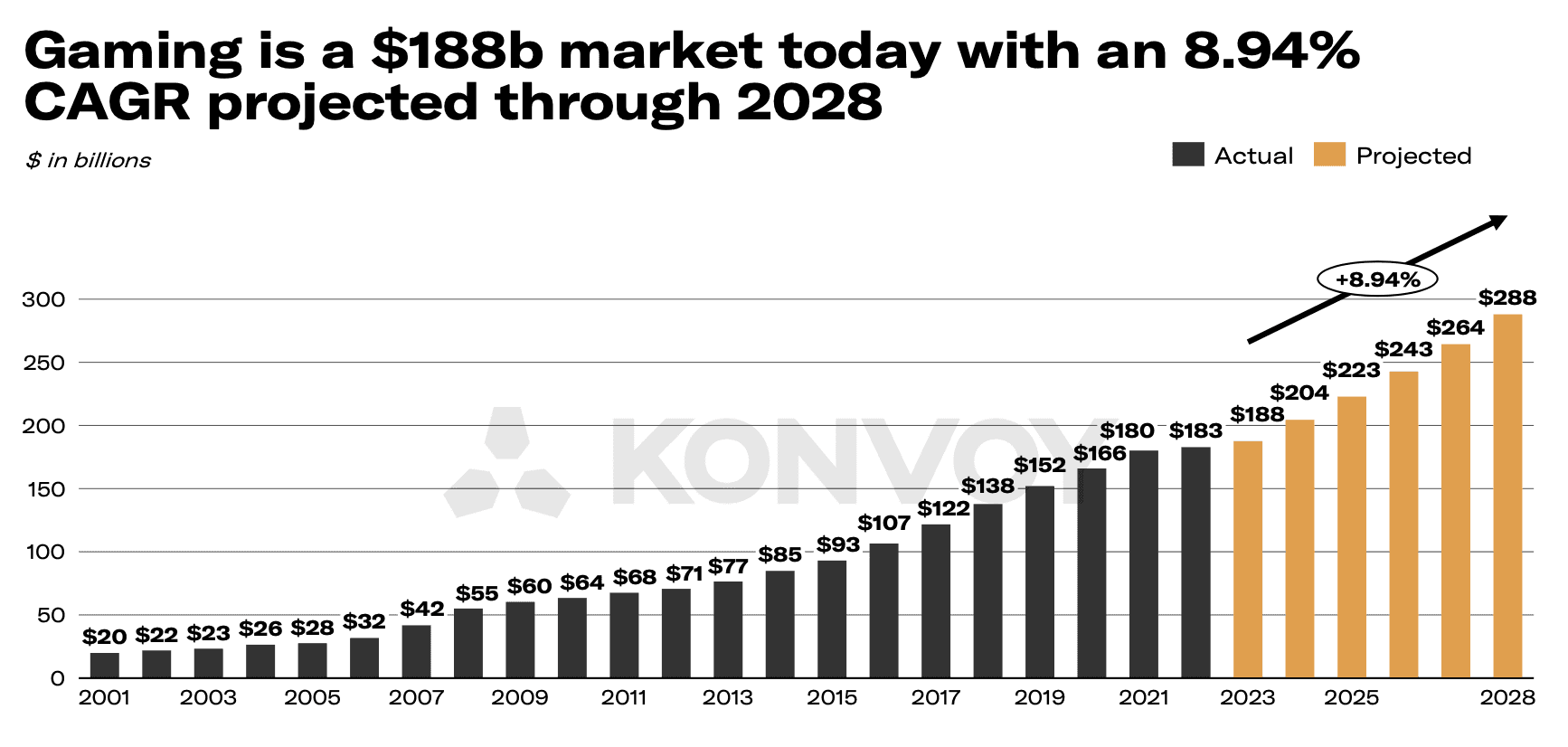

Despite the fall in funding, the sector as a whole remains on an upward trajectory. Konvoy predicts the gaming industry will generate $188 billion in revenue this year and reach a massive $288 billion in 2028, representing a compound annual growth rate (CAGR) of 8.94%.

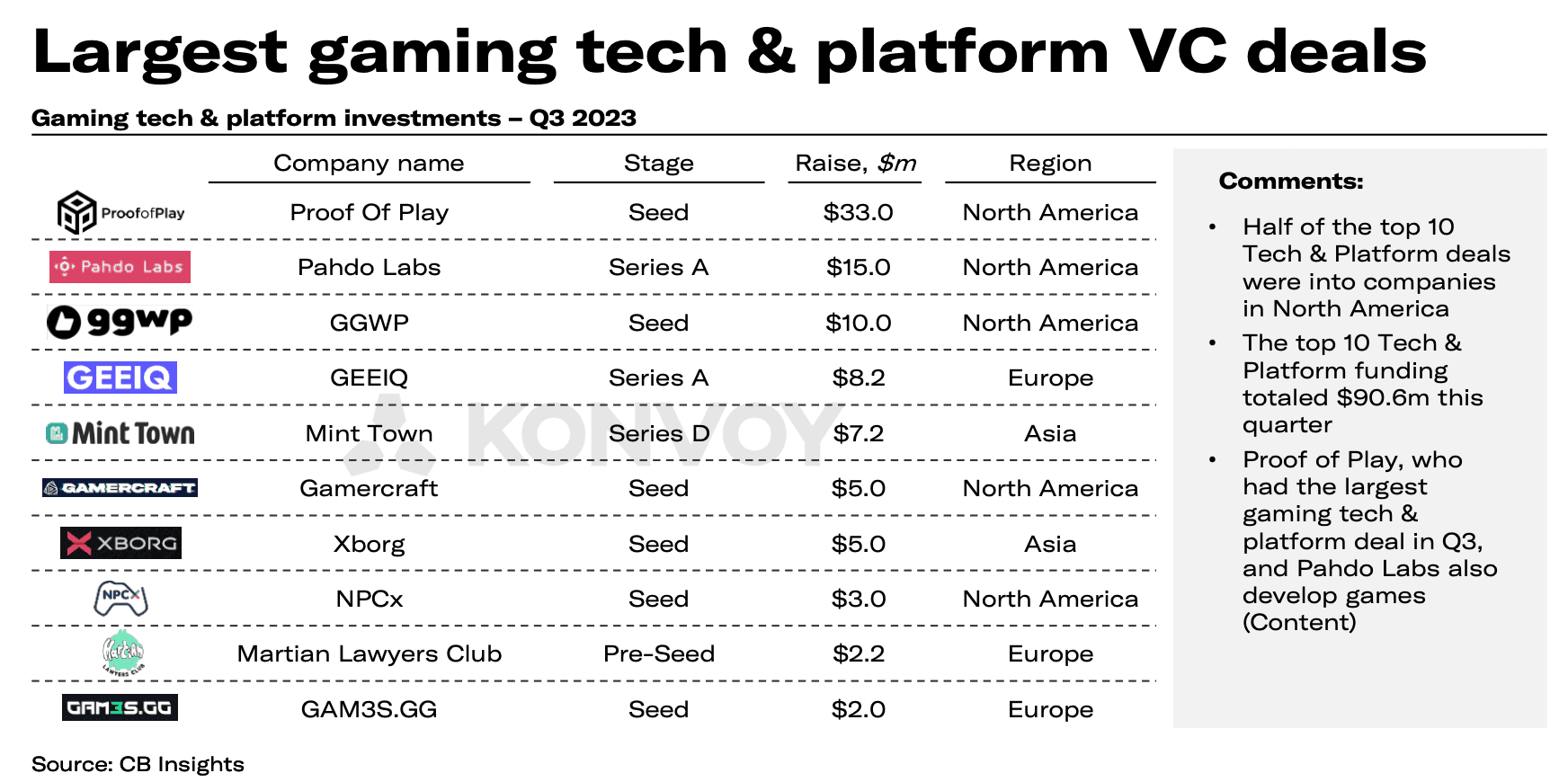

Web3 Gaming Tech & Platform vs. Game Content

The standout players in web3 gaming tech and platform funding were Proof Of Play, amassing $33 million, followed by Xborg with $5 million, and us (GAM3S.GG) securing $2 million. Also of note was Animoca Brands' Mocaverse raising $20 million, Xterio's Overworld with $15 million in funding and GamePhilos raising $8 million.

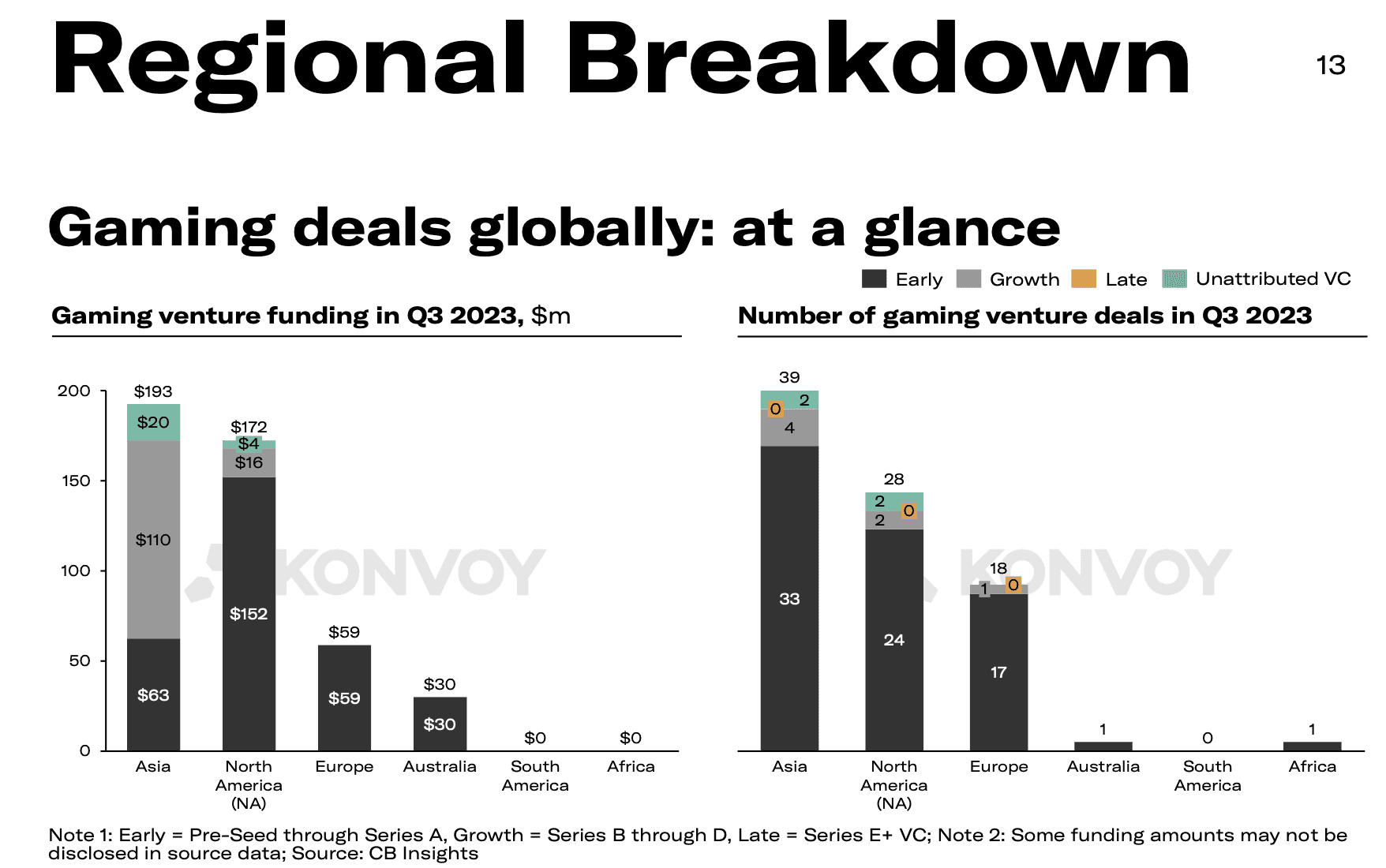

Regional VC Activity

Across regions, Asia maintained its position as the most active area for investment, with $193 million funneled into 39 companies. North America observed a slight uptick, with 2 more deals (+8%) and an additional $2 million (~1%) in funding compared to the previous quarter. However, Europe experienced a substantial decline, with only $59 million invested in Q3, marking a 40% drop from Q2.

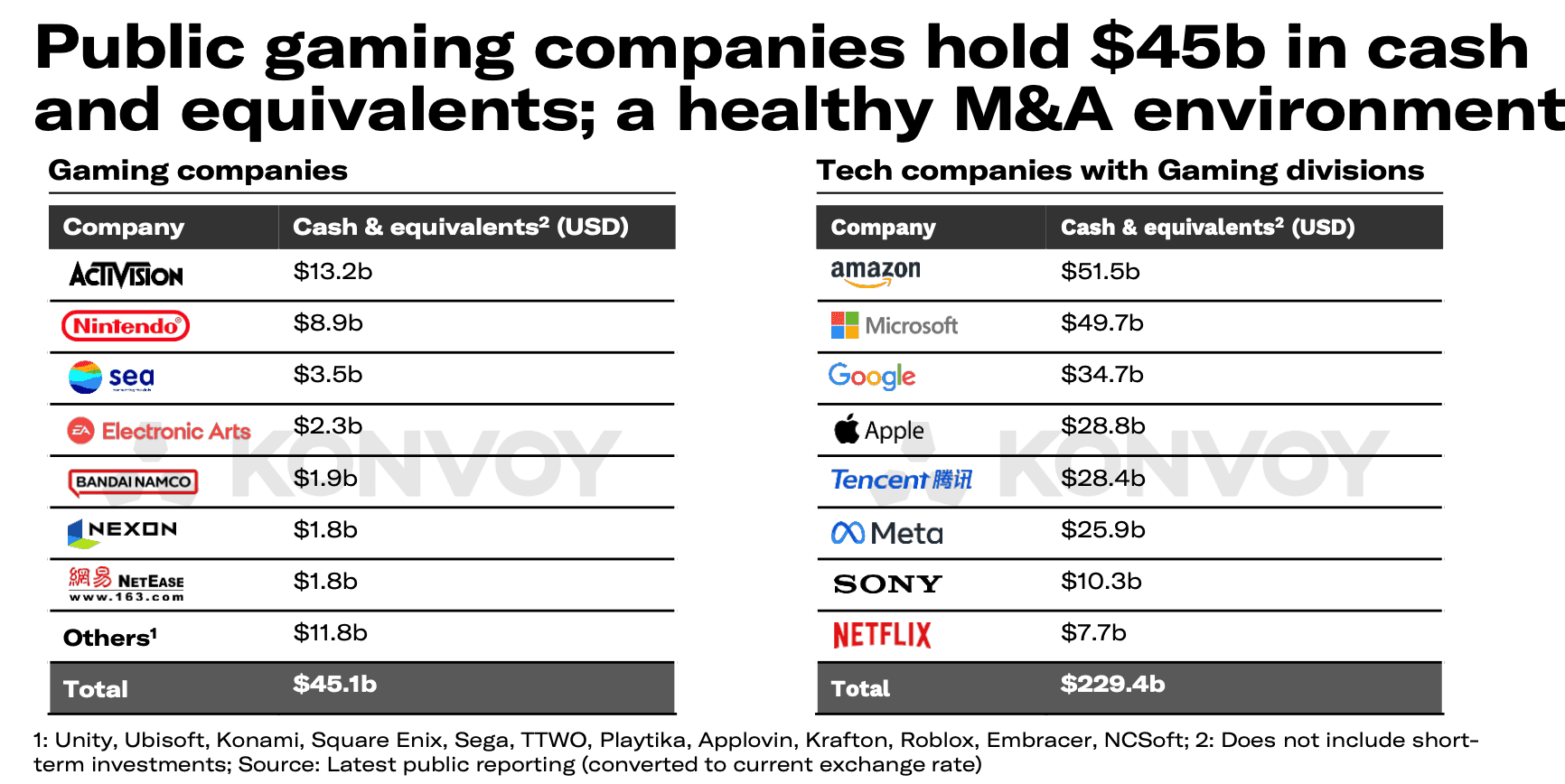

Mergers and Acquisitions

M&A activity in the gaming industry is making headlines once more, returning to pre-COVID levels. In Q2, Konvoy reported on significant deals such as Savvy Games Group's acquisition of Scopely and Take-Two's purchase of Zynga. In Q3, Sega completed its $776 million acquisition of Rovio, and Light & Wonder made an agreement to acquire the remaining 17% of public shares of SciPlay.

The colossal $69 billion acquisition of Activision Blizzard by Microsoft is on the verge of finalization, nearly two years in the making. To address concerns of anti-competitive potential in cloud gaming, Microsoft agreed to divest ATVI's cloud streaming rights to Ubisoft for the next 15 years, a move that was welcomed by UK regulators, leading to the acquisition's approval on the 13th of October.

Relevance to Web3 Gaming

This comprehensive report on Q3 2023's gaming industry trends underscores the evolving landscape of web3 gaming. The focus on content development, substantial funding in the web3 gaming tech and platform sectors, and the dynamics of mergers and acquisitions, coupled with Unity's strategic changes, all play vital roles in shaping the future of gaming. Stay tuned for more insights as the gaming industry continues its fascinating transformation.