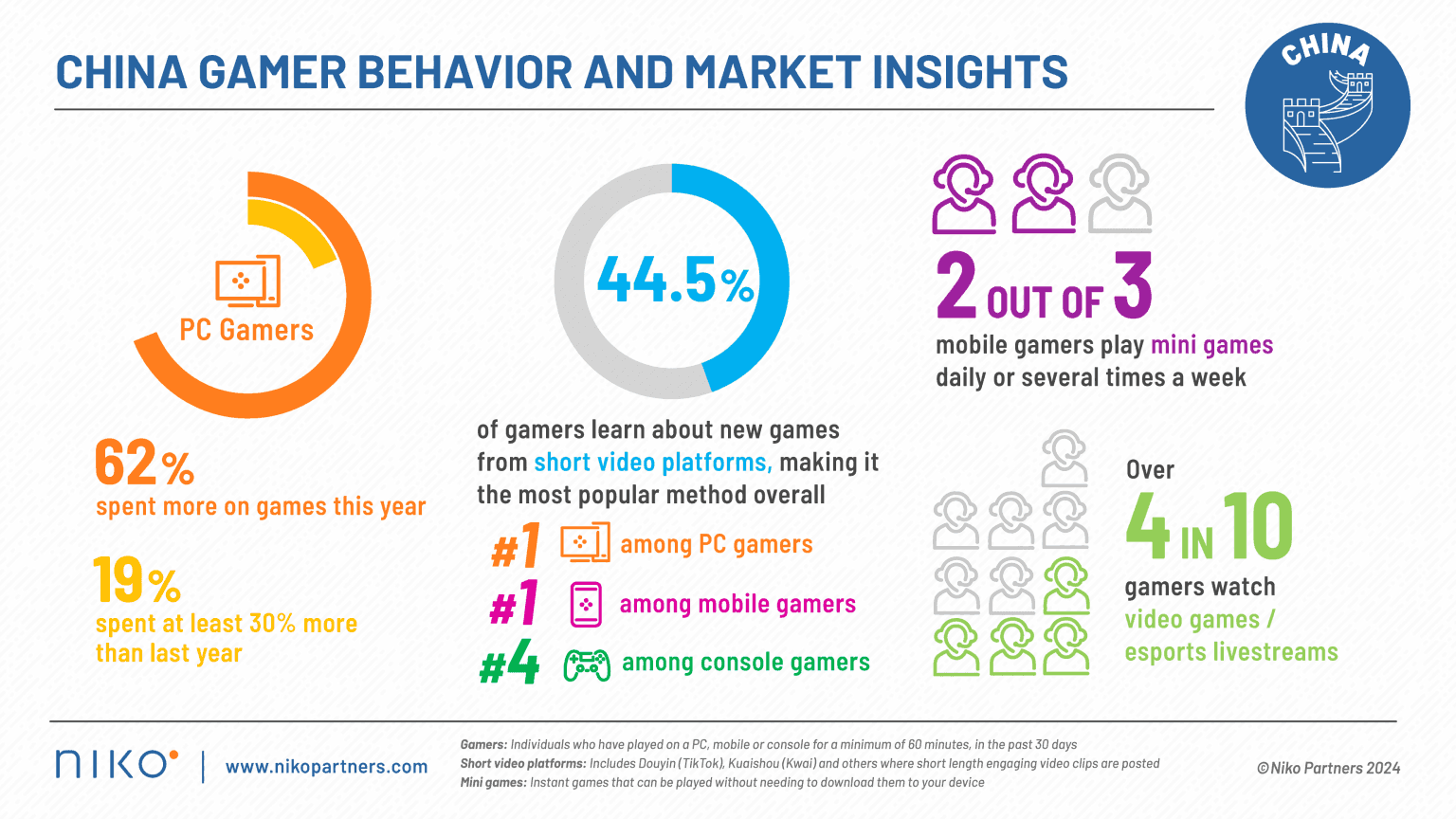

Recent research conducted by Niko Partners has revealed a notable increase in spending among PC gamers in China. According to the 2024 China Gamers Behavior and Market Insights report, 62% of PC game spenders are investing more in their gaming experiences this year compared to 2023, with 19% of them spending at least 30% more. Lisa Hanson, CEO of Niko Partners, commented:

“Our findings show a positive outlook for growth in player spending, notably in the PC gaming segment. Alternative ways for game discovery and non-ISBN games are emerging through short video platforms and continued access to Steam International. This suggests new opportunities for games marketing and monetization, and companies need to better understand the current landscape of the Chinese market to implement appropriate strategies.”

Niko Partners Cover Banner on X

Key Insights and Trends

China's PC gaming market has seen a remarkable surge in player spending according to recent research published by Niko Partners. The 2024 China Gamers Behavior and Market Insights report reveals that 62% of PC game spenders in China have increased their expenditures compared to the previous year, with 19% spending at least 30% more.

This article provides a comprehensive breakdown of the report and analysis of current gaming trends. Specifically looking at the significant growth in PC gaming, the influence of short video platforms on game discovery, and other emerging trends that are shaping the gaming landscape in China.

China Games Market Reports Series

Rising PC Gaming Expenditures

PC gaming has seen the largest increase in individual spending in 2024. The report shows that 62% of PC game spenders have increased their expenditures compared to last year. Additionally, 19% of these gamers report spending at least 30% more than in 2023.

Dominance of Steam

Steam remains the top PC game distribution platform in China, with nearly 80% of PC gamers who play premium games using Steam. Notably, gamers primarily access the international version of Steam without using a VPN.

Growth in Mobile Gaming

The mini-game segment within mobile gaming has seen significant growth, with approximately 650 million gamers engaging in these games. Niko Partners' survey indicates that two-thirds of mobile gamers play mini-games daily or several times a week.

Top Mobile Games China: Downloads and Revenue

Awareness and Interest in AIGC Technologies

Over 78% of gamers in China are aware of AIGC (Artificial Intelligence-Generated Content) technologies, and 37% express interest in their application to video games.

Popularity of Short Video Content

Short video content has become the most popular method for game discovery, with 45% of respondents citing it as their primary source for learning about new games. This trend is particularly strong among PC and mobile gamers.

Livestreaming and Esports Engagement

The survey also found that 44% of gamers watch video game and esports livestreams, with 69% of them using Douyin, a leading short video platform in China.

Douyin: The Chinese TikTok

Impact of Youth Gamer Regulations

Youth gamer regulations, initially aimed at curbing game time for those under 18, appear to be influencing gaming habits even after players reach adulthood. Gamers aged 18-22, who were minors when these regulations were implemented, now play longer hours per week compared to those over 23.

Trends in Game Approvals

Japan continues to lead in import game approvals, with the US regaining its position as the second-largest source of approved games. South Korea has risen to third place, a significant change from three years ago when no Korean games were being approved.

China Games Market Report Summary

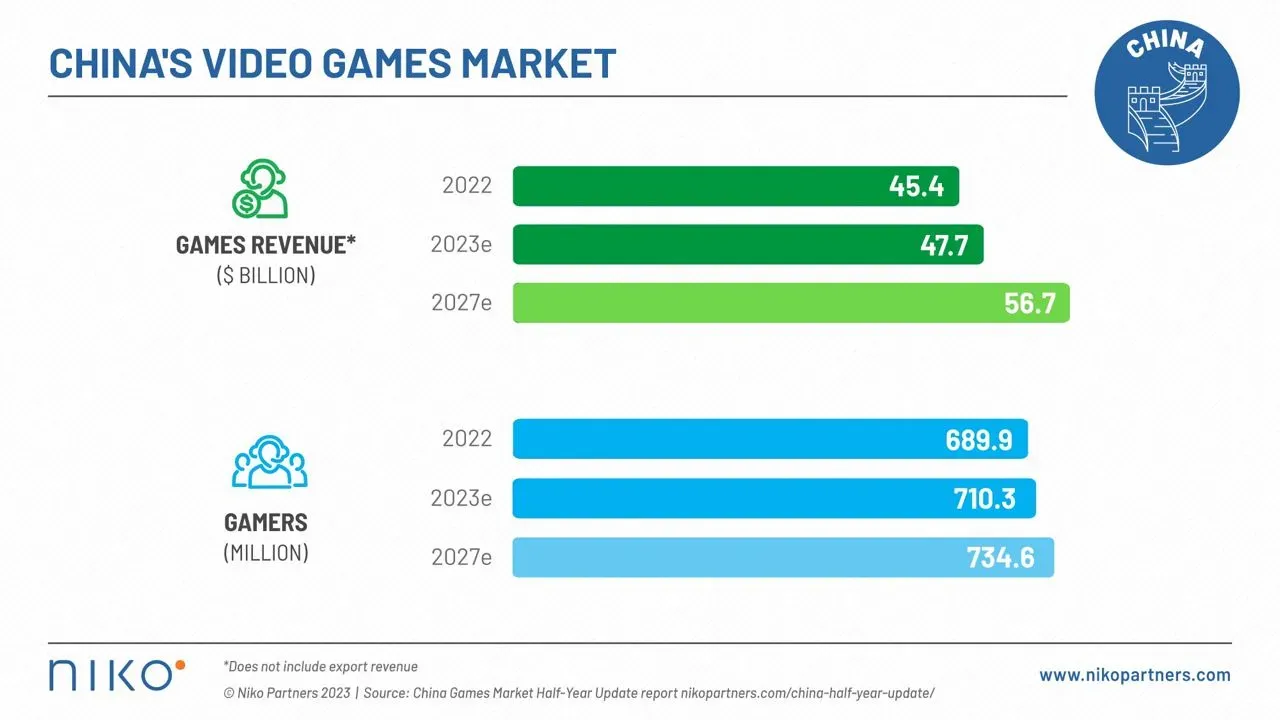

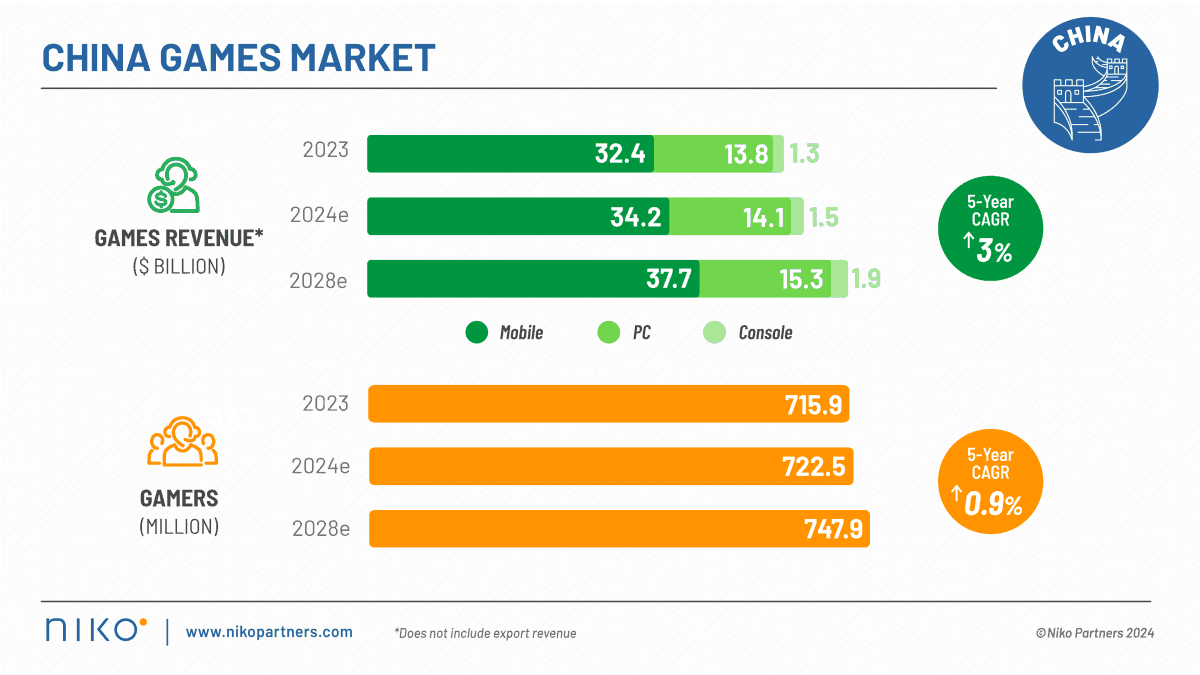

The China video games market generated $47.5 billion in revenue in 2023, reflecting a 6.2% year-over-year increase and a recovery from the 2.5% decline experienced in 2022.

- Monetization and Spending: 36% of gamers in China spend money on video games, with a monthly ARPPU (Average Revenue Per Paying User) of $16.11.

- Projected Growth: The market is projected to grow by 4.9% in 2024, reaching $49.8 billion, and is forecasted to attain $55.0 billion by 2028, with a 5-year compound annual growth rate (CAGR) of 3.0%.

China Games Market 2024

Final Thoughts

Niko Partners' 2024 China Gamers Behavior and Market Insights report highlights significant trends and shifts in the Chinese gaming market. The substantial increase in PC gaming expenditures, the dominance of Steam, and the rise of short video content as a key discovery method underscore the dynamic nature of this market.

Additionally, the growing engagement with mobile mini-games, awareness of AIGC technologies, and evolving impacts of youth gamer regulations paint a comprehensive picture of the current landscape. These insights provide valuable information for companies looking to navigate and capitalize on opportunities within China's rapidly evolving gaming industry. For more information, visit Niko Partners China Games Market Reports.