The European gaming industry has proven its resilience and strength throughout 2022, defying expectations of a recession in the face of global economic challenges. According to a comprehensive report by Video Games Europe (VGE), the association representing the gaming sector, the industry continued its upward trajectory in 2022, with impressive statistics and insights pointing to robust growth. The data for this report was meticulously collected from multiple sources, including GSD, Gametrack, and EGDF-VGE reports, providing us with a clear snapshot of the state of gaming in Europe. In this article, we'll delve into the data, explore revenue trends, examine demographics, and give insights for web3 gaming.

Market Overview

1. Record-Breaking Revenues

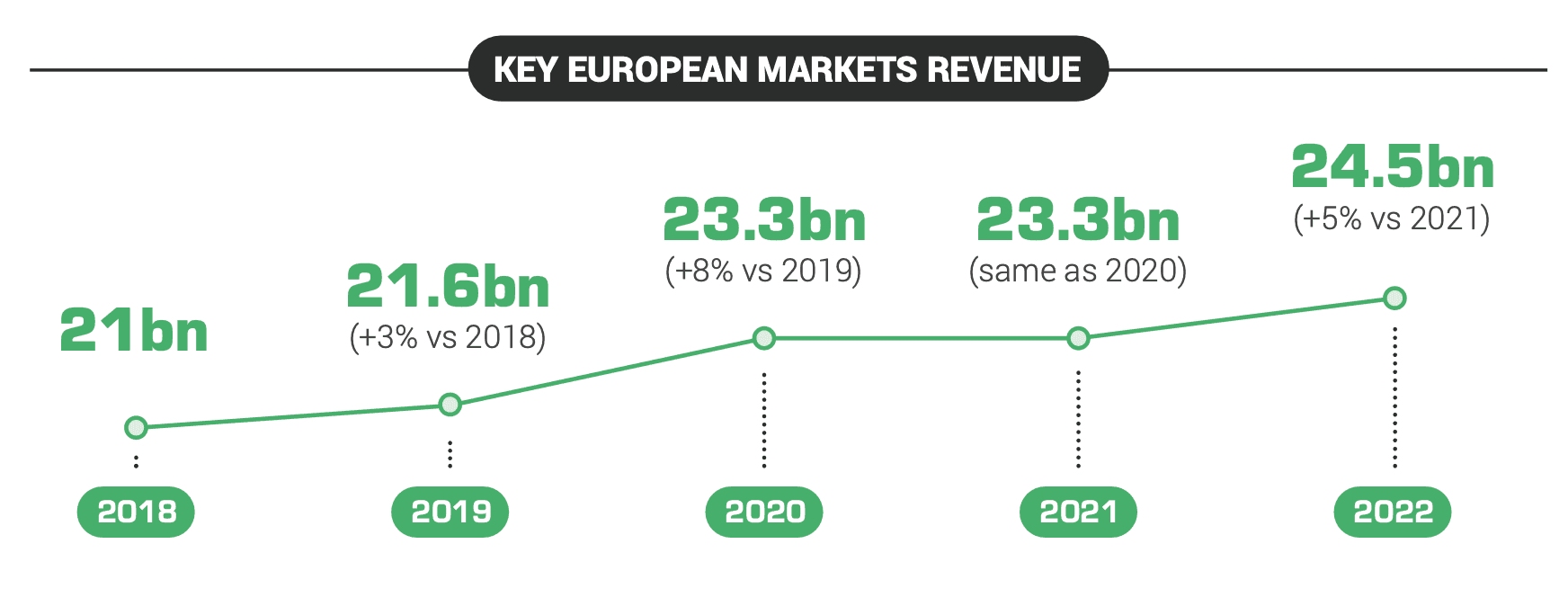

The European gaming industry raked in an astounding $24.5 billion in 2022, marking a remarkable 5% increase from the previous year. This significant growth defied economic uncertainties and underscored the industry's undeniable vitality.

2. Platform Preferences

Console gaming continued to dominate, accounting for 42% of total revenue in 2022, a slight uptick from the previous year's 41%. Mobile gaming closely followed, representing another 42%, albeit a slight decrease from 45% in 2021. PC gaming maintained its share at 13%, while streaming services made a modest gain, reaching 3% compared to the previous year's 2%.

3. Sales Trends

Online game sales showed substantial growth, contributing 41.5% to the industry's revenue, compared to 36% in the previous year. In-game mobile purchases retained their popularity, representing another 41.5%, although down from 45% in 2021. Physical game sales saw a dip, accounting for 17%, as opposed to 19% in the previous year.

4. Workforce Expansion

The European gaming industry is not only thriving financially but also expanding its workforce. In 2022, the sector employed a staggering 110,000 people, marking a notable 12% increase from the previous year. Perhaps even more encouraging is the growing presence of women in the industry, with 23.7% of employees being women, reflecting a positive trend towards greater gender diversity.

Demographics

1. Widespread Gaming Popularity

Gaming has firmly cemented its place in European culture, with a whopping 53% of the population enjoying video games in 2022. The number of gamers reached an impressive 126.5 million, further underscoring the industry's broad appeal.

2. Age Groups

Surprisingly, the largest group of gamers falls in the age range of 45 to 64 years, constituting 25% of the player base. This demographic shift highlights the increasingly diverse appeal of video games. Following closely are the age groups of 15 to 24 years (21%); 25 to 34 years (19%); 6 to 14 years (18%); and 35 to 44 years (17%). The average age of a European gamer stands at 32 years.

3. Platform Preferences Revisited

Mobile gaming saw a notable surge in popularity, with 68% of Europeans opting for this platform, compared to 63% in 2021. Consoles maintained their stronghold, with 58%, a slight increase from the previous year's 54%. PC gaming saw a marginal decline, representing 48% in 2022, compared to 52% in 2021.

Final Thoughts

The growth and demographic shifts within the European gaming industry in 2022 hold significant relevance for the emerging field of web3 gaming. This data, showcasing a 5% increase in market size, diverse platform preferences, and a broad player base spanning various age groups, underscores the opportunity for web3 gaming to tap into a thriving market. The surge in online sales aligns with blockchain's potential to enhance asset ownership, while the industry's resilience and inclusivity trends mirror web3 gaming's principles. This data serves as a promising indicator for web3 gaming's potential to create innovative, decentralized gaming experiences that resonate with a wide and diverse audience.

For more detailed information, you can access the full report on the Video Games Europe website.

Disclaimer: This article is based on the data available up to September 2023, and any subsequent developments in the European gaming industry are not covered in this report.

Share this article and tag us on any of our socials to let us know.