In the ever-evolving landscape of crypto and blockchain gaming, the first quarter Q1 of 2024 has witnessed significant developments, as showcased in the latest report from the Big Blockchain Game List. With key players like Pixels on the Ronin Network leading the charge, the industry has experienced notable growth despite fluctuations in crypto sentiment.

In this article, we will cover the latest insights from the Q1 2024 Big Blockchain Game Report, highlighting the growth of the blockchain gaming industry. We will also explore token performance, gaming activity, investments, and ecosystem movements.

Big Blockchain Game Report

The Big Blockchain Game List presents its inaugural quarterly report, a culmination of 18 months of data collection. The primary objective is to integrate this data with other credible sources and rigorous analysis to furnish thorough insights into the state of the blockchain gaming sector.

It's noteworthy that in tandem with this report, a substantial portion of the collected data is consistently featured and updated on the Everything Blockchain Gaming spreadsheet, ensuring accessibility and currency for stakeholders.

Ethereum and Bitcoin Rally

During Q1 2024, Ethereum (ETH) saw a significant surge of 52%, while Bitcoin (BTC) experienced a remarkable rise of 65%, reaching an unprecedented peak of $73,738 on March 14th. This surge was propelled by an influx of $12 billion from both institutional and retail investors, primarily through investments in Bitcoin Exchange-Traded Funds (ETFs). These developments underscore the prevailing bullish sentiment in the cryptocurrency market.

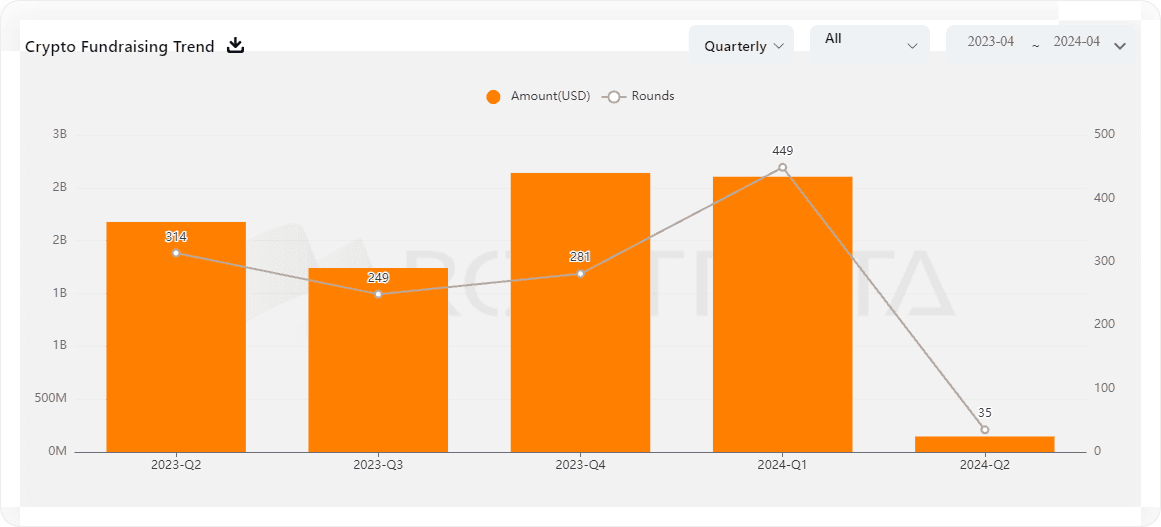

Over $2.6 Billion Funding

As the Bitcoin rally continues to captivate crypto enthusiasts, recent funding developments offer further evidence of renewed interest in the space. Kicking things off, the fourth quarter of 2023 witnessed a notable return of web3 venture capitalists. Now, this March has seen a staggering influx of over $1 billion in web3 funding, as reported by RootData, culminating in a total of $2.6 billion by the quarter's end, mirroring the figures from Q4, 2023.

The momentum carries into the second quarter of 2024, with Bitkraft Ventures spearheading the charge by unveiling a $275 million third fund dedicated to nurturing early-stage gaming startups. Concurrently, A16z has initiated the third iteration of its SPEEDRUN Accelerator, earmarking $30 million specifically for the gaming sector. Let's dive into some examples.

Blockchain Gaming Overview

Though the year has kicked off with a bullish surge in cryptocurrency markets and fresh VC funds, the wider crypto interest has cycled into speculative assets like Solana-based meme coins. Additionally, the blockchain gaming sector saw a more nuanced trajectory.

Tokens and Play-to-Airdrop Events

Tokens such as Heroes of Mavia's $MAVIA and Pixels' $PIXEL saw strong sentiment in January and February, fueled by token launches and play-to-airdrop events. However, this momentum tapered off in March, prompting gaming companies to explore new avenues to capitalize on the crypto frenzy. The launch of the "universal gaming coin" $PORTAL in late February exemplified this trend, albeit with varying degrees of success.

Node Sales

Nevertheless, some gaming projects prioritized genuine utility during the quarter. Successful endeavors included the launch of scaling infrastructure and associated node sales, exemplified by Xai’s Arbitrum-based L3, which raised $15 million, and Hytopia’s Arbitrum-based Hychain, which raised $8 million. Additionally, gaming adjacent cloud-compute project Aethir garnered over $65 million from its node sale.

Web3 Tech Advancements

Several other projects, such as Proof of Play (Pirate Nation), Treasure DAO, Xterio, and Wilder World, expressed intentions to launch similar technology. The ease of launching a blockchain prompted most projects to at least consider it, viewing the current climate as an opportunity to raise funds.

Angle Investors and Degen Mafia

It's noteworthy that individual angel investors, colloquially referred to as the "degen mafia," played a significant role in leveraging their social media influence to highlight earning opportunities and referral programs, enhancing their own return on investment.

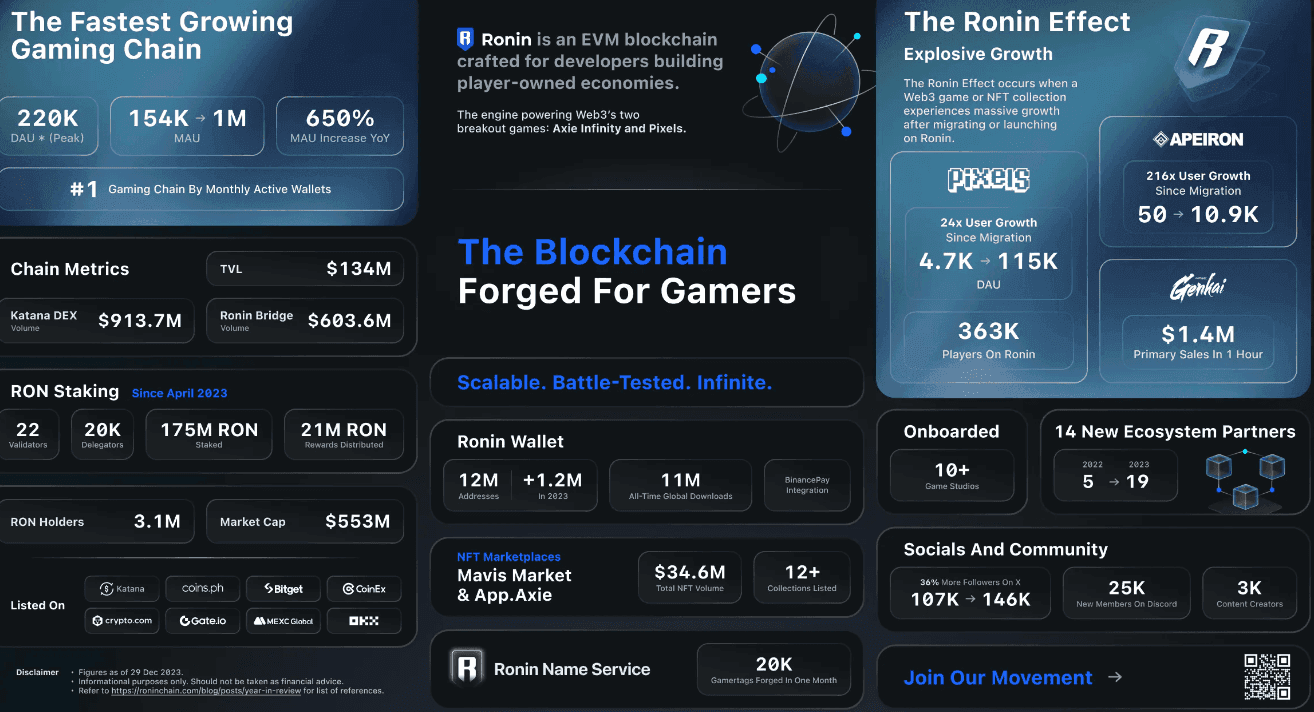

Sky Mavis and Ronin Network

Amidst the broader dynamics, certain teams demonstrated strong product-market fit during the quarter. Notably, Sky Mavis’ Ronin blockchain and the social RPG Pixels emerged as the standout performers. As the most popular blockchain game, Pixels propelled Ronin to an unprecedented peak of 1.2 million daily active unique wallets.

This surge in activity had a ripple effect on other Ronin-based projects such as Apeiron, CyberKongz, and Kaidro, which experienced an increase in their tokens’ value, albeit being in the early stages of their journey. Even seasoned players like Yield Guild Gaming saw a positive impact on their $YGG token following its launch on Ronin.

Playable Blockchain Games

The landscape for other playable blockchain games presented a more intricate scenario, particularly due to their predominantly lightweight blockchain features. However, there were noteworthy achievements: team shooter Nyan Heroes and strategy game Blocklords each surpassed 100,000 downloads on the Epic Games Store, while the extraction shooter Shrapnel attracted over 60,000 players across its two playtests.

Moreover, significant claims emerged, such as Big Time reporting $100 million in revenue since the inception of its pre-season event in October 2023. Additionally, Pixels’ VIP program currently generates a monthly recurring revenue of $1.6 million.

Ultimately, long-term success in the blockchain gaming sector will be determined by projects that effectively combine a robust player base and revenue stream with a clear vision and continuous feature development. Adapting to the currents of crypto sentiment and navigating the unique dynamics of their communities will also be critical factors for sustained success.

On-Chain Gaming Overview

In a sector inundated with data, identifying noteworthy insights can be daunting. However, when analyzing on-chain game activity during Q1 2024, the standout performer was the browser-based social RPG Pixels.

Initially introduced on the Polygon blockchain, Pixels underwent a relaunch on Sky Mavis’ Ronin chain in November 2023, experiencing immediate success. Notably, amidst the decline of Alien Worlds and Splinterlands, Pixels emerged as the most popular blockchain game in terms of daily active unique wallets since December.

Pixels Deep Dive

Originally developed on the Ethereum sidechain network Polygon, Pixels migrated to Ronin in late 2023, contributing to a surge in user activity. Developed by Sky Mavis, the visionary mind behind Axie Infinity, Ronin is a blockchain designed to enhance the gaming experience. Ronin also hosts projects like Wild Forest, The Machines Arena, Apeiron, and more.

Pixels has showcased sustained success since its migration. Recent data from an open dashboard reveals that Pixels has amassed over 1.1 million total unique wallets on the Ronin Network. The game boasts an impressive 320,000 daily active user wallets (DAUWs), including 275,000 retained users and 25,000 new users.

The influx of new users combined with a high retention rate positions Pixels as a game with sustainable growth, moving beyond speculative trends and hype prevalent in the web3 gaming space. This phenomenon mirrors the role guilds played in the boom and bust success of Axie Infinity as a play-to-earn game in late 2021.

However, Pixels distinguishes itself with better-designed game mechanics and a more robust economy. Notably, despite its expanding user base, the $PIXEL token associated with Pixels has exhibited minimal price volatility.

Pixels CEO Luke Barwikowski underscores the importance of user retention and token utility in a recent post on X (formerly Twitter), answering pressing questions such as: "Is Pixels retaining users? What are players doing with $PIXEL? How will Pixels acquire new users? We aim to be a significant player in web3 gaming."

Simultaneously, Ronin Network has experienced a surge in popularity, boasting over 2 million monthly active unique wallets, part of which is driven by Pixel players' interest in planting seeds, acquiring pets, and pursuing $PIXEL rewards.

Following its launch on Binance on February 19th, the $PIXEL token swiftly ascended the ranks, now valued among the top 200 cryptocurrencies globally, with a market cap of $440 million. Pixels' strategic integration of gameplay mechanics, user engagement, and token utility has positioned it as a notable player in the web3 gaming revolution.

The most recent data from DappRadar and Footprint Analytics reveals that Pixels has surpassed the coveted threshold of two million lifetime wallets on Ronin, boasting an impressive daily active unique wallet count of approximately 625,000. This surge in adoption underscores the growing traction of blockchain gaming projects and their increasing appeal to enthusiasts worldwide.

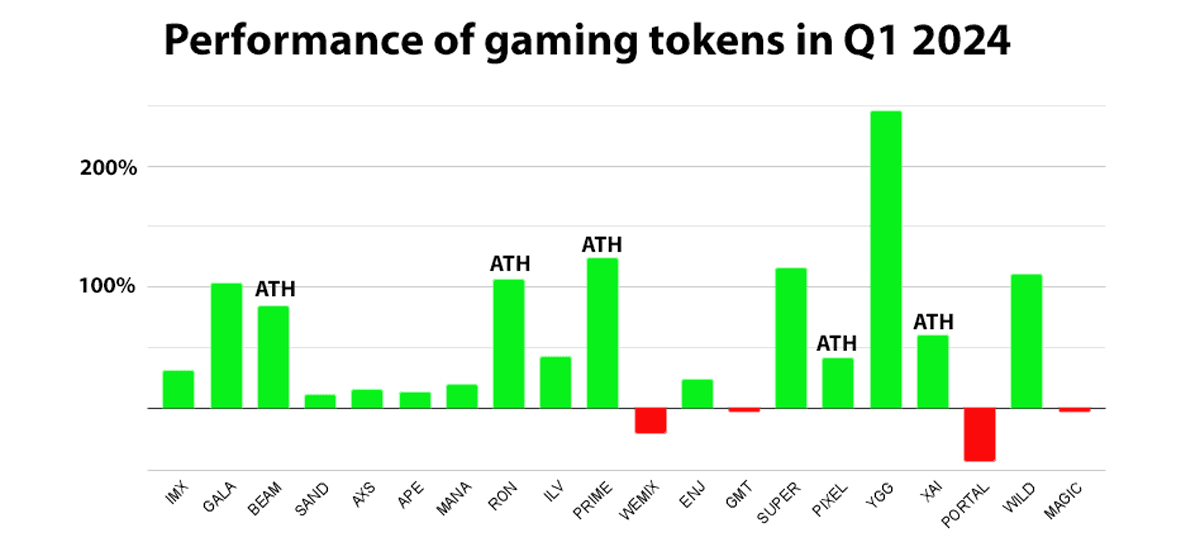

Token Performance Overview

Q1 2024 witnessed a favorable environment for the introduction of new tokens, although this trend has not been uniformly reflected in the gaming sector. While the launch of gaming L3 Xai’s $XAI token proved successful, the introduction of gaming memecoin $PORTAL did not gain traction, underscoring that not all tokens are equally poised for success in this space.

Similarly, several gaming tokens experienced a decline in value during Q1, including Wemade’s $WEMIX, Find Satoshi Lab’s $GMT, and Treasure DAO’s $MAGIC. Conversely, large-cap gaming cryptocurrencies such as The Sandbox’s $SAND, Axie Infinity’s $AXS, and Apecoin’s $APE saw only marginal increases in value.

Nevertheless, several newer tokens reached their all-time highs during Q1, including Parallel Studios’ $PRIME token, the $BEAM token (although technically a reissued version of Merit Circle’s $MC token), and Ronin’s $RON token, originally launched in 2022.

Interestingly, among tokens within the top 200 cryptos ranking, the standout performer was Yield Guild Gaming’s $YGG token, introduced in 2021 during the peak of the Axie Infinity craze. Its recent surge in value can be attributed to its migration to the thriving Ronin blockchain, offering increased liquidity and significantly lower transaction fees compared to its previous availability on Ethereum.

Investment Trends

In the first quarter of 2024, the blockchain gaming sector witnessed 68 investment deals, reflecting a decrease of 1% compared to Q1 2023. However, this figure represents a significant decline of 57% compared to the booming period of Q1 2022, during which 56 deals were announced in March 2022 alone.

The majority of activity in 2024 was fueled by retail crypto investors, with token Initial DEX Offerings (IDOs) and node sales gaining popularity and, in some instances, yielding immediate returns. However, retail activity typically raised limited investment amounts, usually in the low millions through token launchpads.

In terms of total investment value, Q1 2024 saw a total of $301 million invested, marking a 39% decrease compared to Q1 2023 and an 84% decrease compared to the $1.9 billion announced in Q1 2022.

Two-thirds of this total investment came from professional venture capitalists (VCs) and investors, predominantly crypto-only funds. Notably, traditional tech and gaming VCs have remained cautious about re-engaging with the sector following the challenges of 2023. However, there has been a notable resurgence of investor interest across the broader crypto sector, particularly in scaling infrastructure.

Examining specific deals within the gaming sector, there were 24 investments exceeding $5 million, including seven deals valued at $10 million or higher. Notably, several companies had already secured significant investments.

Parallel Studios accumulated a total of $85 million over two funding rounds, Gunzilla Games received over $100 million across seven rounds, and Illuvium amassed more than $125 million through three funding rounds and multiple NFT and token events. Despite the concentration of investments in these companies, investor participation was widespread, involving over 260 named individuals and entities.

The most active investors during the quarter, based on public announcements, were:

- Spartan Capital – 7 deals

- Animoca Brands – 7 deals

- Sfermion – 6 deals

- Merit Circle – 5 deals

- Delphi Ventures – 5 deals

- Yield Guild Gaming – 5 deals

- Cypher Capital – 5 deals

In terms of lead investors, the most active were:

- Framework Ventures – 3 lead deals

- Animoca Brands – 2 lead deals

- Delphi Digital – 2 lead deals

Notable angel investors included:

- Gabby Dizon (YGG) – 4 deals

- Alex Becker (Neo Tokyo) – 4 deals

- Dingaling – 3 deals

Ecosystem Trends

As always, the Big Blockchain Game List continues to monitor broad ecosystem trends concerning game announcements and the blockchains they utilize.

New Games

In Q1 2024, a total of 119 new titles were added to the list. Immutable emerged as the most favored destination in terms of a single blockchain. This is unsurprising given Immutable's preparation for the launch of its Polygon-based Immutable zkEVM infrastructure, which has garnered significant attention and attracted games migrating from Polygon's legacy Proof-of-Stake (PoS) blockchain.

Other popular blockchain choices include Ethereum Layer 2 solutions Arbitrum and Blast. Notably, Blast sparked increased activity with its highly incentivized Big Bang competition, drawing over 3,000 builders to launch apps and games on the high-profile chain. However, it's noteworthy that a significant portion of games—27%—are now adopting a multichain approach, primarily aimed at expanding their addressable audience.

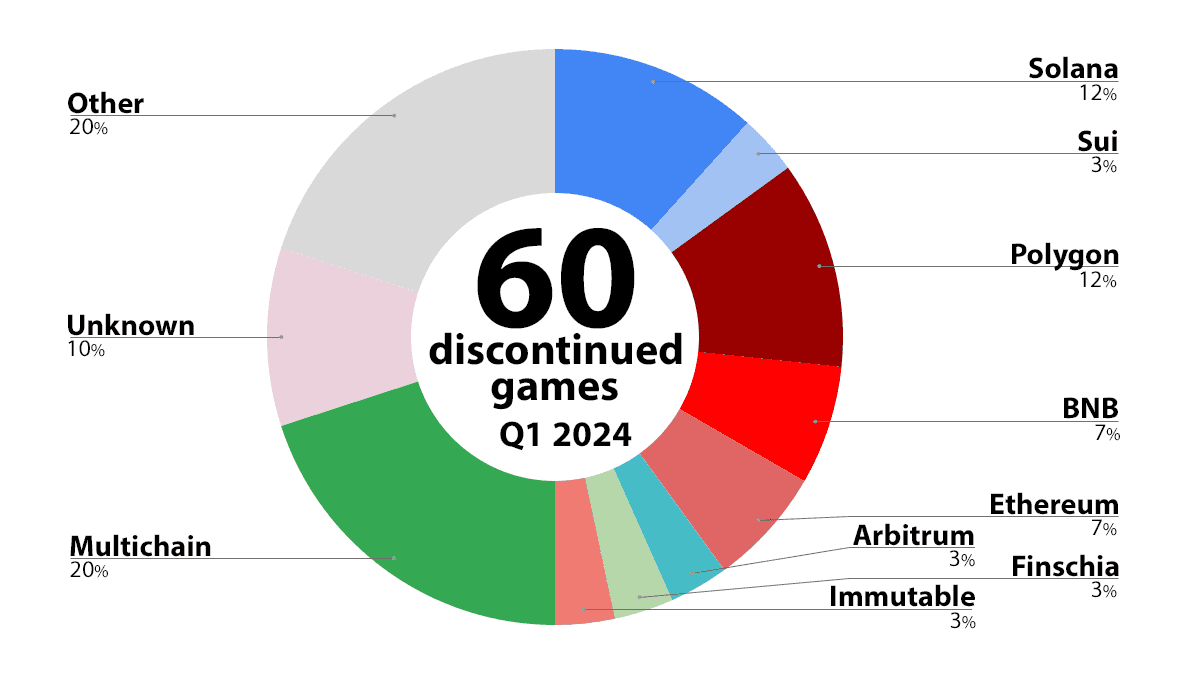

Discontinued Games

In contrast to newly announced games, the single chains experiencing the highest loss of games during the quarter were Solana and Polygon. It's important to note that tracking discontinued games is an imprecise and lagging indicator.

The data captured likely reflects the relative weakness of both the Solana and Polygon ecosystems during 2023. As always, there are more blockchain games in development seeking funding than the market can sustain, so the level of discontinued products is not unexpected.

Interestingly, despite the attrition, the discontinuation rate isn't as high as anticipated. For instance, in 2023, it was observed that 410 games discontinued. Therefore, the rate of discontinuations in 2024 so far suggests an improvement in the sector's sentiment.

Total Games and Chain Analysis

Combining all the data, the Big List concluded Q1 2024 tracking a total of 953 blockchain games. This represents a notable increase from the 896 games tracked at the end of 2023, 824 games at the end of June 2023, and 724 games at the end of January 2023, indicating sustained robust net growth even amidst the 2023 bear market. Once again, the largest single category remains games operating across multiple chains, which has risen from a total of 17% at the end of 2023.

In terms of single chains, Polygon and Immutable lead the pack, although as mentioned earlier, Polygon is currently experiencing the most decline, while Immutable is seeing the most growth. However, it's important to note that this trend is largely due to optics, as Immutable is onboarding games to its zkEVM infrastructure, which essentially runs Polygon’s zkEVM blockchain under-the-hood.

A more significant trend is the ongoing decline of non-EVM blockchains such as Solana, Ton, Sui, Wax, etc., which now constitute less than 10% of all blockchain games. In fact, many of these blockchains are now transitioning to EVM-compatibility.

Arbitrum continues its upward trajectory, owing in part to the flexibility it provides, particularly for developers to utilize its technology for deploying their own infrastructure. Meanwhile, Gala maintains a relatively low profile in terms of new product offerings, while Ronin steadily announces more games.

Following a busy 2023, Wemix seems to prioritize quality over quantity, exemplified by the launch of its MMORPG Night Crows. Similarly, the standout launch for the Japanese gaming blockchain scene is Ubisoft’s Champions Tactics, while Line Next’s Finschia garners attention for its upcoming merger with Kakao’s Klaytn.

Final Thoughts

The findings presented here offer valuable insights into the evolving landscape of blockchain gaming. With the sector experiencing continued growth despite fluctuations in the broader cryptocurrency market, it's evident that blockchain technology is increasingly integrated into gaming ecosystems.

The rise of multichain approaches underscores developers' efforts to expand audience reach and ensure platform flexibility. Furthermore, the success stories of games like Pixels demonstrate the potential for innovative business models, such as play-to-earn mechanics, to drive user engagement and revenue generation.

As the industry continues to mature, navigating the complexities of blockchain infrastructure and investor sentiment will remain paramount for gaming companies seeking long-term success in this dynamic and rapidly evolving space. For a comprehensive overview of the Q1 2024 Big Blockchain Game Report, including detailed analyses and statistics, readers can access the full report on their website or download a PDF version for offline reference.