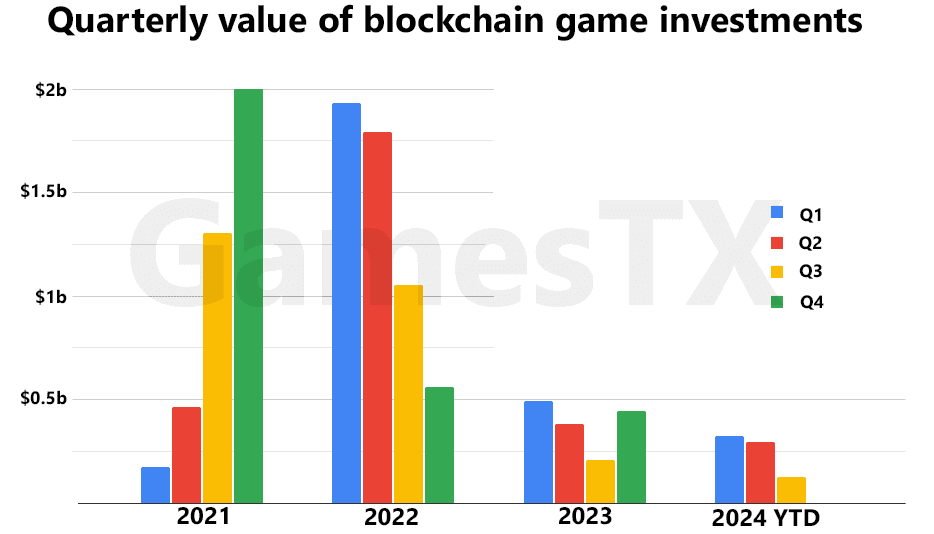

As 2024 enters its final quarter, the blockchain gaming sector faces a notable decline in investment activity. While the number of funding deals and token sales has remained steady compared to 2023, the overall value of investments is down significantly. By the close of Q3 2024, the sector had raised $748 million—31% less than the same period in 2023.

Largest Web3 Gaming Investments for Q3 2024

Web3 Game Investments Q3 2024

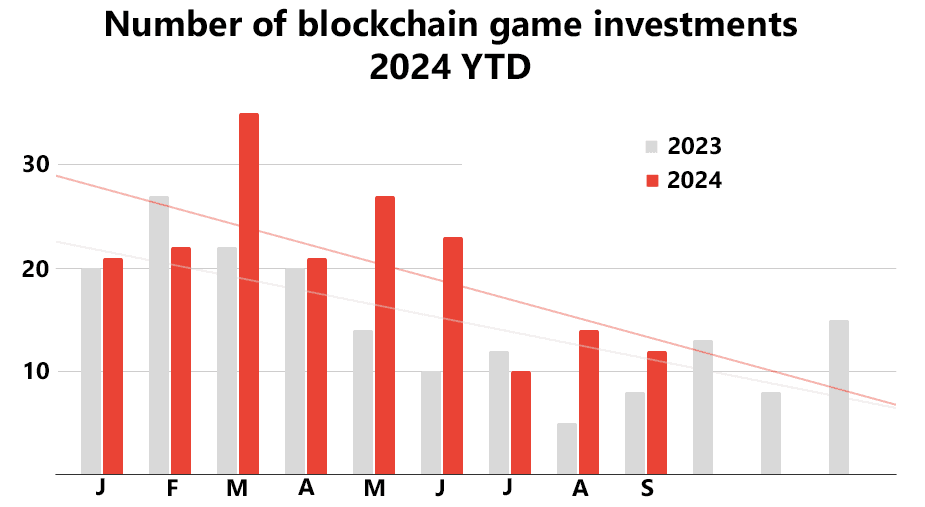

One notable trend in 2024 has been the steady number of publicly announced deals, which are up 34% year-to-date (YTD) compared to 2023. However, this increase in activity has not translated into higher financial returns. The number of deals fell sharply in Q3, with 36 deals closed compared to 71 in Q2. The financial breakdown reveals a downward trajectory throughout the year:

- Q1 2024: $324 million

- Q2 2024: $296 million

- Q3 2024: $128 million

This trend suggests a cooling interest in blockchain gaming, with investment amounts significantly reduced as the year progresses. Looking beyond 2024, the decline becomes more apparent. In 2023, the sector raised a total of $1.5 billion, while the high point was in 2022 when $5.3 billion was invested. With only $748 million raised by Q3 2024, reaching the $1 billion mark by year-end seems ambitious. This would still fall short of 2023’s total, illustrating the ongoing contraction within the industry.

Number of Blockchain Game Investments 2024 YTD

Notable Deals of 2024

Despite the overall decline, several major deals have stood out. The most substantial in Q3 was NPC Labs securing $18 million in seed funding, led by Pantera Capital, for the development of its gaming-focused L3 blockchain, B3. This investment highlights continued interest in web3 infrastructure, even as the broader market cools.

Gameplay Galaxy also made headlines with an $11 million funding round for its mobile web3 sports game, Trial Xtreme Freedom, bringing its total raised to $24 million. Another significant deal was Double Jump Tokyo's series D funding, where it secured just over $10 million, with SBI Investment taking a leading role.

While the market has seen a downward trend through Q3, early signs from Q4 offer a glimmer of hope. Azra Games recently raised $42.7 million in its Series A round, the largest single investment of 2024 to date, for their IP Legions and Legends. This deal surpasses the $35 million raised by Parallel Studios in March, demonstrating that significant investments are still possible as the year winds down.

Quarterly Value of Blockchain Game Investments

Final Thoughts

Blockchain gaming investments have experienced a marked slowdown in 2024, with the total value down 31% year-to-date compared to 2023. While the number of deals remains steady, the declining investment amounts signal caution in the market. However, notable funding rounds, particularly in web3 infrastructure and gaming platforms, suggest that the sector is still attracting interest from key investors.

With Q4 off to a promising start, it remains to be seen whether the industry can surpass the $1 billion mark by year-end. Continued developments in web3 technology and the resilience of key players may shape the future trajectory of blockchain gaming investments.

Source: BlockchainGamerBiz