The emergence of web3 gaming has become a significant development at the intersection of the gaming and cryptocurrency industries. Since 2020, this sector has seen notable shifts, driven by Bitcoin price trends, investor behavior, and changing market dynamics. According to a recent report by InvestGame and GDEV, in this period, play-to-earn mechanics and decentralized gaming concepts piqued the interest of both developers and investors. In this article, we will explore the history of web3 gaming investments, from Bitcoin's influence to major venture capital trends and the evolution of M&A activity.

$1.6 Billion Across 85 Deals

Impact of Crypto on Gaming

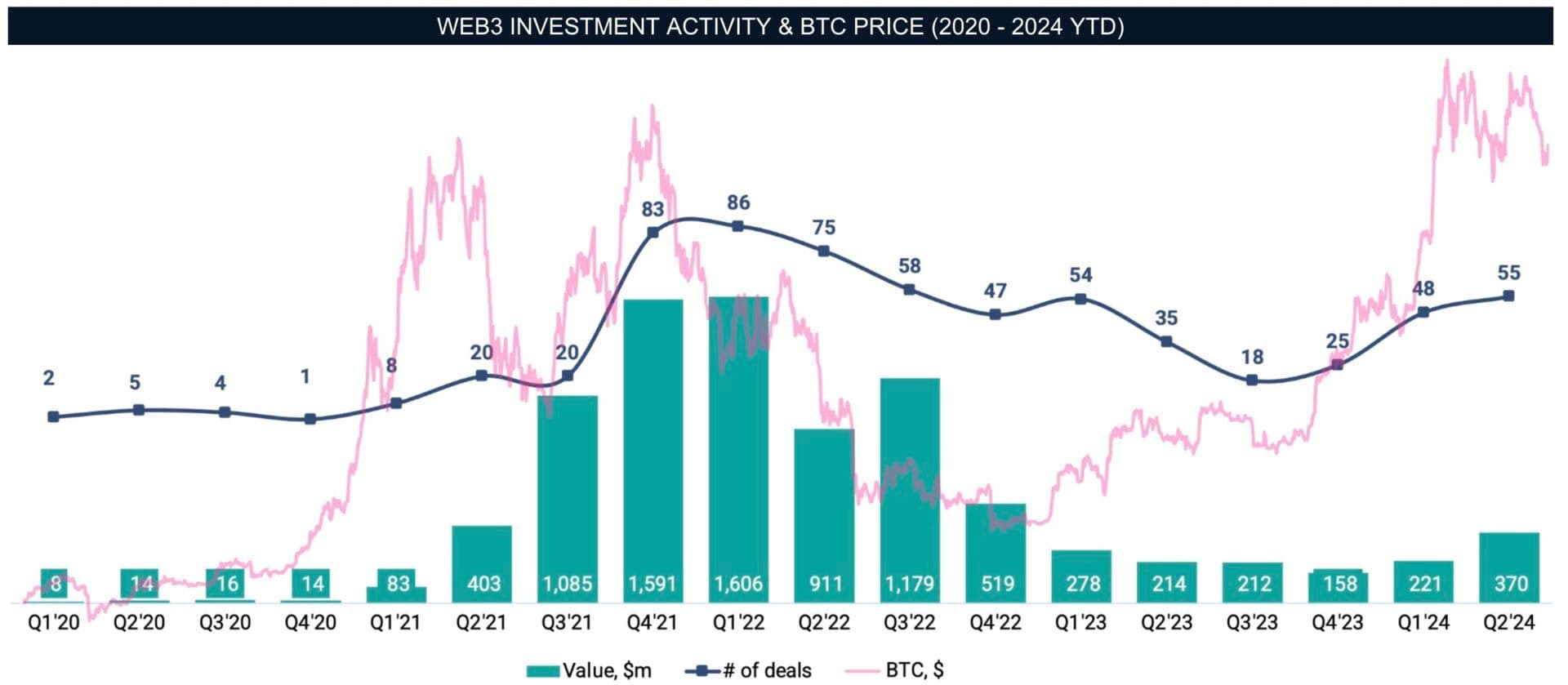

The correlation between Bitcoin price movements and investment activity in crypto gaming has been a recurring theme since 2020. At the beginning of that year, Bitcoin was priced around $7,200, and investment activity in the crypto gaming space was subdued due to market uncertainty brought on by the COVID-19 pandemic. The gaming and cryptocurrency sectors had not yet found a common ground, and few projects effectively combined blockchain technology with gaming.

However, as Bitcoin's value surged towards the end of 2020, reaching $29,000, interest in blockchain-related projects, including crypto gaming, gained traction. The bull cycle, which peaked in early 2021, triggered a wave of investments and attracted new developers and investors to the emerging web3 gaming market. The increased demand for blockchain-based gaming was partly driven by the rise of play-to-earn mechanics and the potential for digital asset ownership within games.

Web3 Investment Acitivy and BTC Price (2020 - 2024 YTD)

History of Web3 Gaming Investments

By Q1 2022, investment in the crypto gaming sector had reached $1.6 billion across 85 deals. Yet, the subsequent "crypto winter" of 2022, marked by the Ronin network hack, the LUNA crash, and the collapse of the FTX exchange, led to a gradual decline in investment activity. The downward trend became more apparent in the latter half of the year, reflecting delays in market reactions and deal announcements.

In 2023, investment activity reached its lowest point by Q3, despite early signs of Bitcoin's recovery. While a new bull run emerged in 2024, with Bitcoin exceeding previous highs, investment in crypto gaming did not immediately rebound to previous levels. This disconnect between Bitcoin's price movements and investment patterns underscores the challenges facing web3 gaming, including market immaturity and the need for sustainable business models.

Investments: Content vs. Platforms & Tech

Web3 gaming startups can be categorized into two main segments:

- Content: Companies that develop blockchain-based games and interactive experiences.

- Platforms & Tech: Companies that provide infrastructure, tools, and technologies for the web3 gaming ecosystem, such as blockchain infrastructure, development tools, and community platforms.

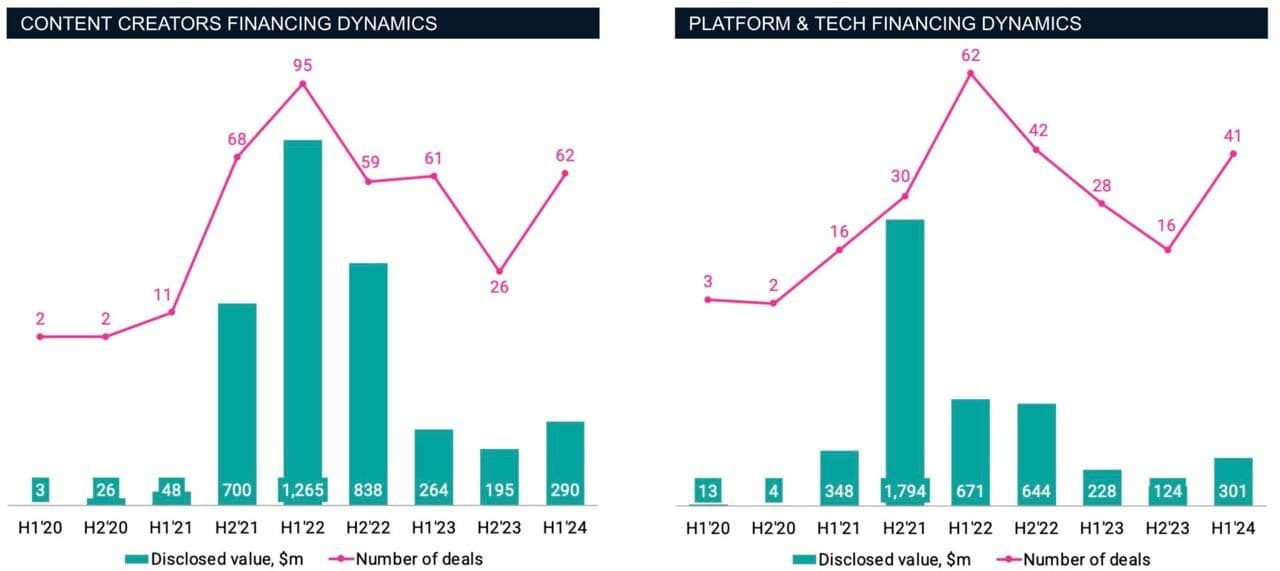

In 2020, web3 gaming was still a niche market, with only $46 million raised across nine deals, reflecting the early-stage nature of the sector. This changed drastically in 2021 with the mainstream adoption of NFTs and the growing popularity of metaverse concepts. That year saw 125 deals, totaling $2.9 billion in investments, driven by the success of early pioneers like Axie Infinity and the rise of play-to-earn games.

Content-focused startups attracted the majority of funding, accounting for over 60% of the total capital raised. By H1 2022, investment activity in Content startups peaked, with 96 deals closed compared to 62 in Platforms & Tech. The preference for Content investments can be attributed to the perceived quicker returns and scalability of game development studios compared to companies focused on the underlying infrastructure.

Content Creators vs Platform and Tech Financing Dynamics

Major Investors and Notable Deals

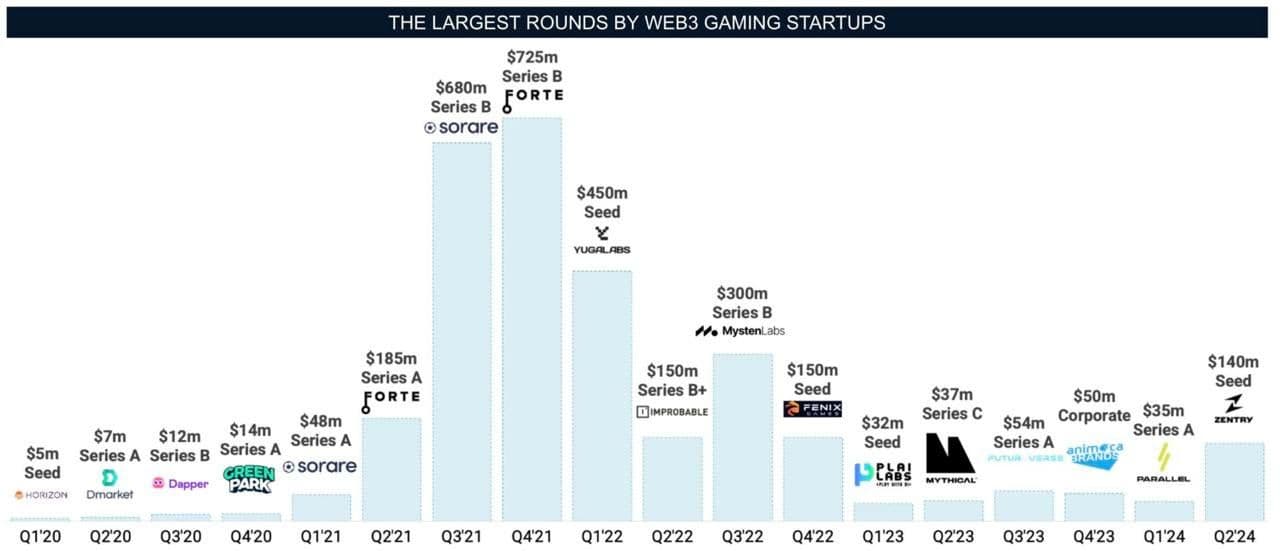

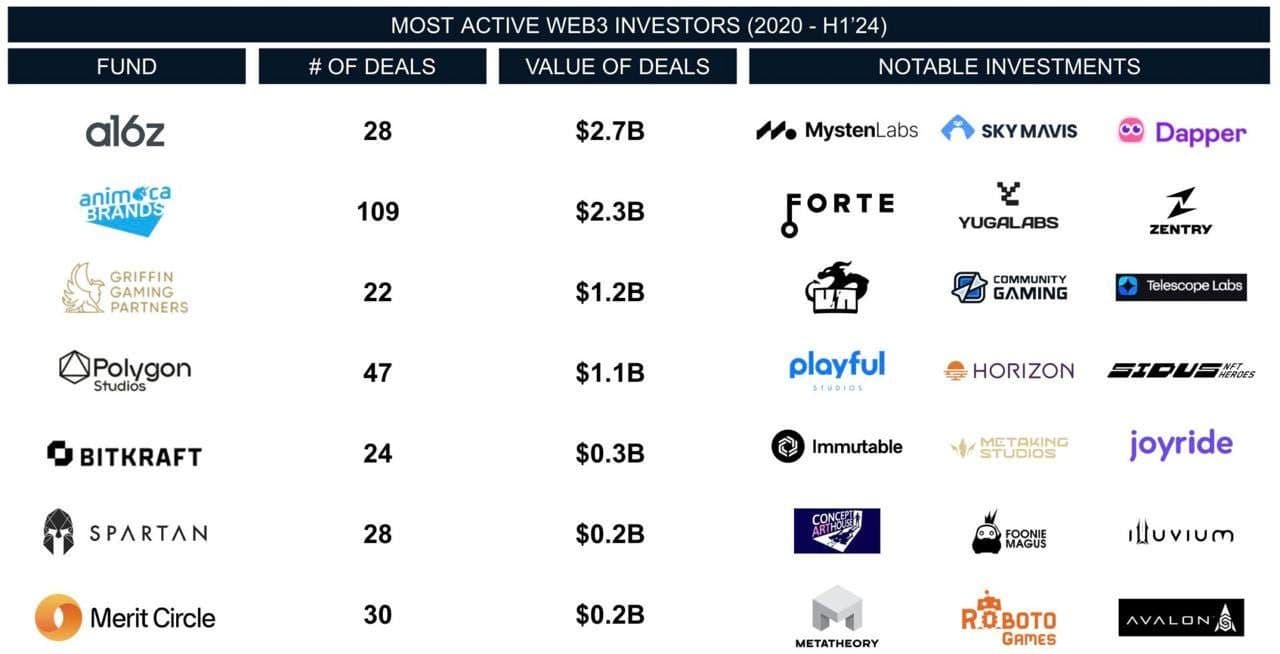

Key venture capital players have consistently shaped the web3 gaming investment landscape. Animoca Brands emerged as a leading investor, participating in 109 rounds totaling $2.3 billion. The company was involved in nearly all major deals across the sector, solidifying its influence. Andreessen Horowitz (a16z) also played a significant role, investing $2.7 billion across 28 deals.

Largest Rounds by Web3 Gaming Startups

Other active investors include Griffin Gaming Partners, BITKRAFT, and Polygon, with each bringing a unique focus to the intersection of web3 and traditional gaming. Several high-profile investments from 2020 to 2024 include Forte, Sorare, Yuga Labs, and Mysten Labs, which collectively raised $2.4 billion. These startups represent almost 30% of the total capital invested in web3 gaming during this period, highlighting their importance in the growth of the industry.

Most Active Web3 Investors (2020-H1'24)

Mergers and Acquisitions (M&A)

While the volume of investments in web3 gaming has been significant, the M&A landscape tells a different story. The industry is still in its early stages, with few startups reaching the maturity needed to become acquisition targets. Compared to the traditional gaming sector, where mergers and acquisitions are more common, the blockchain gaming market has seen limited exit activity.

Between 2020 and 2024, there were 33 M&A deals with a total disclosed value of $146 million. Notable transactions include Wemade's $115 million acquisition of SundayToz and Animoca Brands' involvement in at least six deals, though financial details were often undisclosed. Smaller deals, such as NFT Tech's $6 million purchase of Run It Wild, exemplify the early-stage nature of M&A activity in this sector.

The contrast between high investment levels and limited exits reflects the challenges web3 gaming faces, including the need to establish a sustainable customer base and reliable business models. As the market matures, a rise in M&A activity is anticipated, potentially aligning the sector more closely with traditional gaming.

Web3 Exits and Other M&A Activity (2020-H1'24)

Final Thoughts

- Bitcoin's Influence on Investment Trends: Bullish trends in Bitcoin significantly boosted investment activity in web3 gaming during 2021 and early 2022. However, recent cycles have not produced the same level of investor enthusiasm.

- Impact of the Crypto Winter: The decline in Bitcoin's price was compounded by negative news stories, leading to reduced investor confidence and a gradual drop in deal activity.

- Dominance of Content Investments: Content-focused startups consistently attracted more funding than those in Platforms & Tech, with their rapid growth driven by play-to-earn mechanics and digital asset integration.

- Limited M&A Activity: Despite considerable investment volumes, web3 gaming has seen few exits, highlighting the sector's nascent stage. An increase in M&A is expected as the industry matures.

As web3 gaming continues to evolve, questions remain about its trajectory and the factors that will shape its future. While early signs of recovery in 2024 point to renewed interest, the path forward will depend on the development of sustainable business models and the ability to create engaging gaming experiences. The integration of emerging technologies with daily life presents new opportunities, but no widely accepted strategy has emerged to ensure success.

The answers to these questions, along with the performance of Bitcoin, will define the future of web3 gaming investments. Whether the industry can establish itself as a significant player in the gaming landscape remains to be seen, but the journey from 2020 to 2024 has laid a foundation for future growth and development.

Source: InvestGame