The Drake Star Global Gaming Report Q2 2024 offers a detailed analysis of the gaming and esports landscape for the second quarter of the year, shedding light on significant developments and providing predictions for the remainder of 2024. In this article, we summarize the main findings from the report and discuss their relevance for the emerging web3 gaming sector.

The Drake Star Global Gaming Report Q2 2024

Drake Star Global Gaming Report Q2 2024

With a continued rise in mergers and acquisitions, stability in private financings, and notable activity in the blockchain gaming sector, the Drake Star Global Gaming Report Q2 2024 provides key insights into the industry's current state. Major deals, including EQT's acquisition of Keywords and Nintendo's purchase of Shiver Entertainment, underscore the dynamic nature of the market. As the industry looks towards the remainder of 2024, the report anticipates further growth and strategic investments, setting the stage for an exciting future in gaming and esports.

Key Findings

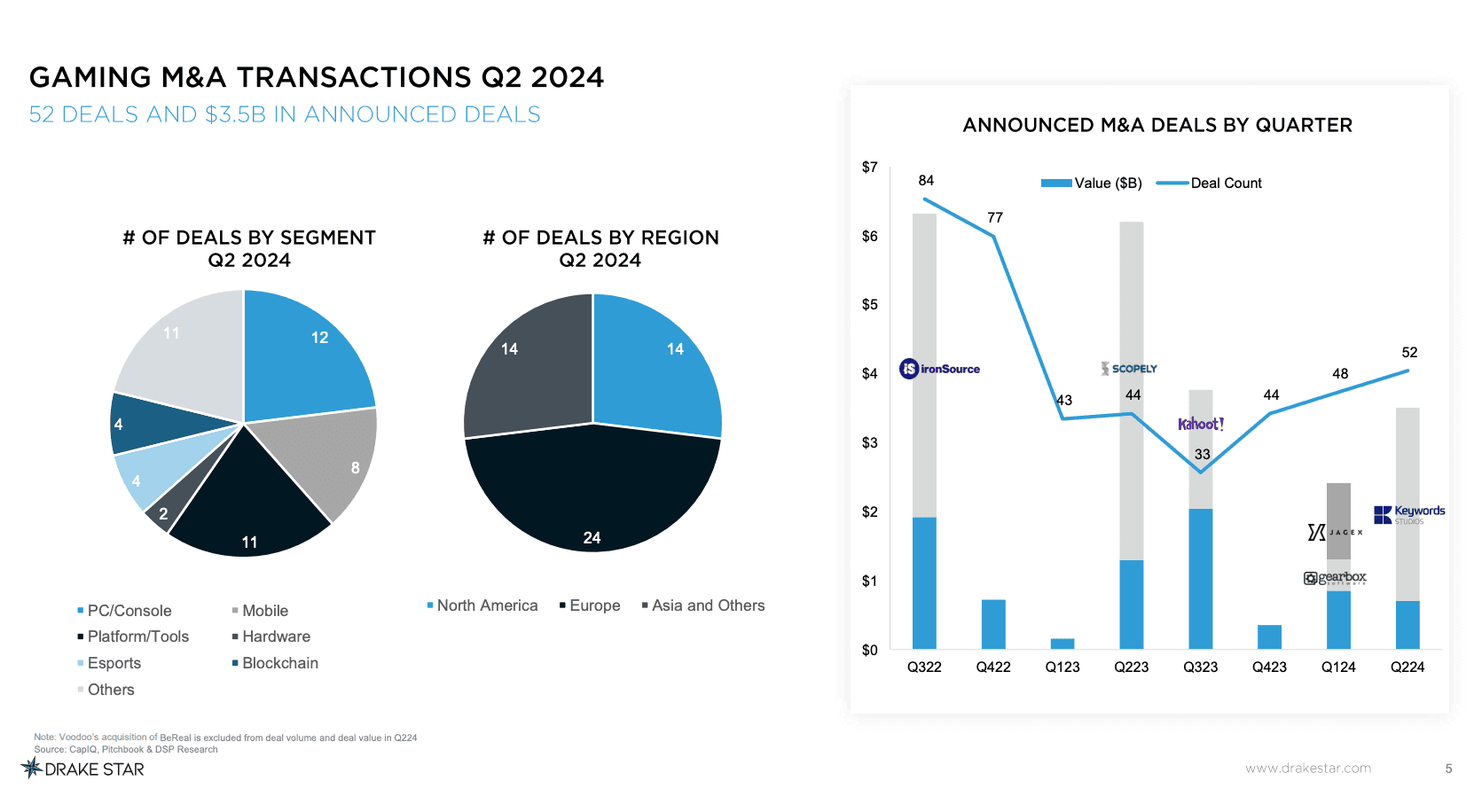

Mergers and Acquisitions (M&A)

The report highlights a continued rise in M&A activity with 52 announced deals totaling $3.5 billion in disclosed value. This marks the third consecutive quarter of increased deal activity, a significant recovery from the 33 deals recorded in Q3 2023. The most notable transaction was private equity firm EQT's acquisition of Keywords for $2.8 billion, making it the largest gaming deal of the year so far. Other significant strategic buyers included Infinite Reality, Miniclip/Tencent, Nintendo, and Tripledot.

Gaming M&A Transactions Q2 2024

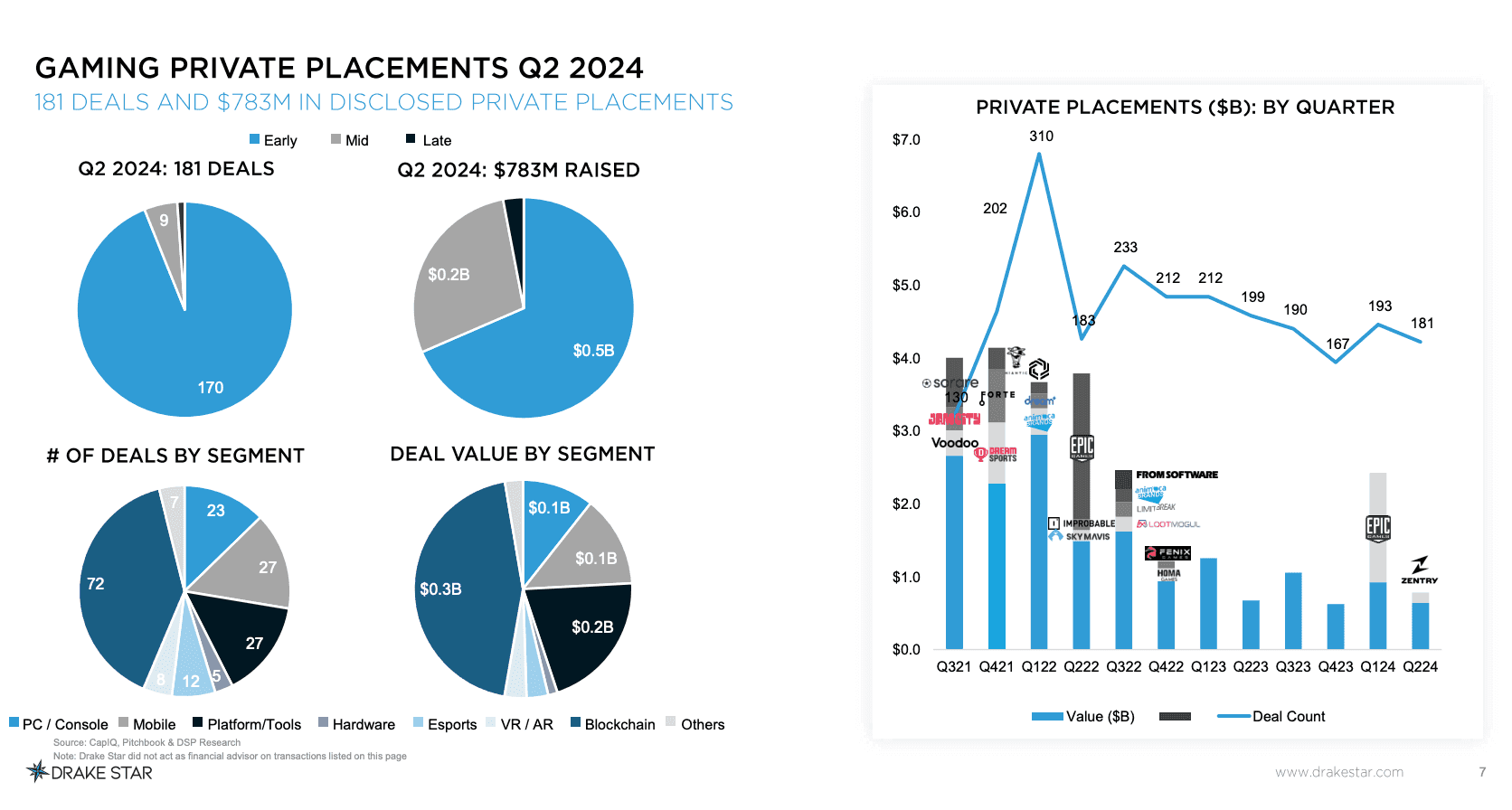

Private Financing Trends

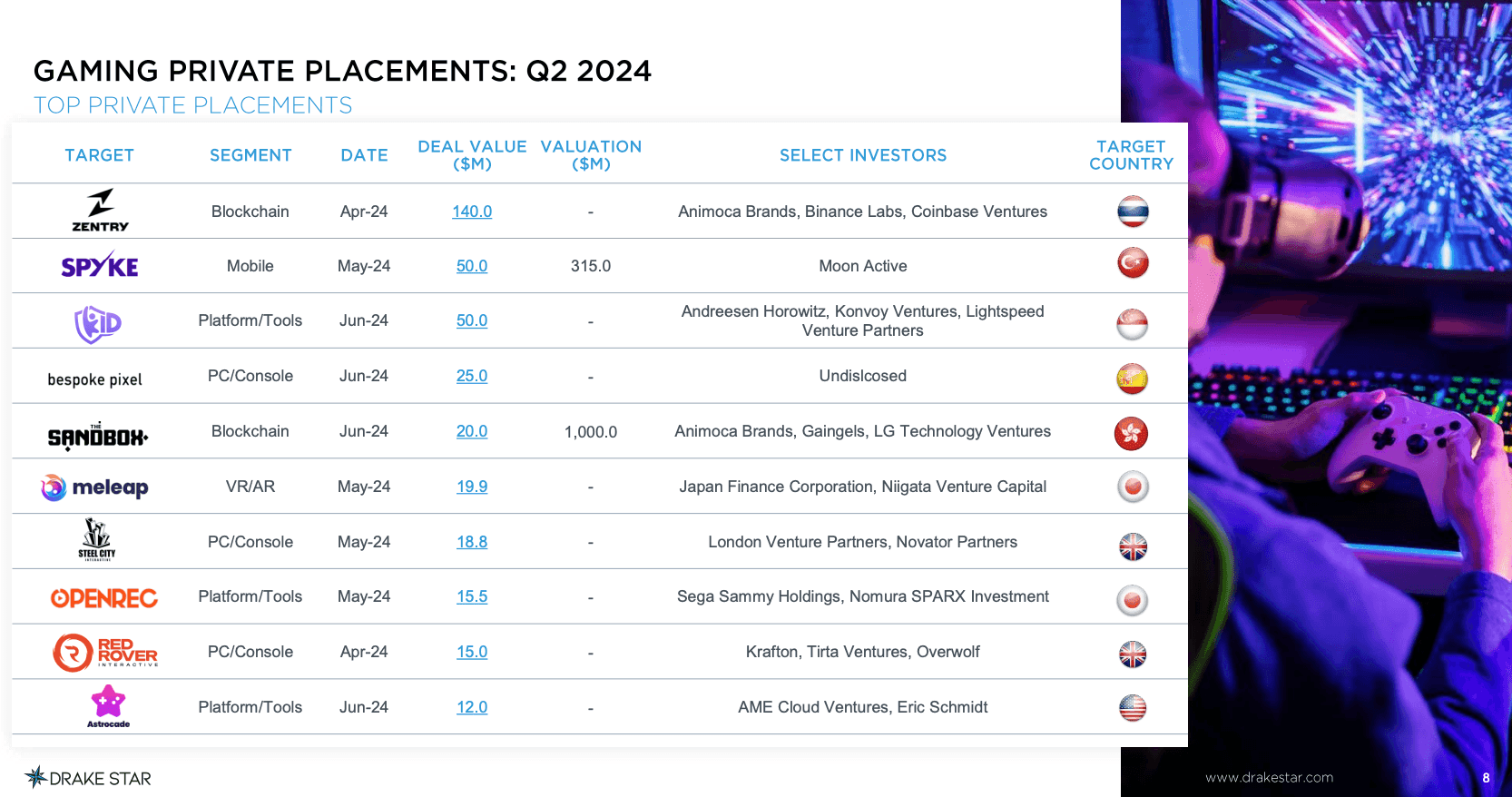

Private financing deals showed stability, with 180 deals in Q2 2024, only slightly down from 191 in Q1. Blockchain gaming attracted the most capital, representing 40% of the total deals and 44% of the disclosed deal value. The largest funding round was Zentry's $140 million raise, followed by Spyke and k-ID, each securing $50 million. Early-stage companies continued to dominate the investment landscape, accounting for 93% of all deals. Asia led the way with the largest financings, followed by Europe/UK, Turkey, and the U.S. Notably, venture capital firms such as Bitkraft, Sfermion, Shima Capital and Play Ventures were particularly active.

Gaming Private Placements Q2 2024

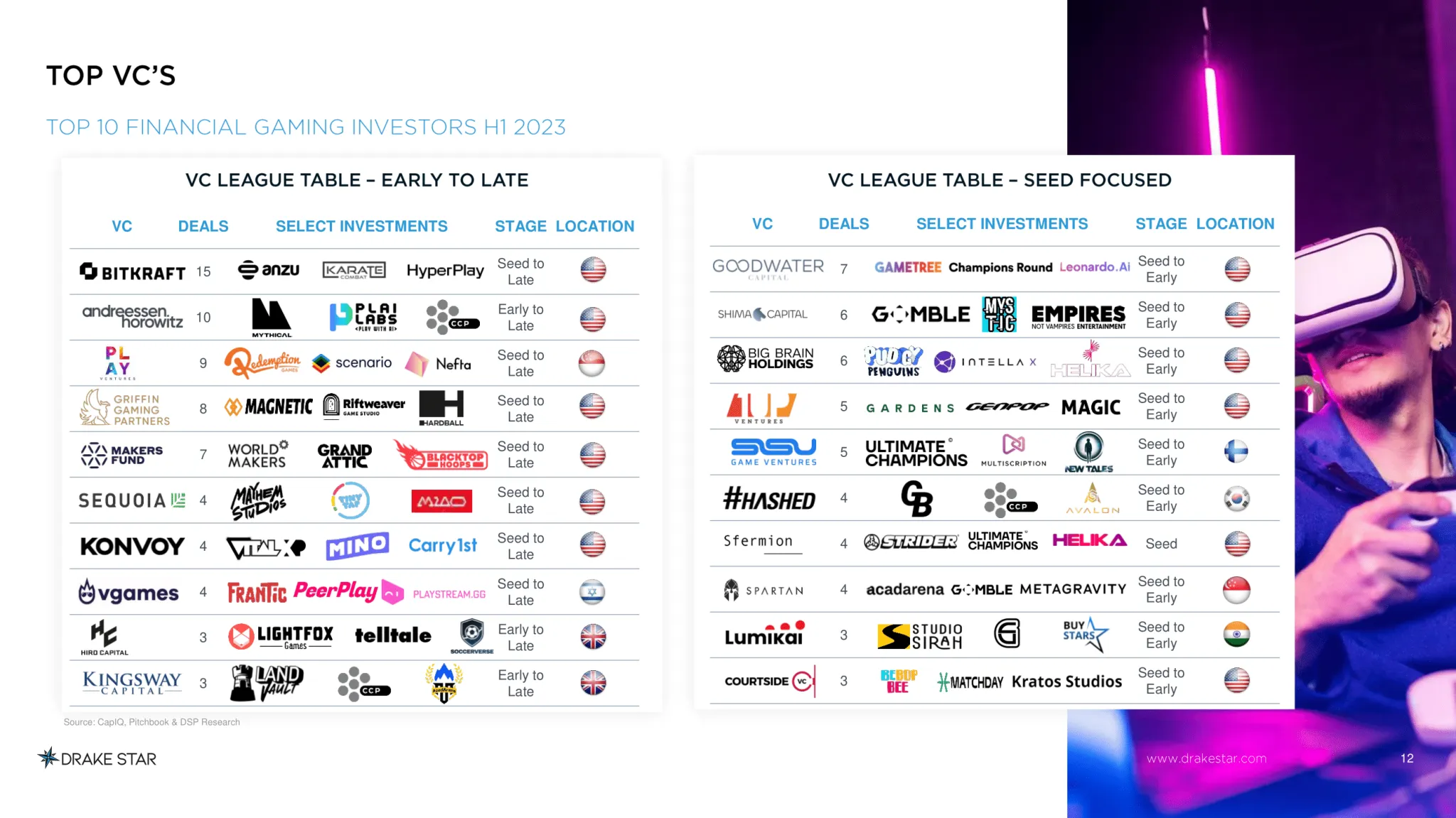

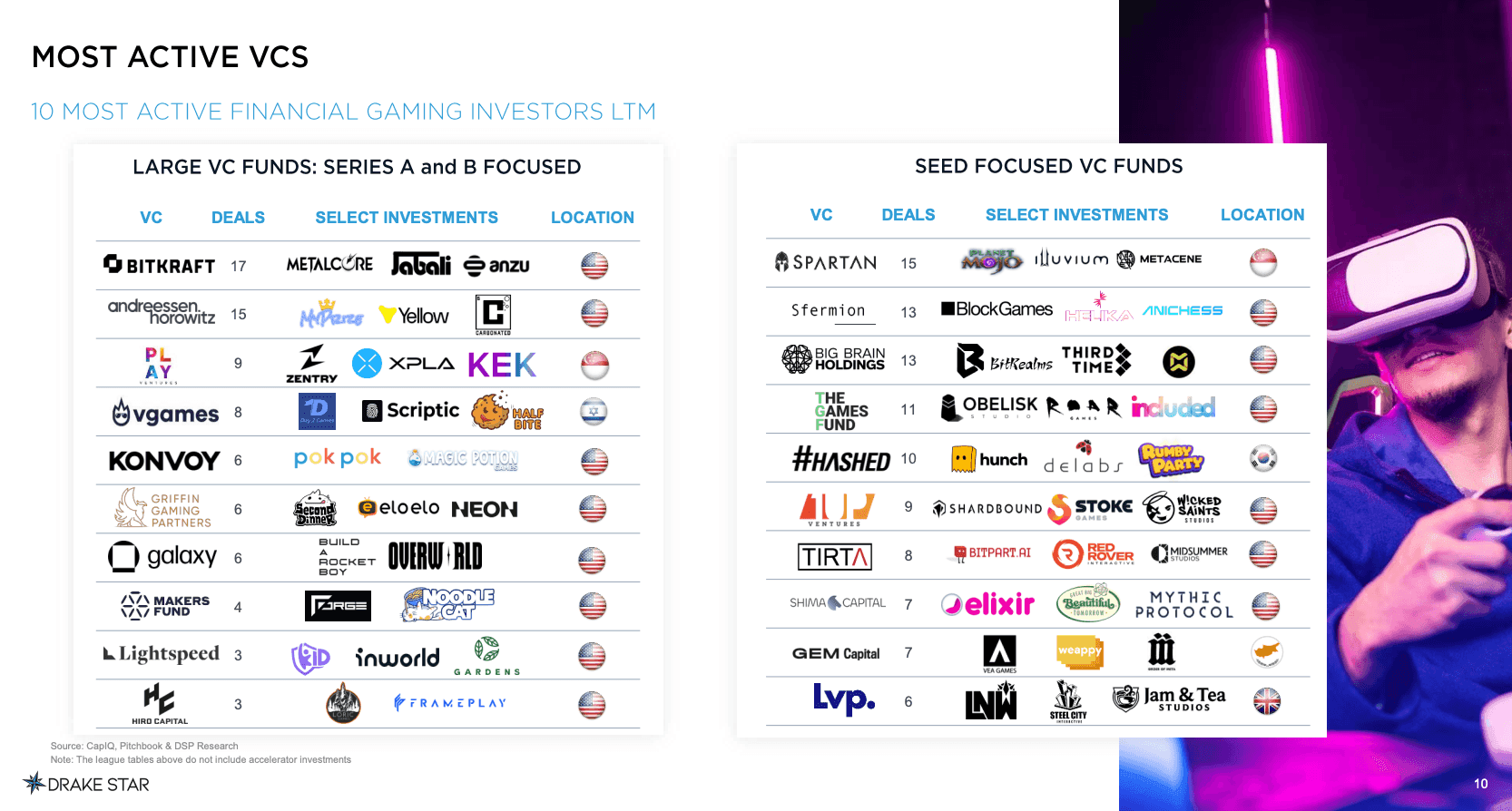

Most Active VCs

In the dynamic world of venture capital, several key players have recently made significant strides in their investment portfolios. BITKRAFT was the most active VC with 17 disclosed deals, directing funds to companies like Metalcore, Jabali, and Anzu. Spartan executed 15 deals, investing in Planet Mojo, Illuvium, and Metacene. Similarly, Andreessen Horowitz completed 15 deals, supporting MyPars, Yellow, and Carbonated. Sfermion made 13 deals, investing in BlockGames, Helika, and Anichess.

Matching this number, Big Brain Holdings also completed 13 deals, including investments in BitRealms and ThirdTime. Play Ventures closed 9 deals, investing in Xentry, XPLA, and KEK. #Hashed also participated in 9 deals, supporting Rumby Party, Hunch, and Delabs. Among other notable venture capital firms, Shima Capital completed 7 deals, investing in Elixir and Mythic Protocol. Konvoy engaged in 6 deals, directing funds to Pokpok and Magic Potion. Makers Fund participated in 6 deals, investing in Forge and Noodle Cat.

Most Active VCs

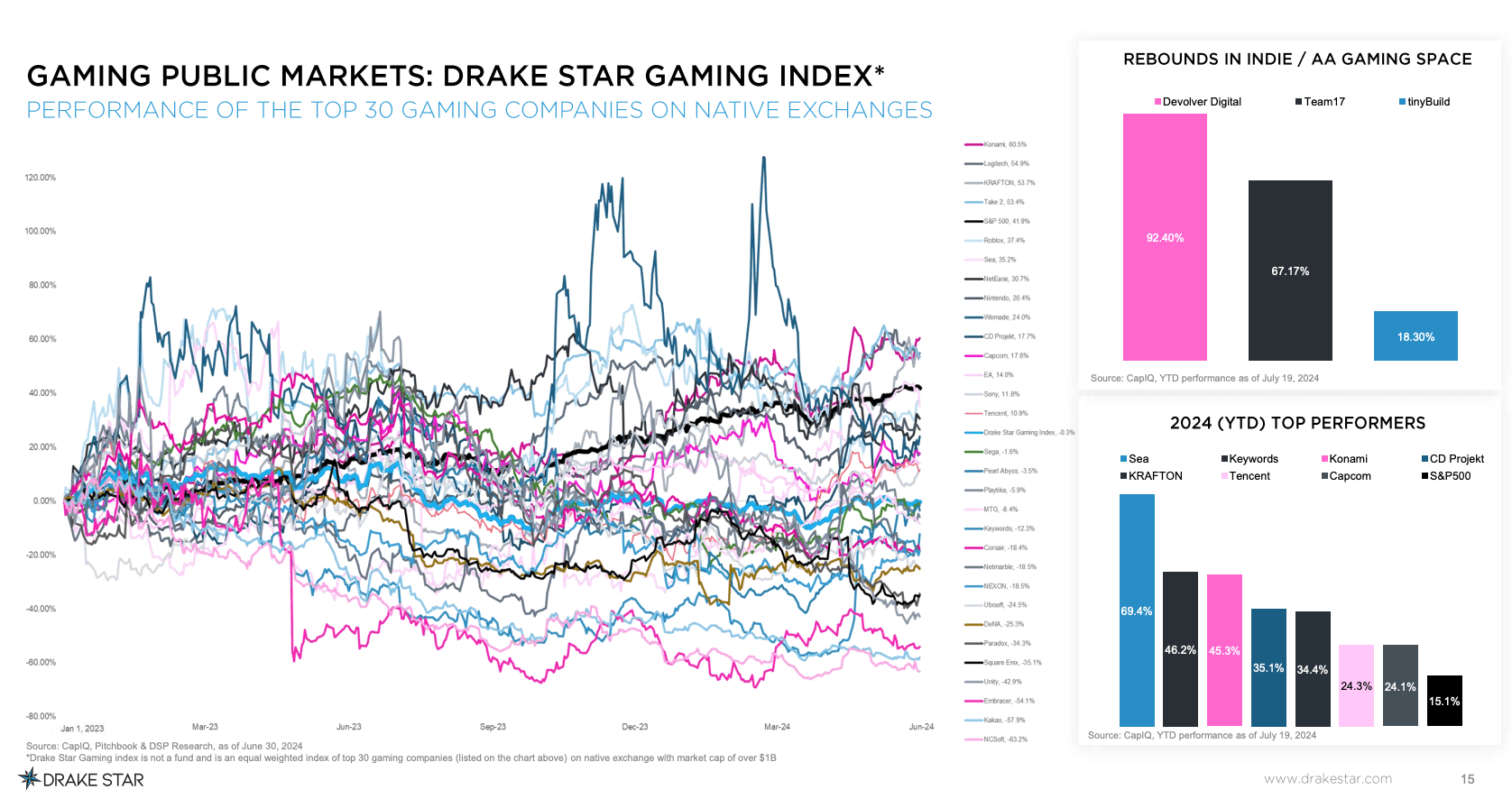

Public Market Performance

Despite some top performers like Konami, Logitech, and Krafton, the broader market of gaming stocks has yet to recover fully. However, leading indie and AA game developers/publishers have experienced a significant rebound this year. Embracer Group announced plans to restructure into three separate publicly listed companies, aiming to unlock the full potential of each segment. Additionally, GameStop raised approximately $3.1 billion in equity, while Embracer, Take-Two, and Modern Times Group raised substantial debt financing.

Gaming Public Markets: Drake Star Gaming Index

The Biggest Disclosed Deals

- Embracer Group: Announced a transformation plan to restructure into three standalone public companies, raising $980 million in debt financing.

- GameStop: Raised $3.1 billion through follow-on offerings involving the sale of 120 million shares.

- EQT and Keywords: Agreed on a $2.8 billion acquisition to accelerate Keywords’ growth.

- Infinite Reality: Acquired Drone Racing League for $250 million and Action Face for an undisclosed sum.

- Nintendo: Acquired Shiver Entertainment, strengthening its development resources.

- Miniclip/Tencent: Acquired Futurlab, known for PowerWash Simulator.

- CyberAgent: Acquired NitroPlus for $106 million to grow its IP-based business.

- Zentry: Raised $140 million to develop digital infrastructure for blockchain gaming.

- k-ID: Raised $50 million to create a cross-platform sign-in system for children.

- Spyke: Raised $50 million from Moon Active to develop and expand its mobile games.

- Bespoke Pixel: Raised $25 million to develop a game based on original IP.

- The Sandbox: Raised $20 million to build a metaverse platform.

Gaming Private Placements Q2 2024

2024 Outlook and Predictions

The outlook for mergers and acquisitions (M&A) in the gaming industry for the remainder of 2024 and into 2025 is promising, driven by the ongoing recovery of the public gaming company market. Major players like Tencent, Take-Two, and Playtika are expected to be active buyers, while the volume of mid to small-sized deals is likely to rise. Private equity (PE) firms, including CVC with Jagex and EQT with Keywords, have been the leading buyers in 2024. This trend is anticipated to continue with more acquisitions and take-private deals by PE firms.

Due to limited mid and later-stage financing options, some gaming companies may choose earlier exits. Following the Voodoo BeReal acquisition, other gaming firms might diversify into adjacent segments by acquiring mobile app companies. In the financing arena, segments such as artificial intelligence (AI), mixed reality, platforms, and tools remain highly attractive. Building on the success of Shift Up's IPO in Korea, several companies poised for public listings, including Appsflyer, Discord, and Epic Games, are expected to begin planning their IPOs in the coming quarters.

Drake Star: Believe in Innovation, Change the World

Final Thoughts

The findings from the Drake Star Global Gaming Report Q2 2024 underscore the growing relevance of blockchain gaming within the broader industry landscape. The substantial investment in blockchain gaming, with 40% of total deals and 44% of disclosed deal value directed towards this sector, highlights its increasing prominence. Significant funding rounds for companies like Zentry and k-ID illustrate strong investor confidence in the potential of blockchain technology to drive innovation and enhance gaming experiences.

With prominent firms like BITKRAFT backing notable names such as Metalcore and Illuvium, it's clear that blockchain gaming is attracting significant attention and capital. The variety of deals and investments—from established entities like Sfermion and Shima Capital to emerging players like Konvoy and Play Ventures—underscores a strong belief in the sector's potential for growth.

The involvement of these investors not only signifies confidence in the transformative power of blockchain technology in gaming but also suggests a growing ecosystem that could redefine the industry’s future. As these VCs continue to fuel innovation, the resulting advancements and new developments in blockchain gaming are likely to have a profound impact on how games are developed, played, and experienced globally. For more information, you can read the full report here.