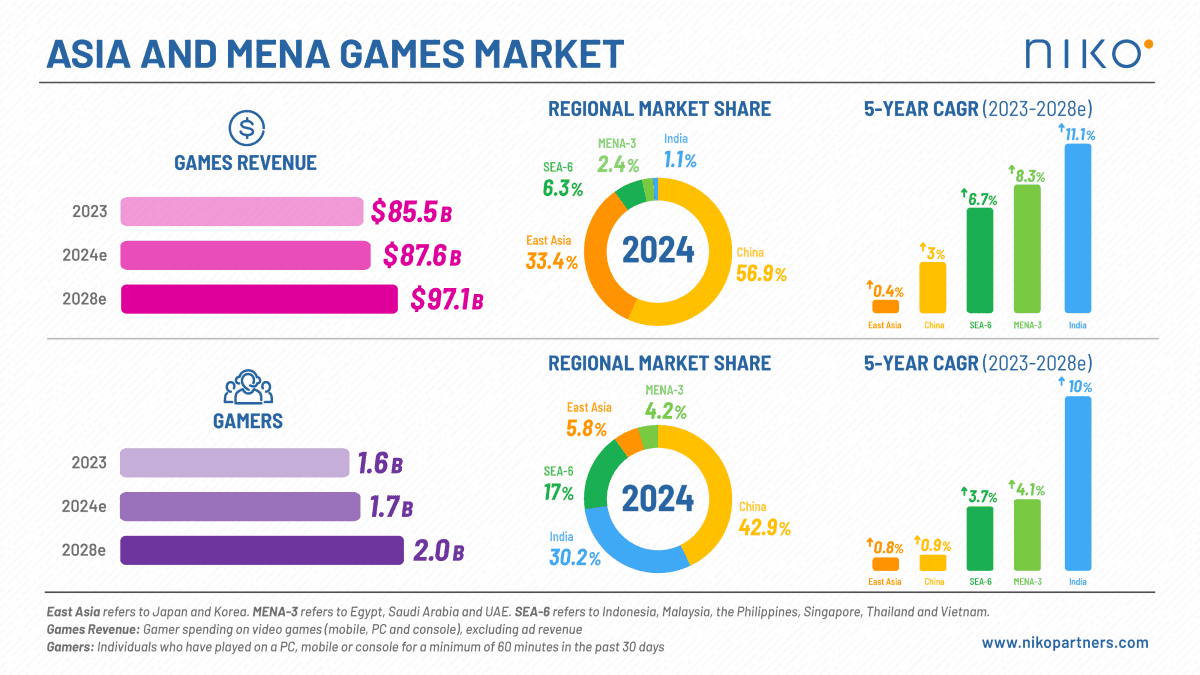

India’s gaming market continues to expand rapidly, positioning itself as the fastest-growing market among those tracked by Niko Partners. Despite its strong growth, the market—excluding real-money gaming (RMG)—remains relatively smaller than leading countries in the global gaming industry. According to Niko Partners' India Gamer Behavior & Market Insights Report, several key trends are shaping the landscape for both gamers and gaming companies.

Video Game Market in India

Increased Willingness to Spend

Monetization opportunities are on the rise, as more Indian gamers are willing to spend on gaming than ever before. Notably, 77.3% of PC gamers reported spending more on PC games in Q1 2024 compared to the same period in 2023. This is a higher growth rate than that seen for mobile and console games.

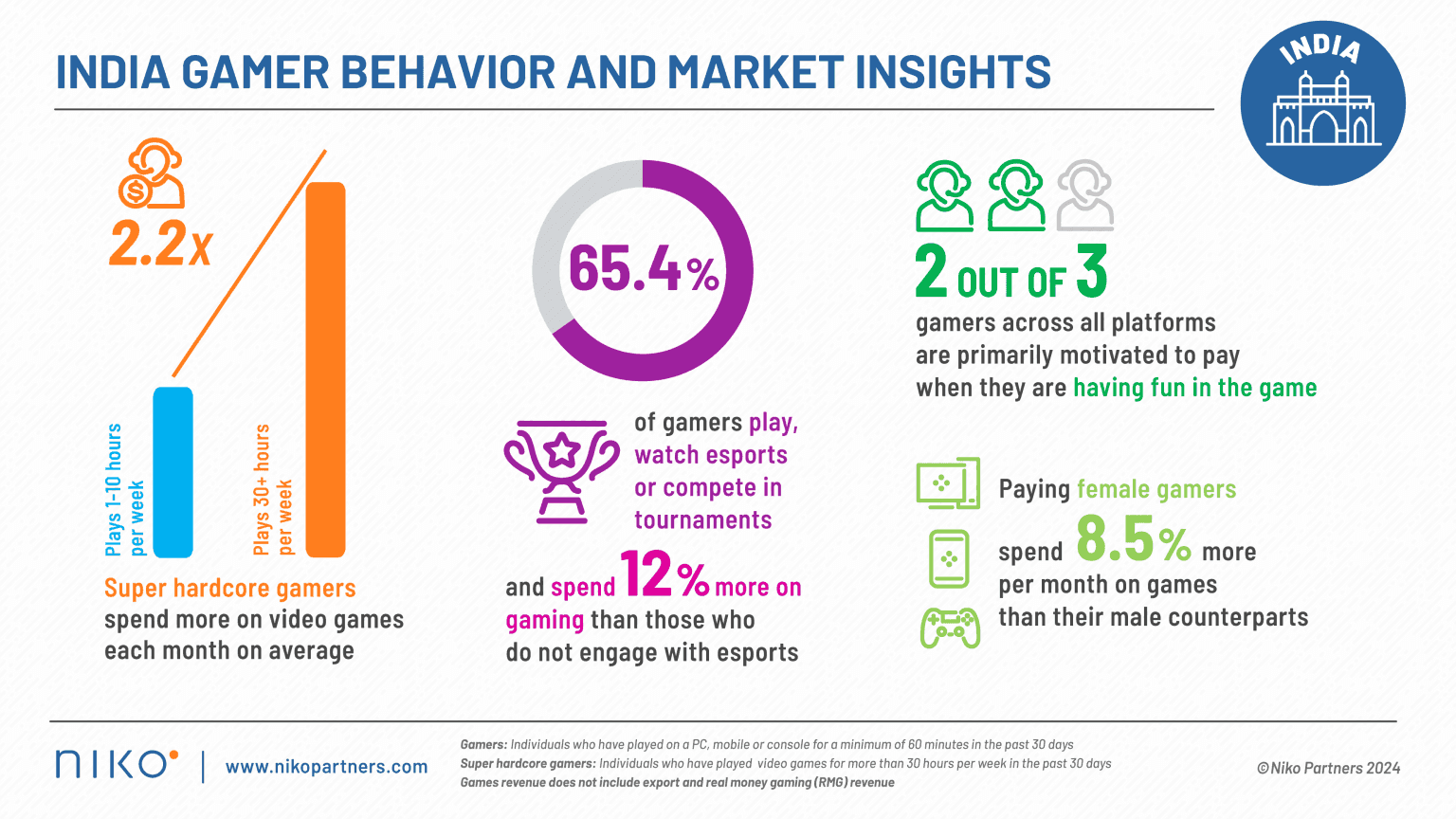

A significant finding from the report is that female gamers who pay for games spend 8.5% more per month than their male counterparts. This highlights a growing diversity in the spending patterns of the Indian gaming audience. With rising disposable incomes and broader access to high-end smartphones, especially driven by mobile-first esports tournaments, average revenue per user (ARPU) is expected to increase.

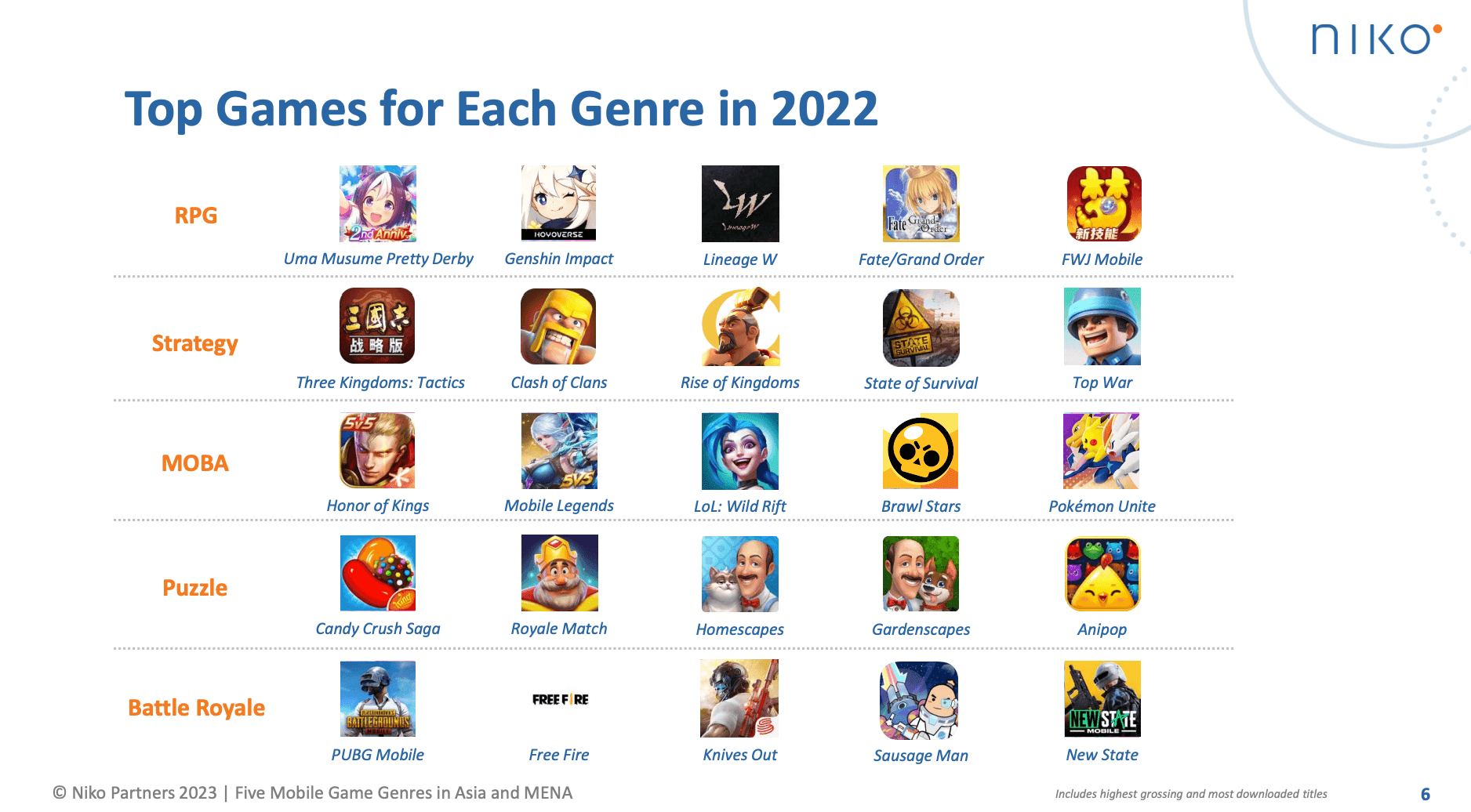

Battle Royale Games and Engagement

The battle royale genre continues to dominate the Indian mobile gaming scene. According to Niko Partners, 57% of mobile gamers in India have played a battle royale game in the past three months, with popular titles like BGMI and Free Fire leading the charge. Among those mobile gamers who spend money, 60% have purchased a battle pass or season pass, reflecting the growing trend of in-game purchases.

Esports has become a major force in India’s gaming landscape. The report reveals that 65.4% of respondents are engaged with esports—whether through playing, watching, or competing in tournaments. Those involved with esports tend to spend 12% more on gaming than those who do not participate in the esports ecosystem. This growing enthusiasm for esports, paired with mobile-centric gaming, will likely continue to fuel market growth.

India Gamer Behaviour and Market Insights

Social Influence and Game Selection

The report underscores the importance of social elements in gaming. A majority of Indian gamers—57.2%—discover new game titles through streamers and influencers. Additionally, the ability to play with or against friends online, along with positive reviews from peers and community influencers, are the two most influential factors for Indian gamers when selecting new games. These findings suggest that peer recommendations and community engagement are powerful motivators in shaping gaming habits.

Market Growth and Forecasts

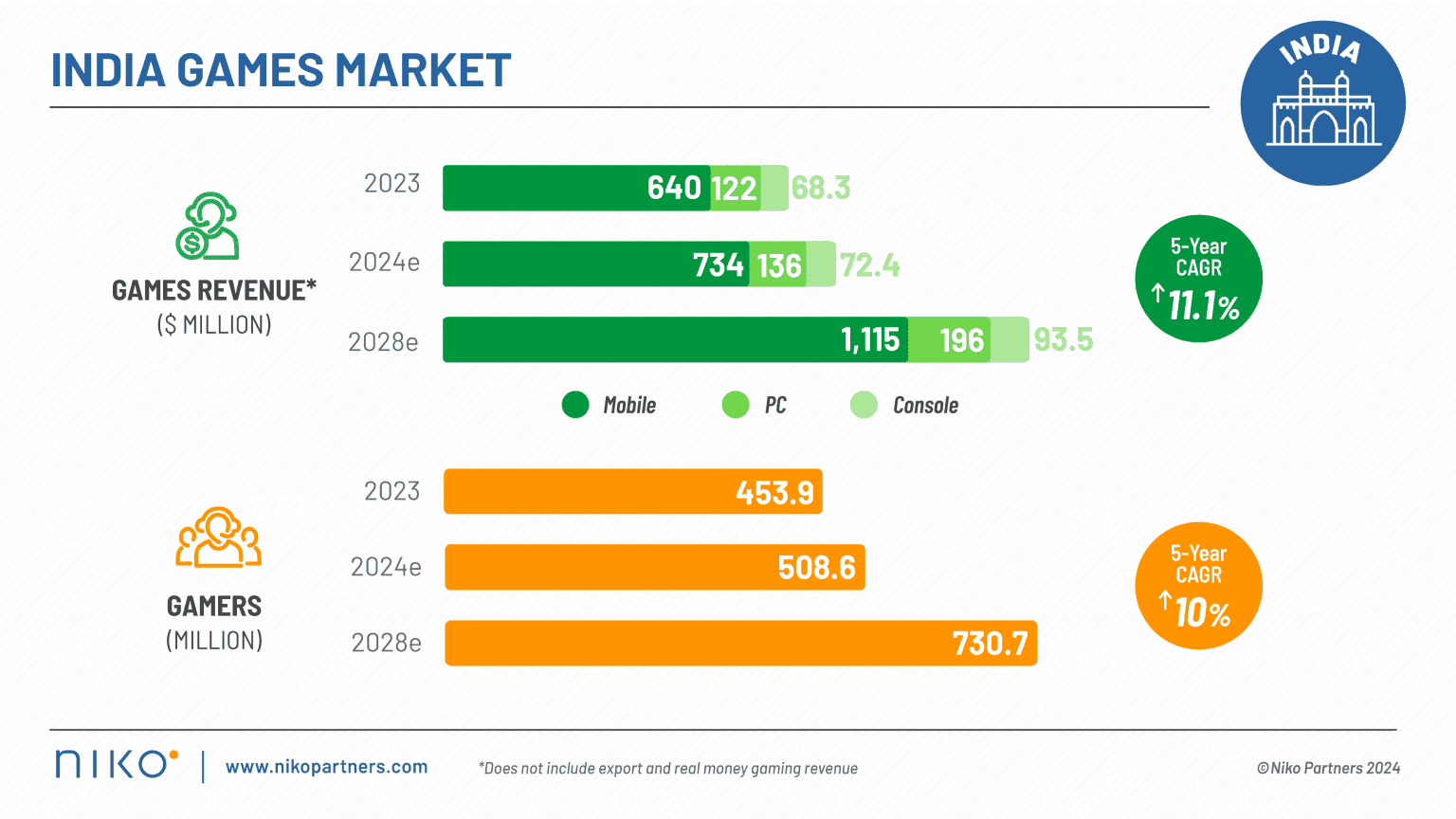

Niko Partners’ India Market Model Report reveals that the Indian video games market generated $830 million in revenue in 2023, marking a 15.9% year-on-year increase, albeit slightly slower than the 19% growth observed in 2022. Of India’s large gaming population, only 3% currently spend money on games, with an average revenue per paying user (ARRPU) of $0.29 per month.

The Indian gaming market is expected to grow by 13.6% in 2024, reaching $943 million in revenue, with a forecast to surpass $1 billion by 2025. Long-term projections indicate the market will hit $1.4 billion by 2028, reflecting a five-year compound annual growth rate (CAGR) of 11.1%.

Mobile gaming will continue to dominate the market, accounting for 77.9% of total revenue, followed by PC gaming at 14.5%, and console gaming at 7.7%. This aligns with the mobile-first trend that has characterized the Indian gaming landscape in recent years.

India Games Market Overview

Final Thoughts

India’s gaming market is set to grow significantly in the coming years, driven by a combination of increased spending by gamers, especially on mobile platforms, and a thriving esports scene. With the market expected to surpass $1 billion in 2025, companies looking to expand in the global gaming industry should take note of these trends. As one of the fastest-growing markets in the world, India presents a wealth of opportunities for both game developers and companies seeking to capitalize on the region’s unique gaming culture.

Source: Niko Partners