The intersection of cryptocurrency and gaming created a significant shift in the investment landscape between 2020 and 2024, introducing the web3 gaming market. As blockchain and gaming merged, investments flowed into the space, influenced heavily by Bitcoin's price volatility.

According to a recent report by InvestGame and GDEV, in this period, play-to-earn mechanics and decentralized gaming concepts piqued the interest of both developers and investors. However, the trajectory of these investments has fluctuated in line with broader market trends, revealing both opportunities and challenges for the emerging web3 gaming industry.

Key Takeaways

- Bitcoin's price fluctuations have driven significant investment in web3 gaming, particularly in 2021 and early 2022.

- Content creators have attracted more funding than platform-focused startups, reflecting quicker potential returns.

- M&A activity in web3 gaming remains limited, highlighting the industry's early stage of development.

- The future of web3 gaming depends on sustainable business models and greater player engagement, with Bitcoin's price continuing to play a role in shaping investment trends.

Top Web3 Gaming Investments Since 2020

Bitcoin’s Influence on Crypto Gaming

Bitcoin’s price movements from 2020 onwards played a central role in shaping investment behavior in the crypto gaming sector. The year 2020 was marked by subdued investment activity due to pandemic-related volatility, but the late-year surge in Bitcoin's value (from $7.2k in January to $29k by December) sparked increased investor interest.

This uptick in cryptocurrency investment coincided with a newfound enthusiasm for projects merging gaming with blockchain technology. The result was a flurry of funding, particularly in 2021 and early 2022, when crypto gaming companies raised significant capital, most notably $1.6 billion in Q1 2022.

Despite the growing attention, the relationship between Bitcoin’s price and crypto gaming investments was not always linear. While a new Bitcoin bull run emerged in 2024, surpassing previous highs, investment activity in web3 gaming did not recover to the levels seen in 2021 and early 2022. This suggests that the industry is still finding its footing, and market reactions to cryptocurrency price trends can vary based on broader developments within the gaming sector itself.

Web3 Investment Acitivy and BTC Price (2020 - 2024)

Investment Trends: Content vs Platform Startups

Crypto gaming startups generally fall into two categories: content creators and platform/tech providers. Content-focused companies develop blockchain-based games and experiences, while platform and tech startups provide the necessary infrastructure and tools to support these games.

In the early days of web3 gaming, content and platform investments were relatively balanced. By 2020, $46 million had been raised across 9 deals, split between content and platform providers. However, the rise of NFTs and metaverse concepts in 2021 shifted this balance. Content creators, benefiting from the success of play-to-earn games like Axie Infinity, attracted more attention and funding. By 2022, content startups had raised over 60% of total investment in web3 gaming, outpacing platform startups, which were seen as offering slower returns and having a more complex route to monetization.

Content Creators vs Platform and Tech Financing Dynamics

Web3 Investment Peaks and Decline

The period from late 2020 to early 2022 was a golden era for web3 gaming investments. Companies raised $2.9 billion across 79 deals in content and 46 deals in platform/tech in 2021, driven by a surge in NFT popularity and the allure of play-to-earn models. However, the subsequent crypto winter in 2022 marked a turning point. Events such as the $625 million Ronin hack, the collapse of the LUNA cryptocurrency in May 2022, and the fall of the FTX exchange led to a sharp decline in market confidence. Although the downturn was not immediate, the crypto market's volatility contributed to a slowdown in web3 gaming investments.

By 2023, deal activity had fallen significantly, reaching a low point in Q3 2023. This decline in funding was surprising, given that Bitcoin showed signs of recovery. However, many web3 gaming projects had stalled, with numerous startups closing due to a lack of user engagement and unclear business models. The future success of the sector relies on projects finding sustainable ways to engage players and deliver value beyond speculative token trading.

Largest Rounds by Web3 Gaming Startups

Some of the most prominent web3 gaming startups received substantial venture capital investments during this period. Notable examples include Forte, Sorare, Yuga Labs, and Mysten Labs, which collectively raised around $2.4 billion—nearly 30% of the total investment in crypto gaming between 2020 and 2024.

Largest Rounds by Web3 Gaming Startups

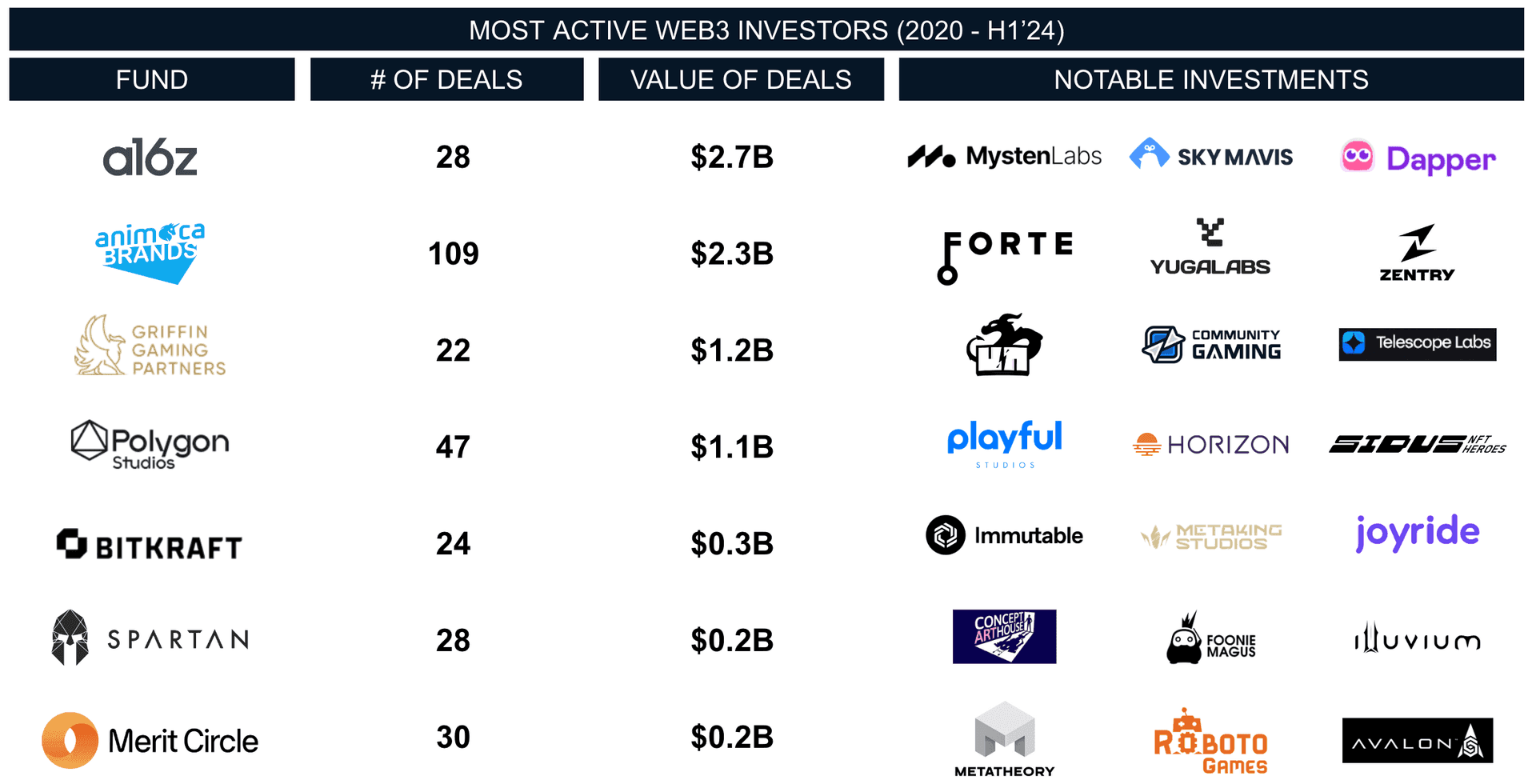

Most Active Web3 Investors

Among the most active investors, Animoca Brands and Andreessen Horowitz (a16z) stood out. Animoca Brands participated in 109 funding rounds, investing a total of $2.3 billion, while a16z contributed $2.7 billion across 28 deals. Other investors, such as Griffin Gaming Partners and BITKRAFT, also supported both gaming and web3 projects, further solidifying their presence in the sector.

Most Active Web3 Investors

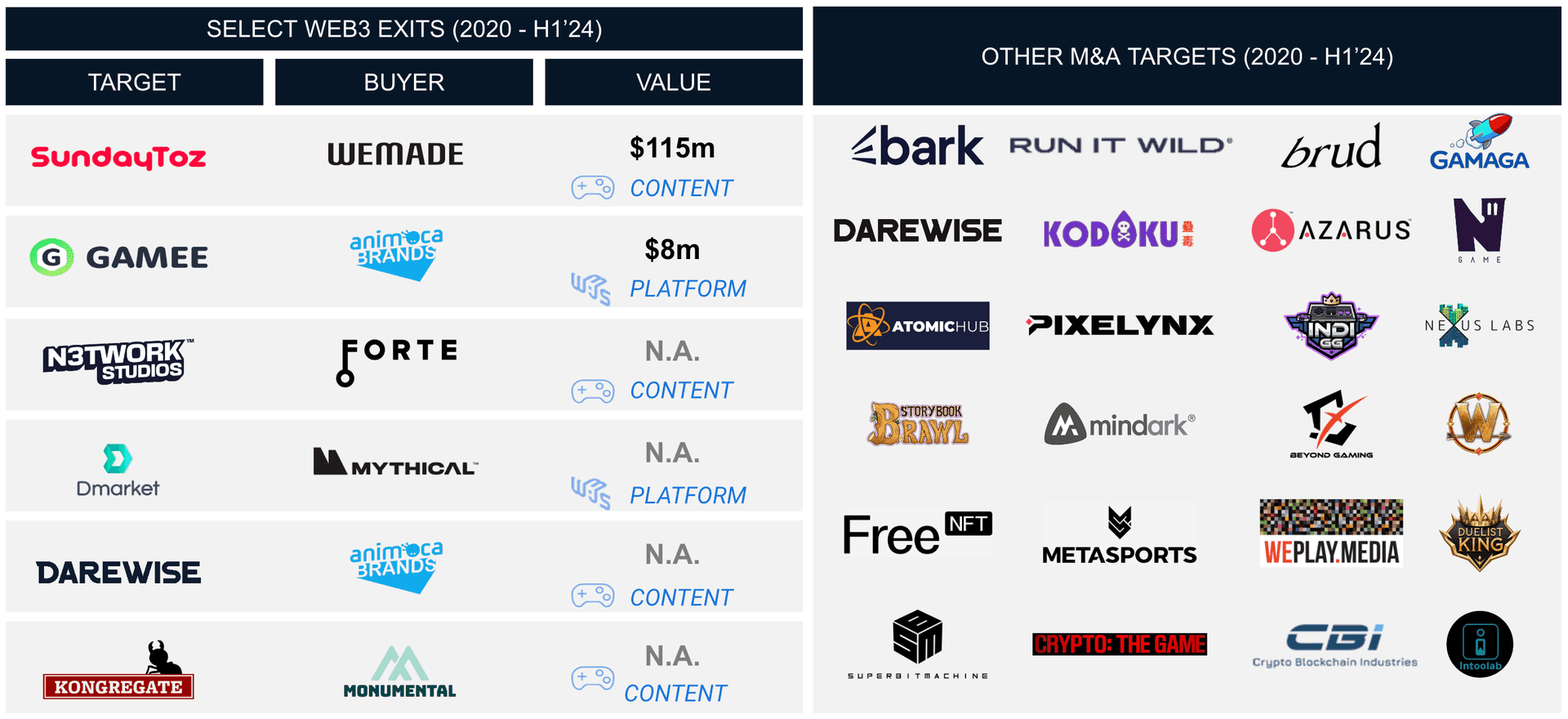

Web3 Exits and Other M&A Activity

While investment in web3 gaming has been robust, the industry is still in its early stages, and mergers and acquisitions (M&A) remain relatively rare. Unlike the traditional gaming sector, where exits are more frequent, the crypto gaming space has seen limited activity on this front. From 2020 to 2024, there were only 33 M&A deals, with a total disclosed value of $146 million. The largest acquisition occurred when Wemade purchased SundayToz for $115 million, but such deals have been the exception rather than the rule.

The contrast between high levels of investment and limited M&A activity underscores the experimental nature of the sector. As more projects either prove their worth or fail, the frequency of exits may increase. Until then, investors remain cautious, awaiting a clear path to market maturity.

Web3 Exits and Other M&A Activity

The Future of Web3 Gaming Investments

The outlook for web3 gaming remains uncertain. After a sharp decline in 2022 and 2023, there are signs of recovery as of H1 2024. New fundraising rounds are being announced, and investor interest is slowly returning. However, the market's future depends on several factors, including the development of sustainable business models, greater player engagement, and continued interest in blockchain technology.

For now, web3 gaming remains in an experimental phase, with no universally accepted model for success. As the market matures, we may see a shift toward more stable investments and greater consolidation through M&A deals. The trajectory of Bitcoin, along with the development of user-friendly, engaging blockchain games, will be key in determining whether web3 gaming can achieve long-term success. More information is available here.