The gaming industry in Southeast Asia (SEA) is poised for significant growth in 2024, following a notable rebound in gamer engagement and spending. The SEA-6 region—comprising Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam—continues to exhibit strong momentum, driven by key trends such as increasing gaming time, a growing interest in esports, and rising adoption of emerging technologies like play-to-earn and web3 gaming. In this article, we dive into the latest data published by Niko Partners.

Southeast Asian Gaming Market to Hit $7.1 Billion by 2028

Gaming Market and Revenue

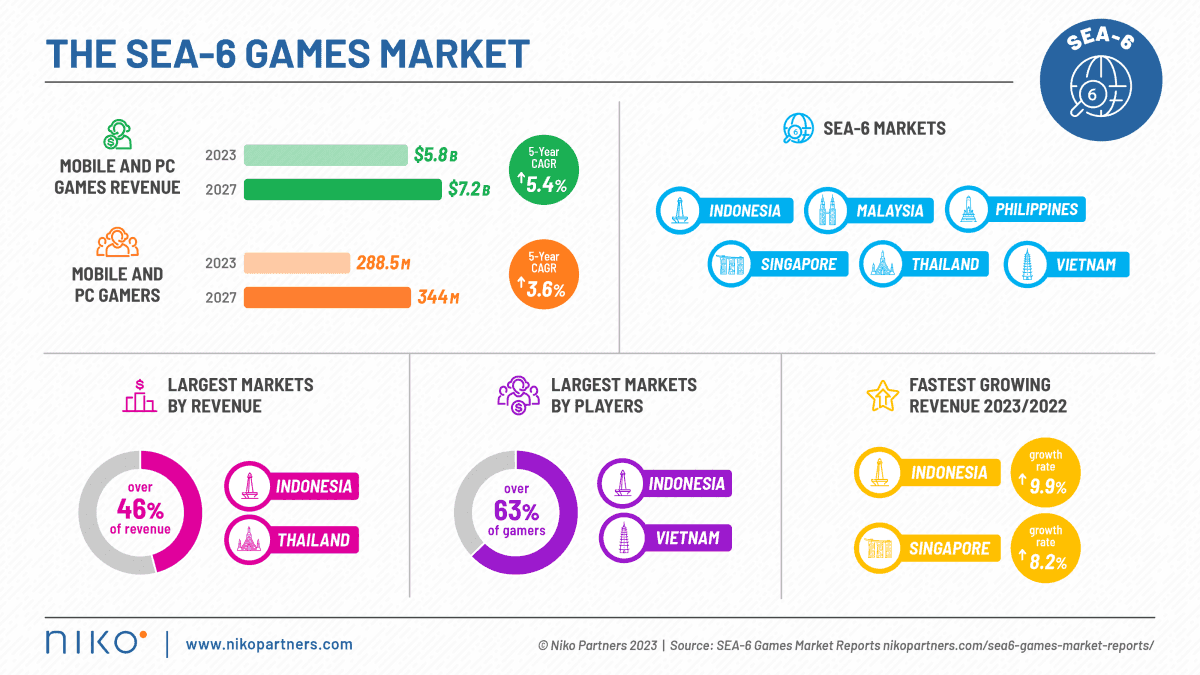

The Southeast Asian gaming market generated $5.1 billion in revenue in 2023, representing an 8.8% YoY growth. This trend is expected to continue, with market revenue projected to reach $5.5 billion in 2024 and $7.1 billion by 2028, growing at a compound annual growth rate (CAGR) of 6.7%. The SEA region is set to become one of the fastest-growing markets in terms of average revenue per user (ARPU), highlighting its increasing spending power.

By 2028, the SEA gaming market is expected to host 332 million gamers—equivalent to the current population of the United States. This represents a significant increase from 277.2 million gamers in 2023, reflecting a steady growth rate of 3.7% CAGR over the next five years. Thailand and Indonesia are leading the way in terms of revenue growth, further solidifying their importance within the regional market.

The SEA-6 Games Market

Game Time, Esports, and Diversity

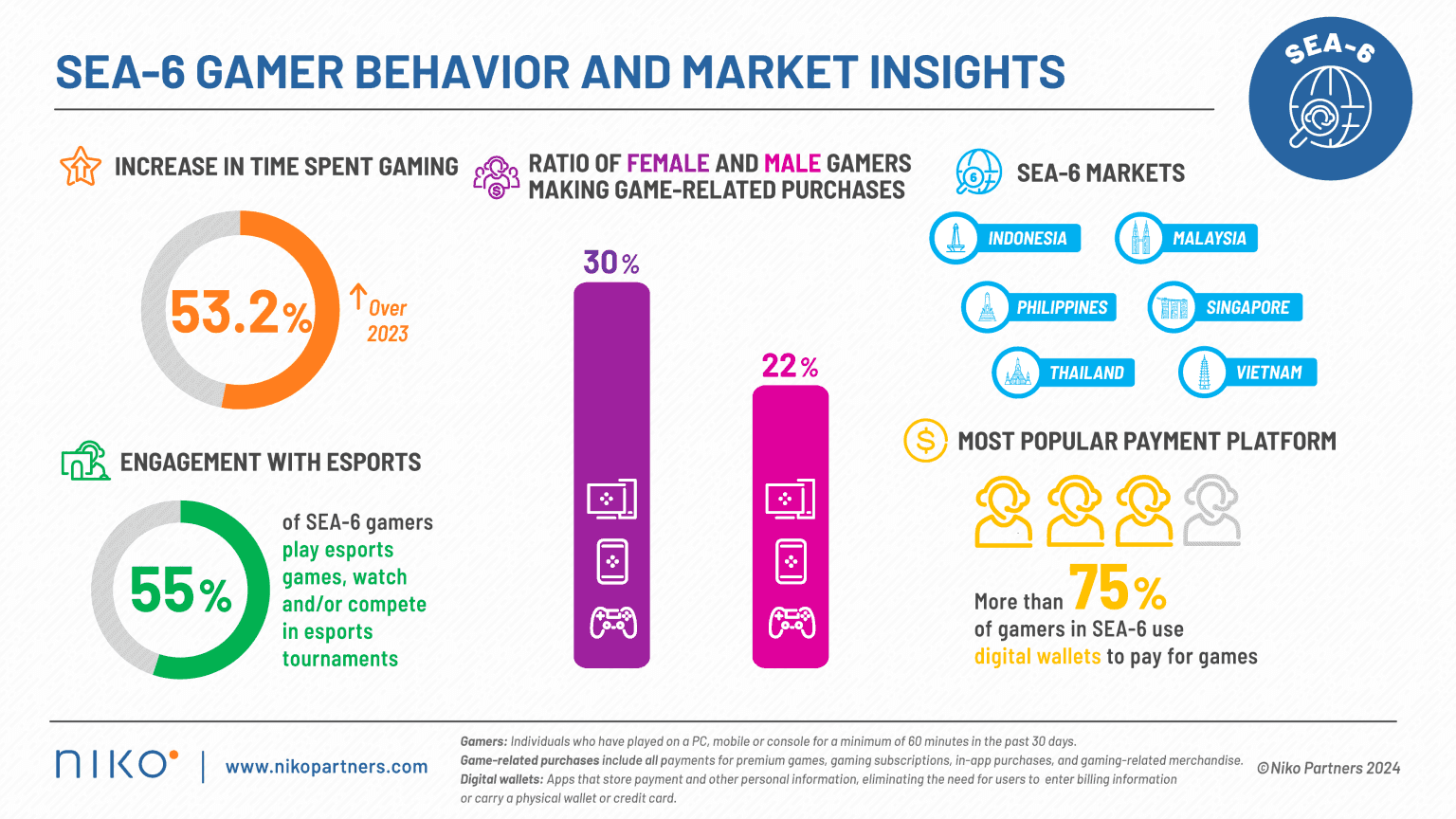

After a decline in gaming time in 2023, largely due to the easing of COVID-19 lockdowns, 2024 is seeing a resurgence in player engagement. Gaming time in the SEA-6 region has increased by 53.2% year-on-year (YoY). Thailand and Vietnam have recorded the highest growth, signaling a strong recovery in these markets. This rebound suggests that the post-pandemic dip was temporary, and gaming remains a popular pastime across the region.

Esports continues to play a pivotal role in the growth of the Southeast Asian gaming market. Over half of SEA-6 gamers are actively engaged in esports in some capacity, either as players or viewers. This trend is further underscored by the fact that a majority of the top 10 games in both mobile and PC categories are esports-focused titles. The thriving esports ecosystem remains a critical area for game developers and companies looking to capture market share in Southeast Asia.

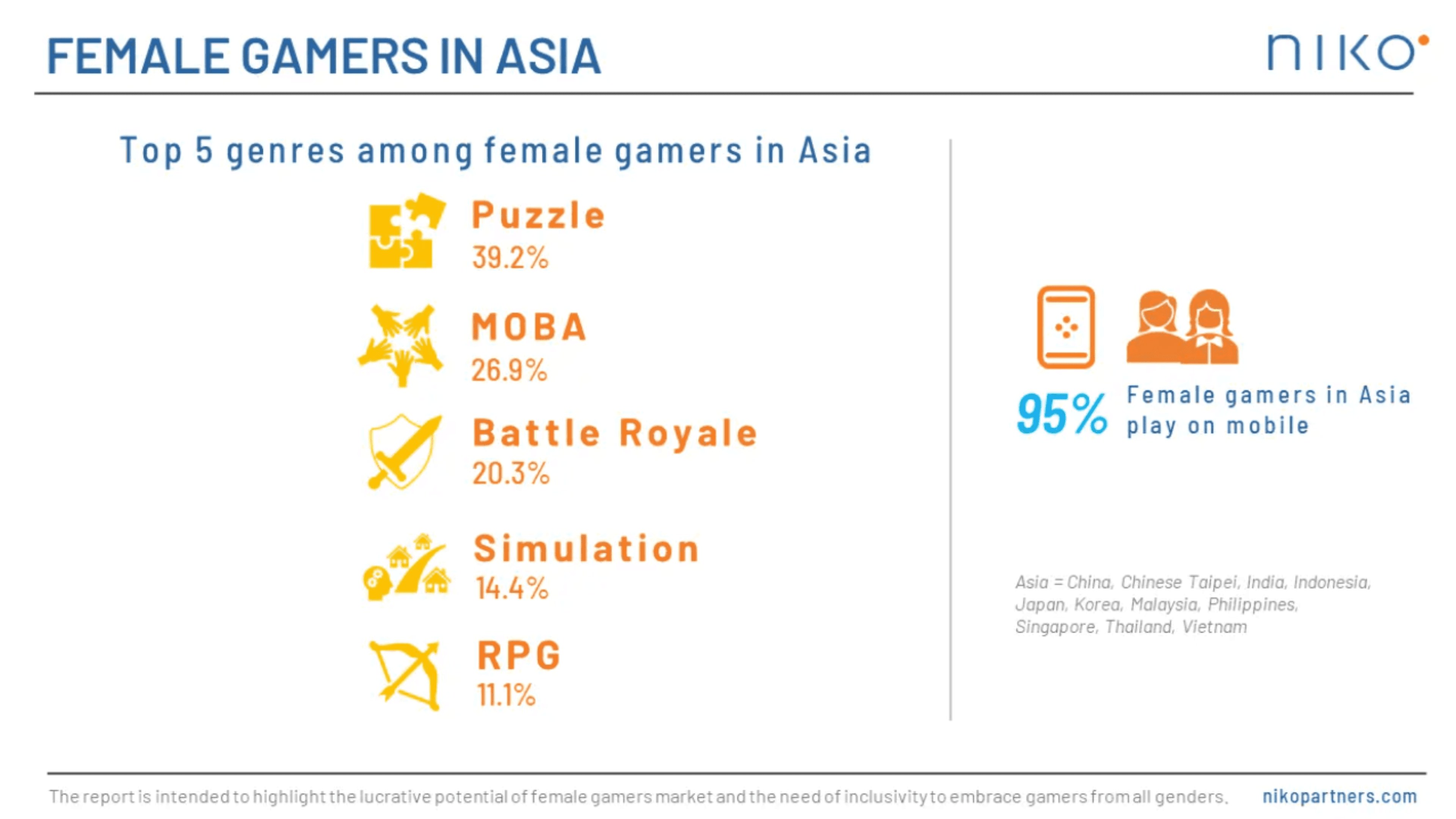

Female gamers represent a significant and growing demographic within the SEA gaming landscape. Notably, a higher percentage of female gamers (30%) make game-related purchases compared to their male counterparts (22%). This highlights the importance of considering female gamers in marketing and game design strategies, as their influence on game purchases continues to rise.

Female Gamers in Asia

Payment Preferences and Web3 Games

Digital wallets are the most popular payment method among gamers in Southeast Asia, with more than 75% of gamers using them for transactions. However, payment preferences vary across age groups. Older gamers, particularly those over 25, tend to favor credit and debit cards, while younger players, especially those under 21, are more inclined to use cash. Understanding these preferences is crucial for game developers and platforms to tailor payment options effectively.

The play-to-earn model and web3 gaming continue to capture the interest of Southeast Asian gamers, despite some slowdown in the growth of these sectors. Play-to-earn games rank among the top three most anticipated gaming technologies in the SEA-6 region, with particularly strong interest in Malaysia, the Philippines, and Thailand. Additionally, web3 gaming remains a prominent trend, especially in the Philippines, Thailand, and Vietnam, with ongoing investments in the space despite slower growth rates.

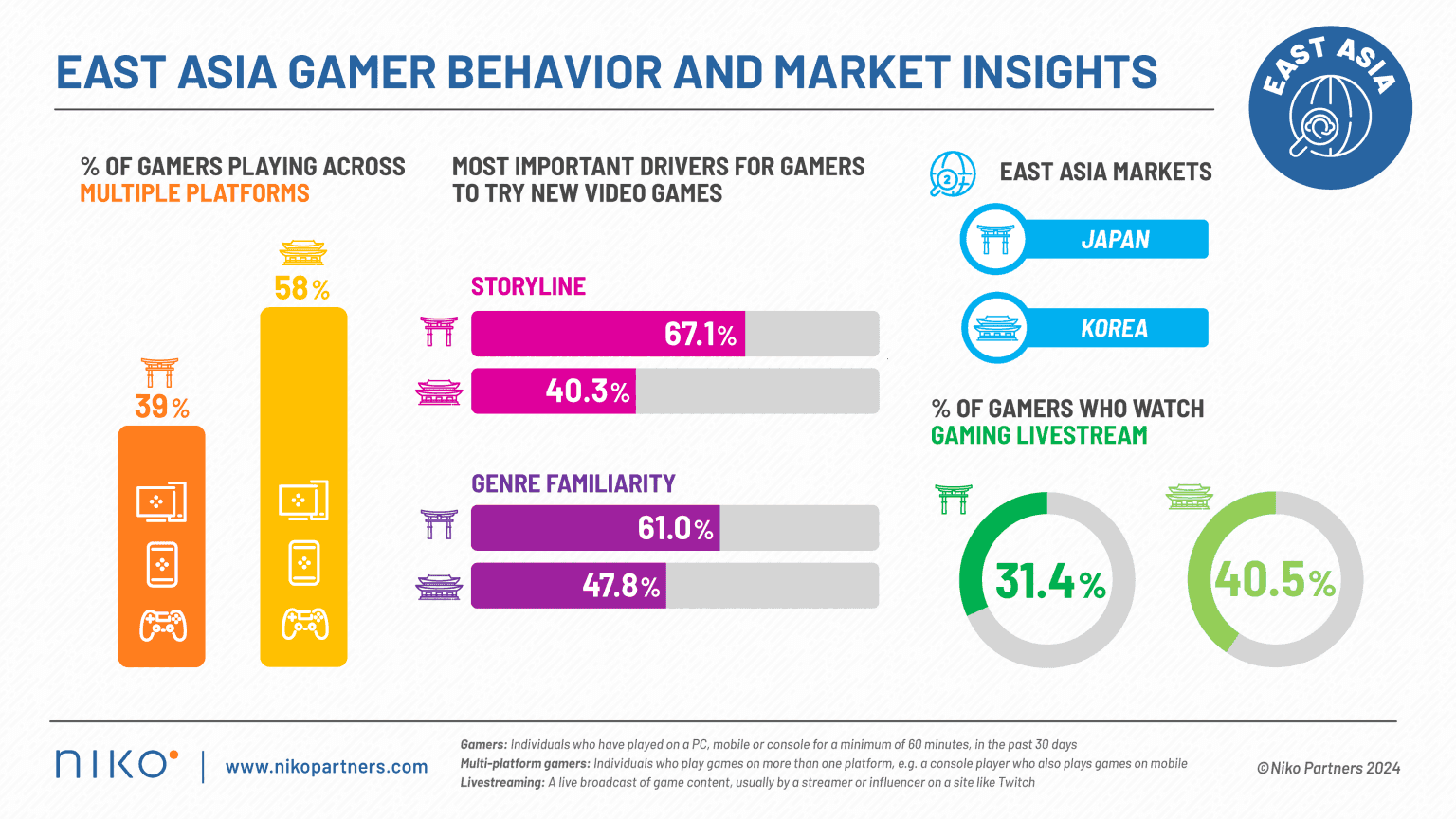

East Asia Gamer Behaviour and Market Trends

Localization and Cultural Preferences

Localization is a key factor for game success in Southeast Asia, particularly in Indonesia, Thailand, and Vietnam, where over 50% of gamers prefer playing games in their native languages. This contrasts with markets like Malaysia, Singapore, and the Philippines, where English proficiency is higher, and language localization is less crucial. Developers looking to expand in Southeast Asia must prioritize localizing games into Thai and Indonesian, two languages identified as essential for regional success.

Southeast Asian gamers are increasingly concerned with issues such as representation, accessibility, and anti-harassment measures in games. The inclusion of well-developed female characters is a particular area of focus, as is the broader push for more inclusive gaming environments. These social issues are becoming important factors for gamers when choosing which games to engage with.

Locally-developed games from Southeast Asia are gaining both regional and international recognition. Titles such as Coral Island (Indonesia), Gigabash (Malaysia), Cat Quest (Singapore), and Home Sweet Home: Online (Thailand) have achieved notable success, showcasing the potential for Southeast Asia’s gaming industry to produce globally competitive content.

SEA-6 Gamer Behaviour and Market Insights

Final Thoughts

The Southeast Asia gaming market is poised for continued growth in 2024 and beyond, with increased gaming time, strong engagement with esports, and rising interest in emerging technologies like play-to-earn and web3 gaming. Localization, cultural preferences, and evolving payment methods will remain critical factors for developers and companies looking to succeed in this diverse and dynamic region. With a forecasted rise in both gamer numbers and revenue, Southeast Asia is cementing its position as a key player in the global gaming industry.