Newzoo Global Games Market Report 2023

In the ever-evolving landscape of the gaming industry, the Newzoo Global Games Market Report 2023 breaks down revenue, trends, and future projections that influence game development, marketing strategies, and player engagement. With a resilient market poised to overcome challenges, this report paints a vibrant picture of the gaming landscape, offering insights for web3 gaming studios.

Revenue Breakdown and Growth

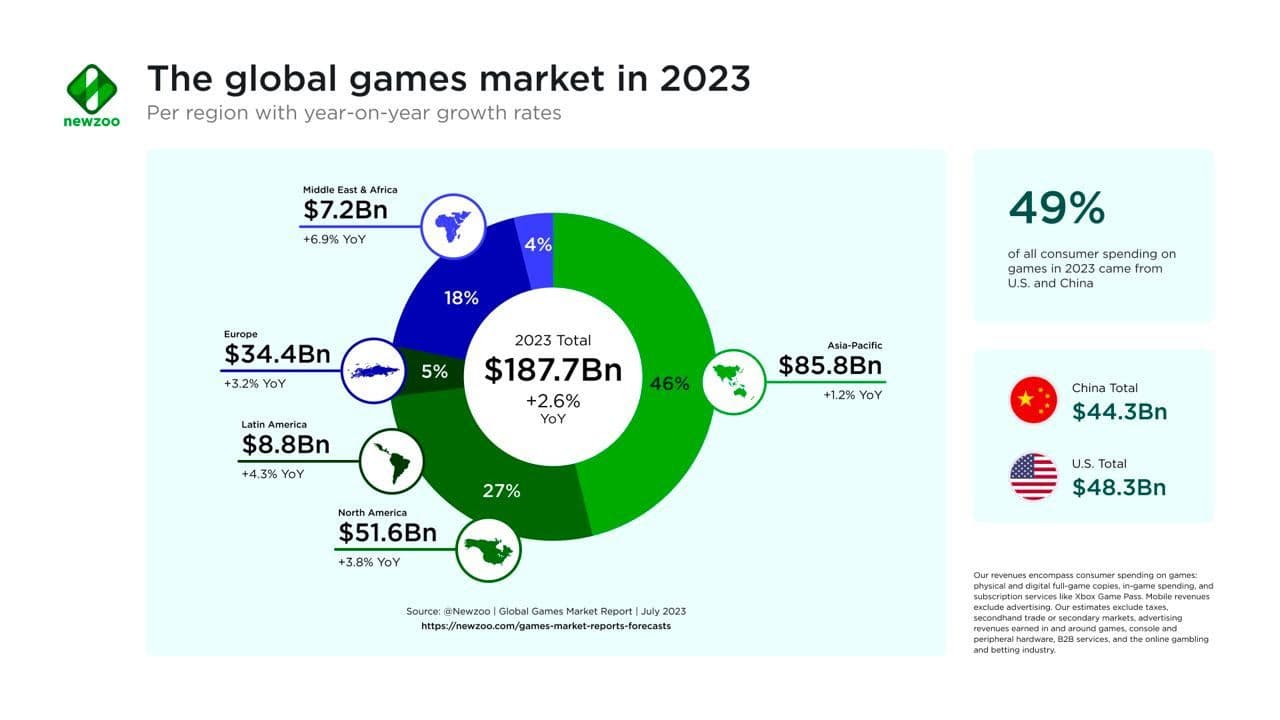

Despite looming macroeconomic challenges, the global games market will generate revenues of $187.7 billion in 2023, a +2.6% year-on-year growth.

All signs point to the industry stabilizing after some pandemic and platform-induced turbulence. Newzoo estimates that the global games market will generate yearly revenues of $212.4 billion in 2026. All segments will grow to varying degrees.

Platform Dynamics

Unsurprisingly, the mobile gaming market maintains its supremacy, contributing a substantial $92.6 billion to the overall revenue. However, the growth rate for 2023 is a modest 0.8%, indicating potential limits to its expansion at least until 2026.

Console games, on the other hand, seize the spotlight with a remarkable 7.4% growth rate, culminating in $56.1 billion in revenue. This success is attributed to the convergence of factors such as the release of postponed titles, the emergence of new hits, and the normalization of console shipments.

The PC games market displays steady growth at 1.6%, reaching $37.1 billion. However, browser PC games continue their downward trajectory, plummeting by 16.9% to $1.9 billion in 2023.

Cloud gaming emerges as a star in the making, poised to gather 43.1 million paying users by year-end. An astonishing 80.4 million users are projected by 2025, indicating an impressive upward trajectory.

Global Revenue Distribution

The Asia-Pacific region reasserts its dominance by contributing 46% of the worldwide gaming revenue ($85.8 billion), followed by North America (27%; $51.6 billion), Europe (18%; $34.4 billion), Latin America (5%; $8.8 billion), and MENA (4%; $7.2 billion).

Interestingly, the Asia-Pacific region not only dominates revenue but also houses 53% of the global gaming audience, amounting to 1.79 billion gamers. MENA emerges as an unexpected contender for the second-largest gaming audience, hosting 17% of gamers (574 million people), surpassing Europe (13% of the audience; 447 million), Latin America (10%; 335 million), and North America (7%; 237 million).

Expanding Gaming Audience

The global gaming audience is set to surge by 6.3% in 2023, reaching 3.38 billion players. Projections for 2026 are even more staggering, forecasting 3.79 billion gamers.

Mobile gaming dominates player preferences, capturing 84.4% of the audience, while PC and console gaming claim 26.3% and 18.6%, respectively. Paying users will escalate by 7.3% in 2023, totaling 1.47 billion, and are expected to reach 1.66 billion by 2026, a +4.7% CAGR.

Industry Leaders

In terms of gaming revenue, the trailblazers among public companies include Tencent ($7.56 billion), Sony ($4.38 billion), and Apple ($3.68 billion).

Key Trends Shaping the Future

The report unveils pivotal industry trends. Live-service games are thriving on PC and consoles, driving fierce competition for players' time. The incursion of AI into gaming is a phenomenon gaining momentum, promising transformative effects on the final product and production processes.

Complimentary consoles, exemplified by the Steam Deck, are projected to gain prominence, while the mobile gaming arena is marked by innovative revenue-generation strategies due to platform regulations. User-generated content (UGC) and the creative economy continue their upward trajectory, as influencers establish gaming studios.

Anticipating a boost in VR/AR, the industry eagerly awaits the ramifications of Apple's announcement of the Apple Vision Pro. Notably, Saudi Arabia emerges as a growth leader, with Savvy Gaming Group assuming an investment role in 2023.

Implications for Web3 Gaming

With Asia and mobile gaming captivating current headlines, the report underscores the importance of these trends for web3 gaming. Web3 game studios would be wise to focus on targeting the sizable mobile gamer audience in Japanese markets, tailoring experiences to align with local preferences and cultural nuances. Developing mobile-friendly games and IPs influenced by Japanese gaming aesthetics could yield fruitful results in this context.

The Newzoo Global Games Market Report 2023 encapsulates not only the present state of the gaming industry but also its promising future. With data-driven insights, this report equips industry stakeholders to navigate the evolving landscape while optimizing strategies to engage and captivate the ever-growing global gaming audience.

Share this article and tag us on any of our socials to let us know.