The 2025 AppMagic monetization report shows a mobile games market that continues to grow, though at a slower pace than in past years. Global in-app purchase revenue inched up from $55.2 billion to $57.1 billion, driven mostly by gains on the App Store, where spending rose 5.4%. Google Play remained essentially flat. Midcore and casual titles expanded modestly, while hypercasual and hybridcasual games posted the strongest surge, nearly doubling year over year despite starting from a smaller base.

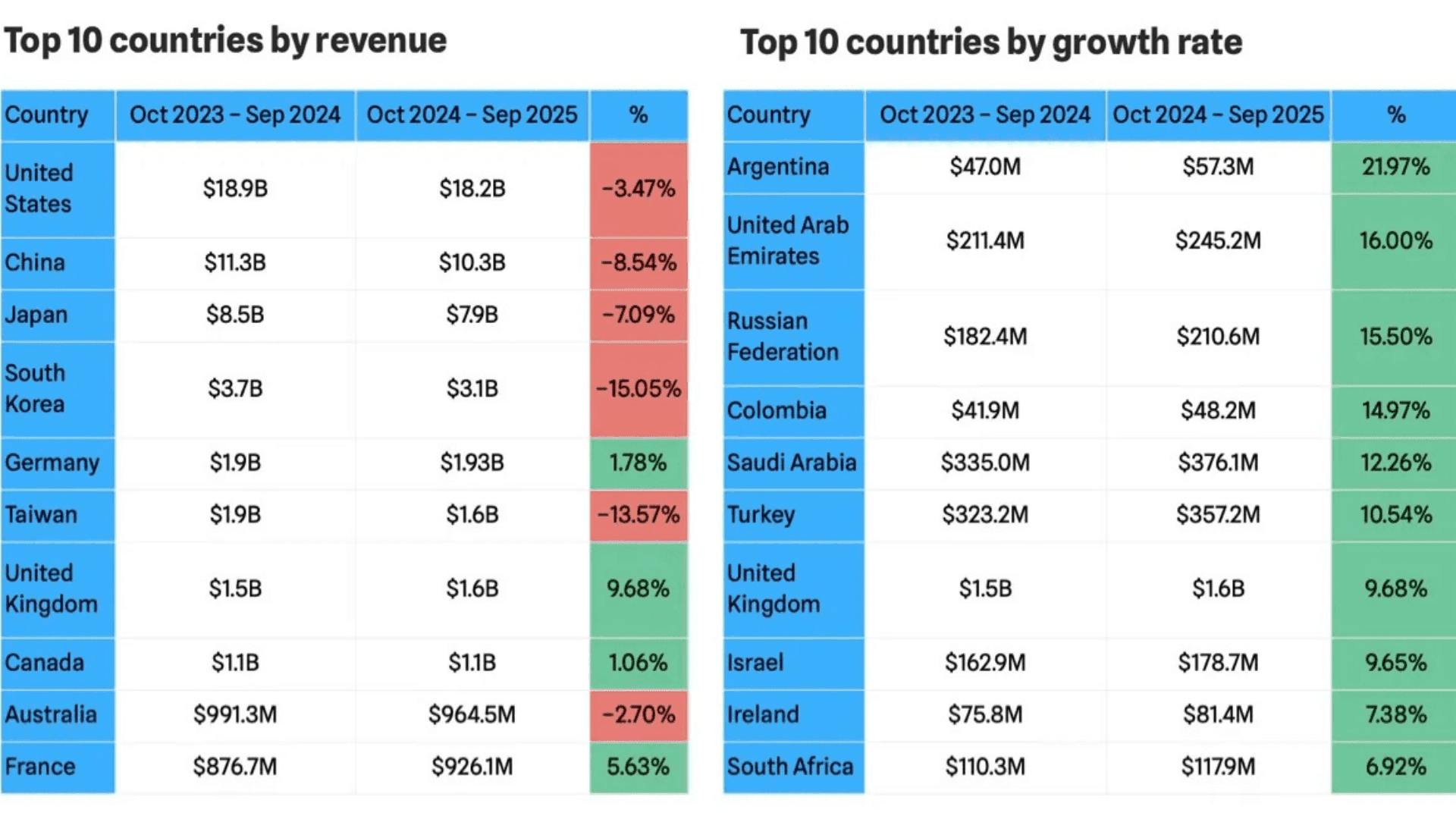

Regional performance varied widely. The United States, China, Japan, and South Korea remained major contributors, but several Asian markets reported steep revenue declines. Meanwhile, parts of Europe and emerging regions like Argentina and the UAE recorded notable gains. AppMagic’s data suggests that revenue growth is gradually shifting away from traditional strongholds toward markets with more volatile economies and currency fluctuations.

The Changing Landscape of Direct-to-Consumer Options

Alternative payment integrations continued to rise, with a 12% increase in payment SDK usage since early 2024. Solutions such as YooKassa, Xsolla, and Card.io saw the strongest momentum, while Stripe, Paystack, and PayU trended downward. Integration activity peaked during the summer of 2024 and then stabilized, with Samsung Pay seeing a spike in removals due to the end of Tizen support rather than broad industry shifts.

In the United States, D2C revenue among the top-grossing 100 games jumped 46% year over year. However, fewer titles now include D2C tools. The share dropped from 72% in late 2024 to 62% in the first half of 2025, indicating that while D2C spending is increasing, adoption among top earners is narrowing. Publishers that maintain these channels appear to be generating more value from them even as the number of participating titles shrinks.

Strategy Games Continue to Climb

Strategy titles saw one of the strongest jumps of any major genre, with revenue rising to $13.5 billion in 2025. Both major storefronts saw meaningful growth, and subgenres such as card battlers, tactical projects, and 4X strategy reported significant gains. Only MOBAs declined. AppMagic highlights that much of the genre’s revenue continues to come from Asian publishers whose early gameplay loops often mask deeper systems.

U.S. player spending patterns show that strategy players remain among the highest-value payers on mobile. By day 90, spending per payer in strategy titles is roughly double that of casino players. iOS users spend substantially more than Android users, often more than $15 per transaction, and high-priced bundles like $99 packs appear regularly among top revenue sources.

A Difficult Year for RPGs

RPGs experienced one of the most severe downturns of 2025. Revenue fell from $13.7 billion to $11.6 billion, with both platforms dropping at similar rates. China posted one of the steepest regional declines at 25%. Tactical RPGs and roguelikes offered rare bright spots, but most subgenres contracted.

Payment behavior in the United States shows contrasting trends between platforms. On Google Play, both purchase frequency and ARPPU fell sharply. On the App Store, spending increased on both fronts, and first-purchase prices rose to an average of nearly $18. Hard-currency bundles and large package offers remain the dominant revenue generators. Some RPGs are experimenting with low-cost event bundles designed to broaden conversion among non-spending players.

Puzzle Games Expand with New Subgenres

Puzzle games grew from $7.7 billion to $8.8 billion, driven primarily by App Store users. Several smaller subgenres exploded, including Block Puzzle and Fill & Organize. Match-3 continued steady growth, adding around $200 million year over year. Declines in Find the Difference and bubble shooters offset some of that momentum but did not halt overall expansion.

Among the top U.S. puzzle titles, ARPPU dipped slightly and purchase frequency fell sharply on iOS. However, purchase values rose significantly, showing a shift toward higher-priced transactions. Most revenue now comes from LiveOps-linked offers priced between $6 and $15. Some developers are turning customizable bundles into recurring features to improve engagement and flexibility for payers.

Casino Spending Slows Across Key Markets

Casino games declined from $7.8 billion to $7.2 billion in 2025. The U.S. market dropped 11%, although the UK and Germany remained stable with slight growth. Bingo and card-based casino games posted small gains, but slots and Coin Looter games slid noticeably.

Payment activity dropped across both platforms. Google Play showed sharp declines in ARPPU and purchase frequency, while iOS saw higher ARPPU despite fewer purchases. Currency bundles continue to dominate revenue across the segment.

Simulation Shows Steady Growth

Simulation titles grew to $4.8 billion, supported primarily by the App Store. The gap between iOS and Android earnings widened even further over the year. Sandbox games drove most of the genre’s gains, while smaller categories such as work and animal simulators more than doubled from low starting points. Idol Training and fishing simulators declined.

In the United States, purchase frequency fell, but iOS ARPPU increased while Google Play ARPPU dipped. Purchase values rose sharply on both platforms, particularly on the App Store. Currency bundles remained the core driver of revenue, accounting for more than 40% of spending in most of the top titles.

Hybridcasual Leads the Market in Growth

Hybridcasual remained the fastest-growing category, rising from $390 million to $733 million in 2025. The segment continues to evolve as developers layer deeper gameplay systems and more advanced monetization on simple core loops. New hybridcasual titles are reaching top-grossing charts more frequently, showing that the category remains open to competition.

Payment data from the United States shows strong performance. Purchase frequency grew significantly on Google Play and more modestly on iOS, while ARPPU increased across both platforms. Purchase values dropped on Google Play but rose on the App Store. Most revenue comes from low-priced currency bundles, limited-time loss offers, and seasonal passes.

Source: GameDevReports

Frequently Asked Questions (FAQs)

What were the biggest growth genres in mobile gaming in 2025?

Strategy, puzzle, simulation, and especially hybridcasual games saw the strongest growth, with hybridcasual nearly doubling year over year.

Why did RPG revenue drop so sharply?

RPGs saw major declines in key Asian markets, particularly China. Most subgenres contracted except for tactical RPGs and roguelikes.

Is D2C still growing in mobile gaming?

Yes. D2C revenue increased significantly, although fewer top U.S. games are using D2C tools compared to last year.

Which platform saw stronger monetization overall?

Across most genres, the App Store showed stronger ARPPU and higher average purchase values than Google Play.

What is driving hybridcasual growth?

Higher download volumes, deeper monetization, and increasingly complex gameplay systems are helping hybridcasual games reach top-grossing rankings.

Are players spending more or less per purchase in 2025?

It depends on the platform. iOS users are generally spending more per purchase across nearly all genres, while Google Play trends vary by category.