In the first quarter of 2024, Japan's mobile gaming market saw a 7% increase in game installs compared to the same period in the previous year. This growth follows a period of stability after declines in early 2022. While installs and gaming sessions have risen, there has been a decrease in player spending.

Japan remains a prominent market in the global mobile app industry, characterized by high smartphone use and substantial consumer expenditure. The latest figures provide a clear view of current trends and challenges in this evolving sector. Let's dive into the details.

Mobile Game Installs Surge by 6% in Japan Q1 2024

Mobile Gaming in Japan

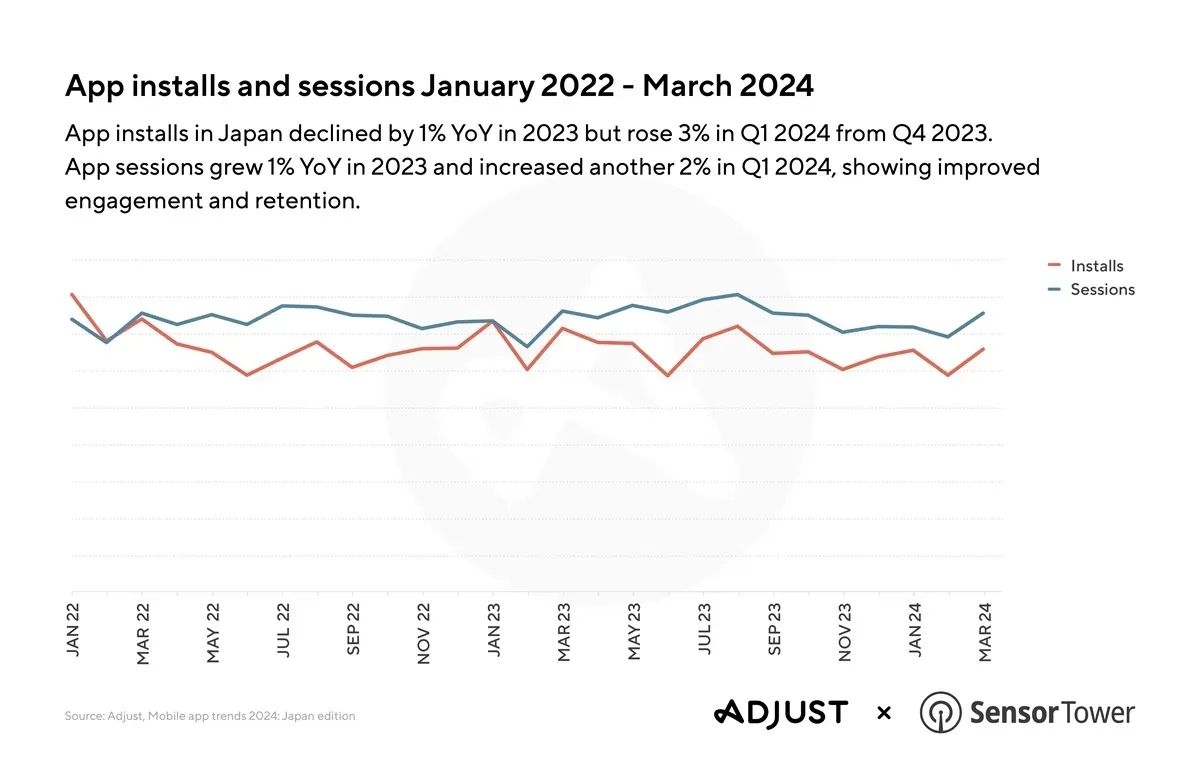

In the first quarter of 2024, Japan's mobile gaming sector experienced significant growth, as reported by Adjust and Sensor Tower. According to the findings, mobile game installs in the country rose by 7% compared to the same period last year.

Sessions also saw an increase of 6% year-over-year, marking a recovery following stability in 2023 after earlier declines in 2022. Despite the increase in installs and sessions, player spending has decreased. This decline contrasts with the overall growth in install numbers.

Mobile Gaming Growth

The report indicates that while the number of installs was up by 18% from the fourth quarter of 2023, spending trends show a decline. The average revenue per monthly active user (ARPMAU) dropped from $1.04 in 2023 to 99 cents in Q1 2024, with RPGs holding the highest ARPMAU despite a decrease.

Demographics and Game Preferences

Japan's mobile gaming market exhibits notable demographic trends. The majority of gaming app users are male (63.6%), though this distribution varies by genre. Sports games are largely played by males, while arcade games attract a significant female audience.

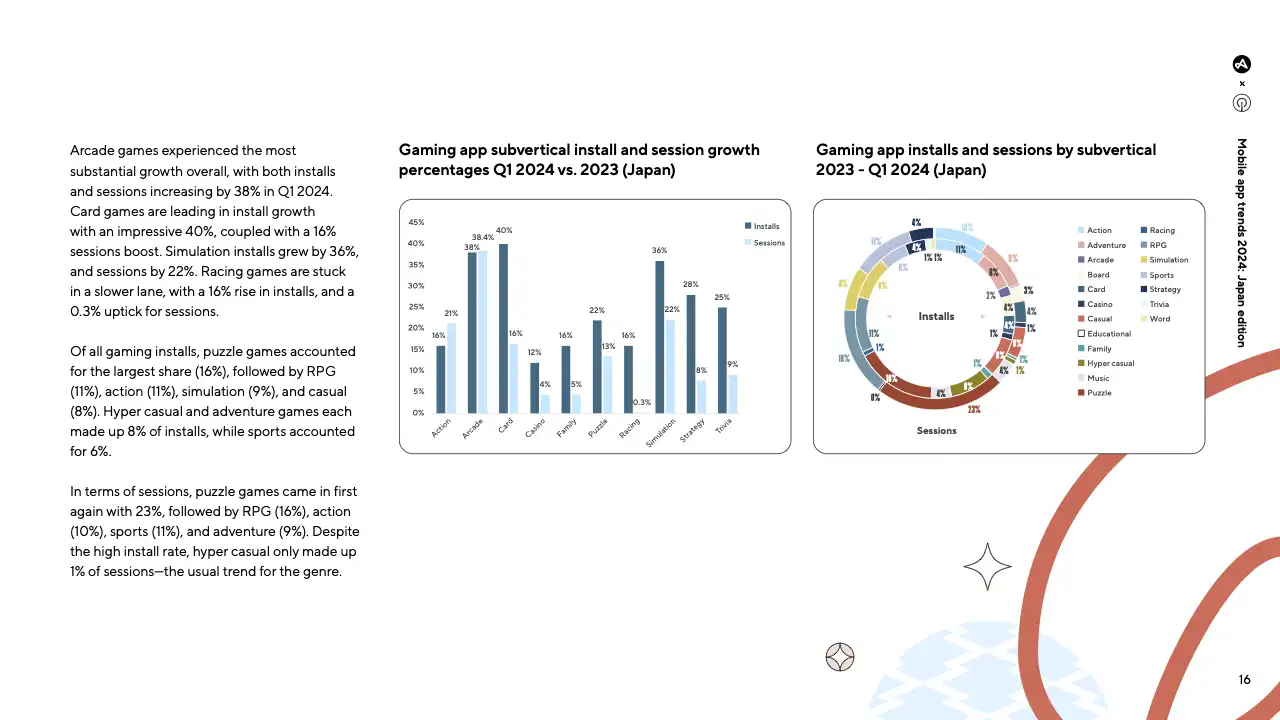

Arcade games experienced substantial 38% growth in both installs and sessions, while card games led in install growth with an impressive 40% increase and a 16% boost in sessions. Puzzle games accounted for the largest share of gaming installs at 16% and also ranked first in sessions with 23%.

Top Games by Installs and Revenue

Age demographics show that players aged 25 to 34 years old are the most engaged, representing 35.5% of the player base. Arcade games led the growth in Q1 2024, with a 38% increase in installs and sessions. The average gaming session length also saw a slight increase from 26.37 minutes in 2022 to 27.37 minutes in Q1 2024.

Trends in Paid User Acquisition

The report highlights a rising trend in paid user acquisition across most gaming sub-verticals in Japan. The paid user acquisition ratio increased from 1.82 in 2023 to 2.31 in Q1 2024, with hypercasual games leading this growth. Board games and simulation games also saw increases in their acquisition ratios.

Overall App Market Insights

In addition to gaming apps, Japan's overall app market continues to demonstrate significant growth. The country recorded over 2.5 billion app downloads in 2023 and consumer spending on apps reached $17.9 billion, positioning Japan as one of the largest app markets globally. Smartphone usage and mobile internet penetration remain high, with 73% and 93% of the population engaged, respectively.

App Insalls and Sessions

The Evolving Digital Landscape

Japan's digital environment is characterized by its adaptability and innovation. Emerging technologies such as artificial intelligence (AI) and machine learning are increasingly shaping the app experience and driving engagement. Despite challenges such as evolving data privacy regulations, Japan's app market remains dynamic and offers extensive opportunities for developers and marketers.

Future Outlook

As Japan's mobile gaming and app markets continue to evolve, staying updated on user behavior trends, technological advancements, and regulatory changes will be essential for success.

The growth in installs and sessions indicates a vibrant market, while the decline in spending highlights the need for strategic adjustments in user acquisition and monetization strategies. This article was inspired by an original blog post, you can read the original write-up here for more information.