In a significant uptick for the mobile gaming industry, the strategy genre has surged to achieve its highest monthly sales in two and a half years within the Korean market, notably in January 2024. This spike in sales has largely been attributed to the contributions of notable titles like WOS: Whiteout Survival, Brawl Stars, and most prominently, Last War: Survival.

In this article, we will unpack the latest data from Sensor Tower - covering how Last War: Survival and other foreign titles drive the Korean mobile strategy game market to its highest monthly sales in over two years. You will learn about the immersive gameplay and effective marketing strategies propelling Last War: Survival to the top.

Korean Mobile Strategy Games

Mobile Strategy Games

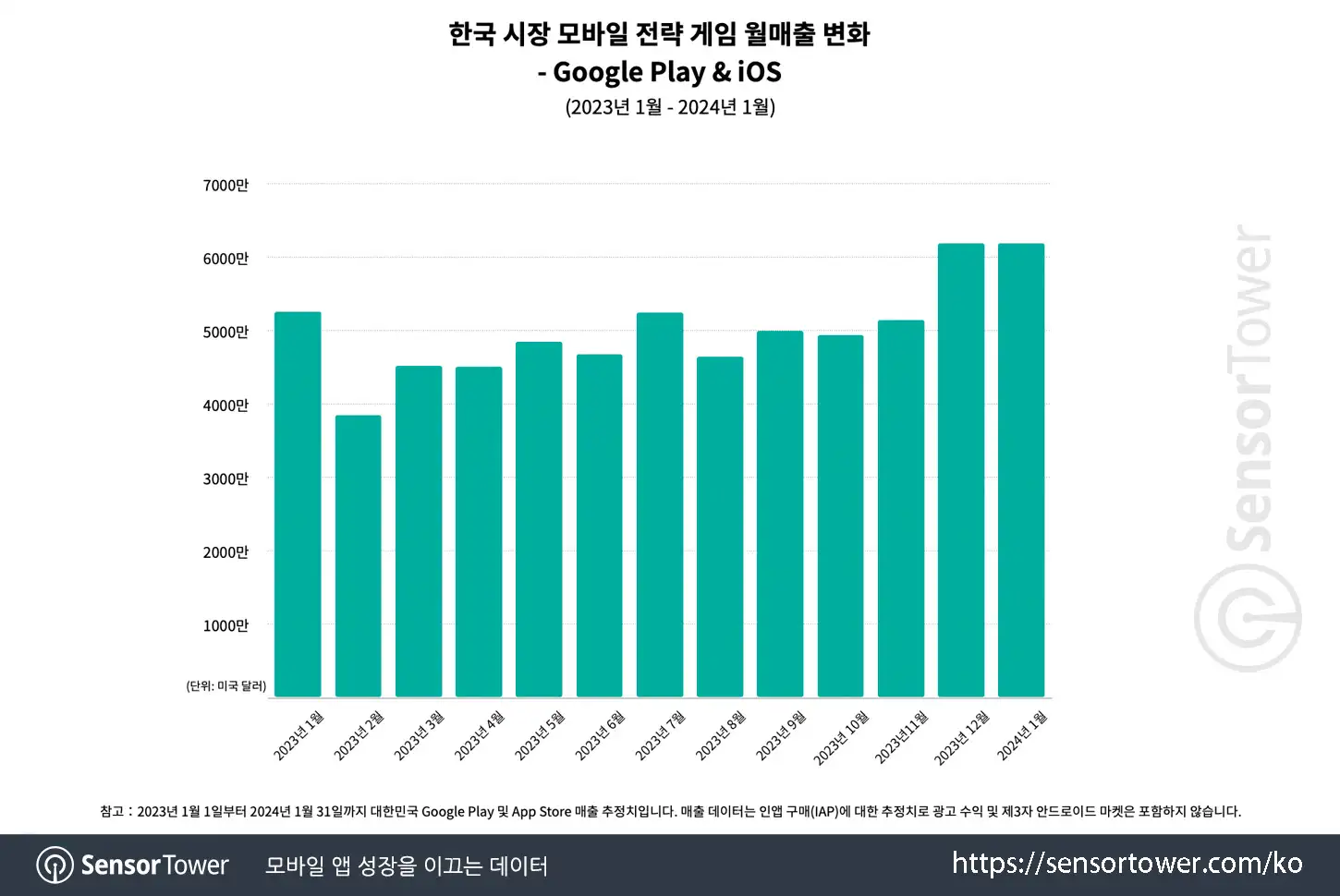

In January 2024, sales of mobile strategy games in the Korean market reached their highest point in two and a half years, as reported by Sensor Tower Game Intelligence. Since February 2023, the strategy genre has demonstrated a significant upward trajectory in sales.

In Korea, the strategy genre stands as the second most significant contributor to overall mobile game sales, trailing behind RPG games. In 2023, it comprised 12.7% of the market share.

Google Play and iOS Data

Analyzing the genre's prevalence across major mobile game markets in 2023, it accounted for 32.8% of iOS mobile game sales in China and 16% of total sales in the United States. Conversely, Japan's proportion stood at 12.4%. Notably, Korea has reestablished its lead over Japan in terms of the strategic genre's share in mobile game sales since 2020.

Top Ranking Games

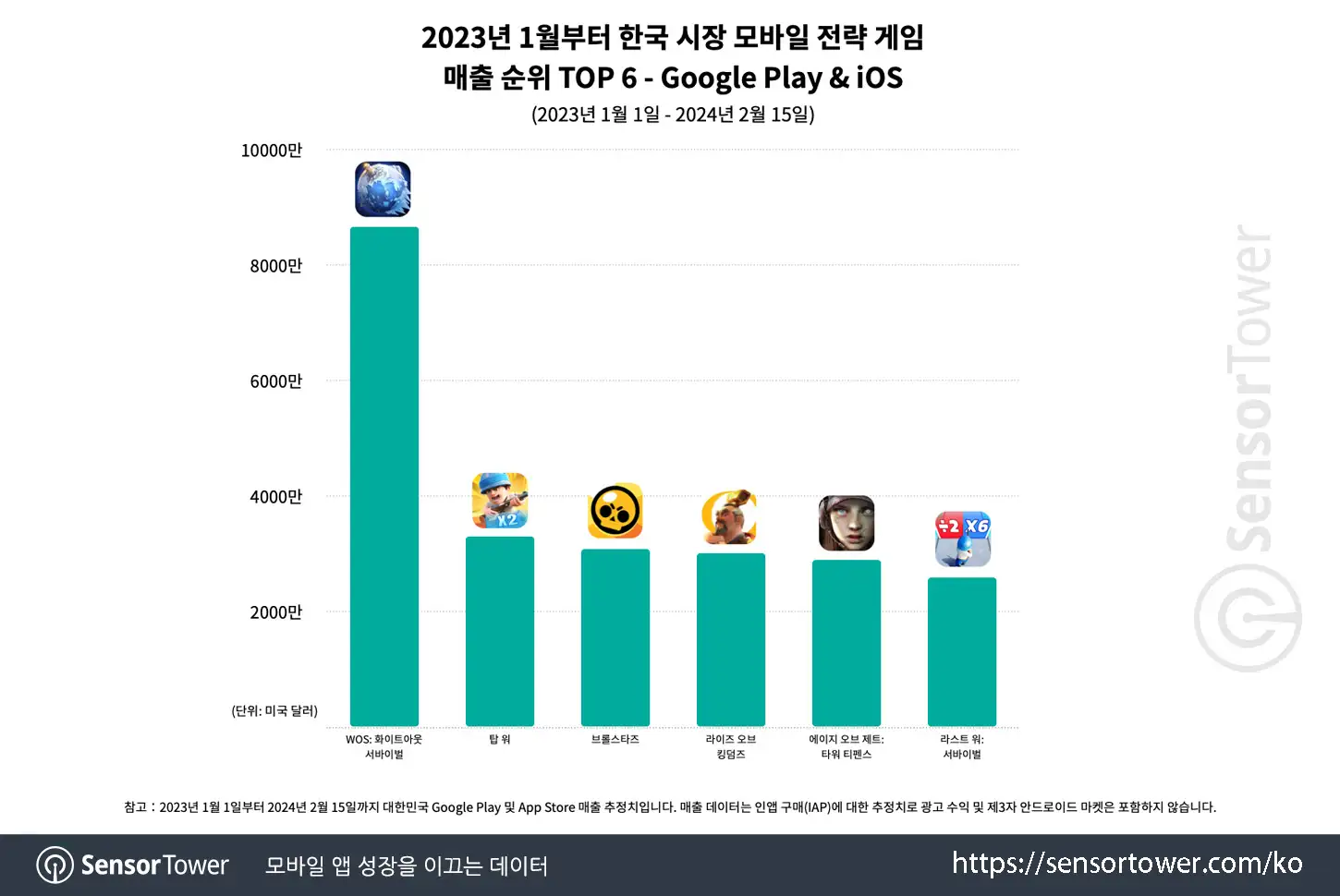

Foreign games such as WOS: Whiteout Survival and Last War: Survival led the growth of mobile strategy game sales. Reviewing the rankings of mobile strategy games in the Korean market since January 2023, all top six positions were occupied by foreign games. In contrast, other major countries showcased a variance in top-ranking strategy games from local publishers during the same period.

For example, in the U.S. market, Top Games’ Ebony ranked first, in the Chinese iOS market, Tencent’s Glory of the Prince ranked first, and in the Japanese market, Koei Tecmo Games’ New Nobunaga’s Ambition ranked second.

Top Six Games on Google Play and iOS

Over $90 Million In Revenue

Since its launch in February 2023, WOS: Whiteout Survival has gained significant traction in the Korean market, securing the top rank in mobile strategy game sales from January 1, 2023, to February 15, 2024. Notably, its sales nearly tripled those of the second-place contender, Top War.

WOS: Whiteout Survival has solidified its position as a premier mobile strategy game in Korea, amassing over $90 million in revenue and claiming the 10th spot in overall mobile game sales across all genres.

Last War: Survival, introduced in July 2023, stands as the most recent addition to the rankings and impressively clinched the 6th position with approximately seven months of sales.

The accomplishments of foreign mobile strategy games like WOS: Whiteout Survival and Last War: Survival significantly contributed to the upsurge in mobile strategy game sales within the Korean market.

Monthly Growth of 380%

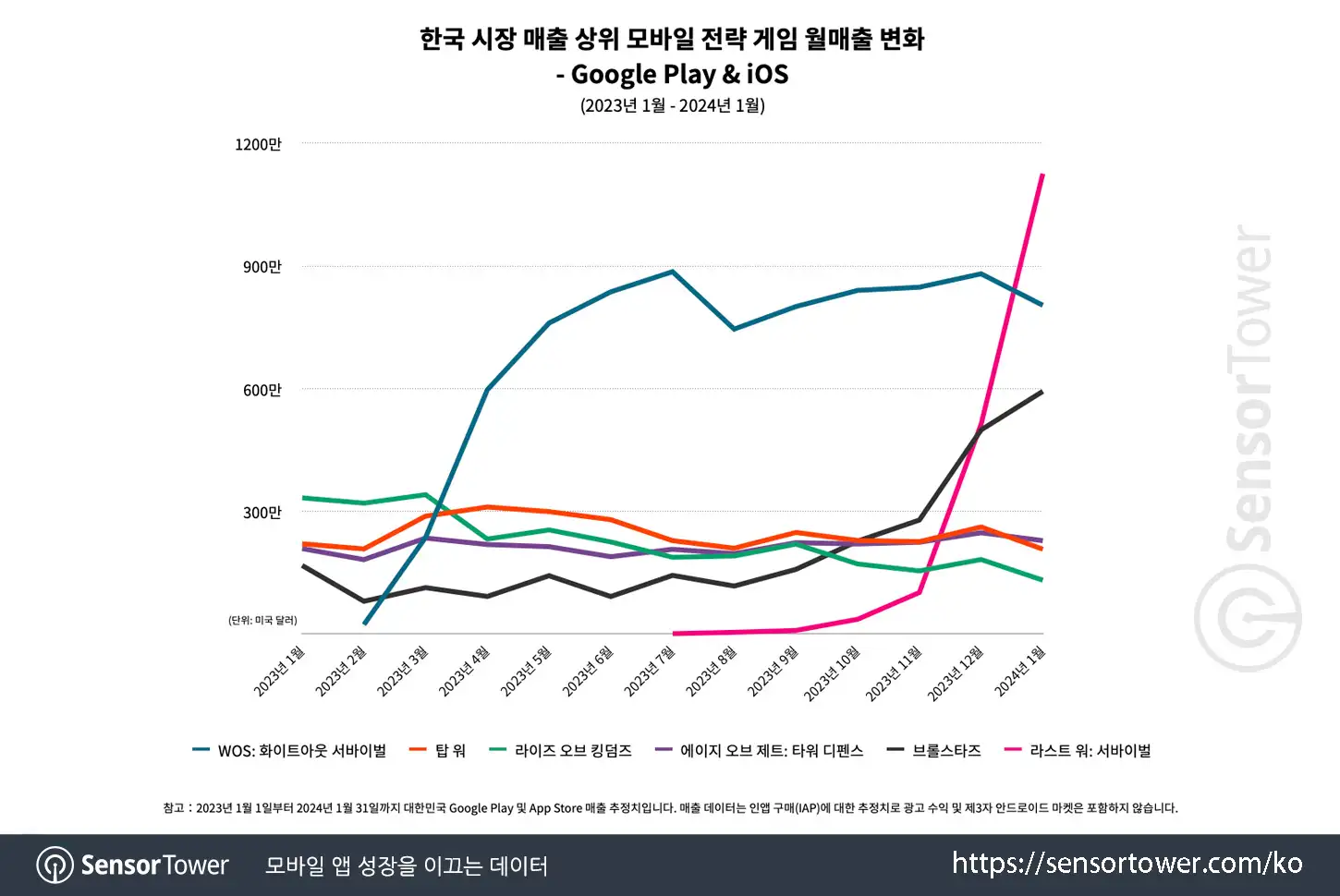

The strategy genre recently reached its peak in monthly sales, marking the highest figures seen in two and a half years. Last War: Survival stands out with an impressive average monthly growth rate of 380%, reflecting its significant impact on the genre's success.

Monthly Growth Rate Data

Mobile strategy game sales, experiencing growth since February 2023, peaked in January 2024, reaching their highest level in two and a half years. Notably, the performance of WOS: Whiteout Survival, Brawl Stars, and Last War: Survival significantly contributed to this surge, particularly in January.

WOS: Whiteout Survival maintained strong sales, while Brawl Stars exhibited sales growth. However, Last War: Survival outshone them both in January 2024, recording the highest monthly sales among mobile strategy games. The remarkable growth of Last War: Survival played a pivotal role in propelling overall sales of the mobile strategy genre to their highest levels in two and a half years.

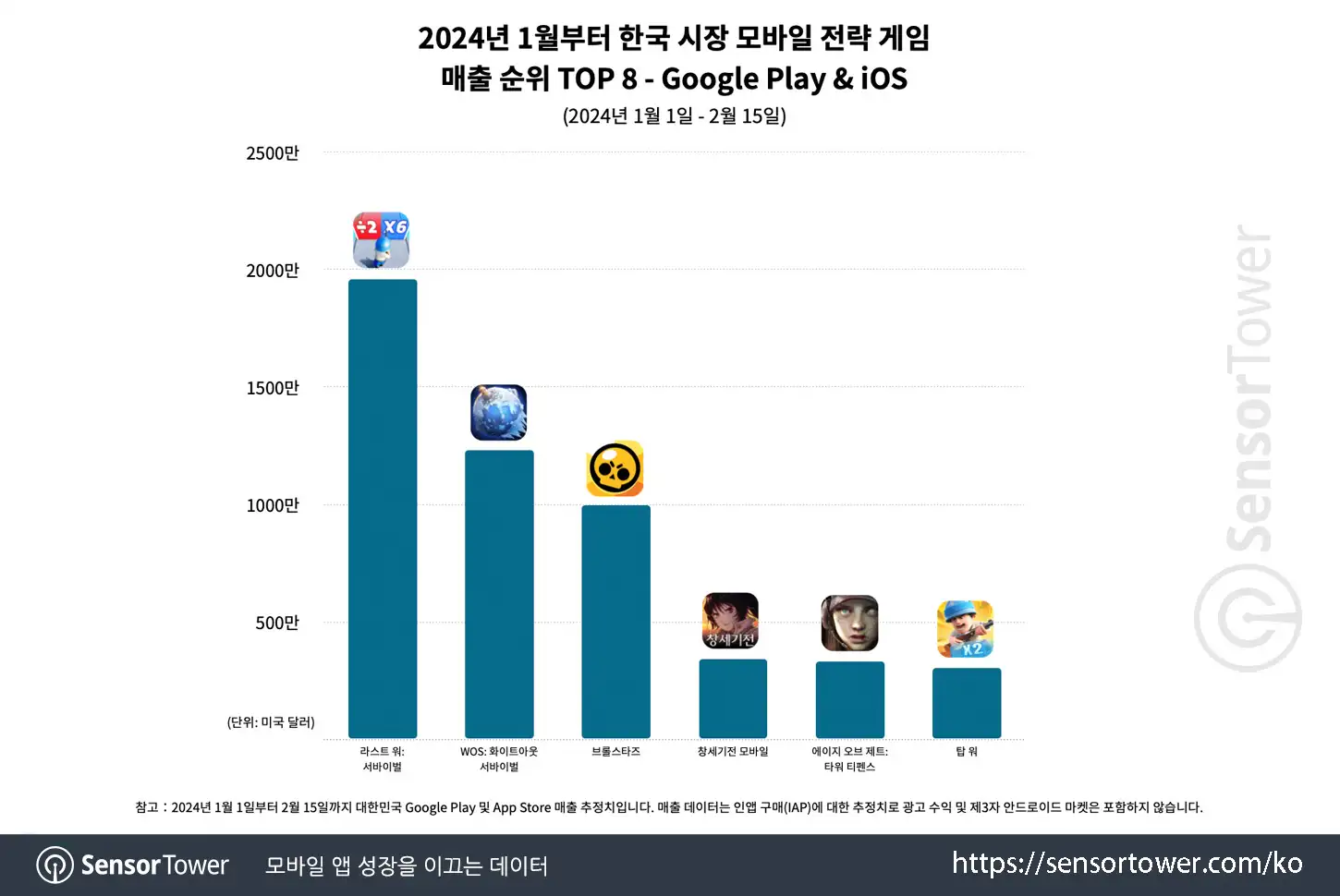

Top Eight Google Play and iOS

Over $11 Million In Sales From January

Last War: Survival achieved an extraordinary average growth rate of 380% in monthly sales from July 2023 to January 2024, culminating in $11 million in sales for January 2024 alone. This remarkable performance propelled Last War: Survival to the top position in mobile strategy game sales in the Korean market post-2024.

Last War: Survival demonstrated its momentum within the overall genre by securing the 4th position among prominent Korean MMORPGs.

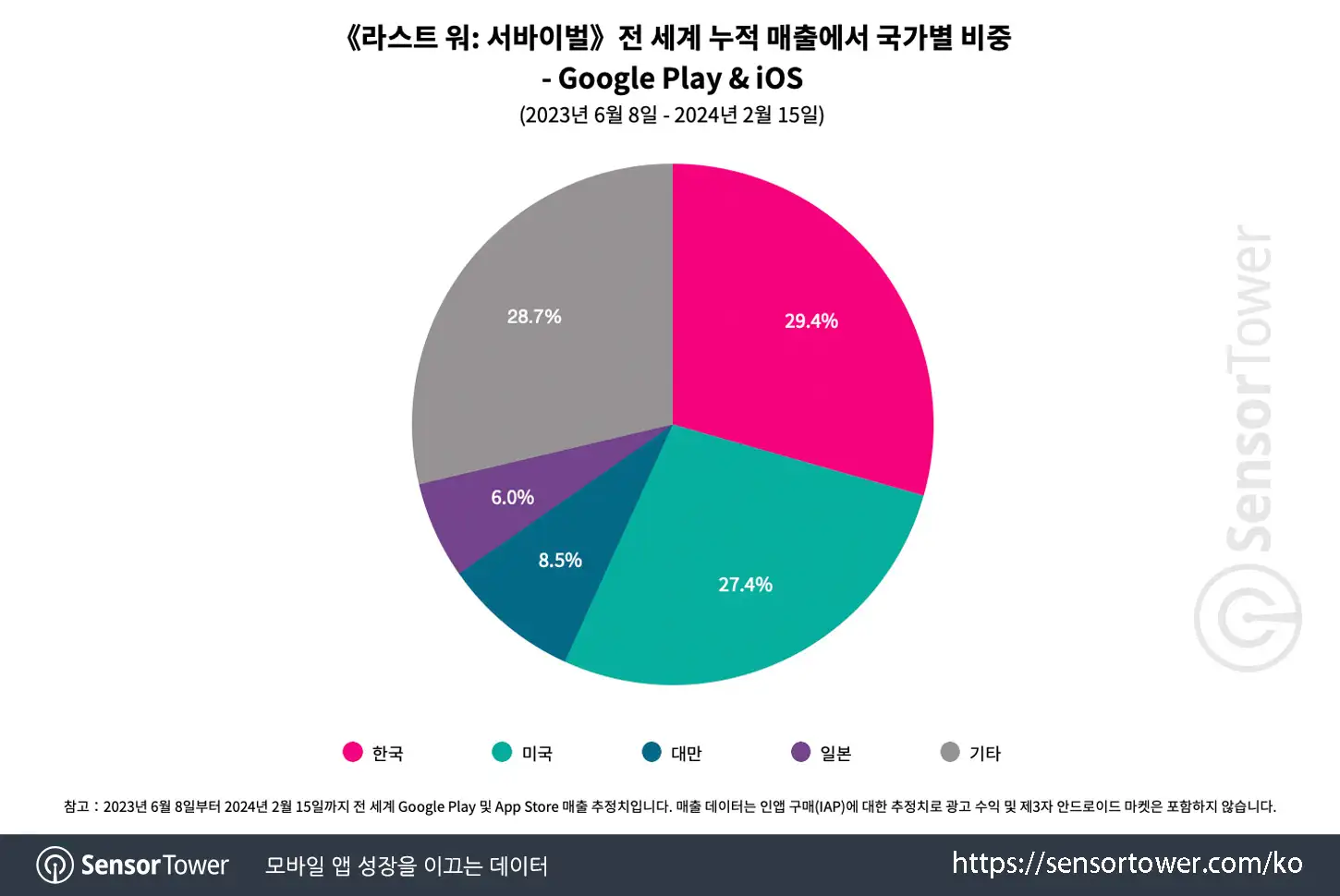

With its notable growth, Korea has emerged as the leading contributor to global sales of Last War: Survival since October 2023. The Korean market accounted for 29.4% of global sales, followed by the United States (27.4%), Taiwan (8.5%), and Japan (6%).

Global Sales Data

Advertising and Gameplay

The immersive gameplay mechanics and effective advertising strategy of Last War: Survival are the primary drivers behind its widespread popularity. According to Sensor Tower review analysis, the term "time" emerged as the most frequently mentioned in high-rated reviews.

Comments such as "I don’t notice time passing" and "Time passing quickly" indicate that the gameplay mechanics of Last War: Survival successfully enhance players' immersion. Indeed, Last War: Survival substantiated this claim by boasting the highest average session time among top-grossing mobile strategy games.

Last War: Survival

Additionally, Last War: Survival emerged as a leading advertiser on major advertising networks. In December 2023 and January 2024, it secured the 2nd and 1st positions in overall mobile gaming ad share on AdMob, as well as the 3rd and 1st spots on YouTube and TikTok, respectively.

TV Commercial Campaigns

The standout creative, which garnered the highest share, captivated the audience with a simple yet engaging video showcasing in-game gameplay.

Last War: Survival executed TV commercial campaigns during significant events like the AFC Asian Cup. Furthermore, considerable efforts were invested in raising awareness of the game by featuring popular Korean celebrities such as 'Shin Dong-yeop' and 'Joo Hyeon-young' in TV advertisements.

Final Thoughts

The findings gleaned from the detailed analysis of Last War: Survival and the broader mobile gaming landscape hold significant relevance for the emerging field of web3 gaming. As blockchain technology continues to revolutionize the gaming industry, insights into successful titles like Last War: Survival offer valuable lessons for developers venturing into the web3 space.

The emphasis on immersive gameplay mechanics and strategic advertising strategies underscores the importance of creating engaging experiences and building strong communities within decentralized gaming ecosystems. Moreover, the utilization of blockchain-based metrics for revenue estimation and user analytics could provide enhanced transparency and trust within web3 gaming platforms.

By leveraging these insights, developers, and stakeholders in the web3 gaming sector can navigate the evolving landscape and unlock new opportunities for innovation and growth. This article was inspired by an original post from Sensor Tower, you can read the full post on their website here for more information.