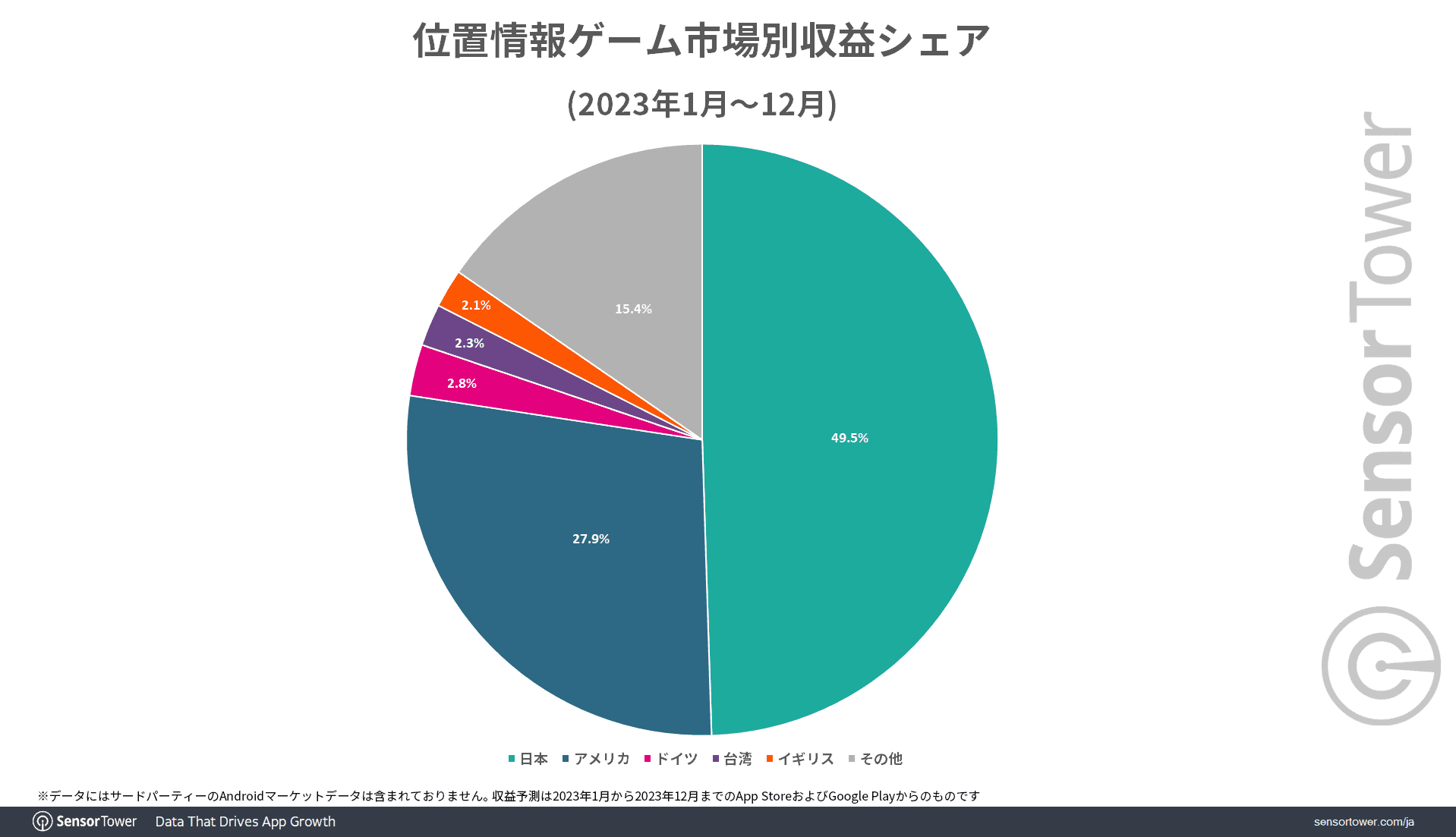

Japan's dominance in the realm of location-based gaming is nothing short of remarkable, as the nation commands an astounding 50% share of the global revenue in this sector. Fueled by a rich cultural heritage, advanced technological infrastructure, and a passionate gaming community, Japan stands as an unrivaled powerhouse in shaping the landscape of location-based gaming experiences.

With iconic franchises like Pokémon GO capturing the imagination of millions worldwide and innovative developments continuing to emerge from Japanese developers, the country's influence in this dynamic industry is poised to endure and evolve. In this article, we will cover everything you need to know about the latest data and share insight into relevance for web3 gaming.

Japan Makes Up 50% Of Global Location-Based Game Revenue

Location-based games, leveraging the capabilities of mobile devices, have emerged as a popular genre with numerous releases. According to recent data from Sensor Tower, as of 2023 Japan witnessed a staggering annual user spending surpassing $600 million on location-based games. This significant figure represents approximately 50% of the total global revenue generated by location-based games, establishing Japan as the foremost market for this genre worldwide.

Japan Makes Up 50% Of Global Location-Based Game Revenue

Japan Makes Up 50% Of Global Location-Based Game Revenue

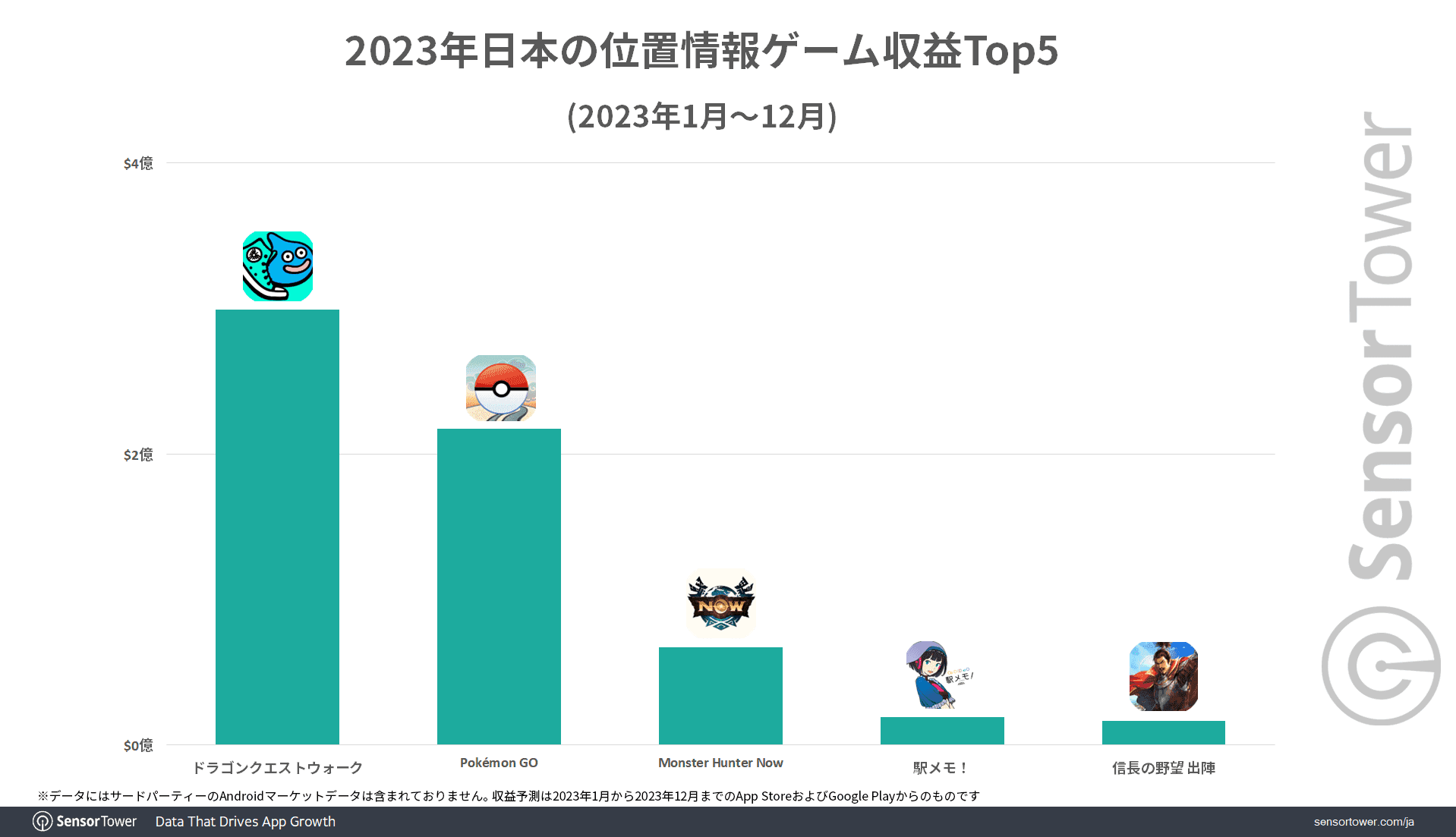

In 2023, Japan witnessed remarkable success in the location-based gaming sector, as indicated by the rankings of top-grossing games. Dragon Quest Walk by Square Enix clinched the leading position, amassing a staggering $300 million in revenue. Following closely were Pokémon GO and Monster Hunter Now, both developed by Niantic, securing the second and third spots respectively.

Of particular note is the dominance of Pokémon GO in the US and South Korean markets during the same period. In the US alone, the game generated revenue exceeding $300 million, while in South Korea, it amassed over $14 million.

Japan Makes Up 50% Of Global Location-Based Game Revenue

The revenue analysis across various markets reveals Japan's significant lead. The collective revenue of the top 5 location-based games in Japan soared to $620 million, surpassing the United States' revenue by approximately 60%, which amounted to $380 million. South Korea's revenue remained comparatively modest at less than $16 million, with China trailing behind at revenue under $2 million, signaling a relatively nascent market for location-based games in these regions.

These figures underscore Japan's supremacy in the location-based gaming arena compared to key international markets. According to Sensor Tower data, location-based games contributed 5% to Japan's overall mobile game revenue in 2023.

Furthermore, the popularity of location-based games in Japan is evident in the mobile game revenue rankings, with both Dragon Quest Walk and Pokémon GO securing positions among the top 10 mobile games by revenue for 2023, as reported by Sensor Tower. Dragon Quest Walk claimed the 6th spot, while Pokémon GO held strong at 9th, cementing the genre's firm foothold in the Japanese gaming landscape.

Factors Contributing to Success

Several factors contribute to the popularity of location-based games in Japan compared to other countries. One significant factor is transportation. In Japan, where trains and walking are common modes of travel, location-based games seamlessly integrate into people's daily commutes or leisurely strolls. Conversely, in the United States, where cars dominate transportation, the gaming experience may not align as seamlessly with the typical lifestyle.

Additionally, the availability of location-based games tailored to Japanese lifestyle habits plays a crucial role. For instance, Station Memories ranks 4th in Japan's location information game revenue ranking for 2023. This game targets Japan's extensive railway network, providing entertainment for commuters during their journeys to work or school.

Japan Makes Up 50% Of Global Location-Based Game Revenue

Another key factor contributing to the popularity of location-based games in Japan is the incorporation of intellectual property (IP) derived from popular games. In 2023, four out of Japan's top 5 location-based games by revenue leveraged well-known Japanese game IPs. By building upon existing game universes, developers tap into established fan bases, facilitating the success of location-based adaptations.

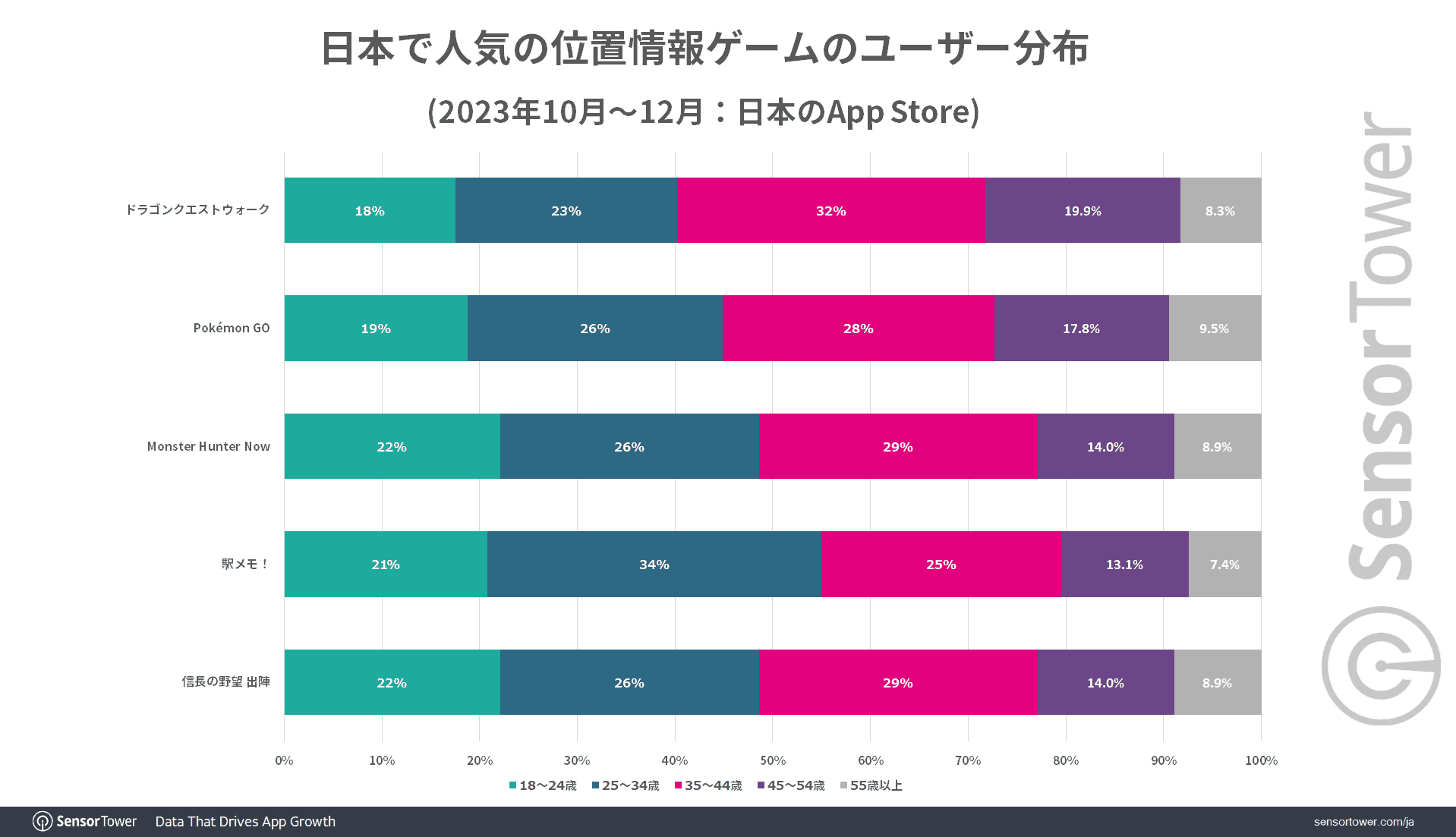

Moreover, examining the user distribution of popular location-based games in Japan reveals a significant proportion of female users. Sensor Tower data from the fourth quarter of 2023 indicates that these games maintain a roughly 6 to 4 ratio of men to women on the Japanese App Store.

Notably, titles such as Koei Tecmo Games exhibit a balanced gender ratio, with an average user age of 35 years old. This demographic profile suggests that individuals are engaging with these games during their commutes, after work, or during lunch breaks, further highlighting the alignment with Japanese lifestyle patterns.

Hours of Gaming

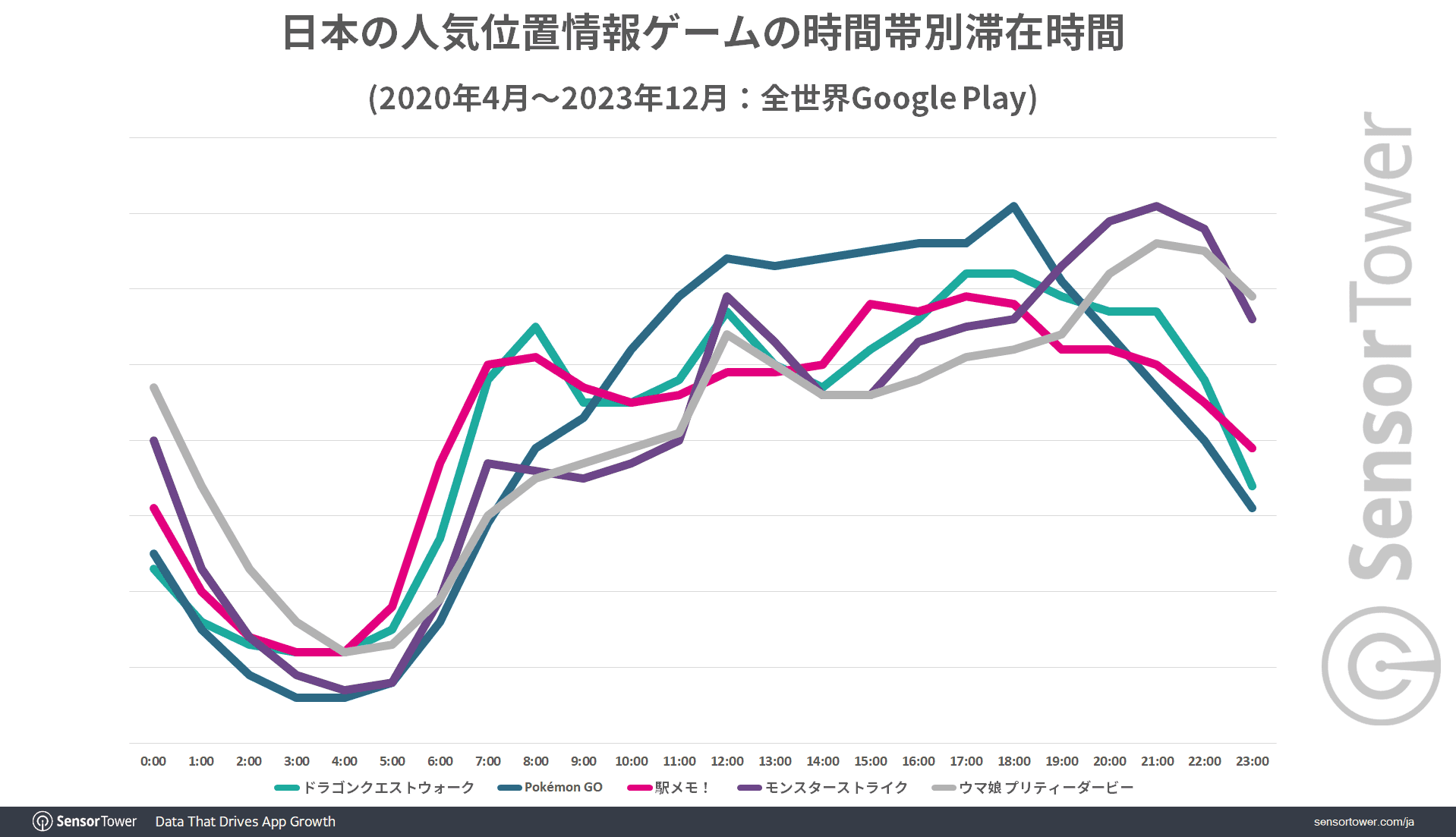

Analyzing mobile game usage patterns reveals interesting trends, particularly in the realm of location-based games. While the general trend for mobile game usage sees an uptick around 21:00, popular location-based games exhibit a different pattern. Sensor Tower data indicates that the duration of engagement for these games peaks earlier, between 17:00 and 18:00, with increased activity observed from 8:00 to 12:00 as well.

Japan Makes Up 50% Of Global Location-Based Game Revenue

This shift in usage patterns is evident when comparing two top-ranking titles in Japan's revenue charts: Monster Strike by MIXI and Uma Musume Pretty Derby by Cygames. Both games experience significant engagement during the aforementioned peak hours, highlighting a departure from the typical evening surge seen in other mobile games.

The early evening peak suggests that users are actively participating in location-based gaming during their commute home from work or school, capitalizing on the convenience and entertainment value offered by these games during daily routines. This unique usage pattern underscores the appeal and integration of location-based gaming into the fabric of Japanese daily life.

Duration of Gameplay

The data on the duration of gameplay by time of day suggests a distinctive pattern among users of location-based games. It appears that many users engage with these games during daytime hours, possibly integrating them into their daily routines. However, after returning home, there seems to be a shift towards playing other types of mobile games.

Japan Makes Up 50% Of Global Location-Based Game Revenue

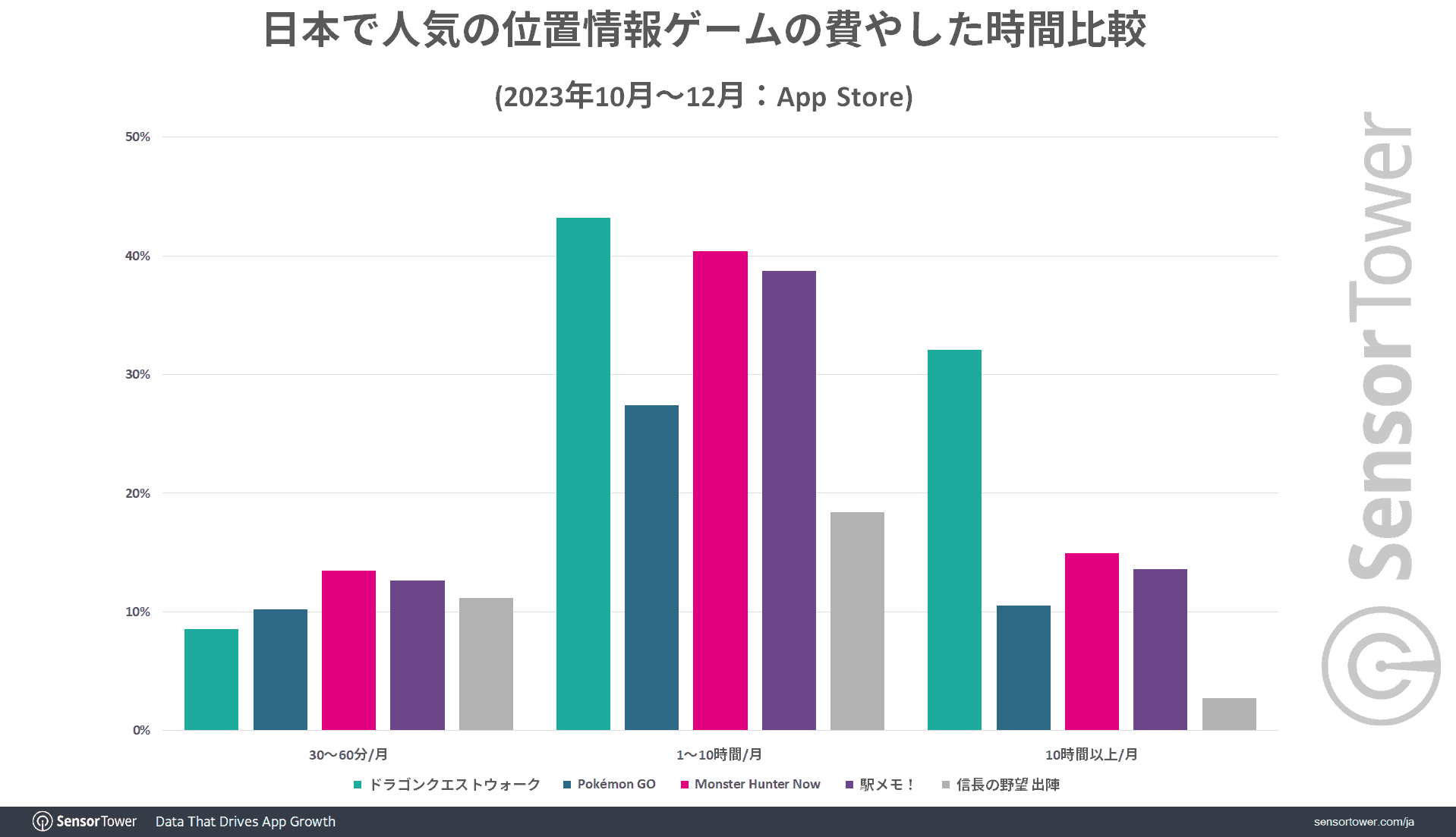

Furthermore, when examining the time spent playing popular location-based games, Dragon Quest Walk emerges as a standout performer. Sensor Tower data reveals that from October to December 2023, the duration of gameplay for users in Japan predominantly falls within the 1 to 10 hours per month range.

However, Dragon Quest Walk significantly surpasses its counterparts, with over 30% of users spending more than 10 hours per month playing the game. In contrast, the next highest game, Monster Hunter Now, only achieves a rate of 15%, making Dragon Quest Walk's dominance in this regard nearly twice as high as its closest competitor.

Relevance to Web Gaming

Major Japanese game developers, including Sega (Battle of Three Kingdoms), Bandai Namco (RYUZO), Square Enix (Symbiogenesis), Konami (Project Zircon), and Ubisoft (Champions Tactics), have embraced web3 technologies, working on blockchain gaming projects and forming partnerships with web3 companies.

Ubisoft's launch of Champions Tactics: Grimoire Chronicles marks the company's entry into the web3 gaming space. Over 20 game developers have become validators on the gaming-focused blockchain Oasys, actively participating in transaction validation, network security, and governance.

Japan Makes Up 50% Of Global Location-Based Game Revenue

Japan vs Korea vs China

Japan's web3 gaming industry is drawing international attention, with South Korean companies like Com2uS collaborating with Oasys to explore new avenues for growth.

Gaming-centric blockchain Oasys recently confirmed the partnership with the leading Korean game developer Com2uS, the conglomerate behind video game titles such as ‘Summoners War: Chronicles’ and ‘The Walking Dead: All-Stars,’ and its web3 business subsidiary XPLA. The alliance marks a significant step in the developer’s expansion into the Japanese market.

The influx of developer talent from countries like China and South Korea contributes to Japan's expanding web3 gaming ecosystem. The government's support, combined with collaboration from big businesses, positions Japan as a thriving hub for web3 gaming innovation.

Japan Makes Up 50% Of Global Location-Based Game Revenue

Final Thoughts

These findings hold significant relevance for the world of web3 gaming. As blockchain technology continues to revolutionize the gaming industry, the insights gleaned from Japan's dominance in location-based gaming offer invaluable lessons for developers looking to leverage decentralized platforms.

By understanding the preferences and behaviors of Japanese gamers in the context of traditional mobile gaming, developers can tailor their strategies to capitalize on the unique opportunities presented by web3 gaming. With its strong culture of gaming and technological innovation, Japan is poised to play a pivotal role in shaping the future of decentralized gaming experiences.