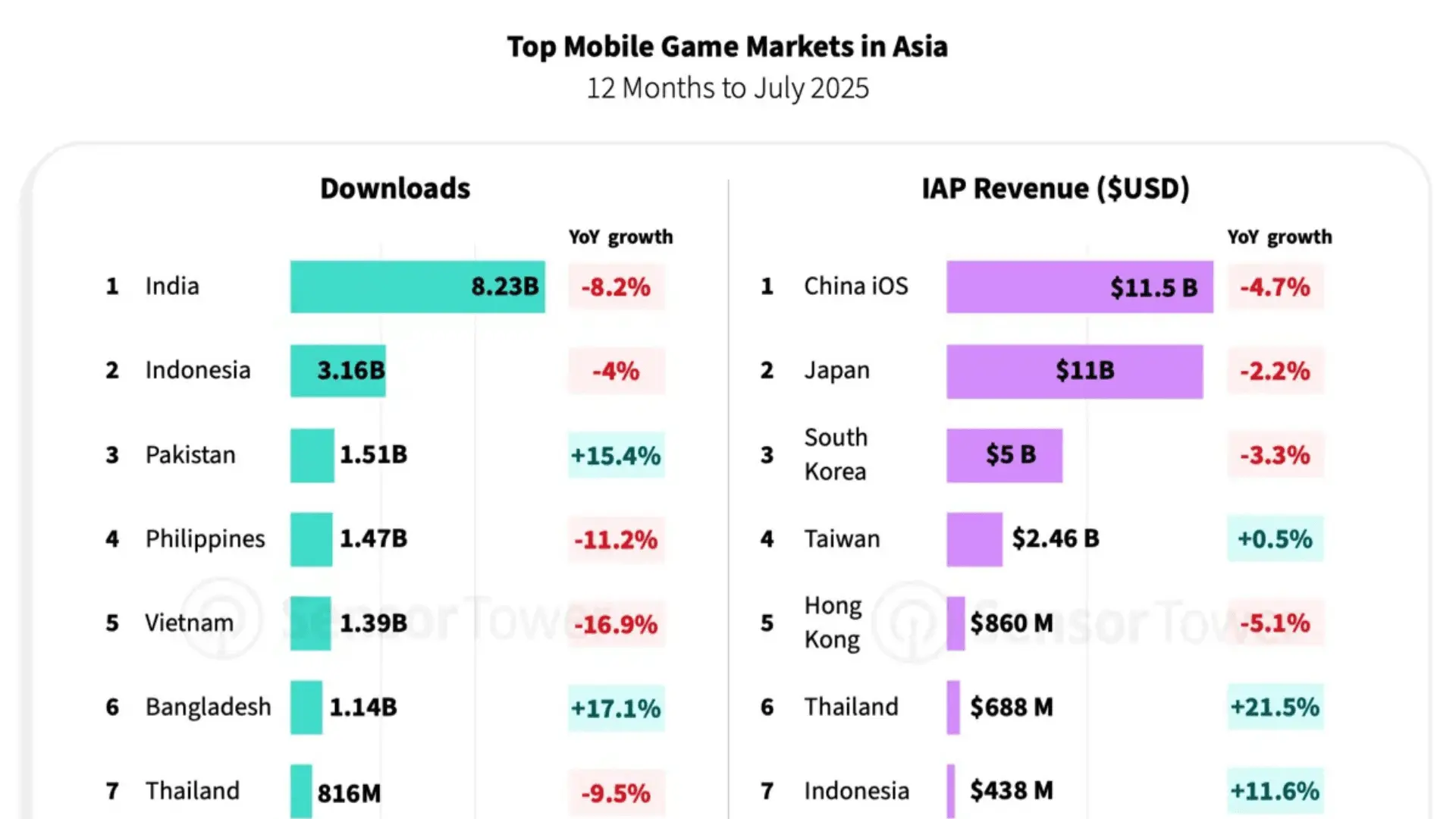

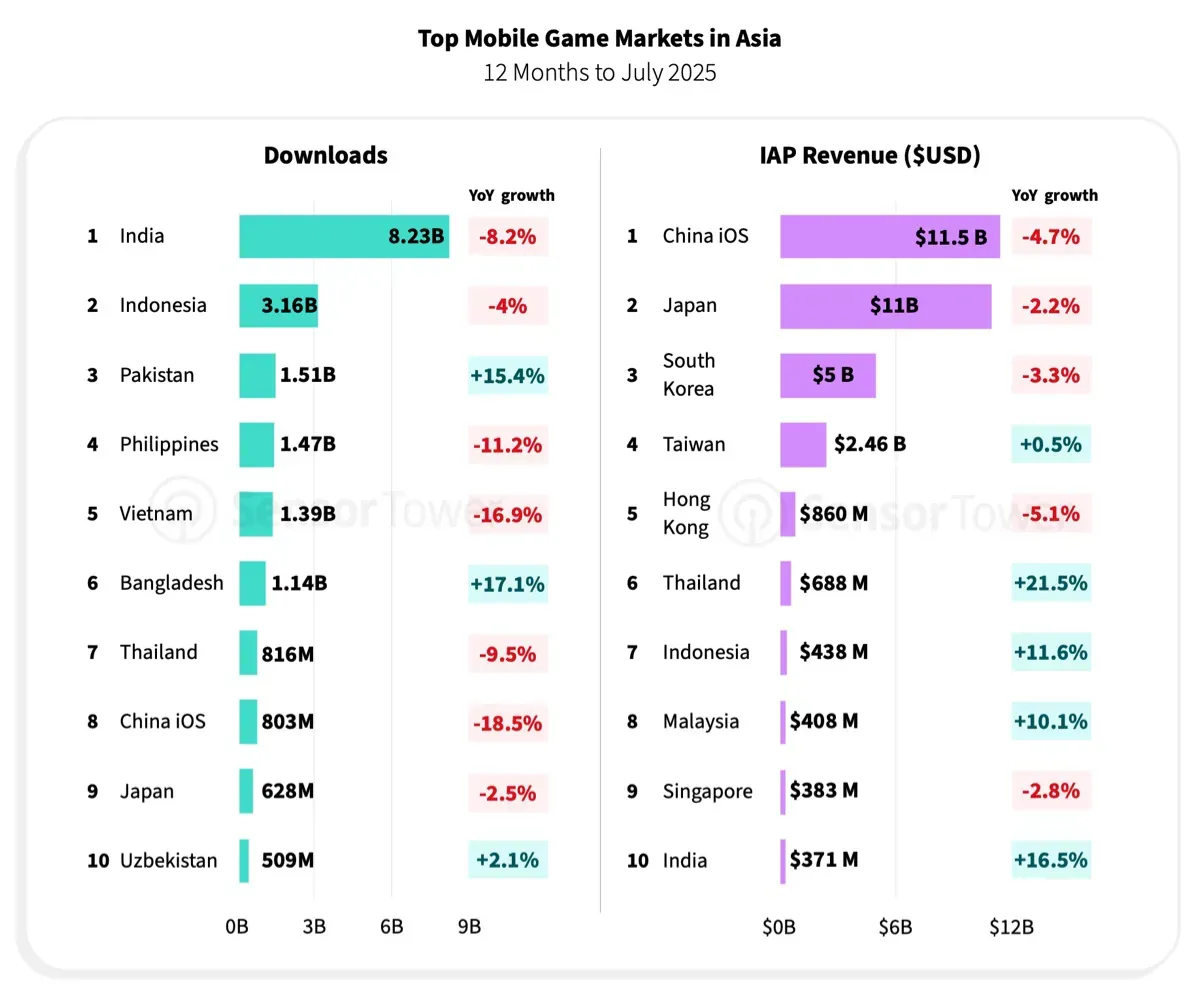

Sensor Tower’s latest report on Japan’s gaming market reveals a year defined by stability rather than expansion. Between August 2024 and July 2025, Japan’s mobile gaming industry brought in around $11 billion in revenue, second only to China’s iOS market. Yet despite the large figures, total revenue slipped by about 2.2% year over year, showing that the market may have reached a maturity point.

Japan's Gaming Market in 2025

Shifting Momentum in Mobile Gaming

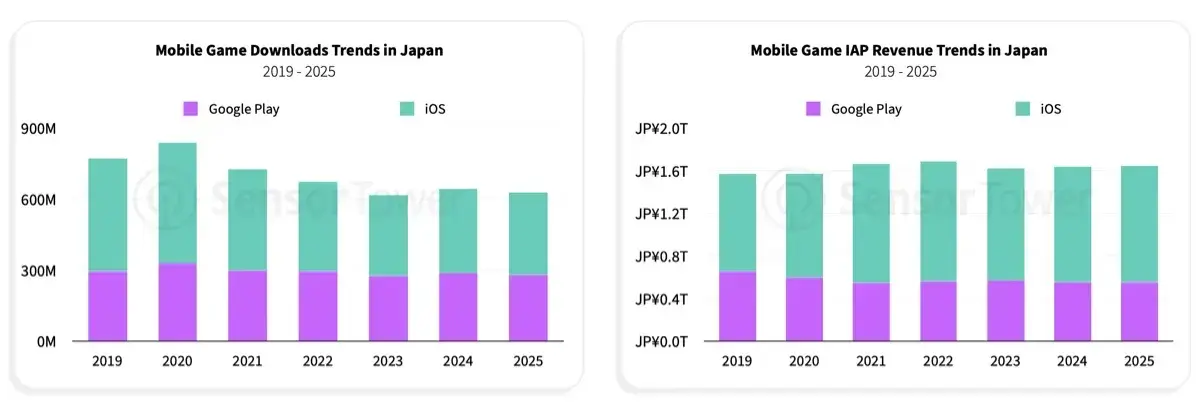

Japan’s mobile game ecosystem continues to show consistent engagement, even as growth slows. Total downloads reached roughly 628 million during the reporting period, down 2.5% from the previous year. The country still ranks ninth in Asia by downloads, far behind India, which dominates the region with over eight billion installs.

While both downloads and revenue have slightly declined, Sensor Tower notes that the drop is mostly due to currency fluctuations and broader economic factors. When measured in yen, spending levels remain relatively steady. After the pandemic-driven surge of 2020, Japan’s mobile market has found a plateau where both player numbers and spending remain consistent.

Japan's Gaming Market in 2025

What’s Driving Revenue in 2025

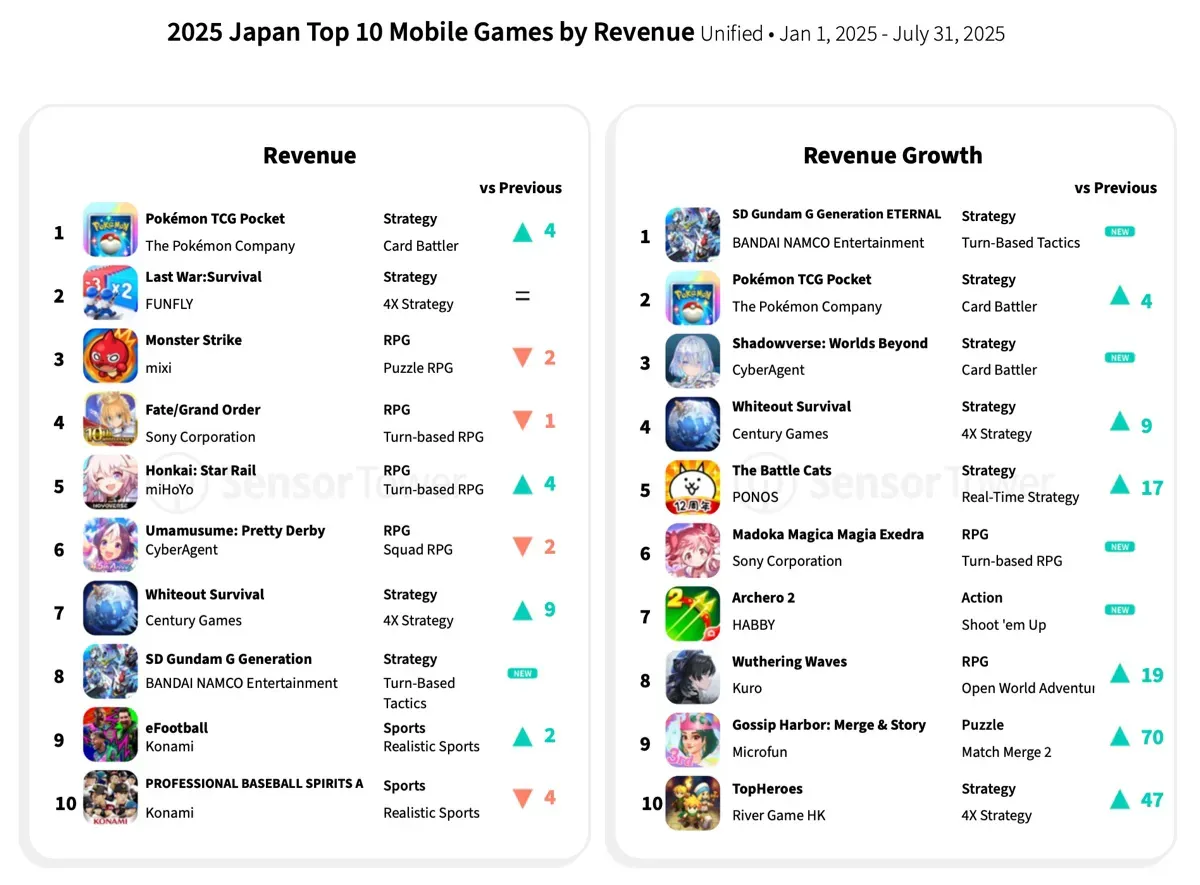

From January through July 2025, Pokemon TCG Pocket, Last War: Survival, and Monster Strike topped Japan’s mobile revenue charts. The newest title in the top ten, SD Gundam G Generation ETERNAL, launched in April and quickly climbed the ranks. The game’s success was driven by timed events that spiked player activity and spending, reflecting a broader trend where live operations continue to define mobile monetization.

Other titles showing strong revenue growth include Shadowverse: Worlds Beyond and Madoka Magica Magia Exedra. Across genres, Japanese players remain loyal to familiar IPs such as Pokemon, Fate, and Dragon Quest, all of which continue to perform strongly in both downloads and revenue.

Japan's Gaming Market in 2025

Genre Trends and Audience Behavior

Puzzle games lead Japan’s market by downloads, making up about a third of all installs over the past 12 months. Arcade and simulation titles also hold steady positions, while role-playing games continue to dominate spending, accounting for over a third of all mobile revenue. Strategy and puzzle titles follow closely behind.

However, RPG subgenres are showing signs of fatigue. Sensor Tower data points to a drop in spending on squad-based, puzzle, and turn-based RPGs, each down between 14% and 22% year over year. On the other hand, strategy categories such as 4X games and card battlers are gaining ground, the latter seeing a dramatic 305% increase in revenue thanks to the success of Pokemon TCG Pocket.

The audience remains majority male, with about two-thirds of Japanese players identifying as men. Men dominate competitive genres like action, shooters, and sports, while women continue to favor casual and narrative-driven games. Players aged 25 to 34 tend to prefer competitive titles, whereas older players lean toward slower-paced, casual experiences.

Japan's Gaming Market in 2025

Anime and Otome Games Stay on Top

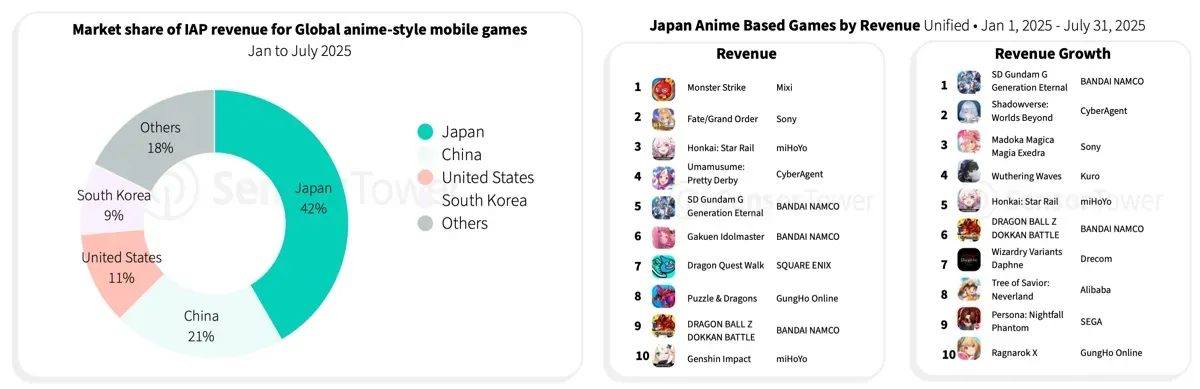

Japan continues to be the world’s leader in anime-style game revenue, responsible for roughly 42% of global spending in this category. Chinese developers contribute about half that amount, underscoring Japan’s continued dominance in anime-influenced game design.

The Otome game market—focused on romantic storytelling and primarily targeted at women—has grown consistently over the past two years. Japan accounts for 34% of all Otome game revenue worldwide, second only to China. Popular titles include Ensemble Stars!! Music, Love & Deepspace, and Disney: Twisted Wonderland, all of which blend storytelling with strong live-service elements to maintain loyal fanbases.

Japan's Gaming Market in 2025

The Role of Japanese Publishers

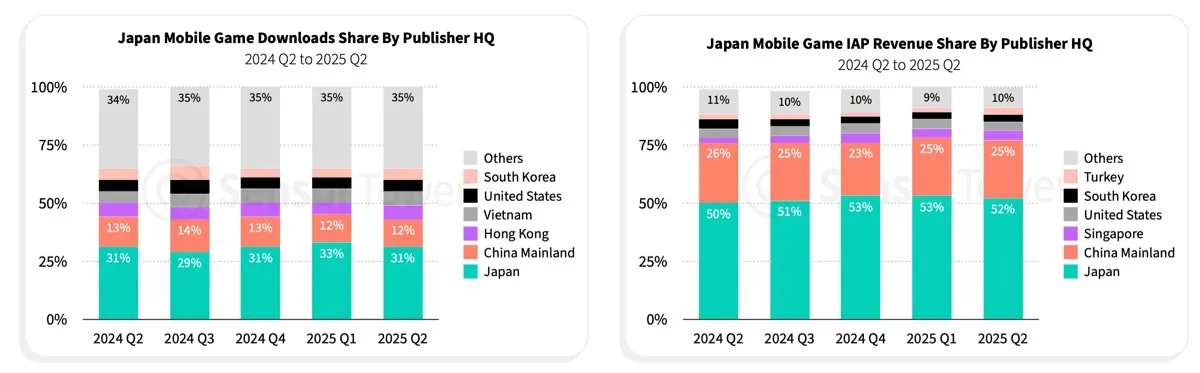

Japanese publishers continue to prioritize their home audience, collecting roughly 70% of all domestic mobile IAP revenue in 2025 while making up about 17% of total downloads. KAYAC Inc., SEGA, and The Pokemon Company lead by downloads, while Bandai Namco Entertainment, The Pokemon Company, and Konami lead in revenue.

Globally, Japanese titles such as Pokemon TCG Pocket, eFootball, and Dragon Ball Z Dokkan Battle perform strongly, maintaining Japan’s influence in the international market. Among foreign publishers, developers from China and South Korea dominate Japan’s charts, while Western and Turkish studios like Niantic (Pokemon GO) and Dream Games (Royal Match) also appear in the top rankings.

Japan's Gaming Market in 2025

PC, Console, and Advertising Trends

Outside of mobile, Japan continues to play a major role in the PC and console landscape. Steam revenue is expected to rise 12% this year to $11.9 billion, with game sales up 8% to around 770 million units. Japanese studios account for about 15% of global Steam installs in 2025, and major developers such as Bandai Namco, SEGA, and Capcom rank among the top revenue earners. One of the year’s biggest global releases, Monster Hunter Wilds, further reinforced Japan’s status as a major console and PC powerhouse.

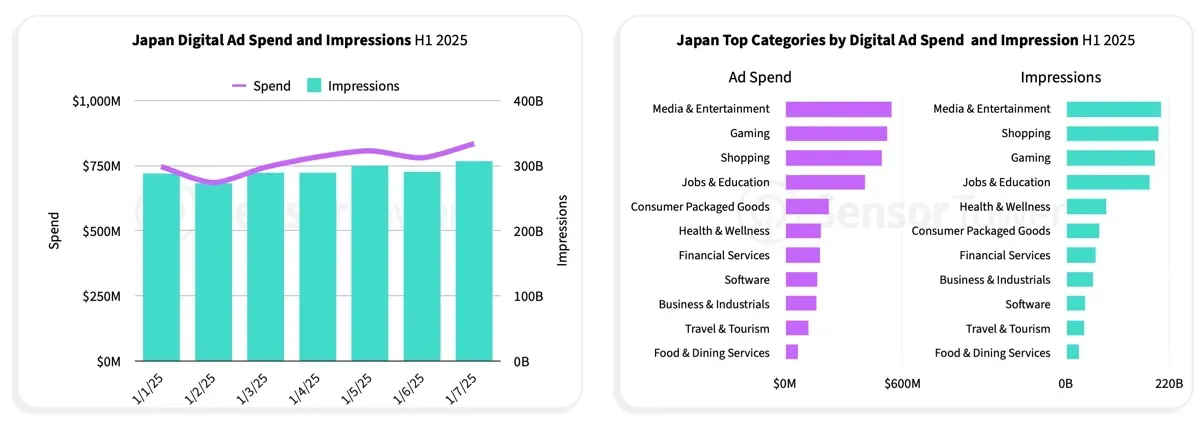

In advertising, digital game marketing spend in Japan averages about $750 million per month, with mobile titles leading the charge. Mobile games represent 63% of total ad spend, particularly in action, strategy, and puzzle categories. On PC and console, shooters attract the most advertising investment. Platforms like LINE, YouTube, and various mobile networks remain the primary drivers of ad reach for games.

Japan's Gaming Market in 2025

A Market That Has Matured, Not Declined

Japan’s gaming market in 2025 shows few signs of rapid growth, but it remains highly stable and influential. While in-app purchase revenue has flattened, engagement levels stay high across both mobile and console platforms. Established franchises continue to dominate the charts, and new IPs that leverage recognizable brands—like SD Gundam G Generation ETERNAL—still find success.

The combination of a loyal player base, evolving strategy genres, and the ongoing appeal of anime-inspired titles ensures that Japan remains a cornerstone of the global gaming industry.

Source: Sensor Tower

Here is a complete list of all games mentioned:

- Pokemon TCG Pocket

- Last War: Survival

- Monster Strike

- SD Gundam G Generation ETERNAL

- Shadowverse: Worlds Beyond

- Madoka Magica Magia Exedra

- Fate/Grand Order

- Umamusume: Pretty Derby

- Dragon Quest

- eFootball

- Dragon Ball Z Dokkan Battle

- Number Master: Run and Merge

- Pokemon GO

- Royal Match

- Monster Hunter Wilds

- Ensemble Stars!! Music

- Love & Deepspace

- Devil Butler and the Black Cat

- Disney: Twisted Wonderland

Frequently Asked Questions (FAQs)

How much revenue did Japan’s gaming market generate in 2025? Japan’s gaming market generated around $11 billion in mobile revenue between August 2024 and July 2025.

Why is Japan’s mobile game revenue not growing? The lack of growth is mainly due to market maturity and economic factors such as currency fluctuations. Player engagement remains steady, but spending growth has slowed.

Which games earned the most revenue in Japan in 2025? Top earners include Pokemon TCG Pocket, Last War: Survival, and Monster Strike.

What genres are most popular among Japanese gamers? RPGs lead by revenue, while puzzle, arcade, and simulation titles dominate downloads.

Who are the leading Japanese publishers in 2025? The leading publishers by revenue are Bandai Namco Entertainment, The Pokemon Company, and Konami. By downloads, KAYAC Inc., SEGA, and The Pokemon Company take the top spots.

What role do anime and Otome games play in Japan’s gaming market? Anime-style games generate 42% of global revenue in the genre, and Otome games continue to grow, with Japan contributing 34% of global spending in this category.

Is Japan still relevant in PC and console gaming? Yes. Japanese developers like Capcom, SEGA, and Bandai Namco are among the top revenue earners on Steam, and games like Monster Hunter Wilds show Japan’s ongoing impact on global PC and console markets.