Hyper-Casual Games Dominate In-App Advertising

Discover the latest benchmarks in mobile game advertising with Mintegral's 2024 Casual Gaming Report. Learn about ad buys, retention rates, and eCPMs across platforms and regions.

Mintegral, a leading programmatic and interactive advertising platform, has teamed up with GameAnalytics and Tenjin to release its 2024 Casual Gaming Report. The comprehensive report provides marketers with crucial insights into mobile game advertising trends using data from 2023.

In this article, we will cover the latest benchmarks in mobile game advertising with Mintegral's 2024 Casual Gaming Report. You will also learn about benchmarks for key metrics such as ad buys, retention rates, sessions, regional data, and effective cost per thousand impressions (eCPMs).

Mintegral 2024 Casual Gaming Report

Casual Gaming Report

The report, in partnership with GameAnalytics and Tenjin, demonstrates the impact Casual gaming has had on the wider app marketing industry. The report highlights where and how casual games spend their considerable ad budgets and benchmarks the typical in-app performance that results from performance marketing.

Key Takeaways

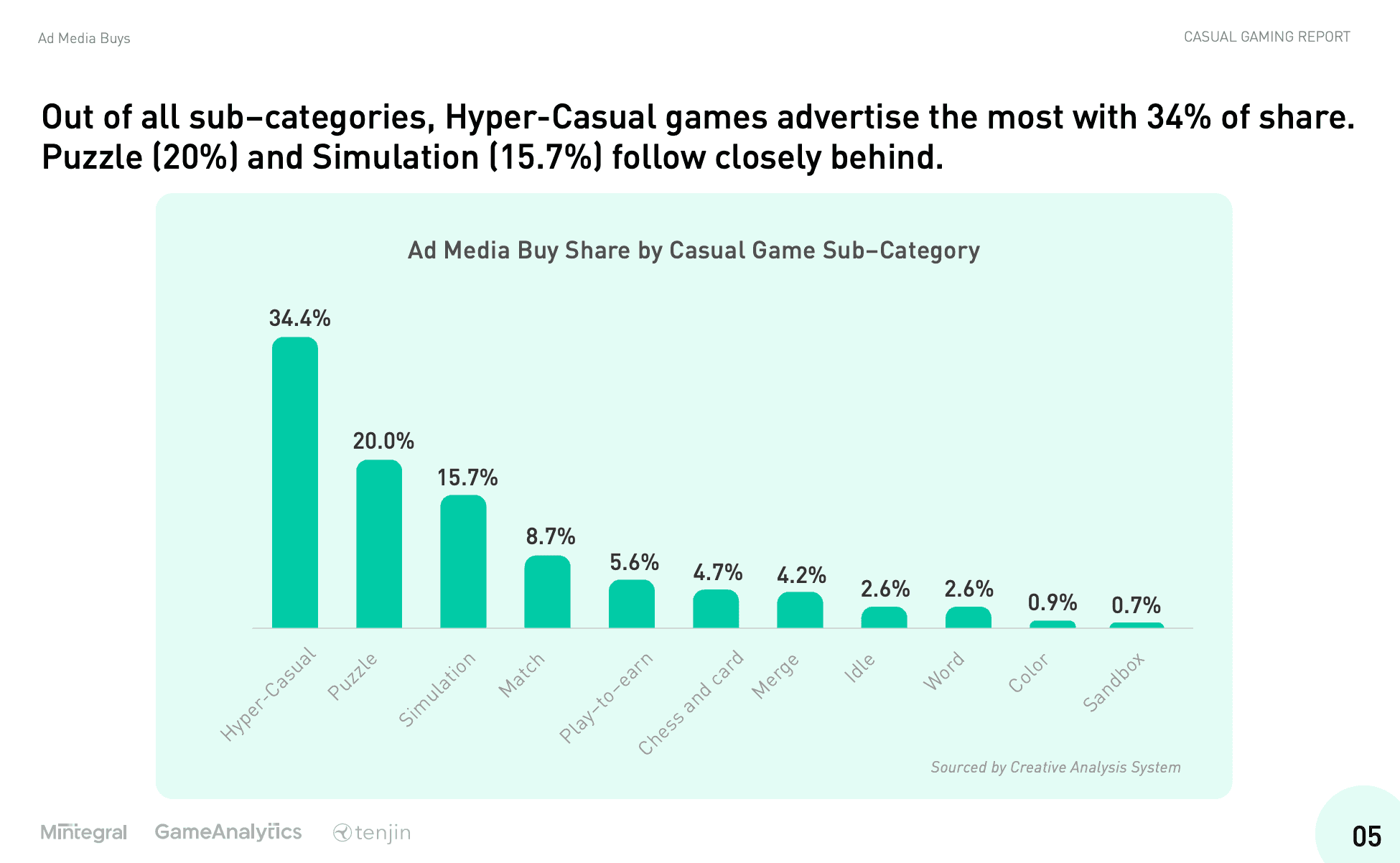

- Hyper-casual games still dominate among other casual games when it comes to in-app advertising, capturing 34% of the market share.

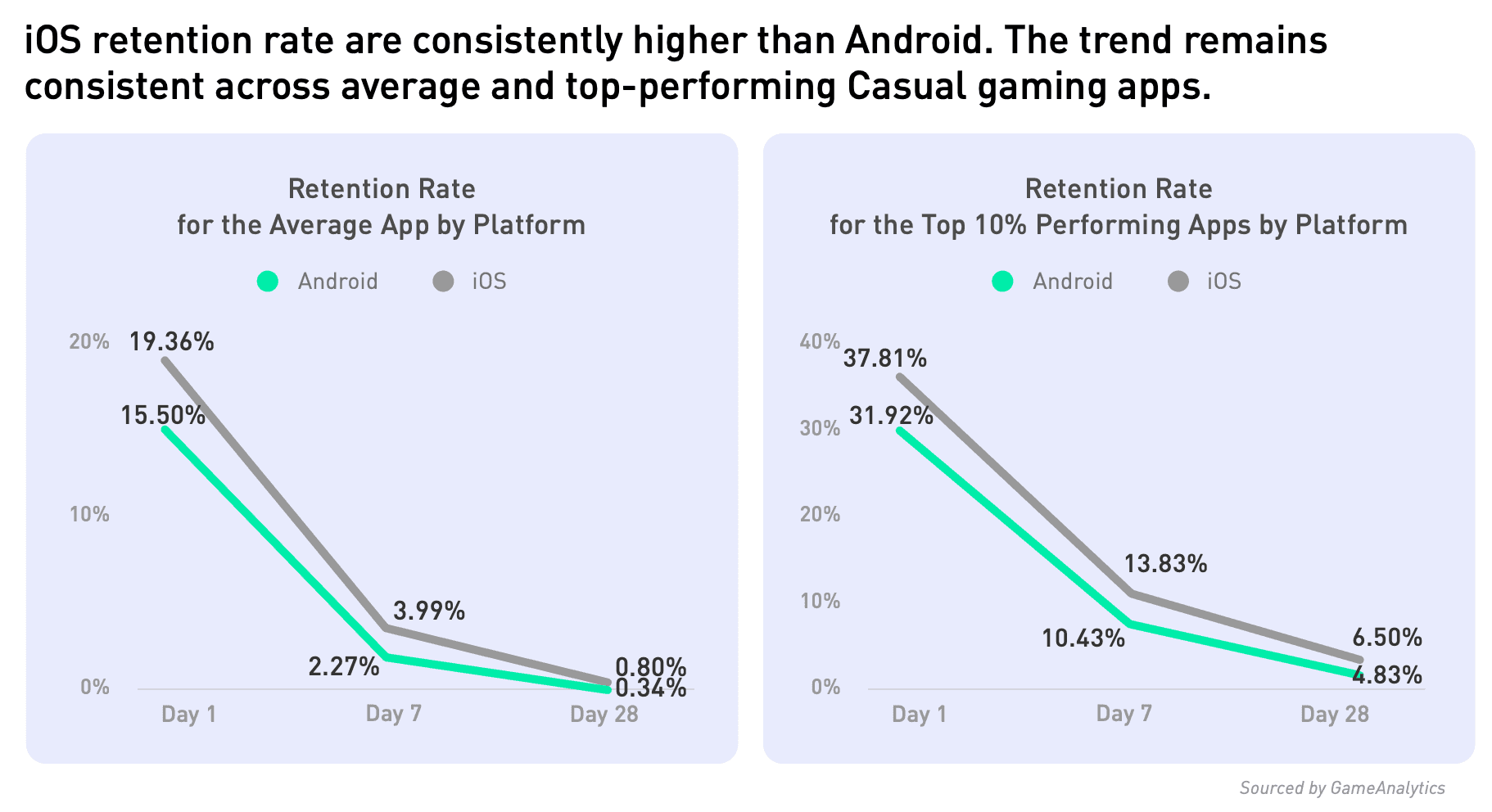

- The average app retains only 17% of users after one day (D1). But the best apps (90th percentile and above) achieve double that figure (35%).

- The average gaming app is opened around 4.4 times per day, per user. The best apps are opened an average of 7.7 times each day.

- Video is by far the most popular advertising format, currently capturing almost 70% of the market share — or almost 90% in all regions except Asia.

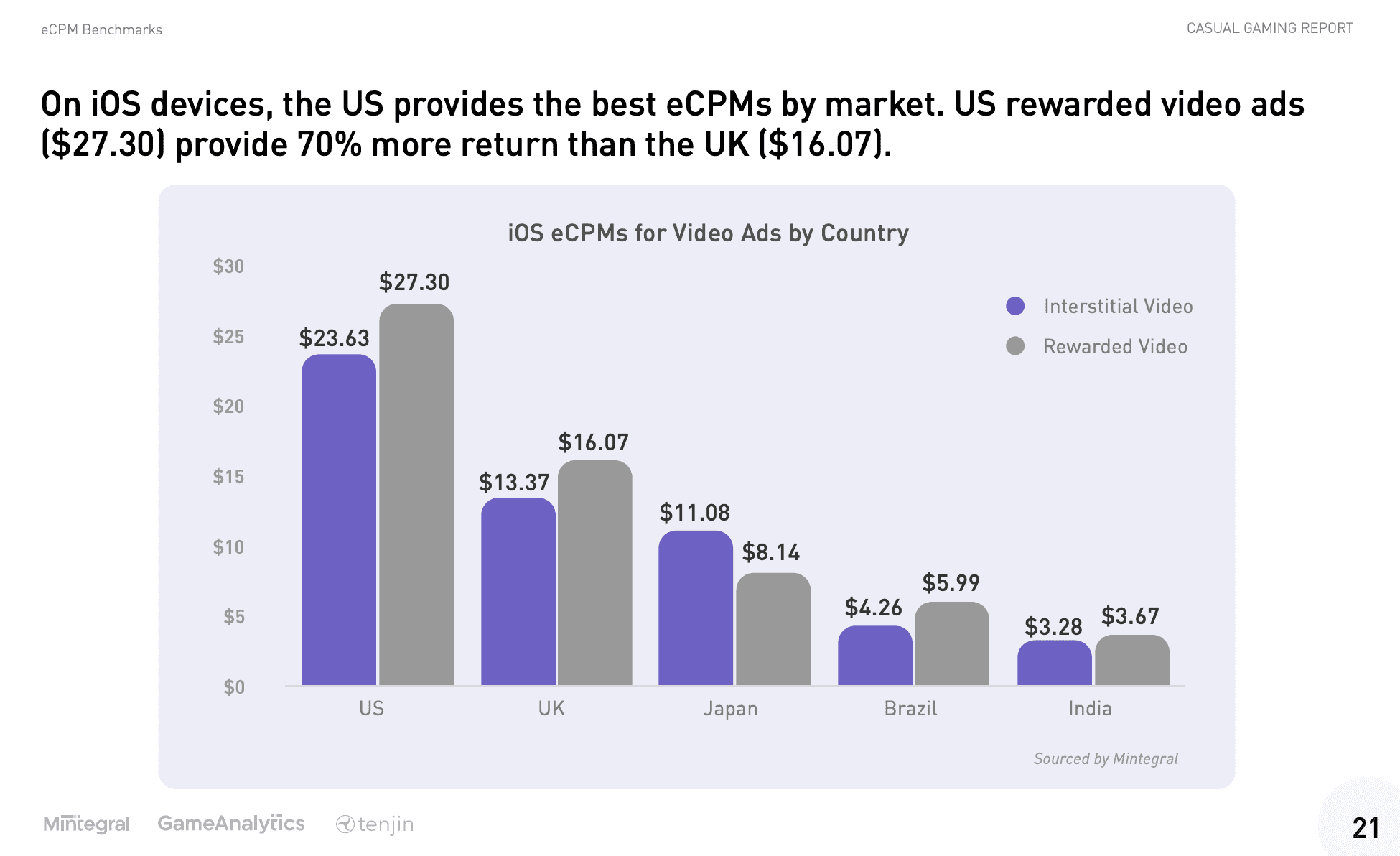

- The US offers the best eCPM globally. Rewarded ads in the US outperform the next best country by 70%.

Mintegral 2024 Casual Gaming Report Highlights

Hyper-Casual Games Dominate

Among various sub-genres, hyper-casual games dominated the ad buy landscape, capturing 34.4% of the share. Combined with puzzle and simulation games, these top three sub-genres accounted for over 70% of ad buys in the casual gaming category.

Video ads emerged as the most popular format for promoting casual games, comprising nearly 70% of all ads. This figure rises to about 88% in regions such as EMEA, North America, and LATAM. In the APAC region, while video ads still led the way, image ads constituted 43% of the advertising volume.

Hyper-Casual Games Dominate In-App Advertising

Platform Differences

The report highlights important distinctions between Android and iOS platforms that marketers should consider. Android commands the majority of ad media spend at 62% and sees users opening gaming apps 1.37 more times per day on average compared to iOS users. Despite similar session lengths across both platforms, these usage patterns reflect distinct engagement behaviors.

Retention Rates and eCPMs

Retention rates and eCPMs reveal why iOS users are highly valued by advertisers. On average, casual gaming apps retain 17% of users on Day 1. When broken down by platform, iOS retains a 1.25 times greater share of users compared to Android.

iOS vs Android Retention Rates

Furthermore, eCPMs for interstitial and rewarded video ads are consistently higher on iOS devices than on Android in key markets such as the U.S., U.K., Japan, Brazil, and India. Consequently, developers earn higher returns per ad on iOS devices, despite the greater overall ad volume on Android.

eCPMs for Interstitial and Rewarded Video Ads

Erick Fang, Chief Product Officer of Mobvista, Mintegral’s parent company, emphasized the importance of understanding user behavior and advertising trends in the competitive casual gaming market.

Erick stated: “Casual gaming remains a powerhouse in the mobile app industry. Understanding user behavior and advertising trends is key to success in this competitive space. Our report equips marketers with the data and insights they need to develop winning strategies.”

The full 2024 Casual Gaming Report from Mintegral is now available here, offering detailed insights and data to help marketers navigate the evolving landscape of mobile game advertising.

About the author

Eliza Crichton-Stuart

Head of Operations

Updated:

June 19th 2025

Posted:

May 26th 2024