Konvoy has released its report on gaming investments for the first quarter of 2025, offering a detailed overview of market activity across different segments of the industry. The report covers deals involving gaming technology platforms, game content producers, and companies that, while not traditionally seen as gaming firms, contribute to the broader ecosystem. The inclusion of companies like Underdog Fantasy Sports, a fantasy sports platform, demonstrates the expanding definition of gaming-related businesses within investment analysis.

Global Gaming Growth

The global gaming industry continues to grow, although at a slower pace than in previous years. In 2025, the market is expected to reach $186.1 billion. The number of gamers worldwide was recorded at 3.422 billion in 2024, with the Asia-Pacific region representing the largest share at 53 percent. The United States and China, which together comprise 27 percent of the global gaming audience, remain responsible for more than half of the industry’s revenue. These figures reflect ongoing consolidation of revenue in regions with established infrastructure and consumer bases.

Konvoy Highlights Key Gaming Investments in Q1’25

Investment Climate and Funding Trends

In terms of investment activity, the market showed modest signs of recovery. Private investments totaled $700 million in Q1’25, marking a 23 percent increase from the previous quarter. Within this figure, 77 venture deals accounted for $373 million, representing a 35 percent rise in deal value, although the number of deals declined by 6 percent. This continues a broader downward trend in deal volume observed since early 2024. The Q1’25 total is the lowest deal count since the start of 2021, suggesting that while funding levels are beginning to recover, investor selectivity remains high.

Growth-stage investments, specifically those categorized as Series B through D, experienced a significant increase of 125 percent. However, early-stage funding continues to dominate overall activity, indicating ongoing interest in supporting new ventures while larger commitments remain limited to a smaller group of more mature companies.

Gaming VC Deals Make Up $373 Million in Q1’25

Public Market Activity and Company Reserves

Public gaming companies showed relatively strong performance during the first quarter of the year. Gaming exchange-traded funds (ETFs) such as ESPO and HERO recorded growth of 4.8 percent and 6.2 percent, respectively, contrasting with a 5.4 percent decline in the S&P 500 during the same period. In addition, public gaming firms collectively hold around $36 billion in cash or cash equivalents. When including broader technology companies with gaming interests, this figure is considerably higher.

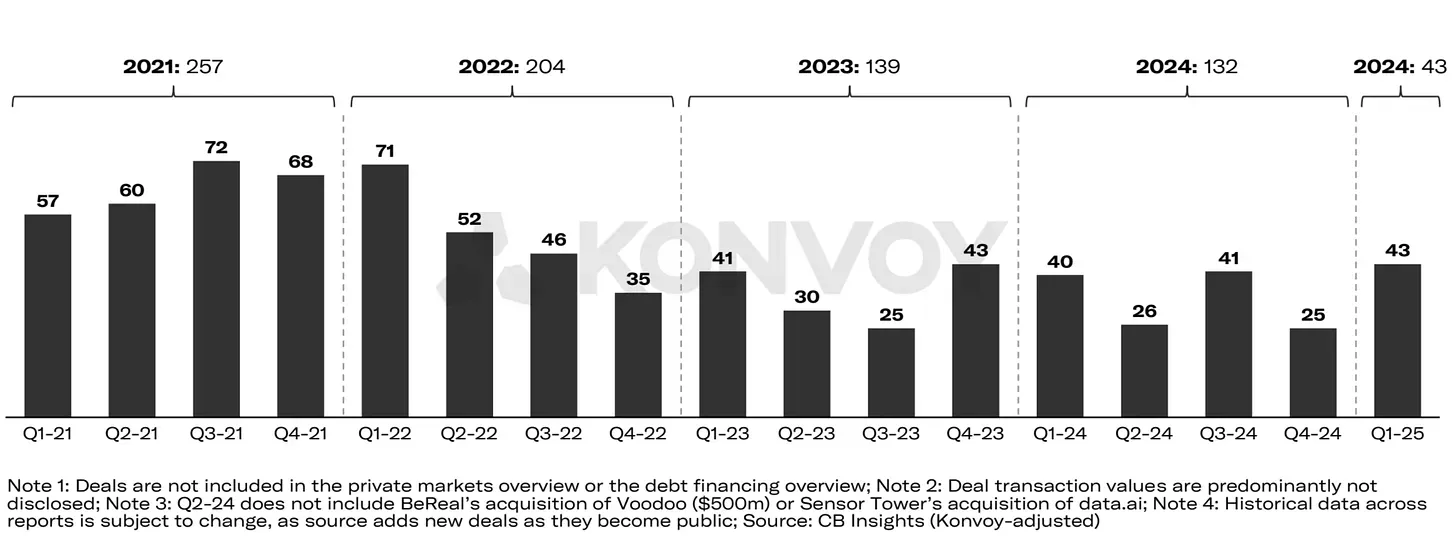

Companies based in Asia continue to lead in cash reserves, reflecting the strength of the region’s gaming and technology sectors. Q1’25 also saw a total of 43 transactions involving public companies, the highest quarterly figure since 2022. While most deal values were not disclosed, the volume of activity points to renewed interest in strategic partnerships, mergers, or acquisitions within the gaming space.

Q1’25 Sees 43 Transactions Involving Public Companies

Major Deals in Gaming Technology and Content

The largest technology and platform-focused deals during the quarter included Underdog’s $70 million Series C funding round, Halliday’s $20 million Series A, and SlingShot DAO’s $16 million Series A. These companies, while connected to the gaming ecosystem, also operate in adjacent markets. Underdog is primarily known for fantasy sports, Halliday supports blockchain-based app development, and SlingShot DAO provides an AI-powered launcher for Roblox, integrating web3 features. Their inclusion in gaming investment data highlights the evolving boundaries of what constitutes a gaming company.

On the content side, notable transactions included Grand Games’ $30 million Series A, Good Job Games’ $23 million investment, and Pixion Games’ $12.4 million Series A. Pixion Games, based in the United Kingdom, attracted attention not only for its funding round but also for its strategic decision to migrate its mobile action RPG, Fableborne, from the Avalanche blockchain to Ronin. The Ronin blockchain, developed by Sky Mavis, is widely known for supporting blockchain-based games and maintains an active user base in Southeast Asia and Latin America.

Game Content Investments in Q1 2025

Regional Investment Distribution

In regional terms, North America led in total investment volume during Q1’25, with $198 million deployed across multiple deals. Asia, on the other hand, recorded the highest number of transactions with 33 deals. The United States continues to significantly outpace China in venture investment volume, exceeding it by a factor of 7.6 since 2021. A similar gap is evident in the number of deals, underscoring differences in market structure and public deal reporting between the two countries.

Despite some signs of recovery in key markets, investment activity has slowed in other parts of the world. There were no publicly disclosed deals in Africa, Australia, or South America during recent quarters. It is also important to note that Konvoy’s analysis only includes publicly announced transactions, which may not fully capture activity in regions where deals are often not disclosed or are confined to domestic markets.

Regional Breakdown of Gaming VC Deals

Future Outlook and Final Thoughts

Konvoy’s Q1’25 report provides a snapshot of an industry in transition. While funding levels are showing incremental recovery and select deals continue to attract attention, overall investment volume and deal activity remain below historic highs. As companies continue to experiment with new platforms and expand into areas like web3 and mobile-first design, the market’s next phase will likely depend on how quickly developers and investors adapt to changing consumer behaviors and technological opportunities.

Source: Konvoy