Ampere Analysis has released its latest market report assessing the state of the global gaming industry as it moves into the later half of 2025. Despite a nominal increase in market volume, the data indicates that real growth remains limited when adjusted for inflation. The analysis offers a comprehensive look at the changing dynamics of the industry, including the impact of major game delays, regional performance, and shifts in consumer behavior.

Gaming Market Forecast 2025

Gaming Market Forecast 2025

By the end of 2024, the gaming content and services market reached a total value of $199.4 billion, representing a 3.5% year-on-year increase. However, when accounting for inflation, the real growth was less significant. Ampere Analysis forecasts a continuation of modest expansion over the next two years, with projected growth of 0.9% in 2025 and 2.2% in 2026. The total market is expected to reach $205.7 billion by the close of 2026.

Mobile gaming maintained its dominant position within the industry, comprising 58% of total market revenue. It experienced a 4.1% increase in 2024, with a projected growth rate of 2% to 3% annually over the next few years. While the PC segment recorded the highest growth rate at 5.7% in 2024, it remains smaller in absolute terms compared to both mobile and console gaming. Nonetheless, its global accessibility continues to drive optimism for its long-term potential.

The console segment did not grow in 2024 and is expected to remain flat until at least 2026. Ampere Analysis attributes much of this stagnation to the delay of GTA VI, originally expected to contribute significantly to game and hardware sales. The report estimates that the delay will result in 21 million fewer game copies sold on PlayStation 5 and Xbox Series S|X, a reduction of 700,000 units in console hardware sales, and a $2.7 billion shortfall in overall console segment revenue.

Gaming Market Forecast 2025

Consumer Spending and Monetization Trends

In-app purchases accounted for 77% of all gaming-related payments in 2024, a proportion that has remained stable since 2019. The report also highlights a growing trend in subscription-based spending across various platforms, particularly in the console segment, which includes services such as PlayStation Plus and Game Pass. Conversely, physical game sales continue to decline and are projected to comprise only 2% of total industry revenue by 2026.

Investment in early-stage gaming ventures is beginning to recover after a significant downturn following the highs of 2021 and 2022. However, Ampere Analysis notes that the volume and frequency of investment deals remain subdued compared to past years, reflecting a more conservative investor outlook.

Gaming Market Forecast 2025

Regional Market Dynamics

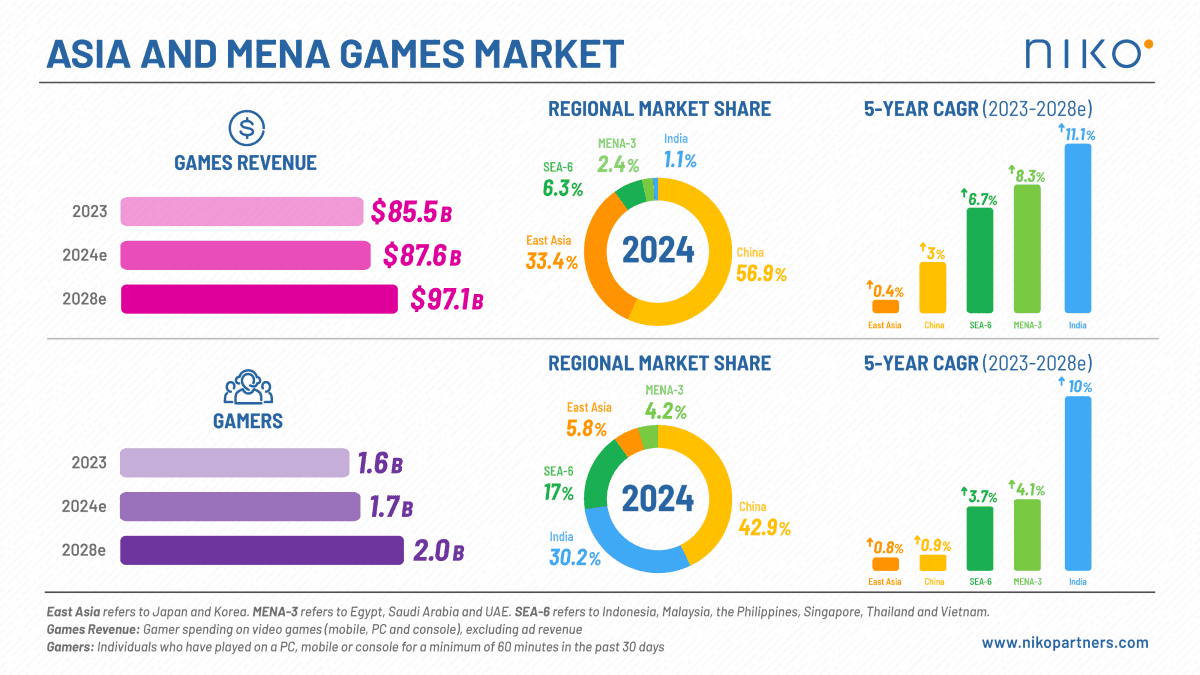

The Asia-Pacific region remains the largest gaming market globally, generating $92.9 billion in 2024—nearly double the $57.7 billion produced by the North American market. Growth is expected to continue in Asia-Pacific through 2025. In contrast, both the North American and European markets are forecasted to decline slightly by 0.4% year-on-year in 2025. The MENA region, particularly Saudi Arabia and the United Arab Emirates, is projected to see the highest regional growth at 6.3% year-on-year, while Southeast Asia also presents substantial market opportunities.

Gaming Market Forecast 2025

Audience Shifts and Demographic Trends

In the United States, the number of active gamers declined from a peak of 223 million in 2021 to 202 million in 2024. This drop brought the proportion of the gaming population down from 67% to 59%. Nevertheless, the overall market value has increased during this time, indicating higher average spending per user. Among younger demographics, 16 million American females aged 16 to 24 are identified as active gamers, with 82% of them playing games.

This is slightly lower than the 93% participation rate among males in the same age group. On average, young women play four hours less per week than their male counterparts and spend around 50% less.Older gamers are also becoming a more prominent audience segment. There are currently 33 million gamers in the U.S. over the age of 55, which represents 32% of the population in that age group.

This demographic is expected to grow further by the end of the decade. Meanwhile, over 35 million U.S. gamers are under the age of 16, many of whom are active on platforms that prioritize user-generated content (UGC), such as Roblox, Fortnite, and Minecraft. Notably, 63% of Roblox players in the U.S. are aged 13 or older, which challenges long-standing assumptions about the platform's user base.

Gaming Market Forecast 2025

Development Strategies and Market Adaptation

The report emphasizes that speed and efficiency in game development are becoming increasingly important. Long development cycles are seen as risky, especially in a market where trends and audience expectations can shift rapidly. Ampere Analysis does not provide a definitive recommendation on whether developers should prioritize single-player or multiplayer formats, noting that player preferences vary significantly across different regions.

In terms of content, there is growing interest in games that incorporate local myths, histories, and cultural narratives. This reflects a broader trend of audience engagement with unique, regionally grounded stories that differ from mainstream Western game design templates.

Gaming Market Forecast 2025

Nintendo Switch 2 vs Steam Deck

New hardware and emerging technologies also present potential growth areas. The Nintendo Switch 2 is expected to sell a cumulative 103.1 million units worldwide by 2030. Combined with the current Switch model, the active user base could reach 130 million between 2026 and 2029. However, Nintendo continues to lag behind its competitors in monetization, capturing only 4% of the total in-game purchase and downloadable content revenue. In comparison, Sony holds 65% of this market, while Microsoft accounts for 31%.

The Steam Deck, a portable PC gaming device, has sold 4.1 million units as of the end of 2024. That figure is expected to nearly double to 7.9 million by 2027. Ampere Analysis suggests that developers consider adding support for portable PCs where technically feasible, given the growing user base.

Additionally, web games, web gaming platforms, and direct-to-consumer (D2C) distribution models are becoming increasingly important. Excluding China, these platforms are forecasted to generate an additional $3.7 billion in revenue for mobile games by 2025. While D2C platforms may not expand the total audience, they offer more effective conversion and monetization options.

Gaming Market Forecast 2025

Final Thoughts

Ampere Analysis presents a nuanced picture of the global gaming market heading into 2025. While overall growth is expected to be limited, regional variations and emerging technologies offer new opportunities. The delay of high-impact titles like GTA VI and the ongoing transformation of the console segment will shape near-term performance. Meanwhile, mobile and PC gaming continue to evolve, driven by shifts in consumer behavior, demographic changes, and the rise of platforms such as web and UGC environments. Developers and publishers looking to succeed in this environment will need to remain adaptable, data-driven, and regionally aware in both strategy and execution.