The landscape of gaming continues to evolve at a rapid pace, fueled by advancements in technology, changing consumer preferences, and innovative development practices. In a comprehensive report unveiled by Unity, one of the leading players in the game industry, insights from various platforms shed light on the evolving landscape of gaming in 2024.

Drawing data from Unity Engine, Unity Cloud, and ironSource, along with a survey of over 7,000 respondents, the report outlines five key trends shaping the industry. In this article, we explore the latest insights from Unity's 2024 report on gaming trends, including AI integration, evolving monetization strategies, the rise of cross-platform projects, and relevance to web3.

Key Trends Covered

- Developers are integrating AI into their processes to accelerate development.

- Studios are changing their approaches to monetization. More attention is being paid to advertising amid the decline in IAP revenue.

- Studios of all sizes are releasing more cross-platform projects.

- Developers are prioritizing multiplayer projects despite the complexity of their development.

- Developers are now trying to build strong franchises rather than just games.

Increased Use of AI

Integration of AI Accelerates Development

One prominent trend highlighted in the report is the increasing integration of Artificial Intelligence (AI) into game development processes. As development timelines expand, with the average development time rising from 218 days in 2022 to 304 days in 2023, studios are turning to AI to expedite processes. From improving animations to generating art and levels, AI finds applications across various stages of development, though challenges such as time constraints and technical skill gaps persist.

In recent years, the average duration of game development has seen a notable uptick, rising from 218 days in 2022 to 304 days in 2023. Studios are actively exploring innovative avenues to streamline their processes, although they encounter persistent challenges along the way.

Research indicates that 40% of developers invest substantial time in research and development (R&D) phases. Additionally, 37% grapple with the integration of emerging technologies, while 31% find it difficult to uphold project timelines and scopes amidst the adoption of these advancements.

Key areas where AI is frequently applied in game development include enhancing animations (46%), automating code writing tasks (37%), generating art and levels (36%), crafting narrative elements (36%), conducting automated playtests (36%), adapting difficulty levels dynamically (35%), and moderating voice and text chats (33%).

For the vast majority of studios (96%), prototyping consumes less than three months, with a notable subset (42%) completing this phase in under one month. Additionally, 68% of respondents affirm that AI significantly accelerates the prototyping process. This observation is substantiated by data from 2022, revealing that 85% of studios were able to prototype within the three-month timeframe.

Among studios incorporating AI into their workflows, 56% leverage the technology for world-building purposes. This encompasses various popular applications such as crafting non-player characters (NPCs), generating distinctive gameplay moments, implementing speech recognition features, and providing contextual NPC responses.

AI finds its most frequent utilization among various segments of the gaming industry, notably among AR/VR developers (29%), multiplayer game creators (28%), casual game developers (27%), open-world projects (25%), and RPG games (25%). Primary hurdles encountered during the integration of AI include time constraints (43%), insufficient technical expertise (24%), and a lack of awareness regarding the capabilities of AI (20%).

According to developer surveys, the majority of studios possess relatively modest asset bases, with 51% having fewer than 1000 assets. Additionally, 35% manage asset volumes ranging from 1001 to 5000, while 9% handle between 5001 to 50,000 assets, and 5% manage over 50,000 assets. Notably, 20% of respondents report spending more than 4 hours per week organizing their asset libraries. AI stands poised to offer significant assistance in addressing this challenge.

Mobile Market Status and Revenue

Shift in Monetization Strategies

Amid a decline in In-App Purchase (IAP) revenue, studios are reevaluating their monetization strategies, placing more emphasis on advertising. According to the report, attention is shifting towards advertising revenue, which experienced significant growth compared to IAP revenue. This shift reflects a broader trend in the industry as studios adapt to changing player preferences and market dynamics.

Based on Unity data, mobile game DAU (Daily Active Users) experienced a 4.5% increase in 2023 compared to the previous year. However, the average figures for D1 Retention decreased by 1%, and D7 Retention saw a slight decline of 0.1%. In terms of revenue, there was a notable decline in IAP (In-App Purchase) revenue, with the median IAP ARPDAU (Average Revenue Per Daily Active User) dropping from $0.018 in 2022 to $0.015 in 2023, marking a 13% decrease.

Furthermore, the percentage of paying users in mobile games showed a continuous annual decrease: from 0.7% in 2021 to 0.5% in 2023. However, the behavior of paying users has remained consistent over time, with an average of 1.46 transactions per paying user. Additionally, the average revenue per transaction increased from $7.89 in 2022 to $8.15 in 2023.

In contrast, advertising revenue experienced significant growth, surging by 26.7%. The IAA (In-App Advertising) ARPDAU rose from $0.03 in 2022 to $0.038 in 2023. Among different game genres, simulation games, casual projects, and puzzles witnessed substantial growth in IAA revenue.

On the other hand, IAP revenue increased solely for RPGs and shooters, while other genres experienced declines. Unity data also suggests that projects featuring Rewarded Video and offerwalls tend to have more daily sessions, averaging 3.12, compared to projects with only Rewarded Video (2.62), only offerwalls (2.58), or neither (2.1).

Unity's findings align with the observation that projects lacking additional monetization systems typically exhibit lower retention rates. Conversely, projects featuring comprehensive advertising monetization tend to demonstrate better performance in terms of user retention. This suggests a correlation between the sophistication of monetization strategies and overall user engagement and longevity within the game.

Please note: It is important to consider potential biases in the data analysis. Projects with more monetization mechanics often indicate larger teams working on bigger games, which could skew the findings. These projects might also incorporate numerous mechanics aimed at enhancing audience retention beyond just monetization strategies. Therefore, when interpreting the data, it's crucial to account for these factors and consider the broader context of game development and audience engagement strategies.

Cross-Platform Analysis

Rise of Cross-Platform Projects

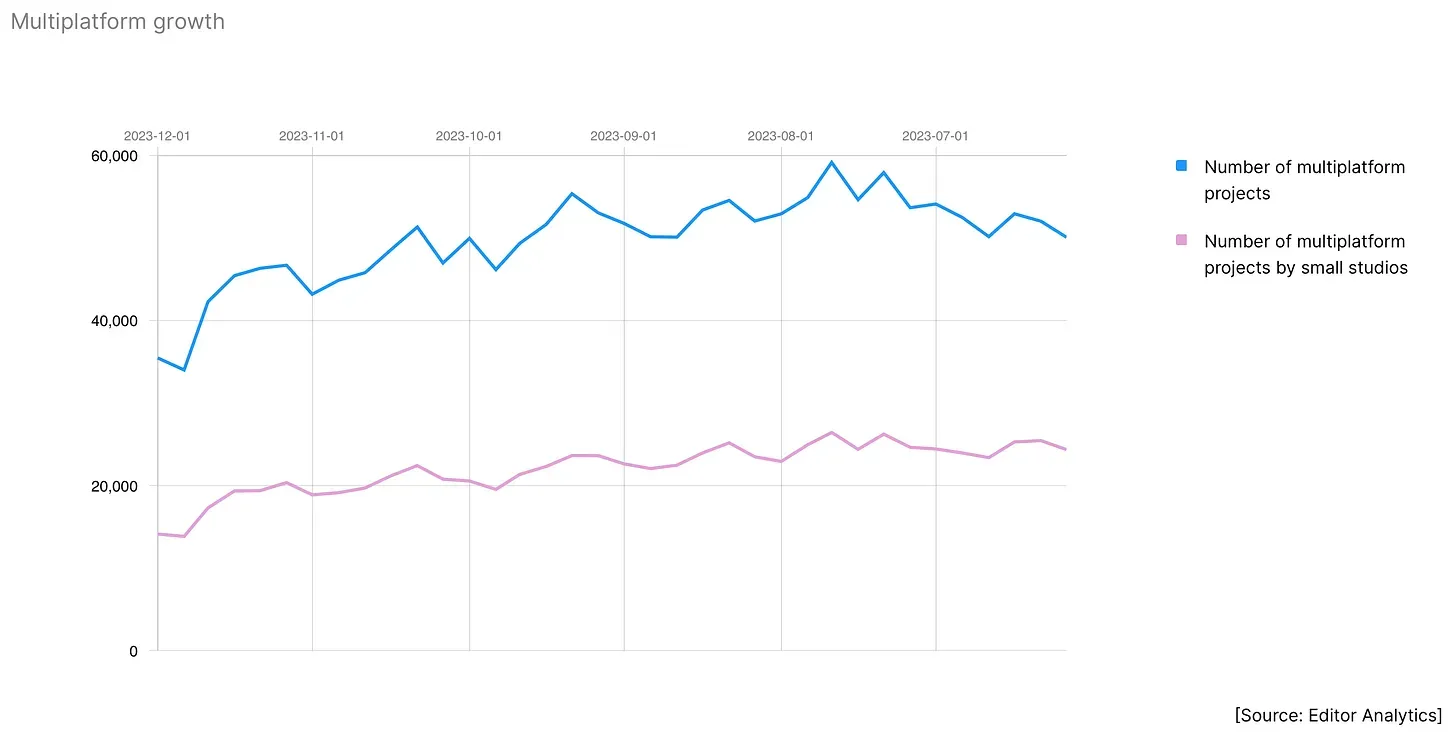

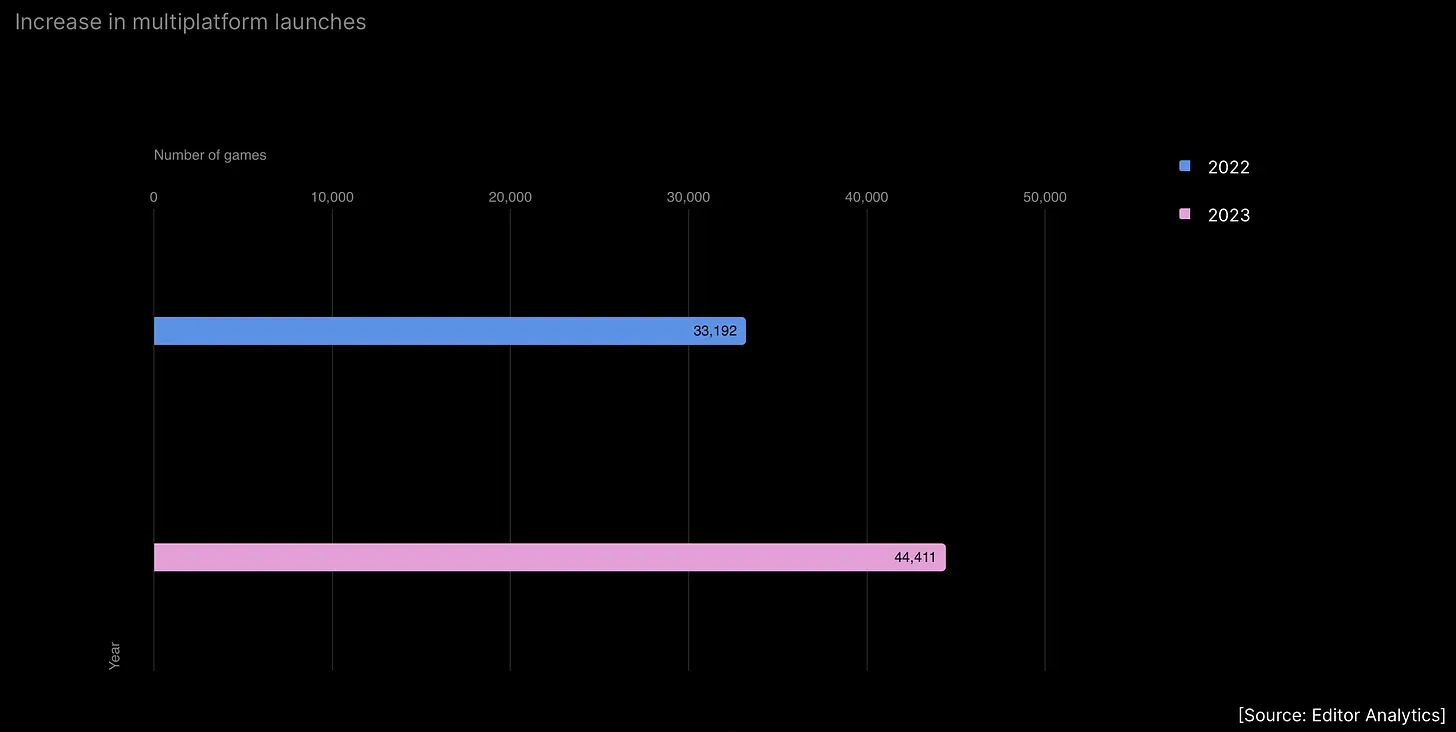

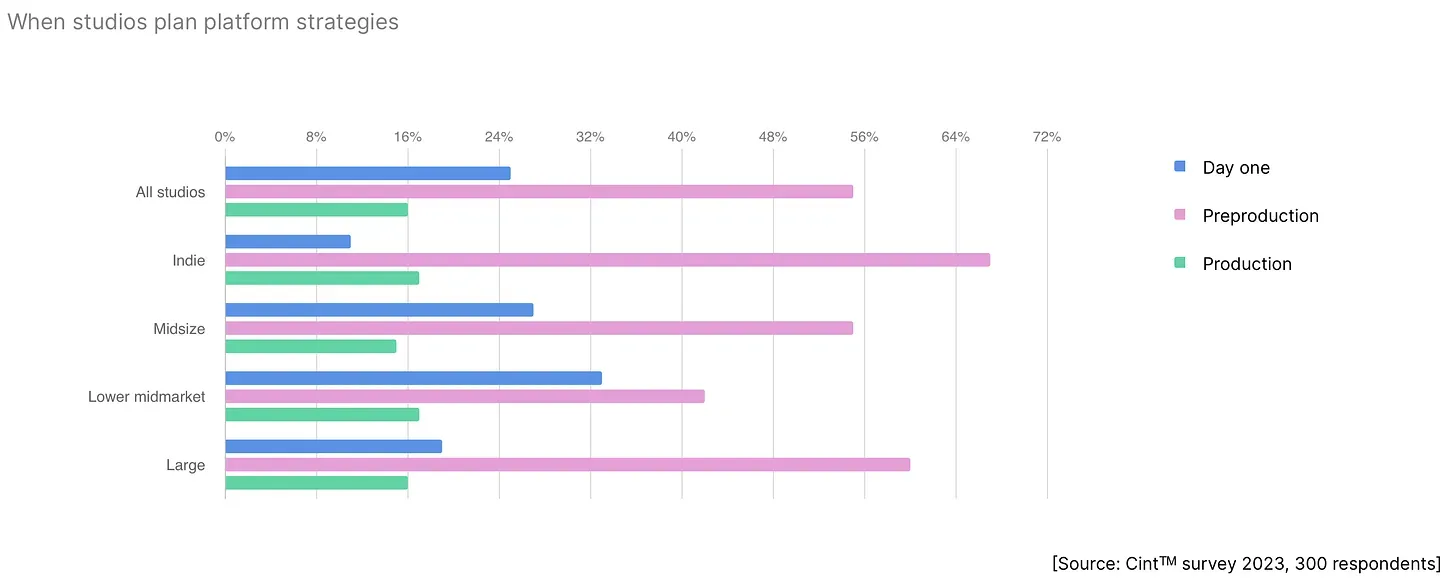

Another notable trend is the increasing prevalence of cross-platform projects. Studios of all sizes are embracing cross-platform support, with smaller studios witnessing a 71% increase in such projects since 2022. From RPGs to shooters, cross-platform support has become a common practice, allowing developers to reach wider audiences and enhance player experiences.

In 2023, there was a significant 34% rise in projects available on three or more platforms compared to the previous year.

Among studios with fewer than 50 employees, the primary platforms of focus are mobile (66%), PC (62%), and consoles (47%).

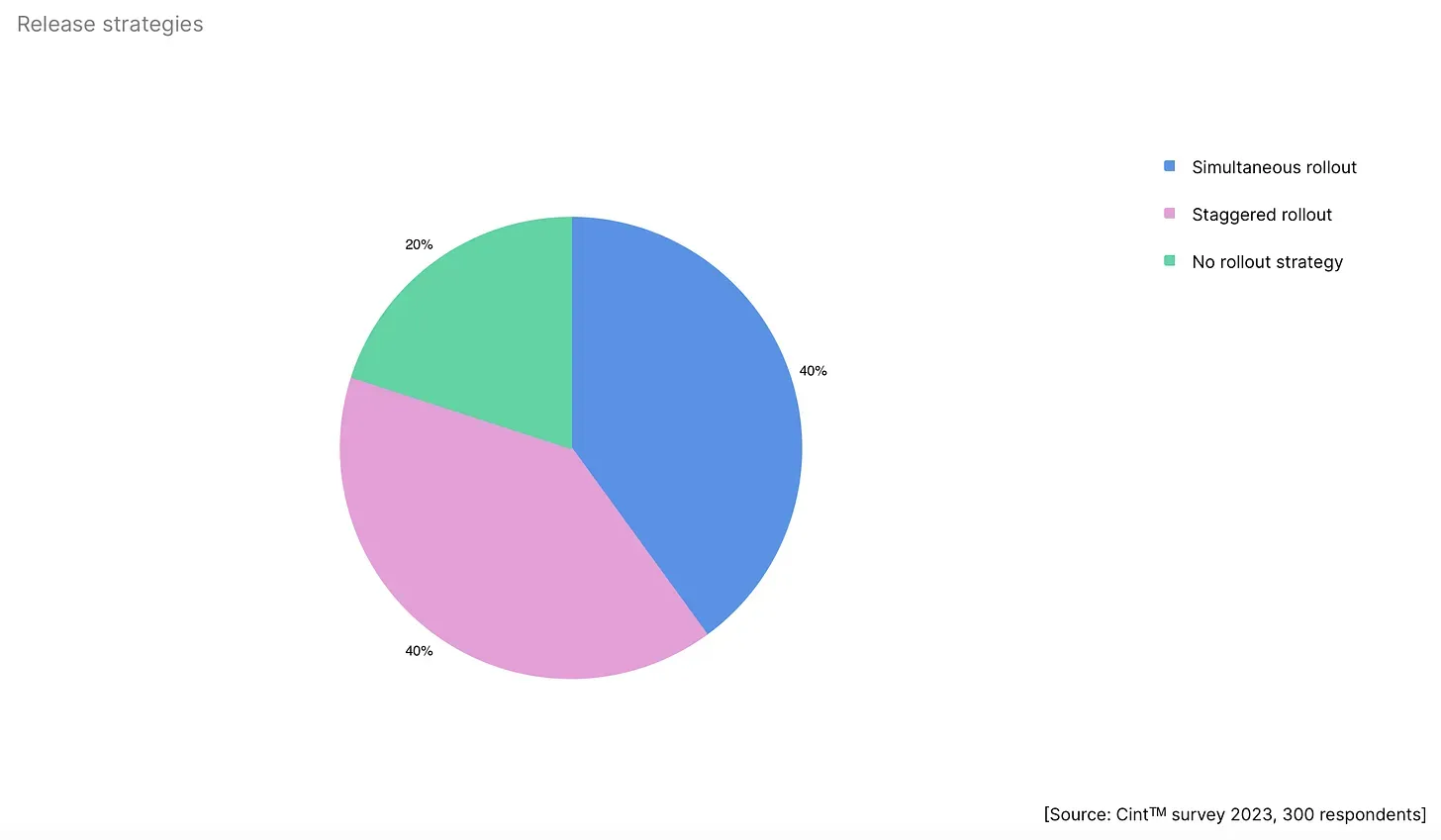

Regarding release strategies, 40% of studios launch their projects on all platforms simultaneously, another 40% opt for a gradual release approach, while 20% lack a specific strategy.

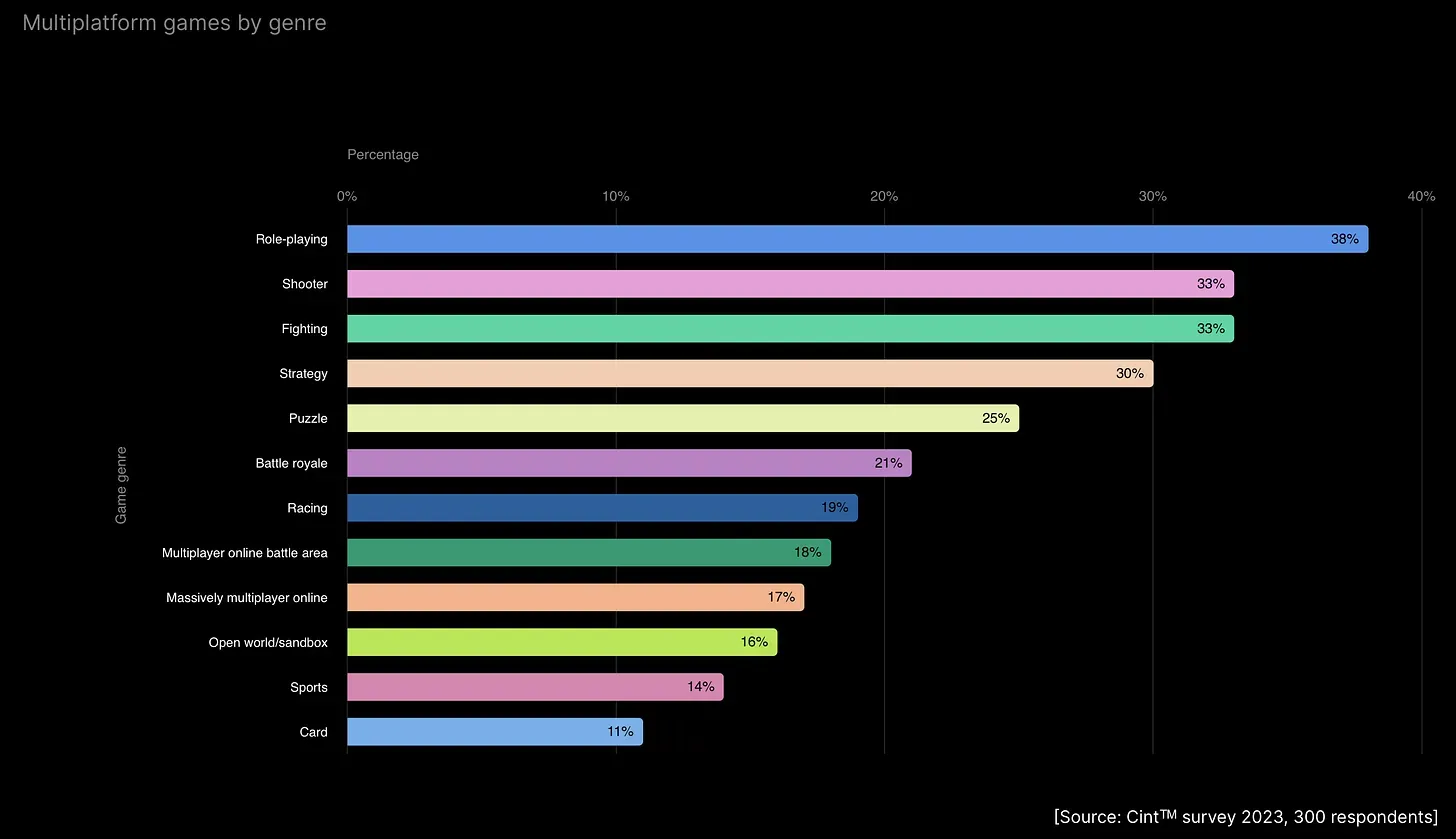

RPGs (38%), shooters (33%), fighting games (33%), and strategy games (30%) emerge as the most popular genres for cross-platform development.

Notably, larger studios are more inclined to implement cross-play features, with 95% of studios boasting over 50 employees adopting this approach.

Multiplayer Games

Focus on Multiplayer Development

Despite the complexity involved, developers are prioritizing multiplayer projects, driven by the higher engagement rates observed in multiplayer games. With mobile multiplayer games boasting a 40.2% higher Monthly Active Users (MAU) compared to single-player games, studios are investing resources in creating compelling multiplayer experiences, catering to evolving player expectations.

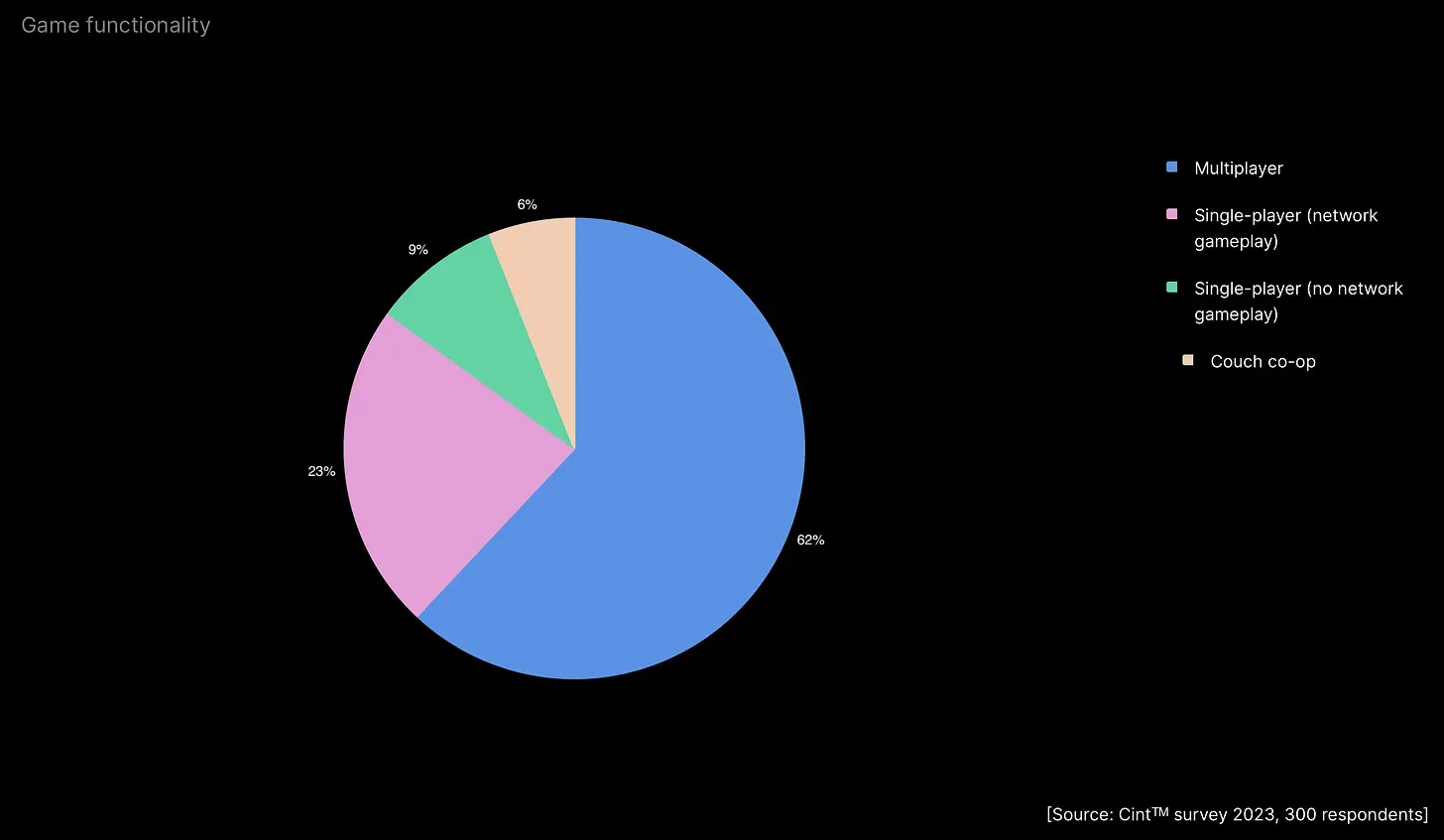

According to surveys, 68% of studios are actively engaged in multiplayer game development, with 6% dedicated to projects featuring cooperative gameplay on a single screen.

Furthermore, 69% of cross-platform games incorporate multiplayer functionality, while an additional 7% offer local cooperative play.

A noteworthy 62% of developers plan for multiplayer features during the idea or pre-production stages. Interestingly, 5% decided to incorporate multiplayer elements just before the game's launch.

The primary challenges encountered in managing the audience for multiplayer projects include limited budgets (53%), handling a large volume of feedback (47%), staffing constraints (44%), and technological limitations (43%).

Developers acknowledge that users expect certain features from multiplayer games, including free communication (38%), minimal lag (37%), fair matchmaking (34%), and shared progress (31%).

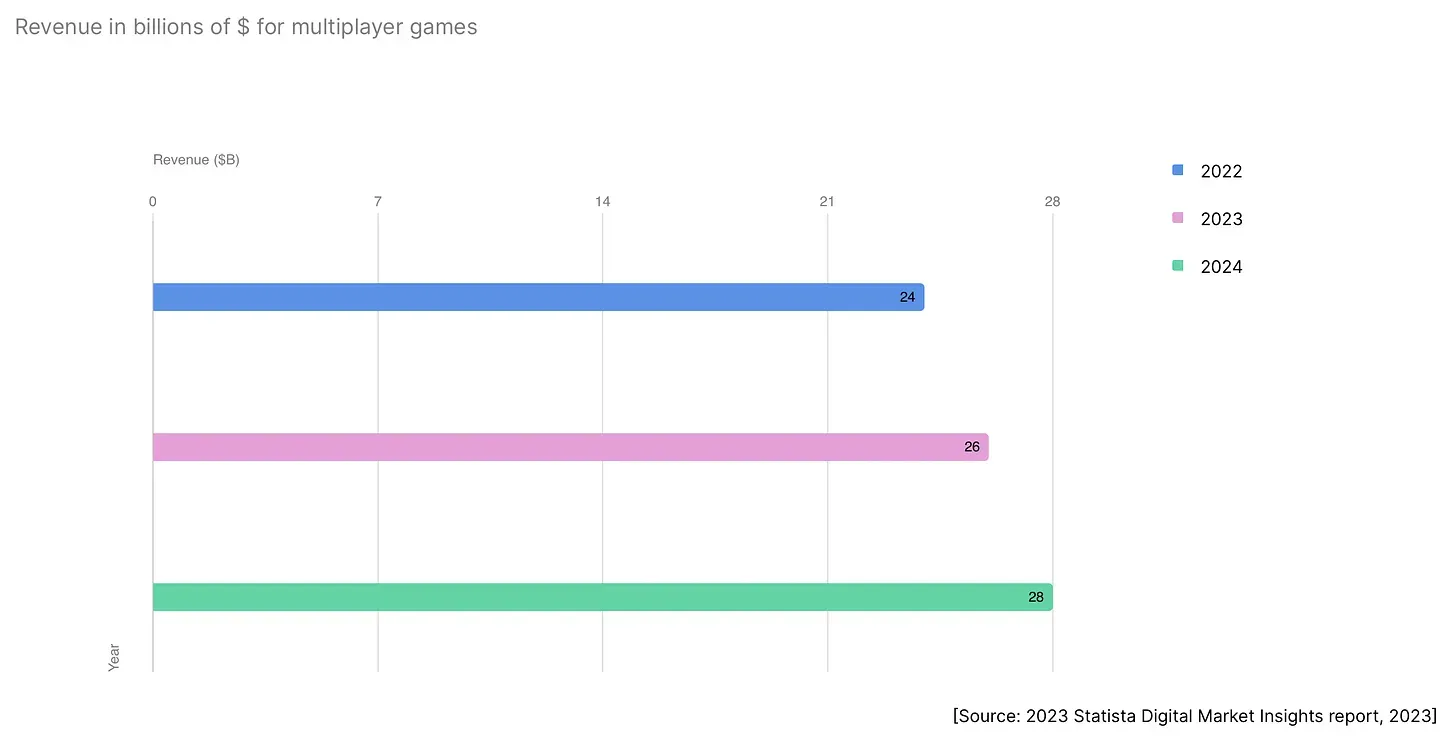

Moreover, revenue from multiplayer games is on a steady incline, with figures reaching $24 billion in 2022, $26 billion in 2023, and an anticipated $28 billion in 2024.

Developers and Live-Ops

Emphasis on Building Phases and State of Market

Before releasing their first public versions, a significant majority of developers (83%) have a clear understanding of how they will operate the game.

To tackle market challenges, studios adopt various strategies, including entering new markets with existing projects (53%), consistently generating new content (52%), seeking opportunities for enhanced efficiency (50%), diversifying game portfolios (47%), prioritizing player retention (35%), and investing in monetization and user acquisition (26%).

Regarding game support durations, 7% of games receive support for less than six months, 39% for six months to a year, 49% for one to two years, and 5% for three to five years.

Users' attention to toxic behavior in games is notable, with 46% of players choosing to block toxic users, while 34% opt to leave the game altogether.

Developers recognize various mechanics as effective for increasing retention, including daily missions and rewards (67%), achievements and challenges (59%), Rewarded ads and in-app purchases (40%), leaderboards (33%), and PvP (31%).

Looking ahead, 39% of developers are contemplating adding user-generated content to their games, while 27% have already implemented such features. However, 34% do not currently plan to incorporate player-generated content.

As the gaming industry continues to evolve, studios face both challenges and opportunities. From integrating AI to reimagining monetization strategies and embracing cross-platform and multiplayer development, the Unity Gaming in 2024 report provides valuable insights for developers navigating the dynamic landscape of gaming.

Relevance to Web3 Gaming

These findings hold significant implications for the rapidly evolving landscape of web3 gaming, where decentralized technologies and blockchain integration are reshaping traditional gaming paradigms. With a clear understanding of operational strategies before public release and a focus on market challenges such as player retention and monetization, developers are well-positioned to navigate the unique dynamics of web3 gaming ecosystems.

The emphasis on user-generated content, coupled with strategies to combat toxic behavior and enhance player engagement, aligns seamlessly with the principles of decentralization and community-driven experiences inherent to web3. Furthermore, the shift towards cross-platform development and multiplayer experiences underscores the importance of interoperability and inclusivity within decentralized gaming networks.

As web3 gaming continues to gain momentum, these insights provide invaluable guidance for developers seeking to leverage blockchain technology and decentralized architectures to create immersive, sustainable, and inclusive gaming experiences for the future.