Electronic Arts (EA) shareholders have approved the company’s $55 billion sale to a consortium led by Saudi Arabia’s Public Investment Fund (PIF). The all-cash deal, set at $210 per share, cleared a major step toward completing the takeover. Once finalized, the PIF will own 93.4% of EA, taking the company private after more than 40 years as a publicly traded entity.

The consortium also includes investment firms Silver Lake and Affinity Partners, both known for their technology-focused portfolios. EA first signed a definitive agreement with the group in September, making this the largest all-cash take-private deal in gaming history. The transaction is expected to close within six to nine months, pending final regulatory approvals.

PIF’s Expanding Role in the Gaming Industry

The PIF previously held approximately 10% of EA’s shares. The acquisition reflects the fund’s broader strategy of expanding its presence in the gaming sector, particularly through its investment in Savvy Games Group. By taking control of EA, the PIF significantly increases its footprint in the global games market, aligning with Saudi Arabia’s Vision 2030 plan to diversify the economy beyond oil.

Industry observers note that this move further demonstrates the growing role of sovereign wealth funds in gaming, particularly in acquiring major studios and intellectual property. For EA, the shift from a public to a private company may allow for long-term strategic changes and investment without the pressures of quarterly reporting.

What This Means for EA and the Gaming Community

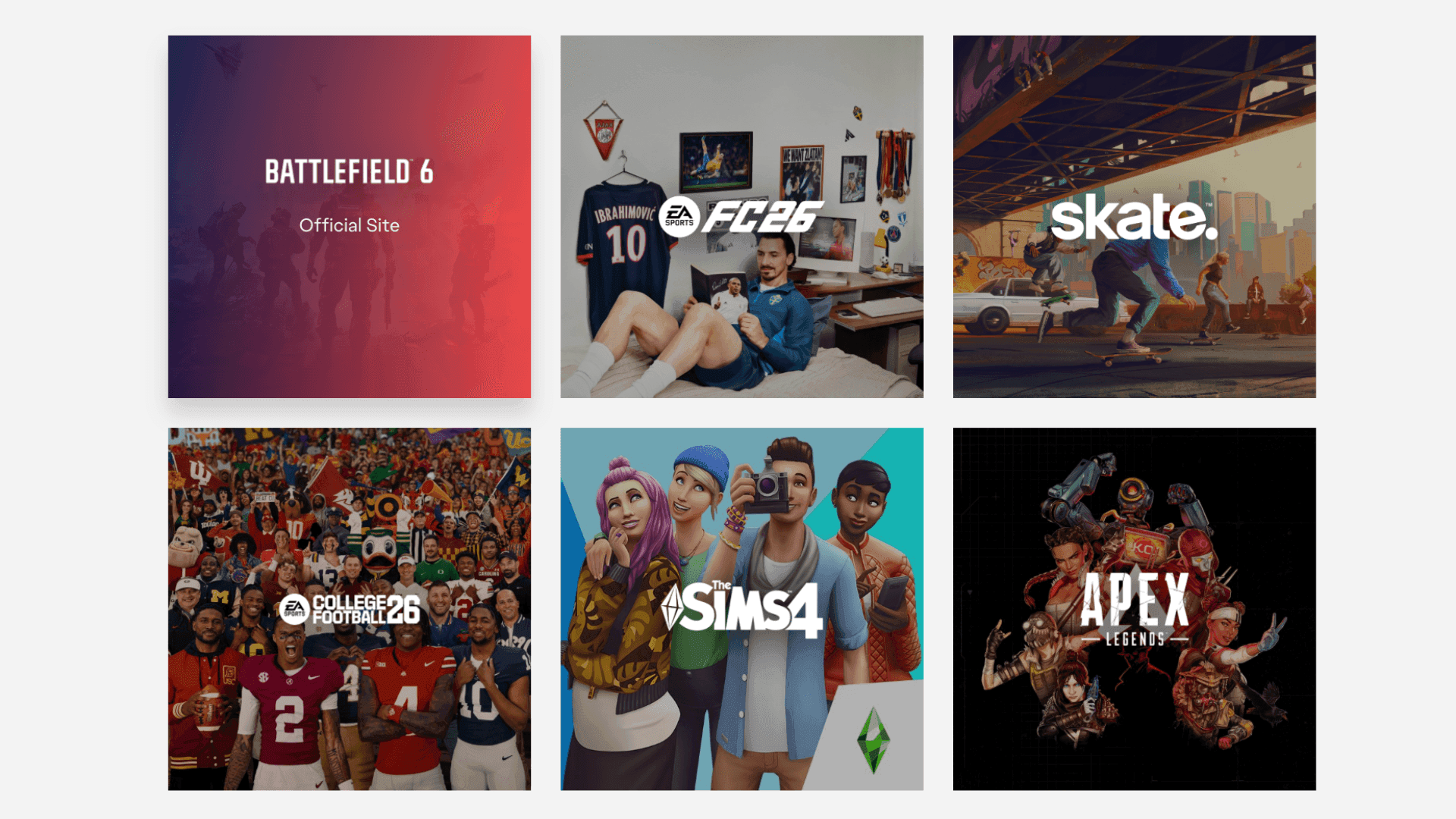

For EA, the acquisition represents a major transition. While the company’s portfolio of franchises, including FIFA, Madden, and The Sims, will remain under the EA brand, private ownership may influence future development strategies, partnerships, and publishing models. Additionally, the deal highlights the increasing intersection of global finance and the gaming industry, including potential opportunities in web3 and other emerging technologies.

Frequently Asked Questions (FAQs)

Who is buying Electronic Arts?

EA is being acquired by a consortium led by Saudi Arabia’s Public Investment Fund (PIF), with Silver Lake and Affinity Partners also part of the group.

How much is the acquisition worth?

The deal is valued at $55 billion, with EA shareholders receiving $210 per share in an all-cash transaction.

Will EA remain a public company?

No. Once the transaction is complete, EA will be taken private after more than 40 years as a publicly traded company.

When is the acquisition expected to close?

The deal is expected to close within six to nine months, subject to regulatory approval.

Why is Saudi Arabia investing in EA?

The acquisition aligns with the PIF’s strategy to expand its gaming industry presence and supports Saudi Arabia’s Vision 2030 plan to diversify the economy beyond oil.

How could this affect EA’s games?

While core franchises will continue, private ownership may influence development priorities, strategic partnerships, and potential investment in emerging technologies, including web3.