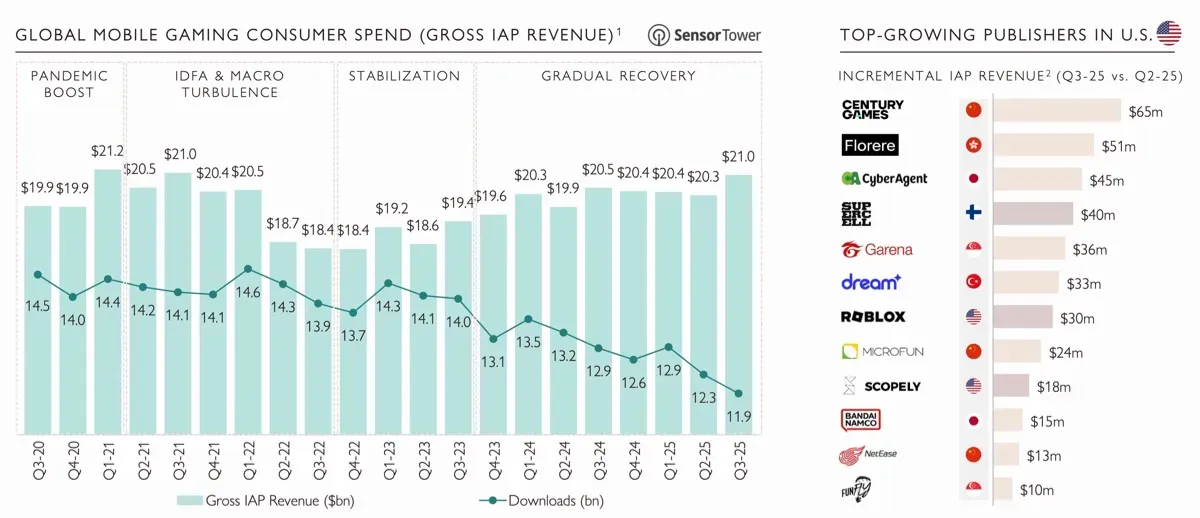

Aream & Co. has released its latest report on Q3 2025 gaming industry trends, highlighting record M&A activity, strong PC performance, declining mobile downloads, and private investment challenges. The global gaming industry experienced contrasting trends in Q3 2025, with record levels of in-app purchase (IAP) revenue coinciding with a decline in overall game downloads.

According to Sensor Tower, total downloads reached 11.9 billion, the lowest in the past five years, while IAP revenue hit a four-year high. This suggests that while fewer games are being installed, players who remain engaged are spending more on in-game content.

Biggest Gaming Deals in Q3 2025

Regulatory changes are expected to impact mobile revenue in the coming months. Starting October 22, U.S. developers will be allowed to integrate external payment methods on Google Play and inform users about purchasing options outside the store ecosystem, mirroring earlier changes implemented on iOS. Early experiments with Xsolla’s Buy Button on iOS demonstrated revenue increases of up to 120%, and similar results are anticipated on Android.

Asian developers led revenue growth in the U.S., with Century Games, Florere, and CyberAgent showing notable increases compared to Q2 2025. Publishers from China, Vietnam, and Cyprus dominated download numbers, while Pakistan’s publishers achieved a 27% year-over-year increase.

In terms of IAP revenue, China, the U.S., and Japan remain the strongest markets, highlighting the continued dominance of Asian companies in both revenue and audience expansion, in contrast with stagnating Western developers.

Biggest Gaming Deals in Q3 2025

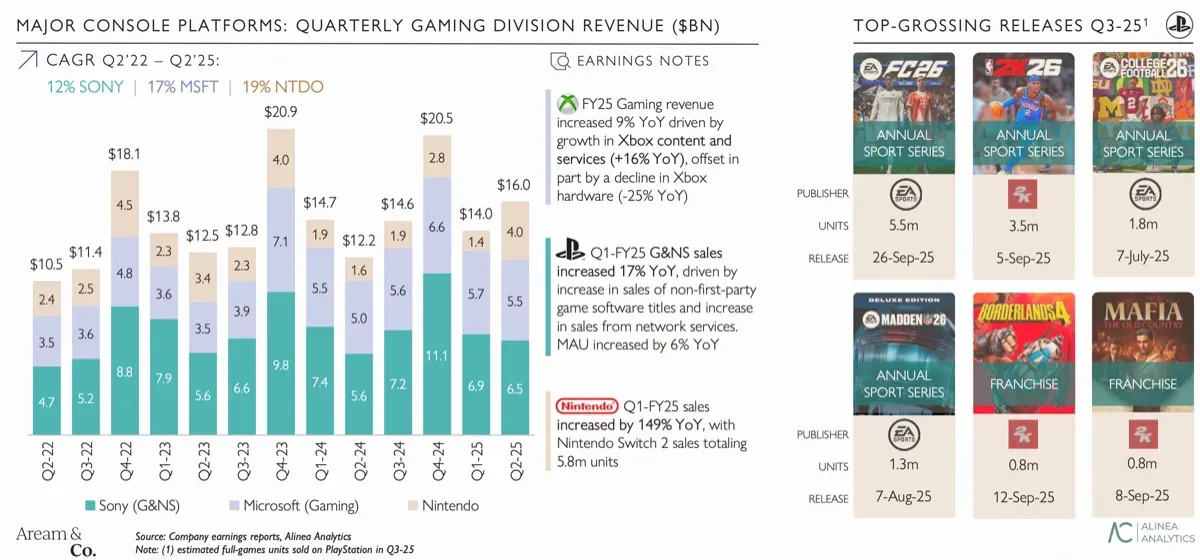

PC and Console Market Trends

The PC gaming market showed steady growth, with Steam posting its best quarter in five years. Total revenue for the platform reached $4.8 billion, with $3.7 billion coming from paid games. Major releases contributing to this performance included Borderlands 4, Dying Light: The Beast, and Hollow Knight: Silksong. Among these, only Wuchang: Fallen Feathers was a new IP not tied to an existing franchise.

Console performance was mixed. Nintendo achieved record sales with the Switch 2, while Xbox Series purchases fell 25% compared to the previous year. Sony remained stable, relying on franchise titles and sports games to maintain engagement. In terms of platform activity, Roblox outperformed Steam in concurrent users across its library, while Fortnite continued to see a decline in engagement. Streaming platforms are also seeing shifts in user behavior, with Kick emerging as a growing competitor to Twitch.

Biggest Gaming Deals in Q3 2025

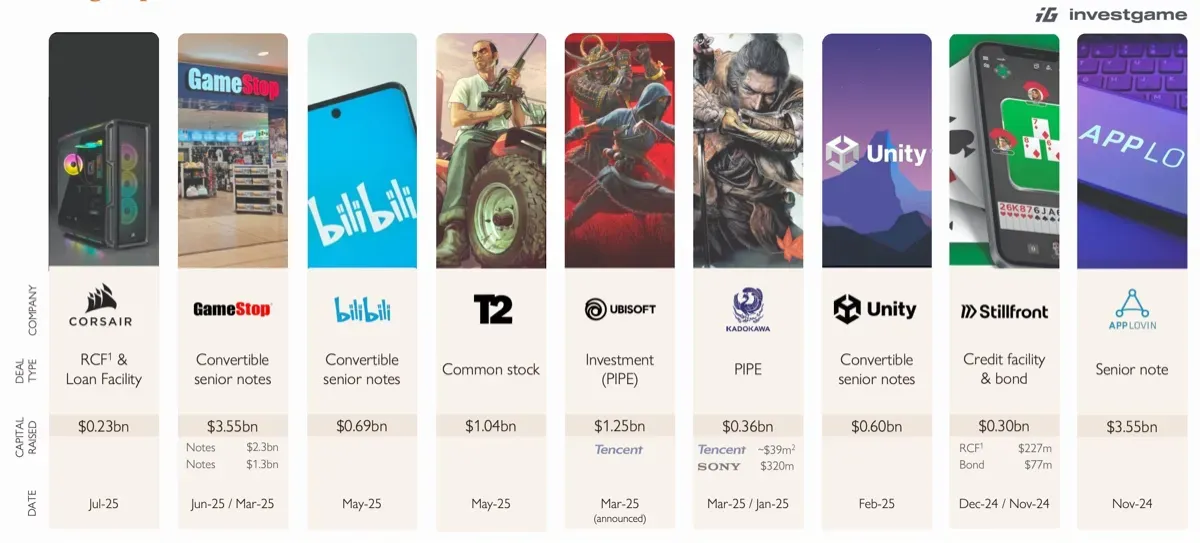

Mergers and Acquisitions

Q3 2025 was a notable quarter for mergers and acquisitions (M&A) in gaming. A total of 49 M&A deals were reported with an aggregate value of $56.9 billion, including the pending Electronic Arts acquisition. Excluding EA, significant deals included AppLovin’s acquisition of a gaming portfolio for $800 million, Sony’s 2.5% stake purchase in Bandai Namco for $464 million, and Prime Insights for $250 million.

Public market activity slowed in Q3 after a strong first half, with total deal volume for the first nine months reaching $10.4 billion, though the number of deals declined slightly compared to the previous year. Over the past five years, M&A activity has focused on established developers and publishers with proprietary intellectual property.

Valuation multiples for major deals such as EA and Activision Blizzard remained comparable, with EV/Revenue ratios between 7.4x and 7.6x and EV/EBITDA ratios of 20.8x to 21.2x. Private equity participation has also grown, particularly from Asian strategic investors including Tencent, Krafton, and Nazara, who are increasingly targeting Western gaming companies.

Biggest Gaming Deals in Q3 2025

Public Market Performance

Gaming companies listed on public markets underperformed the Nasdaq over the past 2.5 years, with an overall increase of 118% for the Nasdaq compared to 84% for diversified gaming holdings. Large, diversified companies such as Nintendo, Sony, Electronic Arts, Bandai Namco, and Tencent showed greater resilience to market fluctuations.

PC and console developers like Capcom, Embracer Group, Ubisoft, and Square Enix saw index growth of 22% since January 2023, while mobile companies faced declining valuations. Western mobile publishers decreased 38% in value, and Asian mobile developers fell 2% over the same period.

Valuation multiples further reflect these trends. Western mobile companies traded at 4.5x EV/NTM EBITDA, Asian mobile companies at 10.1x, and PC/console developers at 14.2x. Diversified gaming holdings maintained the highest multiples at 16.2x EV/NTM EBITDA, demonstrating strong investor confidence in companies with diverse portfolios.

Biggest Gaming Deals in Q3 2025

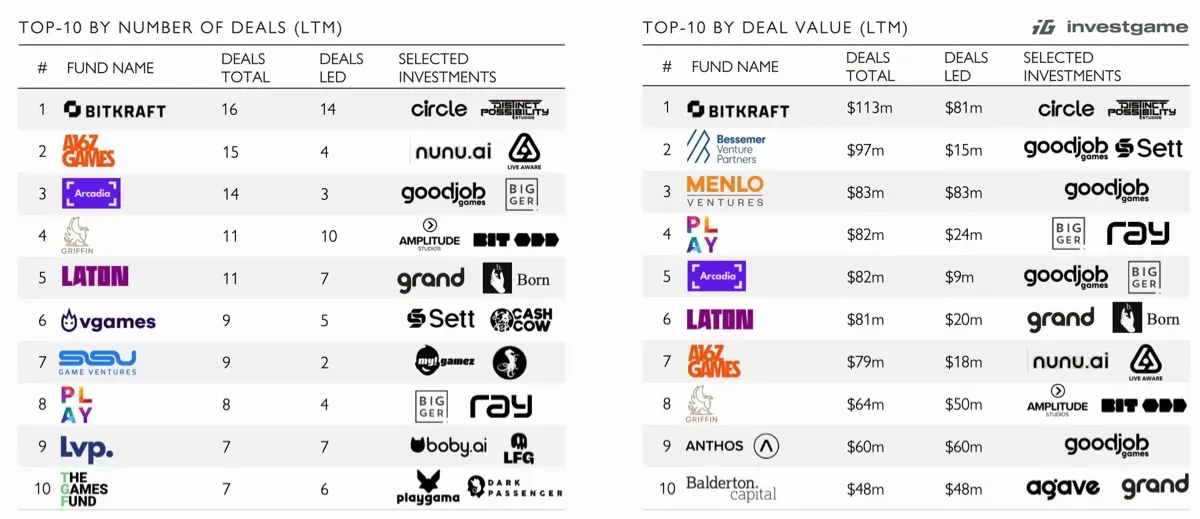

Private Investment Challenges

Private investment in the gaming industry continued at historically low levels in Q3 2025. The first nine months of the year saw $1.5 billion invested across 265 deals, a 63% decline from the previous year. Early-stage funding, particularly pre-seed and seed rounds, accounted for $0.5 billion across 125 deals, while Series A funding fell to $0.3 billion across 22 deals, reaching a five-year low.

Despite these challenges, certain companies in services and technology-related gaming sectors saw larger investments. Viture, Decart, and Appcharge collectively raised $258 million in Series B rounds. Leading investors over the past 12 months include Bitkraft, A16Z Games, Arcadia, Bessemer Venture Partners, and Menlo Ventures.

Biggest Gaming Deals in Q3 2025

Future Outlook

The Q3 2025 report highlights a gaming industry at a crossroads. Record M&A activity and strong PC performance contrast with declining mobile engagement and historically low private investments. Asian developers continue to expand in both revenue and audience share, while Western mobile companies face increasing pressure.

Regulatory changes on mobile payment methods and emerging platforms like Kick could influence market dynamics in the coming months, offering opportunities for diversification and revenue growth.

Frequently Asked Questions (FAQs)

What was the overall state of the gaming market in Q3 2025? The gaming market saw record in-app purchase revenue despite declining global game downloads. PC and console platforms performed strongly, while mobile downloads and engagement continued to fall.

Which regions led revenue growth? Revenue growth was led primarily by Asian developers, particularly from China, Japan, and Pakistan. Western developers experienced stagnation in both revenue and active user numbers.

How did M&A activity perform in Q3 2025? M&A activity remained robust, with 49 completed deals totaling $56.9 billion. Major transactions included AppLovin’s portfolio acquisition and Sony’s stake in Bandai Namco. Asian strategic investors showed increasing interest in Western gaming companies.

What trends are visible in private investment? Private investment reached historically low levels, totaling $1.5 billion across 265 deals in the first nine months of 2025. Early-stage and Series A funding were particularly affected, showing significant declines.

How are public gaming companies performing? Public gaming companies showed mixed results. Diversified holdings such as Nintendo, Sony, Electronic Arts, Bandai Namco, and Tencent demonstrated resilience, while Western mobile companies experienced sharp declines. PC and console developers maintained stronger valuations overall.

What upcoming changes could impact the mobile market? Starting October 22, U.S. developers will be able to integrate external payment methods on Google Play. This change could boost revenue opportunities and alter the competitive landscape for mobile gaming.