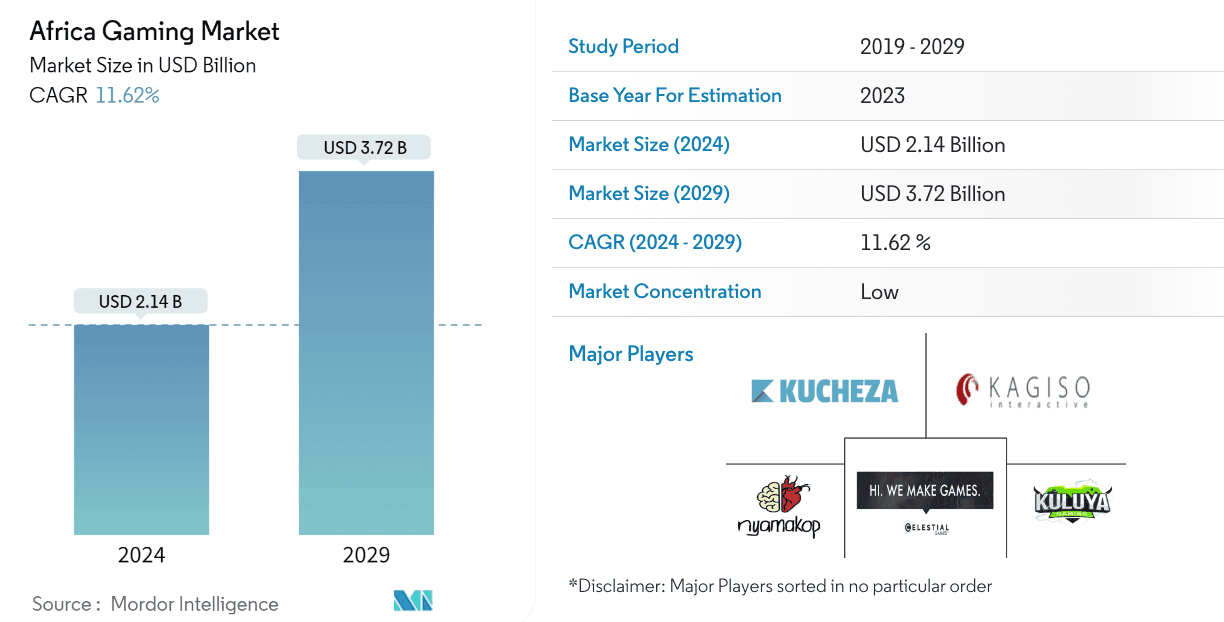

The African gaming market is experiencing rapid growth, fueled by the continent's increasing internet connectivity, widespread smartphone adoption, and a dynamic, youthful population. In 2024, the market size is projected at approximately USD 2.14 billion, with an anticipated increase to USD 3.72 billion by 2029, reflecting a compound annual growth rate (CAGR) of 11.62% over the forecast period (2024–2029). A range of technological advancements and demographic trends are driving this growth, positioning Africa as one of the fastest-growing gaming markets worldwide.

Africa Gaming Market to Hit $3.72 Billion by 2029

Key Drivers of Growth

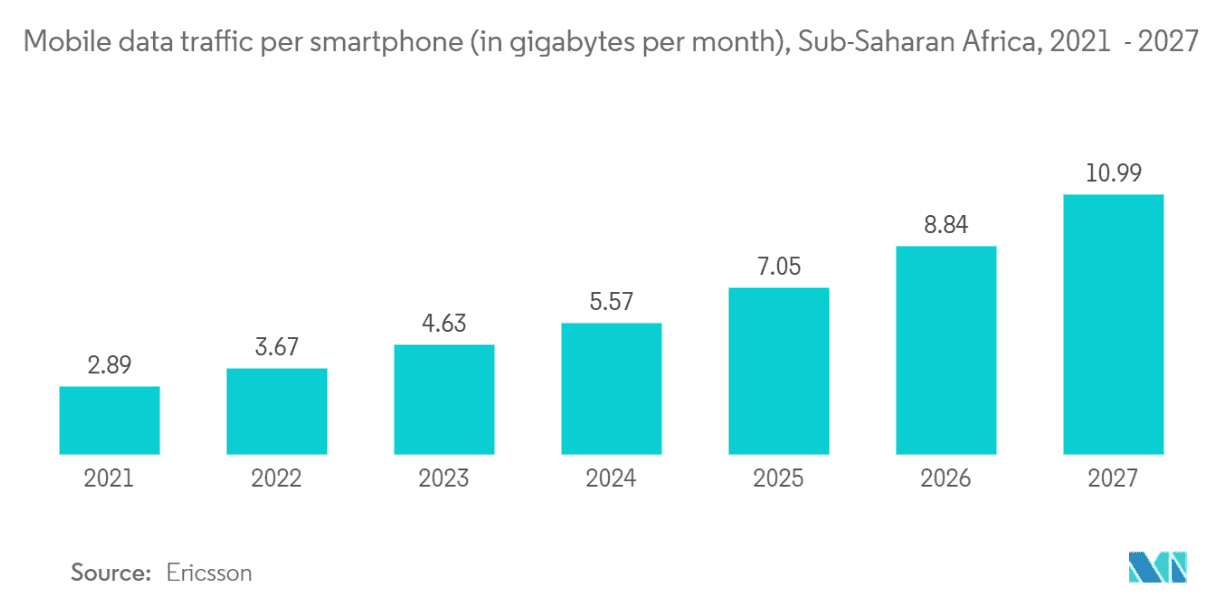

Mobile Technology and Internet Penetration

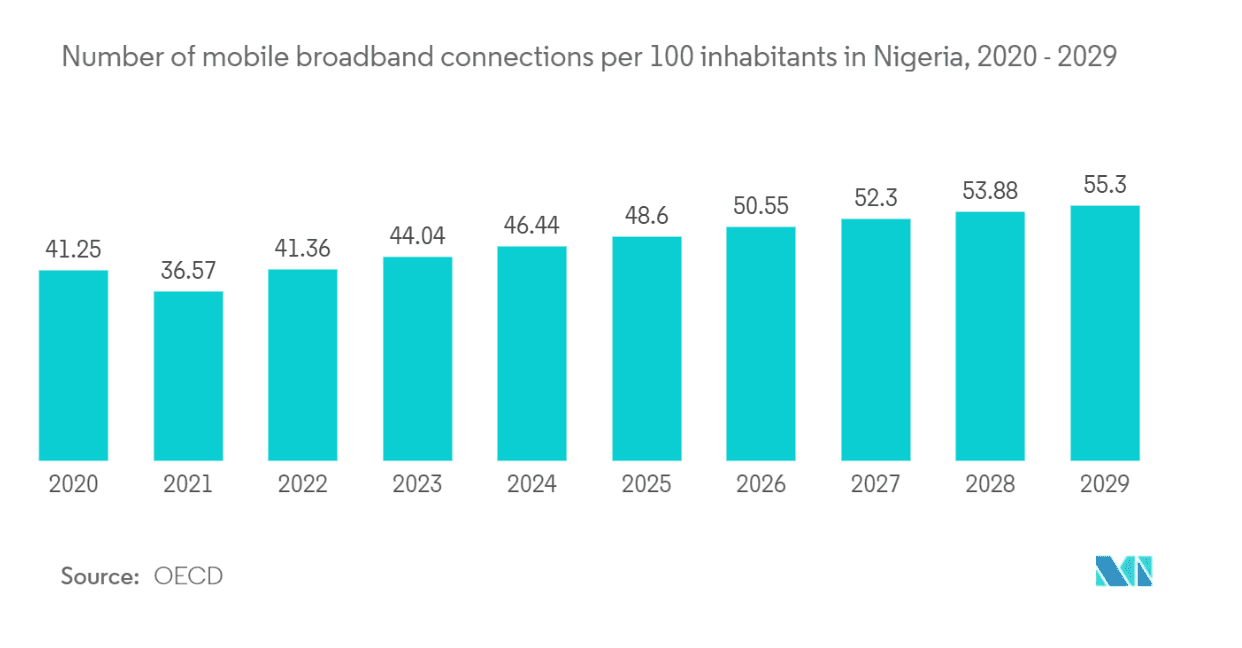

The expansion of mobile technology and rising internet accessibility are two primary forces behind the rapid adoption of gaming across the African continent. With the introduction of high-bandwidth networks like 4G and 5G, particularly in Sub-Saharan and North Africa, millions of new users are entering the gaming ecosystem. The GSMA forecasts nearly 700 million mobile subscribers in Sub-Saharan Africa by 2030, with Nigeria and Ethiopia contributing to a significant portion of this growth. North Africa has similarly high rates of mobile usage, with 290 million mobile phone users, further expanding the region's gaming potential.

Youth Demographic Advantage

Africa is home to one of the youngest populations globally, a trend expected to continue over the next few decades. According to United Nations projections, the African youth population (ages 0–24) is anticipated to grow by 50% by 2050. This large, tech-savvy youth segment is a primary consumer base for digital gaming, making the continent an attractive market for gaming companies looking to tap into emerging markets. Nigeria, in particular, is witnessing a significant expansion in its gaming industry due to its large, youthful population and increasing internet penetration.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic accelerated digital engagement, as lockdowns and restrictions on movement led to a surge in online gaming. With traditional forms of entertainment temporarily unavailable, gaming became a popular alternative, resulting in increased downloads and player engagement. This trend marked a turning point for digital gaming in Africa, solidifying its role as a staple of entertainment across various demographics.

Africa Gaming Market Size 2024 vs 2029

Market Characteristics and Segmentation

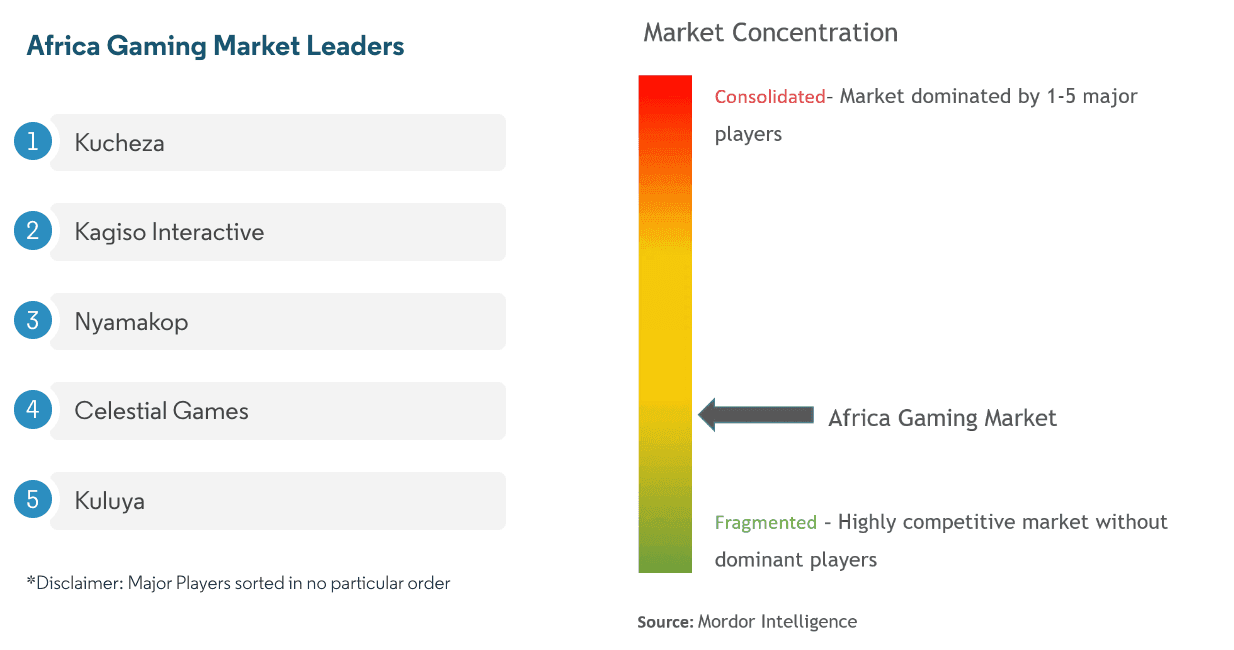

The African gaming market is highly fragmented, with numerous small players contributing to a diverse gaming landscape. The market encompasses various platforms, including mobile devices, PCs, tablets, gaming consoles, and browser-based games. Notably, mobile gaming has gained the most traction due to the widespread availability and affordability of smartphones. This segmentation illustrates the diversity of gaming preferences across Africa, with mobile gaming leading in accessibility and engagement.

The market segmentation across platforms includes:

- Mobile Games: Dominant across the continent due to the prevalence of smartphones and tablets.

- PC and Browser Games: Popular among certain demographics, especially in regions with stable internet connections.

- Console Games: A smaller segment but growing steadily as disposable incomes increase.

Mobile Data Traffic Per Smartphone 2021-2027

Key Players and Investment Trends

The market's growth is supported by various technological investments and partnerships aimed at enhancing gaming experiences. Companies such as MediaTek are launching gaming-focused smartphones, while partnerships with major tech firms aim to provide robust cloud gaming options. Noteworthy names include Kucheza, Kagiso Interactive, Nyamakop, Celestial Games, and Kuluya.

Social gaming and free-to-play models are also gaining traction, with these frameworks making games accessible to broader audiences while encouraging engagement. These developments, coupled with continued investments in mobile gaming infrastructure, offer significant opportunities for both new entrants and established companies.

Key developments in the regional market are as follows:

- Microsoft, via its Africa Transformation Office (ATO), unveiled the second iteration of the Xbox Game Camp in Africa. This initiative was designed to enhance local developer talent and accelerate the growth of the regional gaming industry.

- Sony, through its venture arm, the Sony Innovation Fund, made an undisclosed investment in Carry1st, a video game studio located in Cape Town, South Africa. This strategic partnership was intended to unlock a host of commercial opportunities for both entities.

Africa Gaming Market Leaders

Challenges in the African Gaming Market

While growth prospects are promising, the African gaming industry faces several challenges. Addressing these challenges will be essential for sustainable growth in the market, as companies work to create secure, accessible, and diverse gaming ecosystems.

- Piracy and Regulatory Issues: The prevalence of unlicensed gaming content and varying regulations across countries may create obstacles for market expansion.

- Concerns Over Fraud and Data Security: As online gaming transactions increase, ensuring secure, fraud-free payment systems is essential to maintain user trust.

- Infrastructure Disparities: While internet connectivity is on the rise, rural areas still lag behind in high-speed access, which can hinder the reach of online gaming.

Number of Mobile Broadband Connections per 100 Inhabitants 2020-2029

Future Outlook and Opportunities

The future of gaming in Africa is optimistic, with ample opportunities for both new and established players. As more consumers gain access to internet-enabled devices and mobile penetration increases, the demand for digital gaming will likely continue to rise. The social gaming and free-to-play models are expected to remain popular, making digital gaming accessible to a wider range of users. Additionally, innovations in cloud gaming and partnerships with technology firms are poised to enhance the gaming experience further, attracting new users and increasing market engagement.

With mobile technology and connectivity infrastructure continuing to advance, Africa is positioned to become a major player in the global gaming industry. The continent’s young population, combined with improved internet accessibility, presents a unique market landscape that companies can leverage to drive growth and foster a vibrant digital gaming community across the region.

Source: mordorintelligence