African Gaming Industry to Surpass $1 Billion in 2024

African gaming market to exceed $1 billion in 2024, with smartphone gaming accounting for 92% of players. Insights on key trends and preferences shaping the rapidly expanding gaming scene in Africa.

Eliza Crichton-Stuart

Head of Operations

The African gaming industry is on track to make significant strides in 2024, with recent data suggesting a substantial rise in market value and a strong preference for mobile gaming among players. The Pan Africa Gaming Group (PAGG) and GeoPoll disclosed findings from a survey indicating that approximately 92% of gamers across the continent prefer gaming on their smartphones, signifying a noteworthy shift in gaming habits.

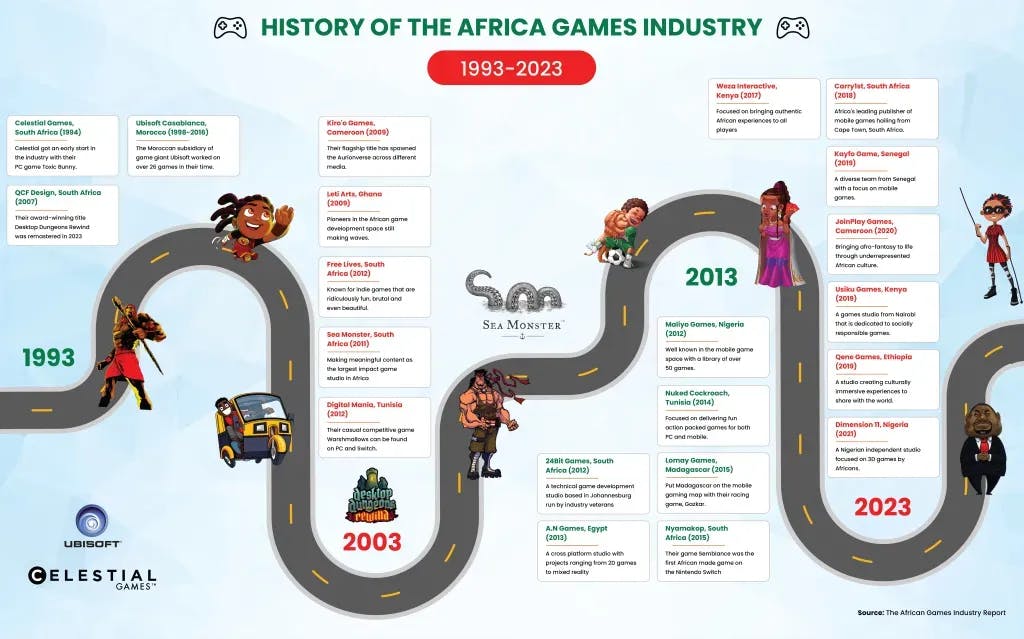

Nigeria-based studio Maliyo Games also recently published its Africa Games Industry Report, shedding light on the dynamic landscape of the gaming industry in Africa, with a staggering 200 million gamers spending hundreds of millions of dollars primarily on mobile platforms.

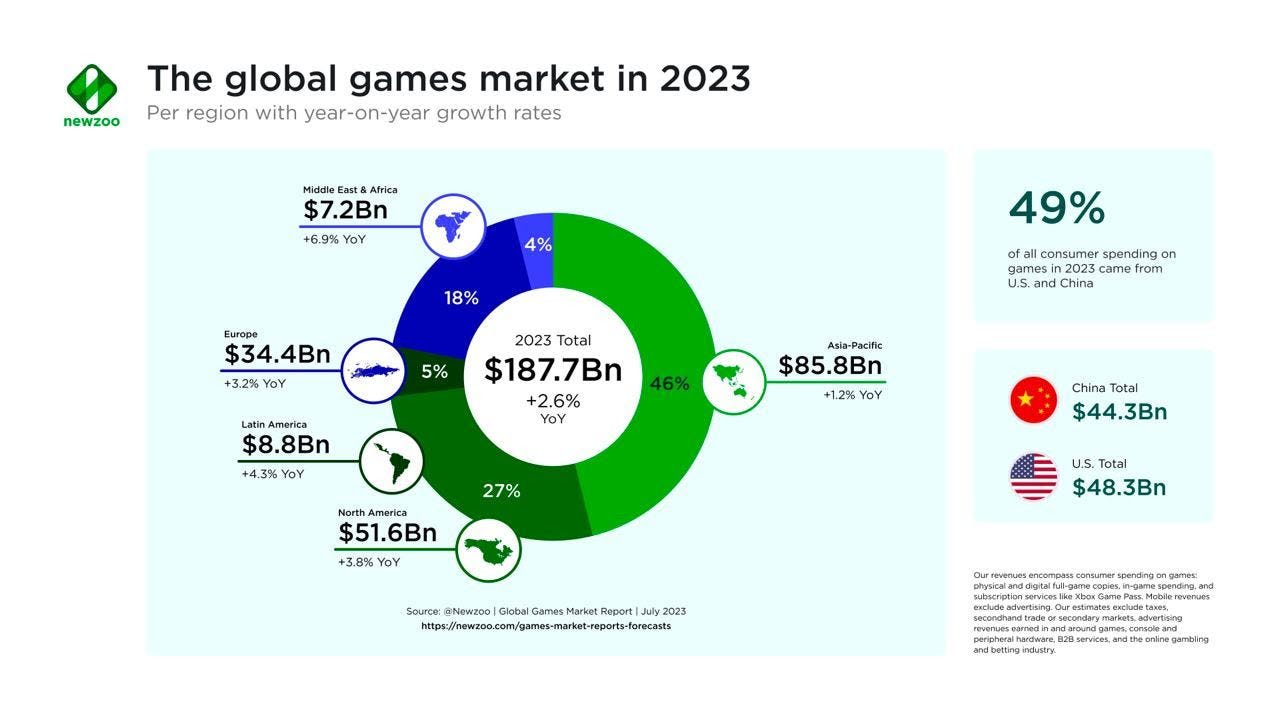

Lastly, according to projections by Newzoo, the African gaming market is expected to exceed $1 billion for the first time in 2024. The recent survey conducted by Geopoll and PAGG further corroborates this forecast, painting a vivid picture of a vibrant and rapidly expanding gaming landscape in Africa. In this article, we unpick the key findings from the three reports and provide essential insights for web3 gaming enthusiasts.

GeoPoll and PAGG Data

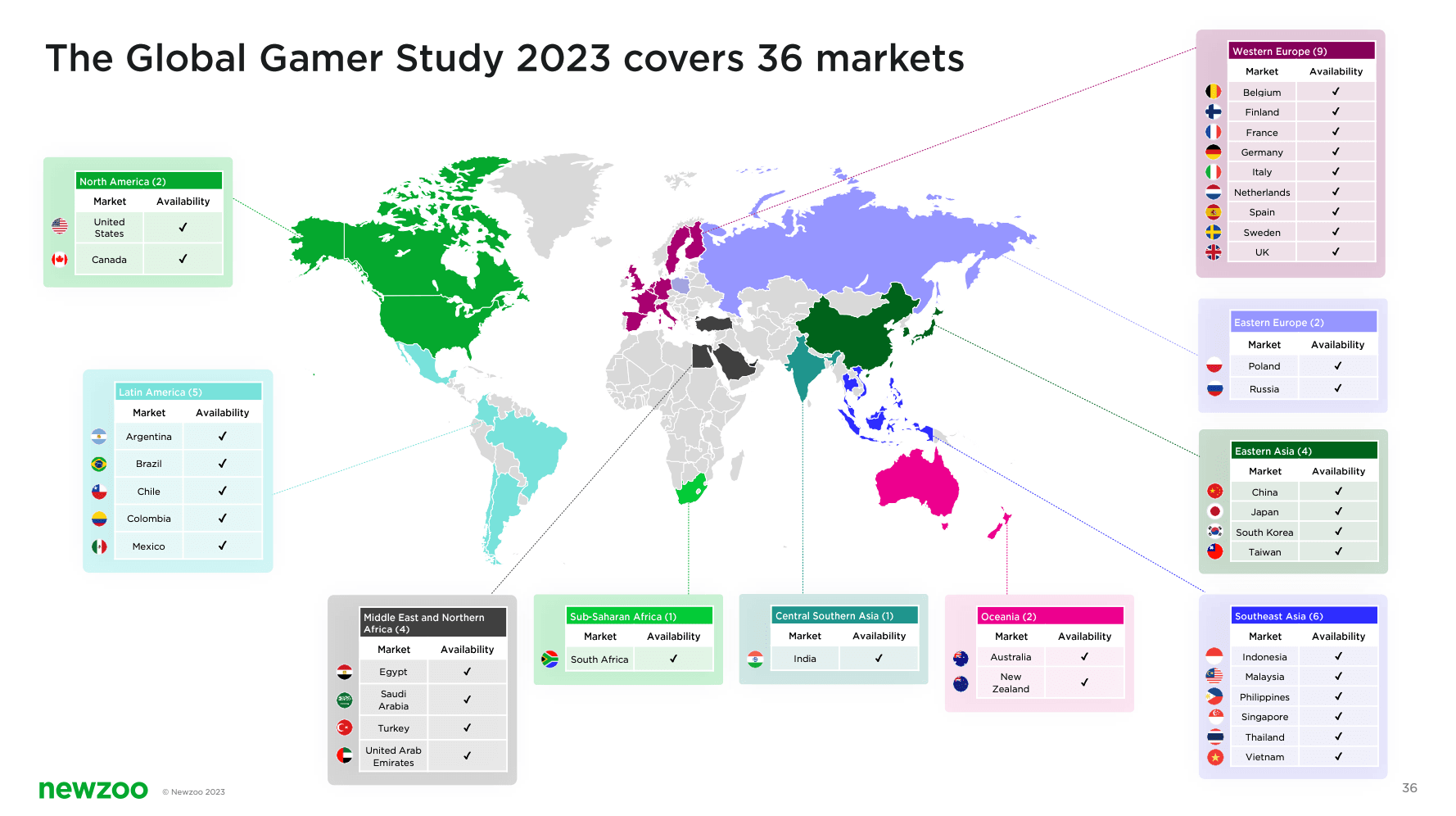

The GeoPoll report, announced during the Game Developers Conference, is a collaborative effort between Geopoll and PAGG. It encompasses insights from over 2,500 game players in key African countries such as Nigeria, Egypt, Kenya, and South Africa, providing valuable information on player interests and behaviors.

The Prevalence of Mobile Gaming: The survey reveals a significant tilt towards mobile gaming, with an astounding 92% of respondents playing games on their mobile phones. This preference is driven by increasing smartphone penetration and the Android platform’s dominance, with 92% of respondents having downloaded games from the Google Play Store.

Engagement: Gaming serves as a primary source of entertainment, relaxation, and a remedy for boredom for the majority of gamers, with 73% playing for fun and 64% for stress relief.

Expenditure: Financial investment in gaming is noteworthy, with 63% of gamers having made a purchase related to gaming. The amount spent varies, with 29% spending between $2 to $5 monthly, illustrating a willing but cost-conscious gamer base.

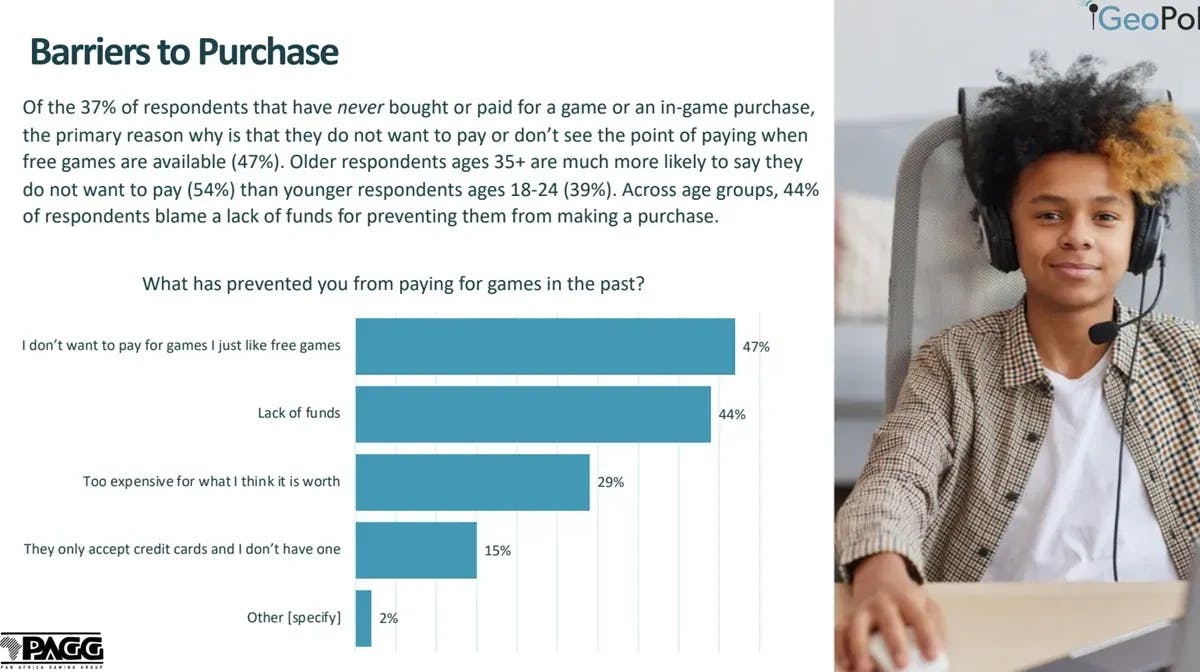

Navigating the Barriers: The report also identifies barriers to gaming purchases, with 47% preferring free games and 44% citing a lack of funds. The cost-related challenges extend beyond purchases, as gamers list the cost of data bundles (42%) and expensive gaming hardware (31%) among their top challenges.

A Call for Cultural Representation: Over half of the respondents value cultural relevance in games, and a substantial 44% feel there are not enough games with characters that look like them or environments similar to their life, signaling an untapped market for local content creation.

In-Game Advertising Insights: Despite mixed feelings about ads in games, a surprising 63% have made a purchase after seeing an ad in a game. This suggests that while ads may be met with some resistance, they remain a potent tool for engagement and monetization within the gaming ecosystem.

The Local Gaming Scene: A striking 56% of respondents are unaware of any games made in Africa, highlighting a significant gap in visibility and market penetration for local developers. However, there is a growing interest in supporting local talent, with varied sentiments across countries regarding the importance of local games.

John Murunga, GeoPoll’s regional director for Africa, expressed excitement over the survey's findings, stating, "Our 'Gaming in Africa Survey' has unearthed fascinating trends that underscore the rapid growth and unique dynamics of the gaming sector on the continent." Murunga emphasized the potential for gaming to serve as a powerful medium for cultural expression and community building in Africa.

With Africa emerging as the fastest-growing global market in the gaming industry, fueled by a population of digital-native youth and increasing smartphone penetration, the continent is poised to reshape the global gaming landscape. Jay Shapiro, chairperson of PAGG, underscored the significance of the data, highlighting the immense potential for growth in the African gaming industry. Shapiro stated, "This report shows the true potential of the continent’s billion youth to find, play, and purchase locally relevant games."

Newzoo and Maliyo Games Data

Market Overview and Spending

According to the Newzoo Global Games Market Report, Africans spend an average of $6 per year on games, mainly through in-app purchases on their mobile phones. Sub-Saharan Africa alone in-app purchase spending is around $778.6 million, making up 90% of all game revenue in the region. South Africa leads with an average revenue per user of $12 per year. The report goes on to predict the African gaming market will generate over $1 billion in consumer revenue by 2024.

Comprehensive Breakdown of Regional Consumer Spending

- Kenya: $46.5 million

- Ethiopia: $42.7 million

- Ghana: $34.6 million

- Côte d'Ivoire: $31.9 million

- Angola: $26 million

- Tanzania: $23.4 million

- Cameroon: $17.2 million

- Uganda: $16 million

Audience and Player Population

The Africa Games Industry report reveals a significant increase in gamers across Sub-Saharan Africa, growing from 77 million in 2015 to 186 million in 2021. Mobile gaming dominates with 95% of the playing population (177 million) favoring mobile games. The top five gaming markets include Nigeria, South Africa, Ethiopia, Kenya, and Ghana.

The diversity of the African gaming market is evident, showcasing a wealth of variety with over 3,000 distinct ethnic groups and a linguistic tapestry comprising more than 2,000 languages. English, French, Swahili, Hausa, and Arabic stand out as some of the most widely spoken languages, underscoring the distinctive challenges and opportunities that characterize the continent.

Demographics and Growth Potential

Africa boasts a youthful population with a median age of 19.7 years, contributing to a significant opportunity for growth. Approximately 60% of Africa's 1.4 billion people are under the age of 18. This demographic shift contributes to Africa's growing buying power, including its consumption of video games.

The Africa Game Developer Survey results showcase a dynamic development landscape, with 78% of respondents working on mobile games, 70% on PC games, and 18% on console games. Unity is the most widely used game engine at 64%, followed by Unreal at 14%. Financial challenges persist for African developers, with only 59% securing external investment, and infrastructure challenges like unstable power supply and unaffordable internet access remain.

VC Funding Carry1st Case Study

With the number of gamers in sub-Saharan Africa projected to exceed hundreds of millions in the next five years, startups like Carry1st are strategically positioning themselves to capitalize on this immense potential.

This South Africa-based publisher of social games and interactive content has garnered substantial backing from investors, including renowned funds focused on web3 and gaming such as Andreessen Horowitz (a16z), Konvoy Ventures, and the recent addition of Bitkraft Ventures in its $27 million pre-Series B funding round.

Interestingly, Africa is emerging as one of the fastest adopters of web3 technology in the world. According to a report published by the International Monetary Fund (IMF), crypto transactions from the region touched $20 billion per month back in 2021. One of the reasons for the popularity of alternative assets in many regions of Africa is that the mainstream fiat assets there are notoriously unstable.

Relevance to Web3 Gaming

The findings from the three reports offer valuable insights into the world of web3 gaming. With 92% of respondents actively engaged in mobile gaming, the data underscores the significance of accessibility and convenience in gaming experiences. Blockchain gaming, with its decentralized and interoperable nature, has the potential to further enhance accessibility by eliminating the need for centralized app stores and enabling seamless cross-platform experiences. This aligns well with the prevailing preference for mobile gaming and could catalyze further adoption of web3.

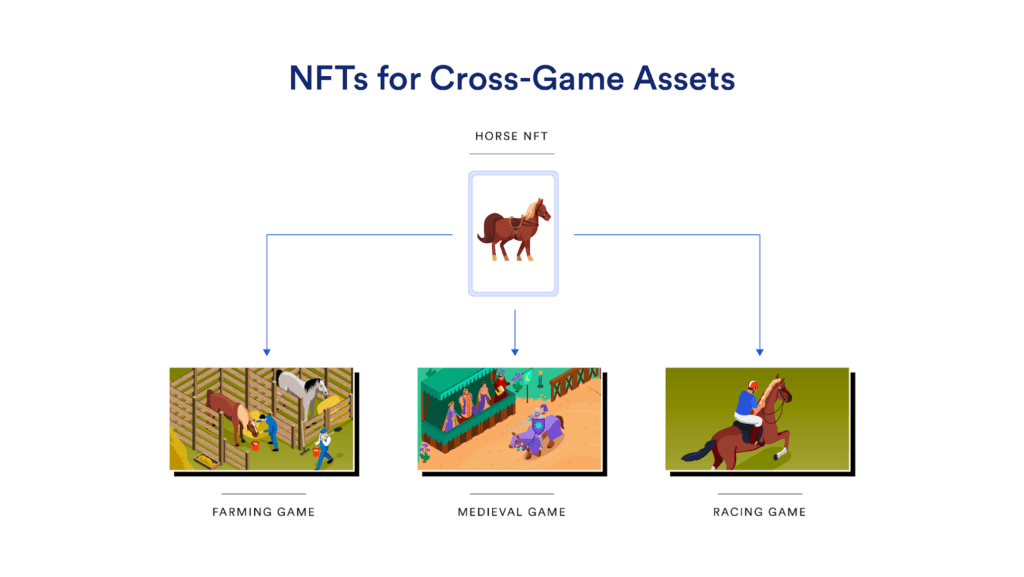

Moreover, the data highlights the significant financial investment in gaming, with 63% of gamers having made purchases related to gaming. This underscores the potential economic opportunities within the web3 gaming ecosystem, where decentralized finance (DeFi) mechanisms can offer innovative monetization models such as play-to-earn and non-fungible tokens (NFTs). These models can empower players to truly own their in-game assets and participate in value creation within virtual economies, thereby fostering a more sustainable and inclusive gaming ecosystem.

The barriers identified in the reports, such as the preference for free games and concerns about costs, also point to areas where web3 gaming can offer solutions. Through decentralized governance and tokenomics, web3 gaming platforms can incentivize participation and reward players for their contributions, thereby lowering the barriers to entry and fostering a more inclusive gaming community. Additionally, the transparency and immutability afforded by blockchain technology can address concerns around data privacy and security, enhancing trust and confidence among gamers.

Final Thoughts

In conclusion, the findings from the reports offer valuable insights into the dynamics of the gaming industry and underscore the potential of web3 gaming to revolutionize how games are created, distributed, and monetized. By embracing decentralization, blockchain technology, and community-driven innovation, web3 gaming has the potential to foster greater inclusivity, ownership, and engagement, ushering in a new era of gaming experiences.

updated:

March 29th 2024

posted:

March 29th 2024