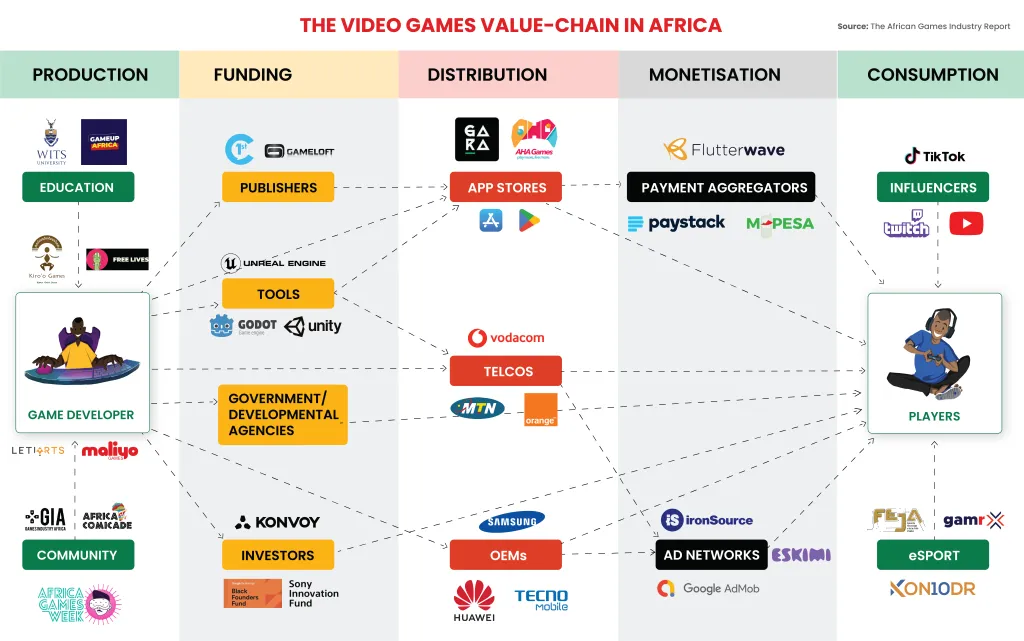

Nigeria-based studio Maliyo Games recently published the Africa Games Industry Report, shedding light on the dynamic landscape of the gaming industry in Africa. With a staggering 200 million gamers spending hundreds of millions of dollars primarily on mobile platforms, the report provides a comprehensive overview of the sector. In this article, we unpick the key findings from the report and provide essential insights for web3 gaming enthusiasts.

Market Overview and Spending

According to the Newzoo Global Games Market Report for 2023, Africans spend an average of $6 per year on games, predominantly through in-app purchases on mobile games. Sub-Saharan Africa alone witnesses total in-app purchase spending of $778.6 million, constituting 90% of all games revenue in the region. South Africa leads with an average revenue per user of $12 per year. Here is a more comprehensive breakdown of consumer spending in the other areas in 2022:

- Kenya: $46.5 million

- Ethiopia: $42.7 million

- Ghana: $34.6 million

- Côte d'Ivoire: $31.9 million

- Angola: $26 million

- Tanzania: $23.4 million

- Cameroon: $17.2 million

- Uganda: $16 million

Looking ahead, the report predicts that the Sub-Saharan gaming sector is poised to continue growing and is projected to generate over $1 billion in consumer revenue by 2024.

Audience and Player Population

The Africa games industry report reveals a significant increase in gamers across Sub-Saharan Africa, growing from 77 million in 2015 to 186 million in 2021. Mobile gaming dominates with 95% of the playing population (177 million) favoring mobile games. The top five gaming markets include Nigeria, South Africa, Ethiopia, Kenya, and Ghana.

The diversity of the African gaming market is evident, showcasing a wealth of variety with over 3,000 distinct ethnic groups and a linguistic tapestry comprising more than 2,000 languages. English, French, Swahili, Hausa, and Arabic stand out as some of the most widely spoken languages, underscoring the distinctive challenges and opportunities that characterize the continent.

Demographics and Growth Potential

Africa boasts a youthful population with a median age of 19.7 years, contributing to a significant opportunity for growth. Approximately 60% of Africa's 1.4 billion people are under the age of 18. This demographic shift contributes to Africa's growing buying power, including its consumption of video games.

The Africa Game Developer Survey results showcase a dynamic development landscape, with 78% of respondents working on mobile games, 70% on PC games, and 18% on console games. Unity is the most widely used game engine at 64%, followed by Unreal at 14%. Financial challenges persist for African developers, with only 59% securing external investment, and infrastructure challenges like unstable power supply and unaffordable internet access remain.

Emerging Markets

While the African gaming industry is comparatively small at present, the report suggests that monitoring successful regions like Brazil, India, Israel, and Turkey could help it grow into a robust video game business hub. Despite challenges, the transformative growth and potential of Africa's gaming industry are evident with increasing spending, a youthful demographic, and a surge in the number of gamers.

Brazil takes the lead in the Latin American gaming market, with a workforce of 12,000 and 1,000 studios contributing to 57% of the global industry revenue, which reached $1.3 billion in 2022. Following closely is India, with seven major studios and an anticipated market growth from $3 million in 2023 to surpassing $6 million by 2028. Israel, a relative newcomer, hosts six major studios and approximately 200 companies employing 14,000 individuals, showing a preference for mobile gaming and an estimated revenue of $9 billion in 2021.

Carry1st

With the number of gamers in sub-Saharan Africa projected to exceed hundreds of millions in the next five years, startups like Carry1st are strategically positioning themselves to capitalize on this immense potential.

This South Africa-based publisher of social games and interactive content has garnered substantial backing from investors, including renowned funds focused on web3 and gaming such as Andreessen Horowitz (a16z), Konvoy Ventures, and the recent addition of Bitkraft Ventures in its $27 million pre-Series B funding round.

Interestingly, Africa is emerging as one of the fastest adopters of web3 technology in the world. According to a report published by the International Monetary Fund (IMF), crypto transactions from the region touched $20 billion per month back in 2021. One of the reasons for the popularity of alternative assets in many regions of Africa is that the mainstream fiat assets there are notoriously unstable.

Relevance to Web3 Gaming

These findings hold particular relevance for the emerging realm of web3 gaming. As the African gaming industry continues to expand, the integration of web3 technologies promises to revolutionize the gaming landscape. With a burgeoning player base, increased spending, and a youthful demographic, Africa stands poised as a pivotal market for the evolution of web3 gaming experiences.

The blockchain-based decentralized nature of web3 gaming aligns with the adaptability showcased by African developers in navigating market challenges. The report's emphasis on mobile game development, a dominant force in the African gaming scene, aligns with the accessibility and decentralization principles championed by web3 technologies.

As the industry grapples with financial challenges and infrastructure hurdles, the decentralized and transparent nature of web3 can potentially offer innovative solutions. Smart contracts, NFTs, and decentralized marketplaces present opportunities to address financial challenges and empower developers with new revenue streams. Furthermore, the inclusivity of web3 aligns with Africa's diverse linguistic landscape, creating a platform that transcends linguistic barriers.

Final Thoughts:

In conclusion, the insights provided by the Africa Games Industry Report not only capture the current state of the African gaming industry but also foreshadow its potential evolution in the web3 era. As the continent embraces its vibrant gaming culture, the intersection of web3 and African gaming presents exciting possibilities for the future of the global gaming landscape.