The GameFi sector is set for significant growth in 2024, driven by a surge in investments and technological advancements. Recent data from the DappRadar Games Report for May 2024 shows that the highest volume of investments since 2021 is flowing into blockchain gaming, indicating strong confidence in the future of web3 technologies. This article examines the factors contributing to this trend and explores why new investment highs for GameFi are expected.

DappRadar Games Report for May 2024

Over $100 Million Invested in Web3 Gaming During May

The DappRadar Games Report for May 2024, presented in collaboration with the Blockchain Game Alliance, highlights the continued resilience and expansion of the web3 gaming industry. This month, significant growth in daily unique active wallets (dUAW) underscores the increasing engagement and enthusiasm within the community.

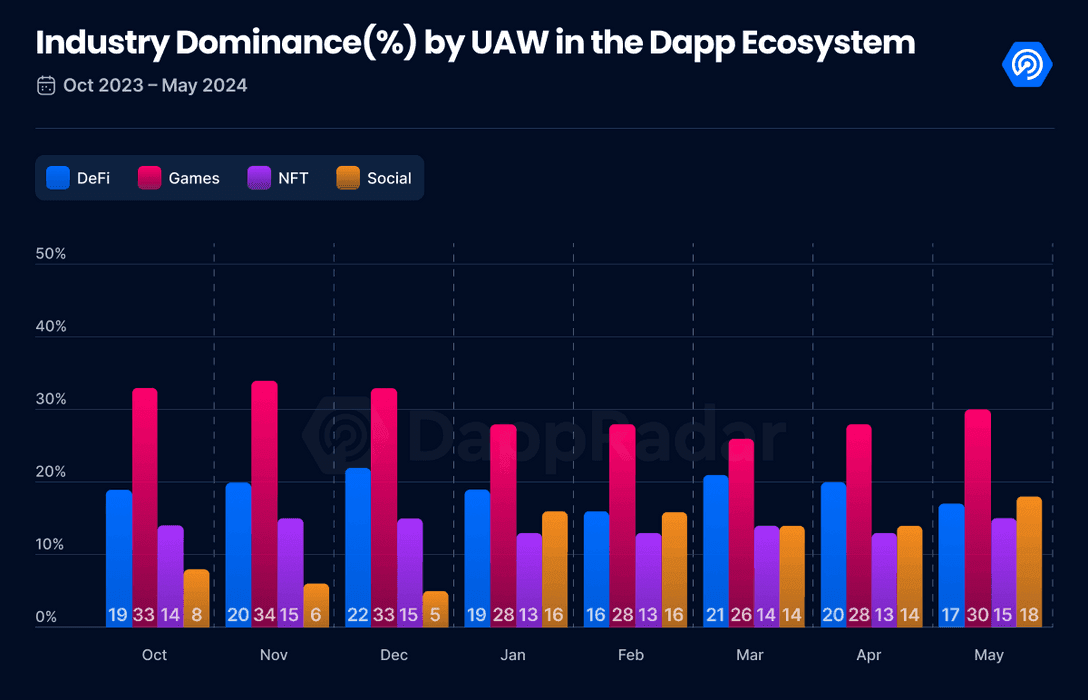

Industry Dominance (%) by UAW

All-Time High in Daily Active Wallets

Web3 gaming is experiencing rapid growth. In May 2024, decentralized applications (dApps) maintained a level of 10 million daily unique active wallets (dUAW), with one-third involved in blockchain games. The GameFi segment reached 3.13 million dUAW, setting a new all-time high. This growth is supported by new releases and technological innovations.

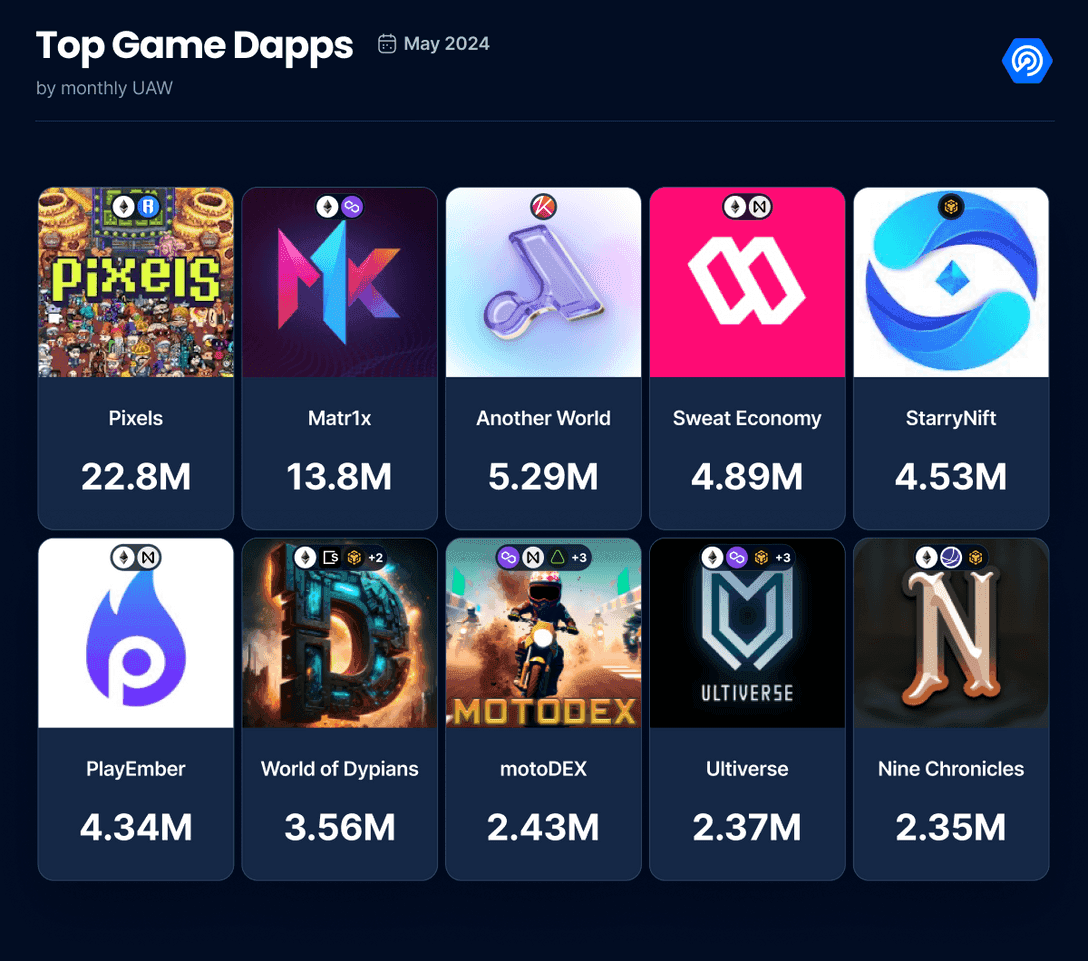

Pixels, the most popular gaming dApp, which has over 20 million monthly UAW. It recently released its second chapter, featuring updated gameplay and tiered rewards. Similarly, Immutable, a network designed for web3 games, saw a 274% increase in dUAW following the launch of Guild of Guardians, a highly anticipated game with over 1 million pre-registered players. The game quickly ranked in the top 10 on Google Play Store and App Store, highlighting the increasing popularity of GameFi.

Top Game Dapps

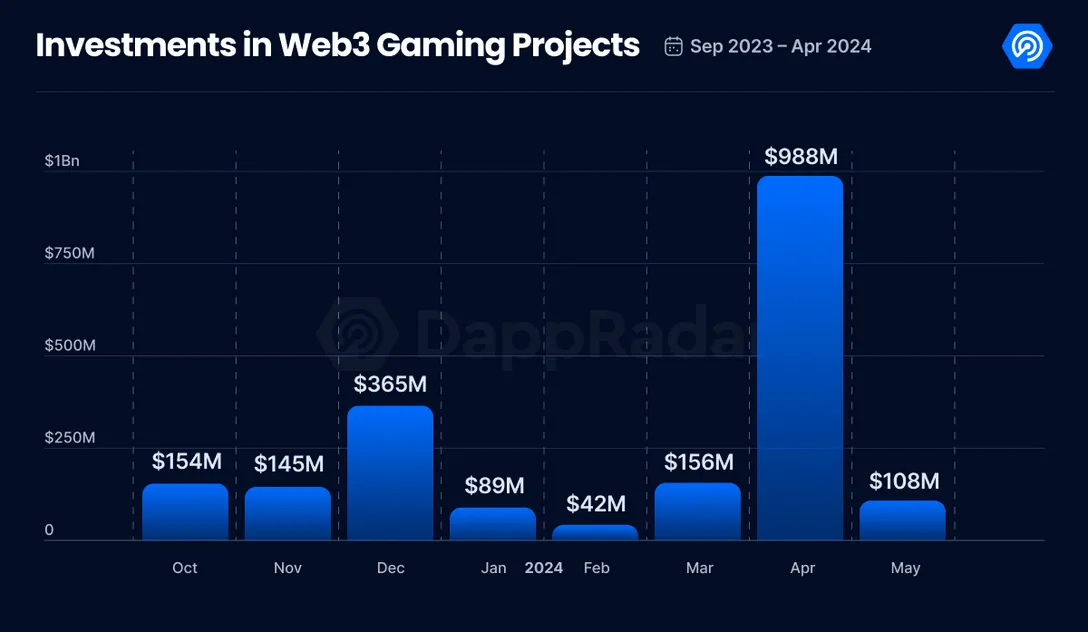

$988 Million Invested Amid Market Changes

In April 2024, the industry received $988 million from venture capitalists (VCs), the highest amount since January 2021. Despite a less impressive $108 million raised in May, the current quarter could still close as the best since Q1 2021. These investments highlight a growing interest in the underlying infrastructure of GameFi rather than specific game titles.

Over 43% of the funds were directed toward infrastructure development, while only 24% went to specific web3 games. The remaining 33% was allocated to metaverse projects. This trend suggests that investors see long-term potential in the foundational technologies supporting web3 gaming.

This record-high funding comes at a time when over 20,000 employees in the gaming industry have been laid off in the past 18 months. VCs remain confident that their investments in this still experimental domain will pay off, potentially leading to a significant influx of talent from traditional industries into blockchain gaming.

Investments in Blockchain Gaming

Why Are VCs Investing So Much?

Several factors explain why investors are allocating more funds to web3 games. The first half of 2024 saw a sharp rise in the crypto market, attracting millions of users interested in profits. Tap-to-earn games, which reward specific activities with potential future gains, contributed to a significant increase in GameFi activity.

However, the long-term viability of tap-to-earn games depends on enhancing gameplay and balancing tokenomics or introducing robust use cases. For instance, Notcoin recently announced it would become a hub for ecosystem projects rather than just a clicker game.

A deeper reason for the current investment influx mirrors the situation before the 2021 peak, when technologies like DeFi and NFTs matured, creating conditions for growth. Today, innovations such as Account Abstraction and Ethereum Layer-3 networks play a similar role, offering benefits that enhance the web3 gaming experience.

Ethereum Layer-3 Gaming Chain

Technological Innovations Driving Growth

Account Abstraction (AA) enhances the user experience of web3 products, making them similar to traditional games. Users can enter games using email or Google accounts without needing a crypto wallet. Zero-gas solutions based on AA technology, like Playblock, facilitate seamless in-game purchases, eliminating barriers that previously impeded onboarding new players.

Ethereum Layer-3 networks operate on top of existing Ethereum L2s, reducing transaction times and decreasing gas fees. Recent data shows that these scaling solutions have helped the Ethereum ecosystem achieve a record rate of 246 transactions per second, demonstrating the growing throughput of the second-largest blockchain network.

What is Playblock?

New Records on the Horizon

Recent advances have made blockchain games more user-friendly for mass adoption. Investors recognize this, leading to significant investments in GameFi. With new technologies under development, web3 gaming is likely to surpass the previous $4 billion funding record set in 2021.

Additionally, the transition of Telegram application users to other GameFi products is expected to drive further growth. Notcoin alone has reached 40 million players, 11.5 million token holders, and a $1.5 billion market cap. The Telegram mini apps industry, though less than a year old, is already fostering new projects that elevate the GameFi ecosystem.

With advancing technologies and increasing investments, a new era of web3 gaming is approaching. Critics of the cumbersome UX of web3 games may find reason to reconsider, while supporters of technology will have new products to explore and enjoy.