The web3 gaming token market, once propelled by excitement around blockchain technology and decentralized gaming, has encountered significant challenges in 2024. After a period of high anticipation and optimism, the first half of 2024 has been marked by price declines and market underperformance. This article summarizes a recent write-up by CryptoCompass, exploring the factors contributing to the downturn of web3 gaming tokens, analyzes their performance, and looks at the future of the sector as it navigates a volatile period.

Why are Web3 Gaming Tokens Down in 2024?

State of Gaming Tokens

The start of 2024 was a mixed bag for the web3 gaming token market. While some tokens launched successfully, others quickly fizzled out. The $XAI token from L3 Xai's gaming project saw a strong debut, but other gaming tokens, such as $PORTAL, struggled to gain traction. Established gaming tokens such as Treasure DAO’s $MAGIC, The Sandbox’s $SAND, and Apecoin’s $APE experienced only slight increases in value, reflecting the subdued market sentiment. Despite these challenges, a few newcomers, including $RON (Ronin), $BEAM (Merit Circle), and $PRIME (Parallel Studios), managed to capture the spotlight in Q1 2024.

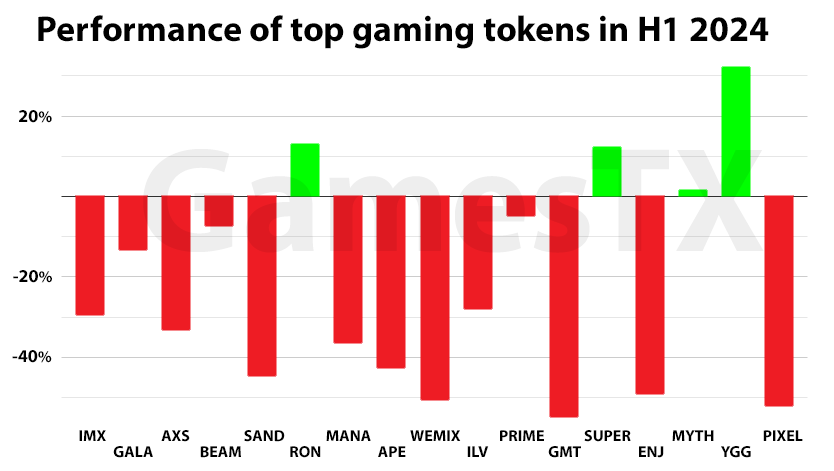

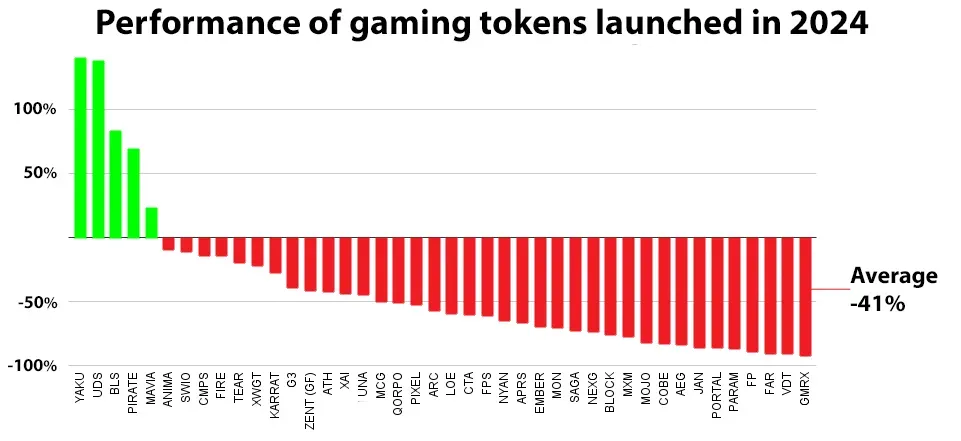

By the second quarter of 2024, the situation had worsened for most major gaming tokens. However, a select few—$RON, $SUPER (SuperVerse), $MYTH (Mythical Chain), and $YGG (Yield Guild Games)—remained in positive territory, helped by strong performance in Q1. In total, 42 gaming tokens were launched in the first half of the year, yet only five managed to increase in value by the end of June 2024. The market overall saw a significant downturn, with an average token performance decrease of 41%.

Performance of Top Gaming Tokens in H1 2024

Challenges Facing Gaming Tokens

One of the key factors contributing to the decline of web3 gaming tokens in 2024 has been heightened regulatory scrutiny, particularly from the United States Securities and Exchange Commission (SEC). The SEC’s increased focus on regulating crypto assets and its concerns over potential misconduct in Initial Coin Offerings (ICOs) have created an uncertain environment for gaming tokens. As a result, investors became cautious, and many pre-sale offerings attracted minimal interest.

Market oversaturation also played a critical role. A backlog of projects from 2023, coupled with the launch of multiple underdeveloped and inexperienced projects in early 2024, led to a flood of new tokens. The rapid release of tokens, often with minimal regulatory oversight, resulted in speculative trading. Many tokens were quickly sold off after launch, driving down their values and eroding investor confidence.

Performance of Gaming Tokens Launched in 2024

Role of Key Opinion Leaders (KOLs) and Declining Investments

Speculation wasn’t limited to developers. Crypto retail investors, Key Opinion Leaders (KOLs), and crypto funds also contributed to the issue by purchasing tokens at launch and "flipping" them for quick profits. This short-term trading behavior led to rapid declines in token values and undermined the long-term viability of several projects.

Another significant factor was declining investment in blockchain gaming. In Q2 2024, 77 new deals were announced, bringing the total number of investments in the first half of the year to 153. However, the value of these investments fell to $296 million in Q2, down from $324 million in Q1. This decline, along with the 5% drop in total investment value compared to the second half of 2023, made it difficult for many projects to secure the necessary resources for development, resulting in underdeveloped games and a lack of user engagement.

Investments in Blockchain Gaming By Month (2021-2024)

Future Outlook for Gaming Tokens

Despite the challenging environment in 2024, industry experts remain optimistic about the future of web3 gaming tokens. Custom Market Insight estimates that the blockchain gaming market, valued at $10.2 billion in 2024, will grow at an impressive compound annual growth rate (CAGR) of 67.7%, reaching $304.3 billion by 2033. The increase in blockchain adoption and demand for decentralized gaming platforms are expected to fuel this growth.

The Zipdo Education Report further forecasts that the blockchain-based gaming market will reach $3.6 billion by 2025, which could boost the value and utility of gaming tokens. Additionally, the play-to-earn segment is projected to have a market capitalization of $20 billion by 2026.

Fortune Business Insights also predicts that the global blockchain gaming market will surpass $614 billion by 2030, driven by traditional game developers integrating blockchain technology into their games. This adoption is expected to accelerate the growth of gaming tokens as players and developers increasingly explore decentralized models, digital assets, and play-to-earn mechanisms.

Number of Investments in the Blockchain Game Sector By Month (2021-2024)

Final Thoughts

A complex mix of regulatory pressures, market saturation, speculative trading, and reduced investment in the sector has driven the decline of web3 gaming tokens in 2024. While the market’s performance in the first half of 2024 has been underwhelming, the long-term outlook remains positive.

As blockchain gaming adoption grows and traditional game developers integrate decentralized platforms, the gaming token market is expected to see renewed interest and expansion in the coming years. Investors and developers will need to navigate the current challenges with a focus on sustainable growth and innovation to capitalize on the sector's potential fully. You can read the original write-up here.