The landscape of Steam game pricing has shifted noticeably over the past two years. While the pandemic and post-pandemic period drove some inflation in game prices, the rise of affordable indie titles has introduced new dynamics.

Games in genres such as roguelikes, survival, and cooperative experiences now often launch between $5 and $15, offering players substantial replay value without the high cost traditionally associated with new releases. Different approaches to pricing continue to coexist. For example, Necesse, a sandbox crafter and colony simulator, launched at $10 and has never exceeded $15.

On the other hand, The Last Caretaker, a survival title still in Early Access, debuted at $35 and continues to perform well in terms of sales. Data on playtime suggests that lower prices do not necessarily equate to less content; both Necesse and CloverPit show median playtimes of about six hours and average playtimes exceeding ten hours.

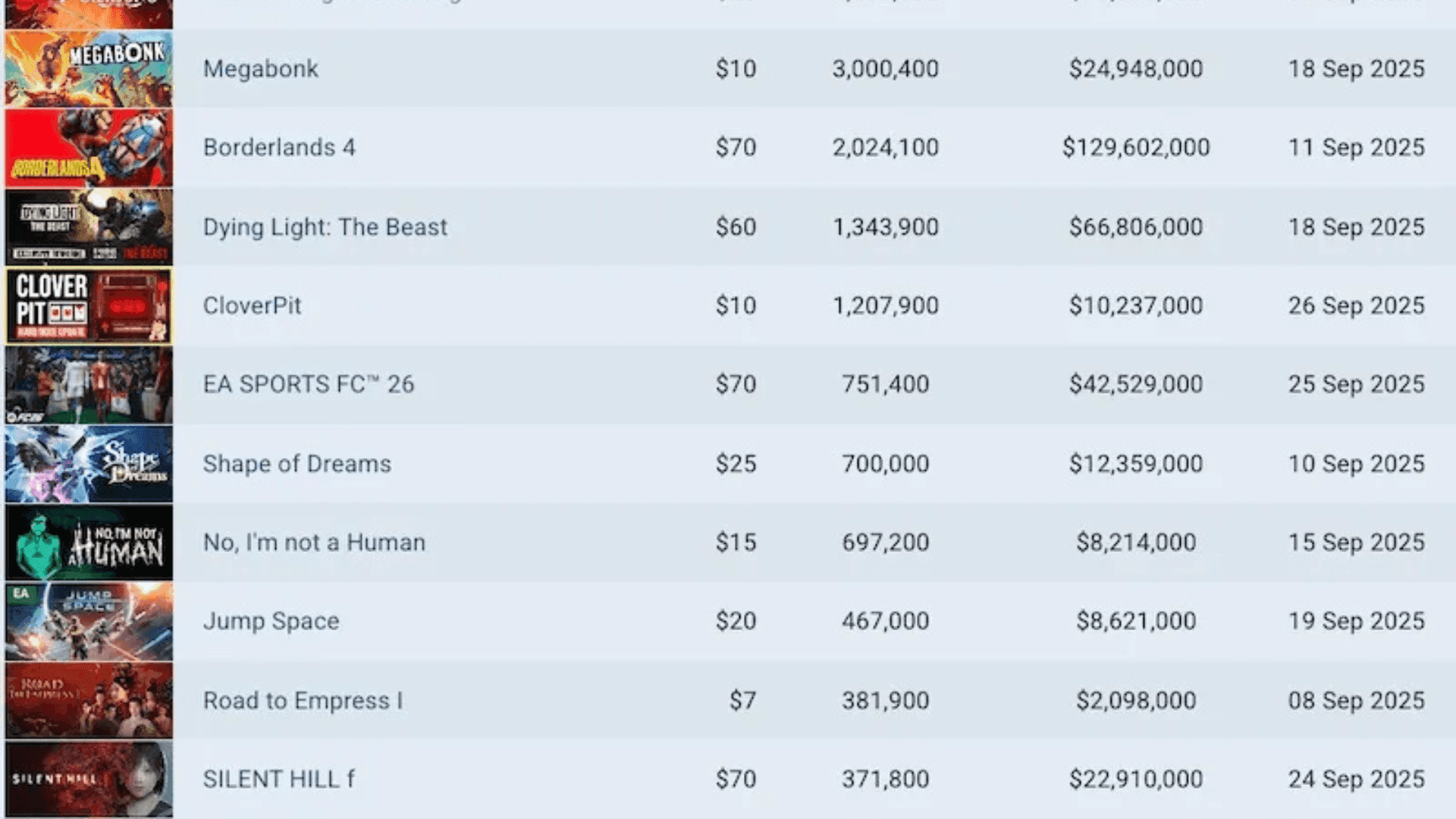

A Look at Recent Steam Sales

Data from September 2025 shows a clear pattern in pricing. Big releases like Borderlands 4 and Dying Light: The Beast are still priced at $60–$70, while a significant portion of top sellers fall in the $5–$10 range, including Megabonk, CloverPit, and Keep Digging. Games priced between $15 and $20 make up another noticeable group, whereas mid-range pricing between $25 and $55 is relatively uncommon.

GameDiscoverCo’s data on the Top 50 new non-free-to-play Steam games by monthly units sold since February 2023 highlights a downward trend in median prices. The average game price over this period has decreased slightly from $21.80 to $21.41, a 2% drop. The median price, however, shows a sharper decline from $19.50 to $15.64, a 20% drop. This suggests a rising number of lower-priced games are dominating sales in terms of units.

Revenue-based analysis paints a similar picture. The average launch revenue-based price fell from $26.20 to $25.76, while the median revenue-based price dropped from $23.70 to $20.35. These figures indicate that even when considering revenue rather than units, lower-cost titles are having a measurable effect on the market.

Challenges for Mid-Priced Games

The data indicates that pricing between $20 and $40 is increasingly difficult for new releases, particularly for games without established IP or a proven fanbase. Successful titles in this range, such as Dispatch ($30), PowerWash Sim 2 ($25), and Titan Quest II ($35), are often sequels, known franchises, or carry significant brand recognition.

For entirely new intellectual properties, launching above $25 requires careful consideration of gameplay depth, replayability, and overall value compared to lower-cost indie alternatives and premium $60–$70 releases. Survival and crafting games with complex systems can still justify higher pricing, but the mid-tier space is narrower than it once was.

Historical Context and Market Pressure

The downward pricing trend became more noticeable in late 2023. In March 2024, several top sellers were priced under $10, including titles like Content Warning, Rusty’s Retirement, and Buckshot Roulette. Frequent Steam catalog sales and steep discounts on older games have also contributed to players expecting lower prices for new releases. Indie developers are increasingly able to create replayable games at lower budgets, further reinforcing this trend.

In 2025, developers must carefully weigh pricing against game scope and player expectations. While the market is not saturated with low-quality games, players now have more affordable options than ever before, making pricing strategy a key consideration for studios of all sizes.

Source: GameDiscoverCo

Frequently Asked Questions (FAQs)

Are Steam games getting cheaper overall?

Yes. Data from the past two years shows that the median price of new Steam games has dropped significantly, primarily due to a rise in low-cost indie releases.

Does a lower price mean less gameplay?

Not necessarily. Many indie games priced under $15, such as Necesse and CloverPit, offer median playtimes of six hours and averages exceeding ten hours.

Why are mid-priced games ($25–$40) more challenging to sell?

Mid-priced games often struggle unless they are established franchises or have recognizable IP. Players compare them to both inexpensive indie games and premium $60–$70 releases.

How do sales and discounts affect pricing trends?

Frequent discounts on older games and catalog sales put downward pressure on prices, influencing player expectations for both new and existing titles.

Should developers price new IPs low to compete?

Pricing strategy depends on game depth and scope. While lower pricing can attract players, complex or replayable games may still justify higher prices, especially in niche genres like survival or crafting.