Southeast Asia’s gaming market is still expanding, but the era of explosive growth appears to be winding down. According to the latest Niko Partners 2025 report, covering six countries - Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam - the region continues to perform well but faces clear signs of stabilization.

In 2024, the combined games market across these countries generated $5.37 billion, a 5.2% increase year over year. However, Niko Partners projects a slower 1.8% growth in 2025, bringing total revenue to $5.47 billion. The report attributes this moderation to economic uncertainty and new regulations, including Vietnam’s licensing requirements for game publishers.

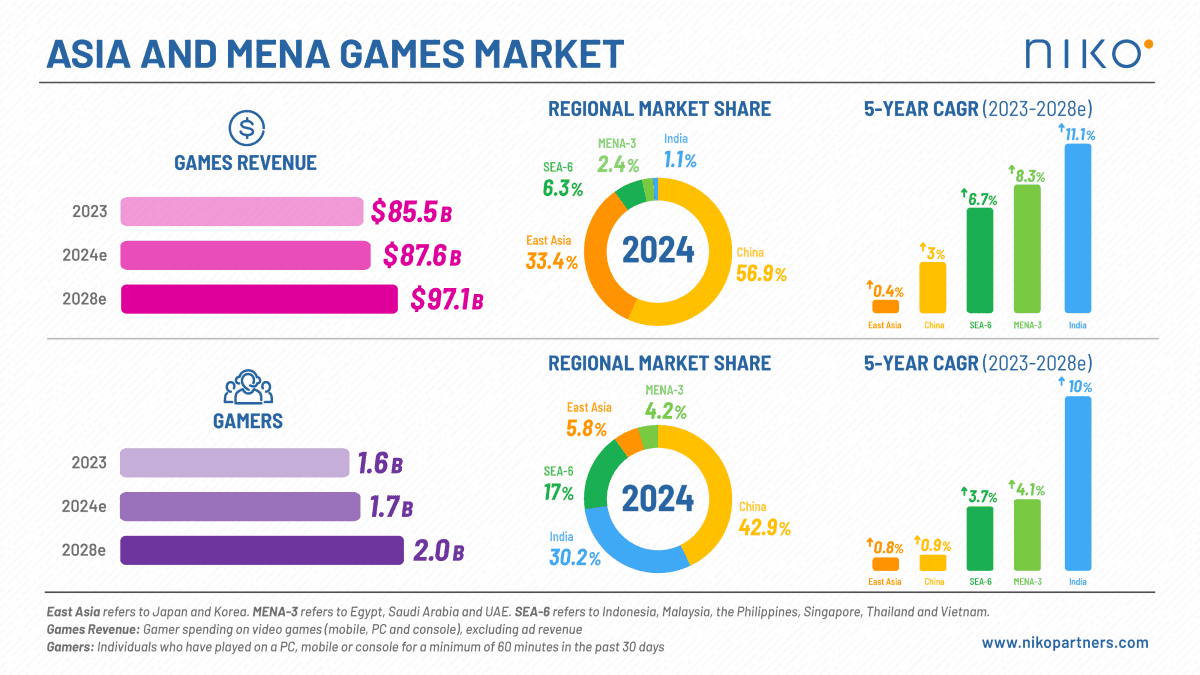

While growth is slowing, the long-term outlook remains positive. Niko Partners expects the SEA-6 market to reach $6.47 billion by 2029, reflecting a compound annual growth rate (CAGR) of 3.8%. However, with inflation outpacing nominal increases, the firm notes that the region’s real growth in USD terms may actually decline, impacting profitability for developers and publishers.

Players Are Still Growing, But Spending Is Flattening

The player base across Southeast Asia remains one of the largest in the world. In 2024, there were 285.82 million active players, up 3.1% from the previous year. That number climbed slightly to 290 million in 2025, an increase of 1.5%. By 2029, Niko Partners expects the number to reach 324.4 million players, with a 2.6% CAGR.

Despite this healthy player growth, spending per player is showing signs of plateauing. The average revenue per user (ARPU) in 2024 was $18.8, up just 2% from the previous year. By 2029, ARPU is projected to reach $19.96, reflecting a modest CAGR of 1.2%.

Interestingly, 26.9% of all in-game payments in the region go through third-party stores, the highest rate in Asia. This trend highlights Southeast Asia’s unique payment environment, where alternative digital marketplaces and wallet services play a major role in player purchases.

Social Gaming and Streaming Define the Region

Gaming in Southeast Asia continues to be deeply social. More than 45% of players actively socialize within games, reflecting the importance of community in regional gaming culture. Streaming and esports also play a major role in how players engage with the medium - 52% of SEA-6 players regularly watch game livestreams, making it one of the most active gaming audiences globally.

However, player engagement time has dropped. In 2024, players averaged 21.8 hours of gameplay per week, but that number fell to 15 hours in 2025. This shift may point to lifestyle changes, greater entertainment competition, or fatigue following years of heavy engagement during the pandemic era.

Another challenge for developers is the growing share of non-paying users, which has increased by 10–20% annually across each SEA-6 market. This suggests players are more selective about spending, reinforcing the importance of free-to-play models, reward systems, and localized promotions.

Localization continues to be a deciding factor for success. Many players view native language support as essential, and games that lack local language options often struggle to retain long-term engagement.

The Role of New Monetization Strategies

Companies are experimenting with new forms of digital engagement to keep players connected and spending. For example, Xsolla collaborated with Second Dinner to build a Marvel Snap webshop, which features personalized offers, promo code redemption, timed rewards, and event synchronization. This kind of web-enabled solution reflects a broader industry shift toward direct-to-player monetization and cross-platform engagement, trends that are particularly relevant in Southeast Asia’s diverse gaming economy.

What Comes Next for the SEA-6 Market

Southeast Asia’s gaming landscape in 2025 represents a turning point. While the growth surge of the past decade is slowing, the region remains one of the most important markets globally due to its massive audience, digital infrastructure, and community-driven player base.

According to Niko Partners, the next phase of development will rely on sustainable monetization, regulatory adaptation, and local market understanding. For developers and publishers, success in the region will depend less on rapid expansion and more on building localized experiences that connect deeply with players.

Source: Niko Partners

Frequently Asked Questions (FAQs)

What is the size of the Southeast Asia games market in 2025?

Niko Partners estimates the SEA-6 games market to be worth $5.47 billion in 2025, representing a 1.8% increase from the previous year.

Which countries are included in the SEA-6 market?

The SEA-6 includes Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

Why is market growth slowing in Southeast Asia?

Growth is moderating due to economic headwinds and new regulations, including stricter licensing requirements in countries like Vietnam.

How many players are there in Southeast Asia?

In 2025, there are about 290 million players, up from 285.82 million in 2024.

What are the key trends in player behavior?

Players are spending less time gaming weekly, more people are watching livestreams, and the number of non-paying users is increasing. Localization and community interaction remain key factors in engagement.

What is the outlook for the SEA-6 games market by 2029?

Niko Partners projects total market revenue will reach $6.47 billion by 2029, with a 3.8% compound annual growth rate.