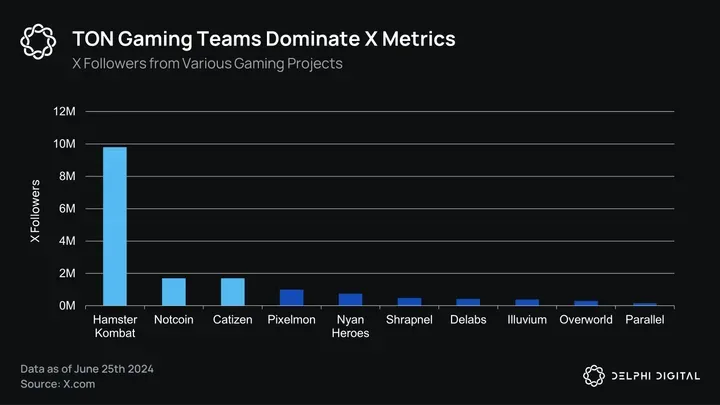

In recent weeks, the TON ecosystem has rapidly emerged as a focal point in the web3 gaming landscape. Significant achievements, such as the $NOT token's fair launch without venture capital backing, opening at a $1 billion Fully Diluted Valuation (FDV), and Hamster Kombat's impressive milestone of 142 million registered users within 77 days, highlight the ecosystem's dynamic growth.

With Telegram's 900 million Monthly Active Users (MAU) serving as a major distribution channel, known for its focus on security and privacy, the platform is well-positioned to drive large-scale web3 adoption. This article examines a recent report by Delphi Digital on the rise of social gaming and why the current Telegram craze is more than just hype.

Telegram Logo

Over 900 Million MAUs

With its 900 million Monthly Active Users (MAU), Telegram serves as a major distribution channel for web3-adjacent users. Known for its focus on security and user privacy, Telegram has become a primary communication app in the crypto space. Every non-US user on Telegram automatically receives an abstracted crypto wallet upon registration, enhancing the TON ecosystem's potential to drive web3 adoption on a large scale.

Each week brings new developments and achievements, highlighting the ecosystem's rapid growth. This article is the first of a series of four parts in which we examine social gaming, specifically exploring the TON ecosystem's unique features. Future articles will look at Telegram's user acquisition strategies, highlight five notable gaming projects on TON, and evaluate the current hype.

Crypto vs Internet Adoption Curve

The Rise of Social Platforms and Gaming

The 2010s saw the Internet become a public good, leading to the formation of social hubs online. Social platforms, aiming to retain and monetize users, expanded into gaming, daily services, and e-commerce, among other areas.

As user bases grew in the late 2000s, social platforms looked for ways to entertain users at scale. Games, being easy to distribute and scalable, provided deep user engagement and revenue opportunities, making them a natural fit. Facebook, Telegram, and WeChat are notable examples of platforms that have invested in gaming.

Telegram Cover Banner on X

The benefits for large platforms include:

- Access to diverse content that complements the core platform experience.

- Games with social layers that encourage competition and interaction.

- Casual, free-to-play games that are accessible, easy to distribute, and inexpensive to develop.

- Large user bases provide superior distribution capabilities compared to most gaming studios.

- Games offering significant user engagement and spending potential, enhancing platform retention and Lifetime Value (LTV).

Comparison of Web2 Social Platforms MAU

Social Gaming: Facebook vs Discord

Facebook's extension into gaming marked the start of the social gaming era. Farmville, a social farming game by Zynga, reached 10 million Monthly Active Users (MAU) within two months of its launch and peaked at around 80 million MAU in 2010. This success demonstrated the scale of social gaming ecosystems.

However, the social nature of these games tends to concentrate player bases among a few big titles. Network effects drive players toward popular games like Candy Crush, Farmville, and Zynga Poker, leaving lesser-known titles struggling to capture market share.

Discord ventured into gaming in the late 2010s but shifted focus back to its core gamer audience after failing to generate significant traction with its game store and library. The 2020 lockdowns saw a spike in Discord users, prompting a brief pivot to broader consumer markets, but the platform ultimately recommitted to serving gamers.

Discord MAU Growth Slowing Down

WeChat: The Chinese Super App

Most messenger apps have added social features over time, but user engagement and monetization through alternative entertainment, like gaming, remain limited. Despite these challenges, WeChat, a Chinese super app, has shown significant growth in social gaming.

In 2017, WeChat introduced mini-apps, allowing small applications to run natively within the app. This led to the introduction of WeChat mini-games, initially developed by Tencent. By 2018, third-party developers gained access to the platform, resulting in over 7,000 registered mini-games by year's end.

Top Three WeChat Mini-Games by MAU

WeChat's introduction of ad-purchasing capabilities across the Tencent ecosystem in 2021 marked a pivotal moment for mini-games. Viral hits like OHHH Sheep, a match-3 tile game, achieved 60 million Daily Active Users (DAU) within a month. By June 2023, there were over 300,000 mini-game developers and 400 million MAU on WeChat, with the mini-game market valued at $6 billion in 2023.

Despite games comprising only 10% of the top 500 WeChat mini-programs by MAU, the platform's success illustrates the potential of integrating games to enhance user engagement and monetize through a highly integrated, frictionless platform.

Top 500 WeChat Mini-Programs

Telegram Expansion

Telegram has made significant strides into gaming as a chat-only app. Since integrating HTML5 compatibility for Telegram bots in 2016 and developing the TON blockchain in 2017, the platform has reduced friction for both users and developers. TON offers payment rails, decentralized storage for in-game assets, and smart contracts for secure, automated game mechanics, all accessible to a community of 900 million MAU.

Final Thoughts

In conclusion, the TON ecosystem and Telegram's expansive user base present a compelling case for the future of web3 gaming. The integration of advanced features like payment rails, decentralized storage, and smart contracts, combined with the accessibility and security Telegram offers positions the platform to drive significant growth and innovation in the gaming industry.

The milestones achieved by projects like $NOT and Hamster Kombat illustrate the ecosystem's potential, while the broader trends in social gaming underscore the importance of combining entertainment with social interaction. As Telegram continues to leverage its unique capabilities and expand its gaming features, the evolving landscape will reveal whether the current enthusiasm will solidify into long-term success.

Keep an eye out for the next series of articles that will look at Telegram's user acquisition strategies, highlight five notable gaming projects on TON, and evaluate the current hype. This article was inspired by an original blog post by Delphi Digital.

Source: Delphi Digital