The gaming industry in the Middle East and North Africa (MENA) region is undergoing steady and measurable growth. In particular, Saudi Arabia, the United Arab Emirates, and Egypt—collectively referred to as the MENA-3—have emerged as focal points of development within the regional market. To provide a structured overview of this trend, Xsolla and Niko Partners have co-published a report titled "What does the monetization landscape look like for video games in MENA?" This article aims to help game developers and publishers understand key factors influencing growth, user behavior, and monetization strategies in this rapidly expanding region.

MENA-3 Gaming Market Report by Xsolla and Niko Partners

Growth Projections and Market Value

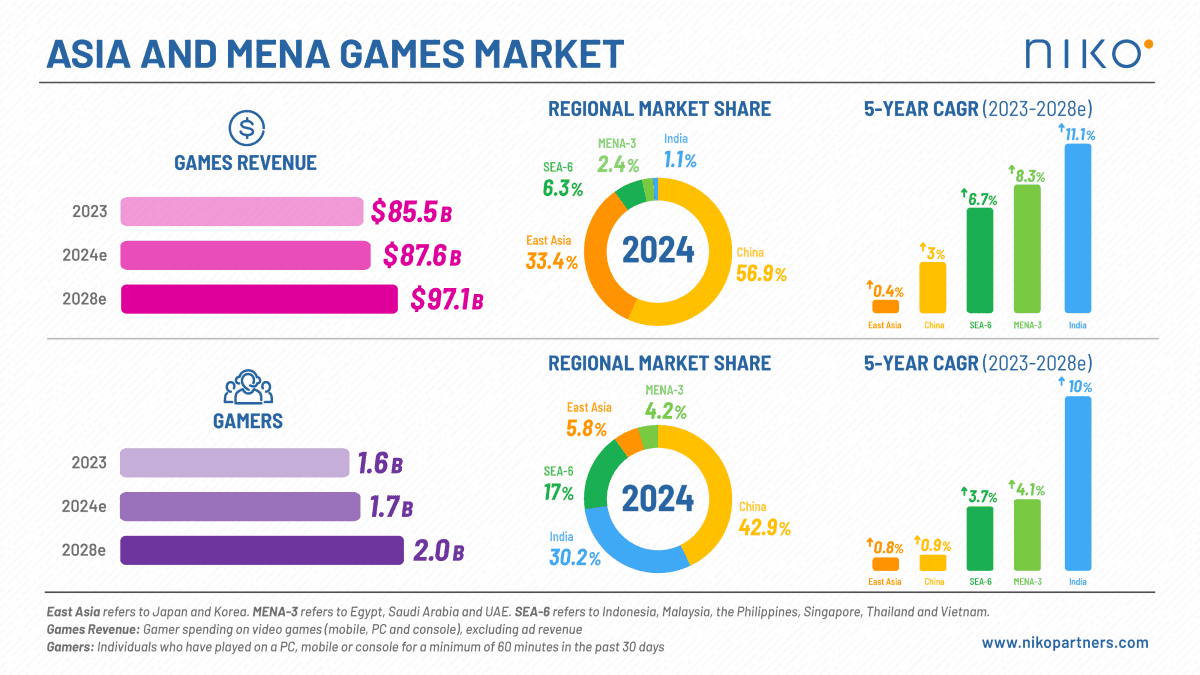

The MENA-3 region is on track to see continued expansion in both user base and market value. By 2028, total player spending is expected to rise to $2.7 billion, supported by a five-year compound annual growth rate (CAGR) of 7.2%. In 2024, the market is valued at approximately $2 billion, up 4% year-over-year. The number of players across Saudi Arabia, the UAE, and Egypt is projected to reach 82.7 million in 2028, an increase from 70.3 million in 2024. This would account for just over half of the total population in these countries, indicating that there is still room for further market penetration.

Country-Specific Characteristics

The MENA-3 countries reflect distinct market attributes. Saudi Arabia, which has already surpassed $1 billion in annual gaming revenue as of 2022, is positioned as the regional leader and is expected to generate $1.5 billion in revenue by 2027. The UAE, though smaller in population, features strong payment infrastructure and high average revenue per user (ARPU), currently estimated at $84.6 annually. Egypt, by contrast, offers a large population base but has relatively weak payment metrics and low ARPU, at $3.5. These differences highlight the importance of localized strategies when entering or expanding within each market.

MENA-3 Gaming Market Report by Xsolla and Niko Partners

Player Demographics and Gaming Habits

A majority of the gaming population in MENA-3 falls between the ages of 18 and 35. This number is likely an underestimation, as the study does not account for players under 18. Internet penetration is nearly universal in Saudi Arabia and the UAE and exceeds 70% in Egypt. Gaming is primarily mobile-based, with 94% of players in the region engaging on mobile devices. PC gaming accounts for 49% and console gaming 34%, figures that are relatively high compared to other emerging markets such as India.

The gender distribution among gamers is shifting, with female participation increasing from 32% in 2022 to 38% in 2025. Players in the MENA-3 countries spend an average of 10.2 hours per week gaming, and in Egypt, over 30% of players exceed 13.25 hours weekly. A significant portion of users, around 61%, engage across multiple platforms, with many switching devices regularly. These figures point to a highly engaged and increasingly diverse player base.

MENA-3 Gaming Market Report by Xsolla and Niko Partners

Income Levels and Spending Behavior

Income levels vary significantly across the region, influencing in-game purchasing behavior. The average monthly income of a gamer in MENA-3 is $2,166, but when excluding Egypt, the average rises to $3,137. In Egypt, only 4% of gamers earn more than $900 per month, compared to 86% in Saudi Arabia and 96% in the UAE. These figures explain why premium games and subscription models tend to perform better in Saudi Arabia and the UAE, where disposable income is higher.

Across the region, 63.4% of gamers have spent money on games. The free-to-play model with in-app purchases is the preferred choice for 61% of mobile gamers and 56% of PC gamers. However, in Saudi Arabia, a higher-than-average 26% of gamers favor premium games. Spending habits are also influenced by pricing sensitivity, with 43.9% of surveyed players indicating that lower prices would encourage them to spend more.

MENA-3 Gaming Market Report by Xsolla and Niko Partners

Payment Preferences and Infrastructure

The financial infrastructure in the MENA-3 region presents challenges for game monetization. Traditional banking access is limited, with 67% of the population either lacking banking services or using them infrequently. Credit card penetration remains low, particularly in Egypt where it stands at 2.8%. In Saudi Arabia and the UAE, the rates are 25.4% and 26.8% respectively. Alternative payment methods are more common. In Saudi Arabia, the Mada payment network is used by 93% of gamers, while PayPal is more widely adopted than credit cards. Only the UAE shows payment infrastructure that closely resembles that of Western markets.

Many players, especially in Egypt, opt to make purchases directly through game websites, bypassing app stores. Over 60% of Egyptian gamers have used this approach. The main reasons cited include faster transaction processes, availability of preferred payment methods, additional rewards, and discounts. Financial incentives remain a strong motivator, with 40% of respondents saying they would make more purchases through webshops if prices were lower. This trend underlines the importance of flexible and localized payment solutions in the region.

MENA-3 Gaming Market Report by Xsolla and Niko Partners

Final Thoughts

The MENA-3 region represents a growing and increasingly influential part of the global gaming landscape. With rising user numbers, increasing average income, and evolving preferences in monetization and payment methods, it offers notable opportunities for developers, publishers, and platforms. However, success in this market requires a deep understanding of its unique economic and demographic context. The white paper from Xsolla and Niko Partners provides a detailed and data-rich foundation for companies looking to expand in Saudi Arabia, the UAE, and Egypt. To access the complete insights, including additional market data and recommendations, readers are encouraged to download the full report.