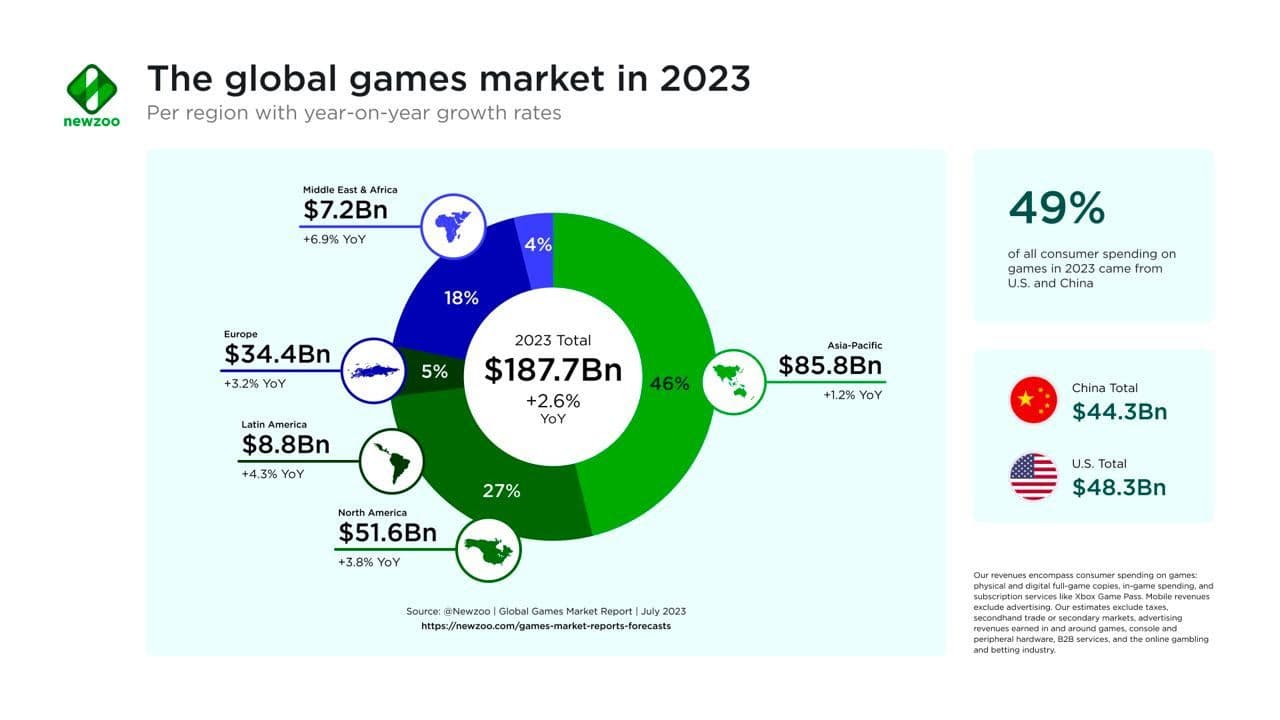

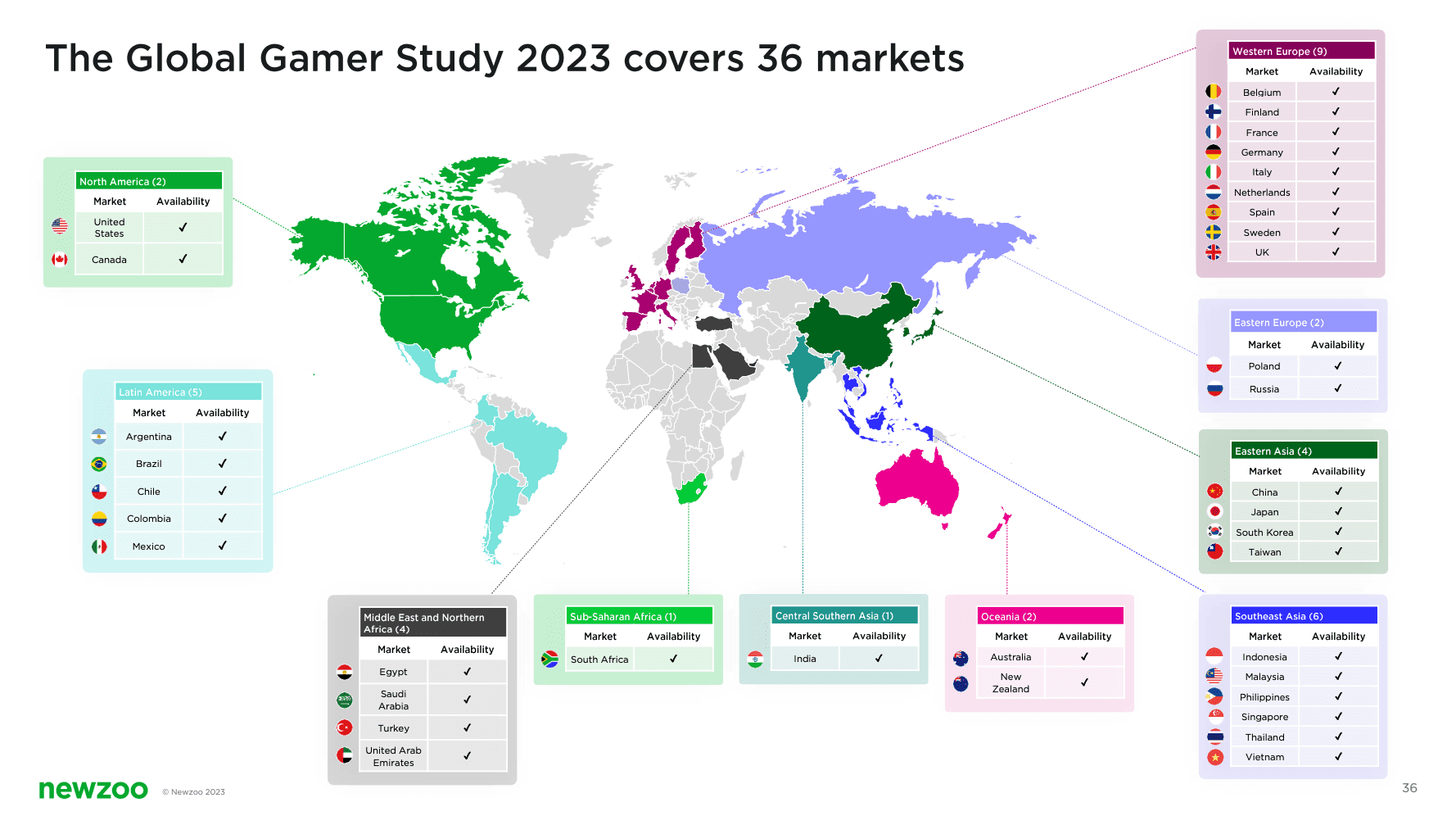

A recent report published by Newzoo reveals significant shifts in global gaming habits, driven by Generation Alpha’s growing preference for games over social media. Based on survey data from 73,000 participants across 36 countries, the study explores trends in gaming engagement, generational differences, popular genres, and spending patterns across platforms.

Over 80% of People Play Games Globally

Over 80% of People Play Games Globally

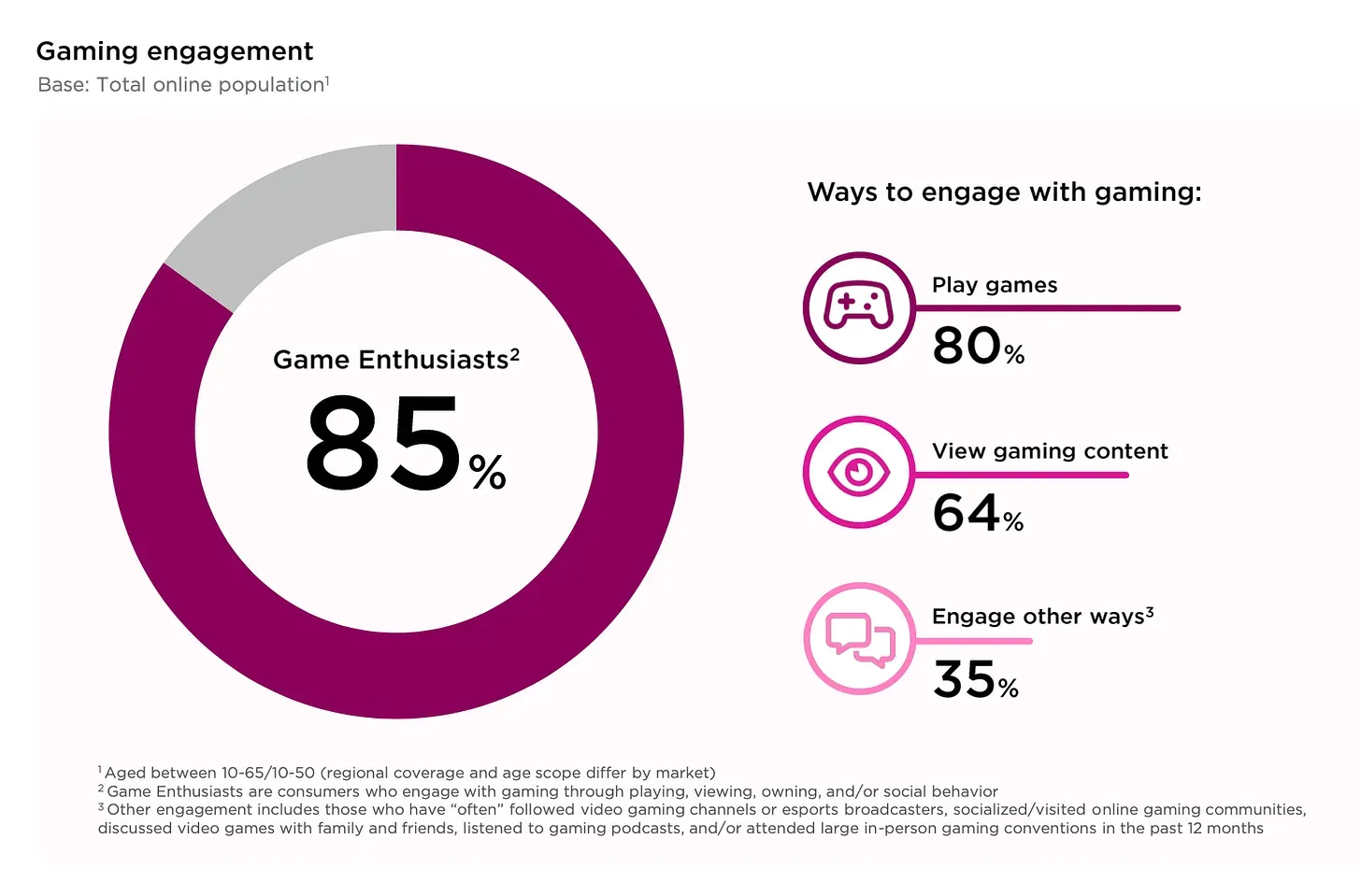

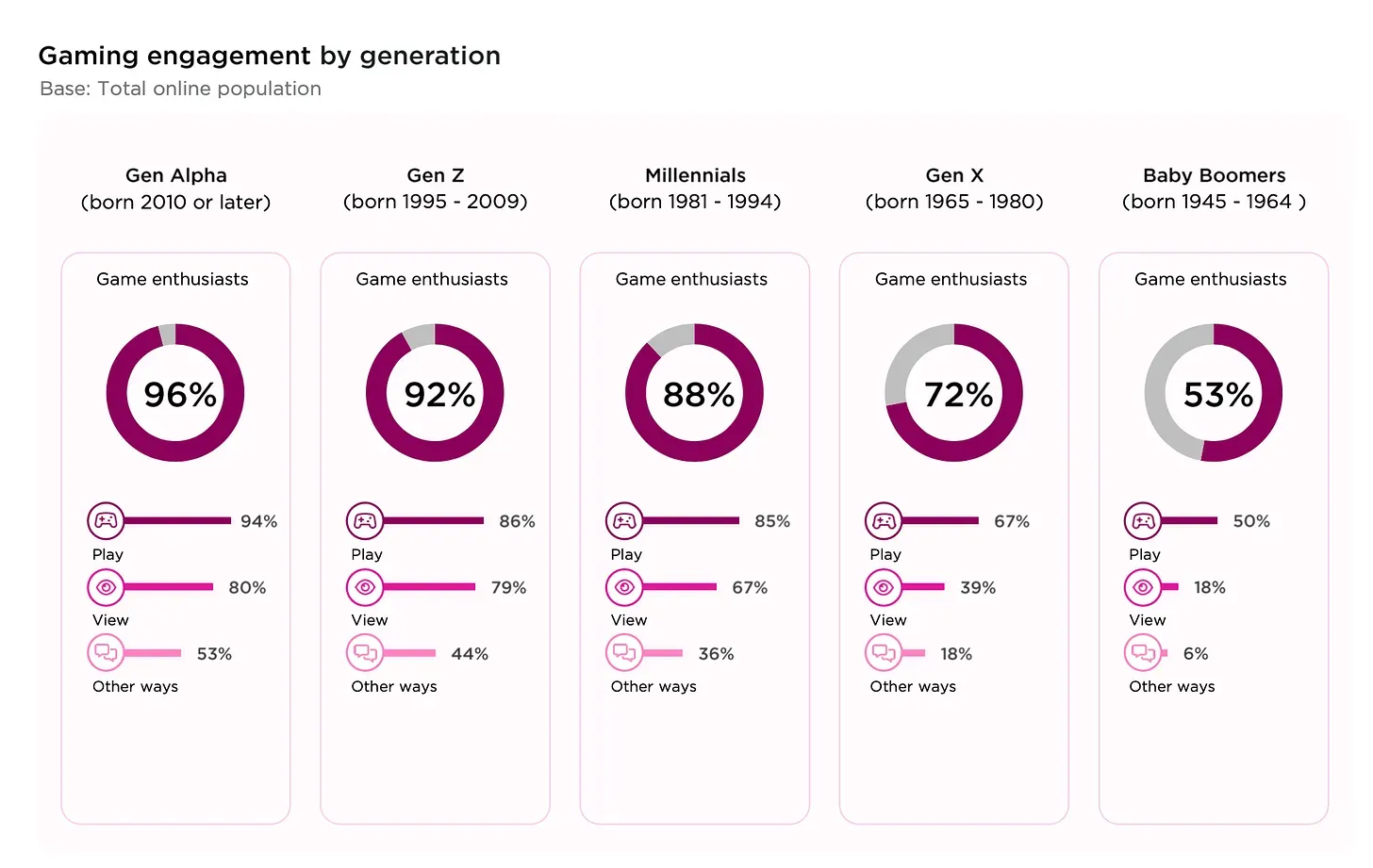

According to Newzoo, a vast majority—80% of people surveyed globally—actively play games, while 64% watch gaming content and 35% participate in gaming-related discussions or communities. Generations Alpha and Z are the most engaged, with over 90% of both age groups interacting with games in some way. Notably, Generation Alpha has become the first to spend more time playing games (5.2 hours weekly) than on social media (5.1 hours weekly), marking a shift from previous generations’ preferences.

- Gaming is firmly entrenched in global mainstream culture. Eighty percent of consumers play video games, and 85% engage with games in some form, including viewing and community activities.

- Console and PC gamers exhibit high spending behavior. PC or console players spend more on average than their mobile gamer counterparts, with a solid share of players spending more than $25 per month on gaming.

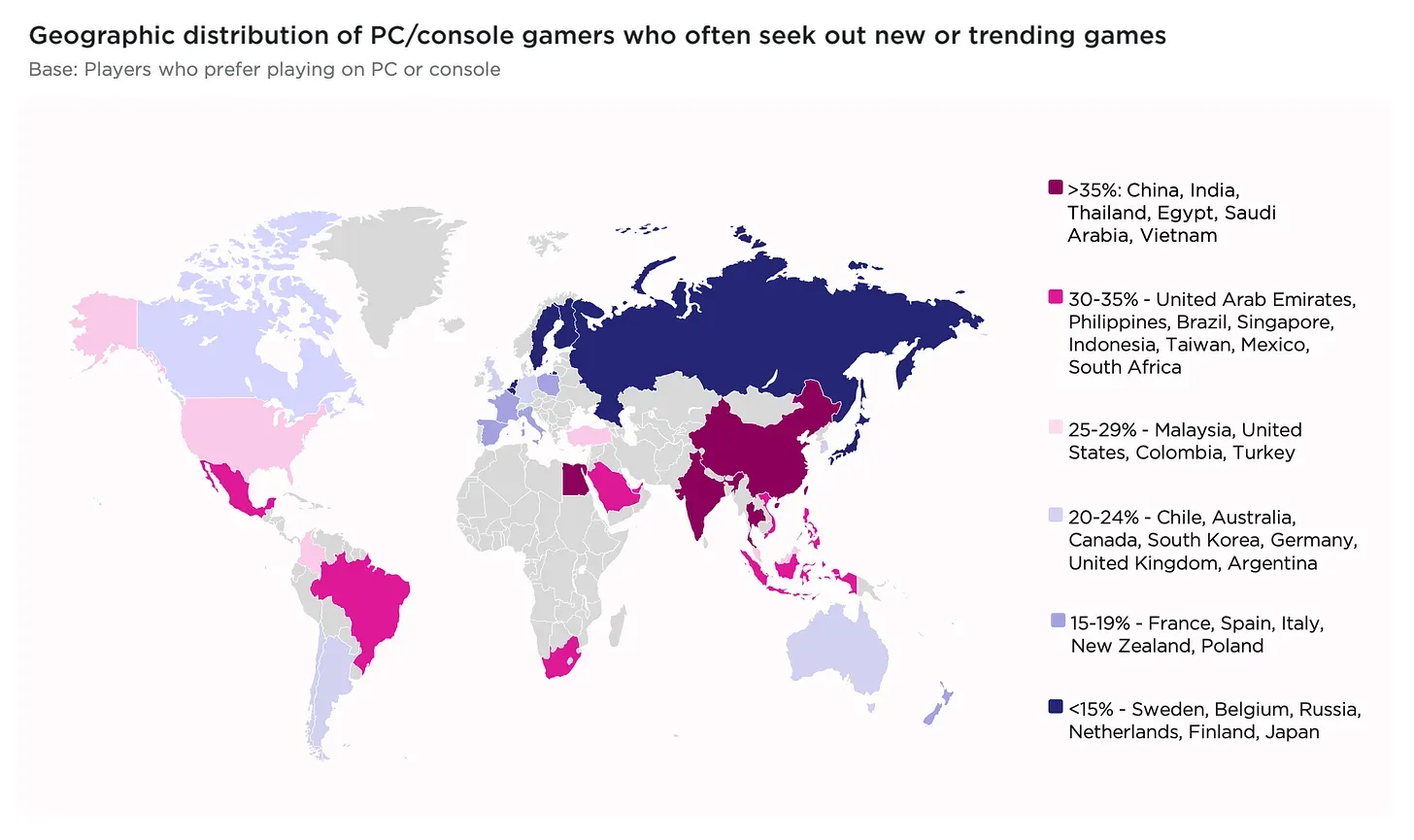

- Players around the world are hungry for the next big thing. Thirty-one percent of PC or console players often seek out new or trending games, with some regions indexing higher on that statistic than others.

Over 80% of People Play Games Globally

Popular Gaming Genres Across Generations

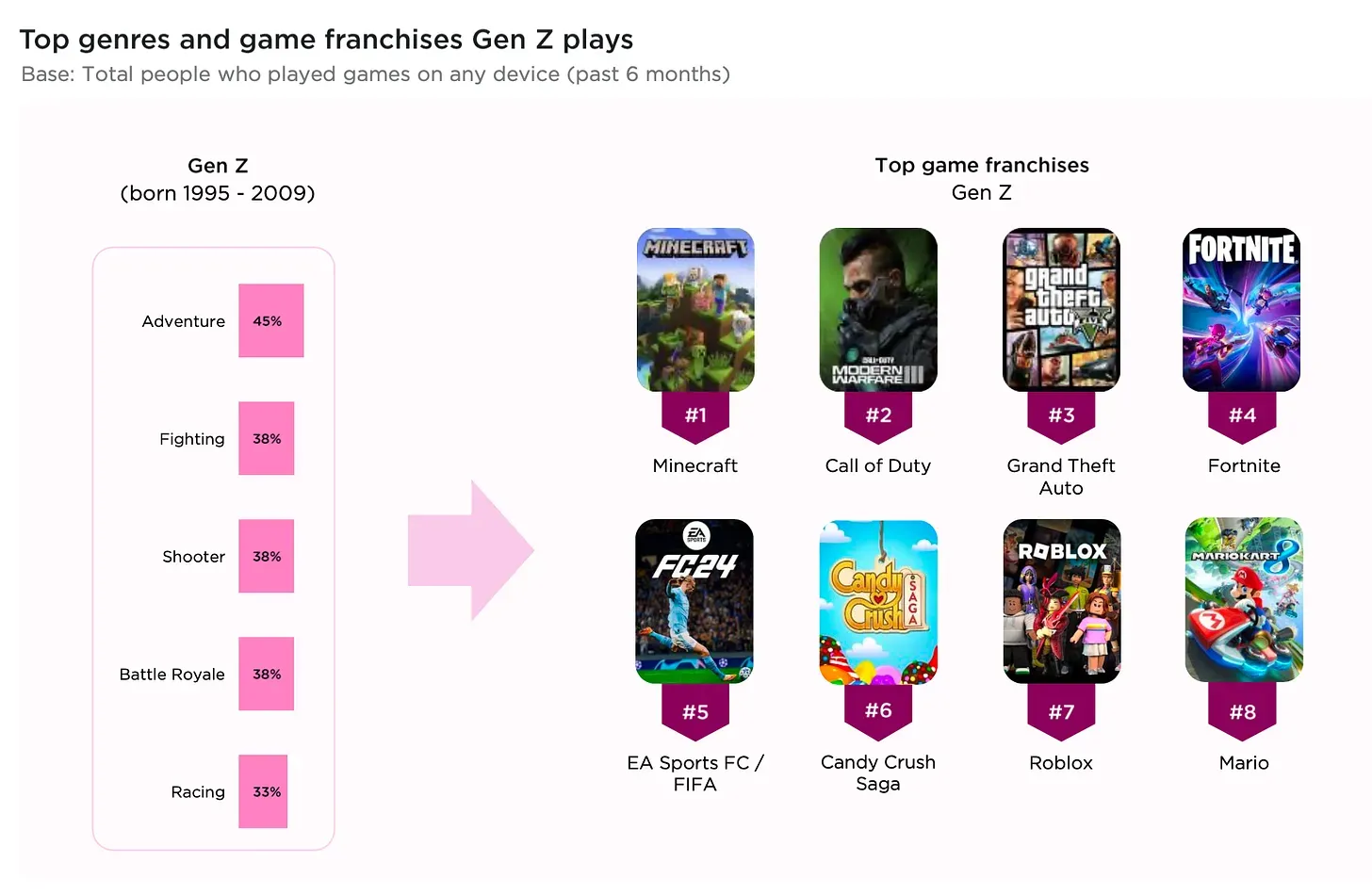

Adventure games emerge as the most popular genre among Generation Alpha, Generation Z, and millennials, while older generations tend to prefer puzzle games. Generation Z’s interests are broader, with a strong affinity for shooters and fighting games. Top game franchises for Generation Z include Minecraft, Call of Duty, and Grand Theft Auto.

Top Genres and Game Franchises Gen Z Plays

Platform Preferences and Social Engagement

Among PC and console players, specific game features drive engagement. Open-world environments (66%) and compelling narratives (65%) are highly valued, with younger players especially drawn to social features like task completion, collaborative combat, and general socialization.

While PC and console users typically play for longer periods daily—averaging 2.1 hours—mobile players game more frequently, clocking in an average of 3.4 days per week, versus 2.6 to 2.7 days for console or PC players. This distribution brings the weekly total hours for each platform close to parity.

Gaming Engagement by Generation

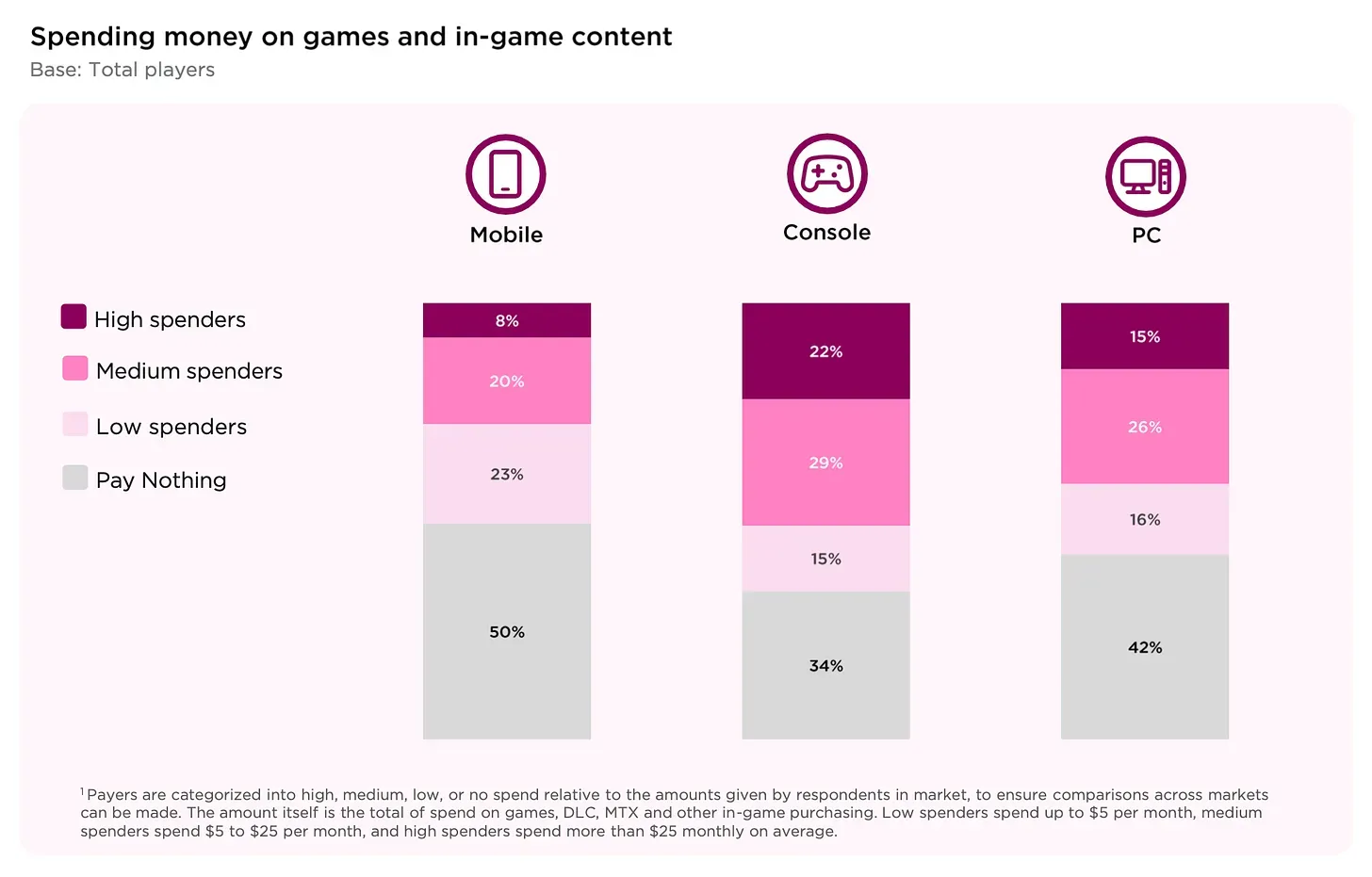

Spending Habits for PC, Console, and Mobile

Newzoo’s report also sheds light on spending behaviors across platforms, showing console players as the highest spenders, with 22% spending over $25 monthly on games, compared to 15% for PC players and just 8% for mobile users. In contrast, nearly half of mobile gamers do not spend money on games, with 71% primarily engaging with free titles, compared to 47% of PC players and 36% of console players. Despite lower spending on mobile, the percentage of female gamers willing to pay for games has increased across generations, hinting at evolving demographics within the gaming industry.

Spending Money on Games and In-Game Content

Audience Seeking New Games and Experiences

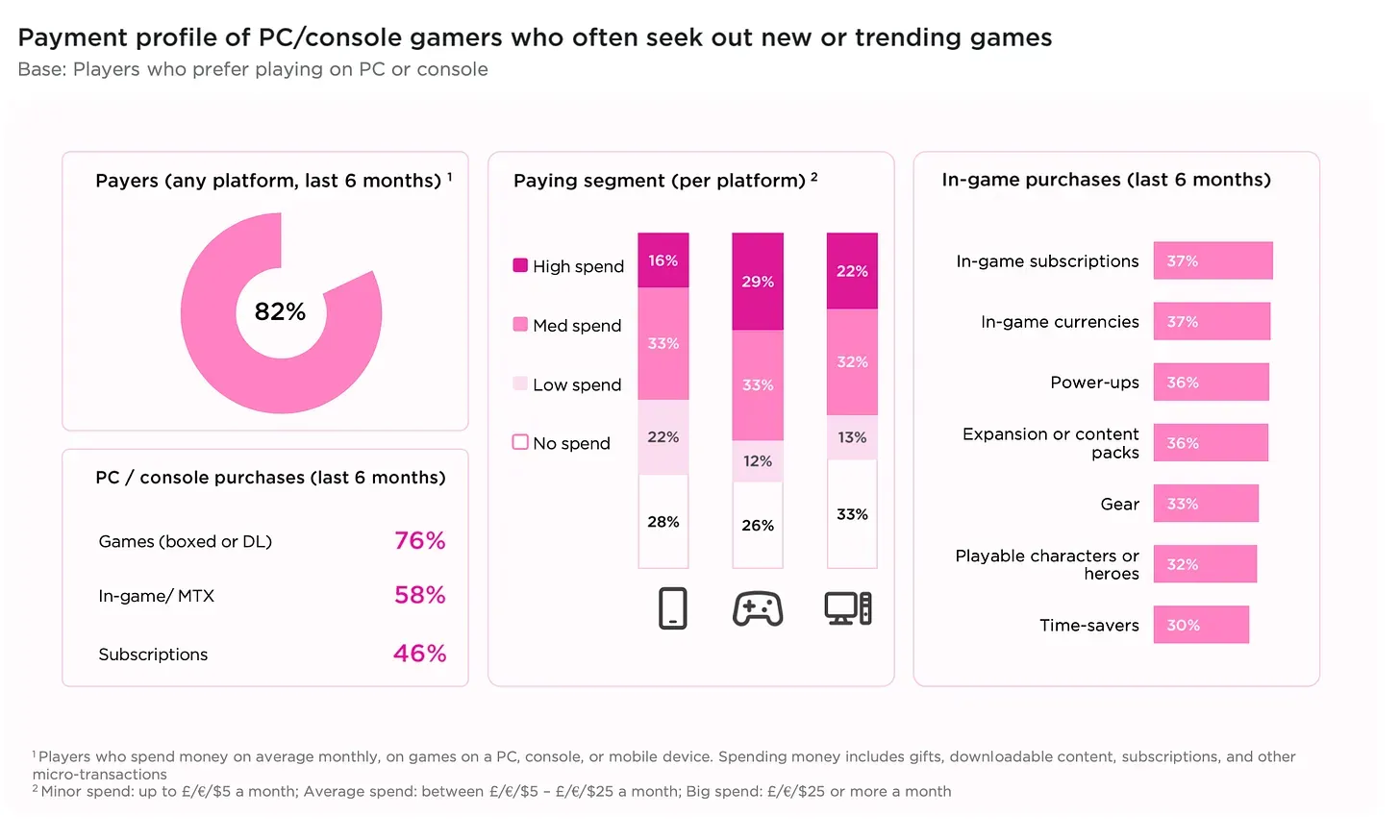

A subset of highly active players is consistently searching for new gaming titles. This audience, primarily in their late 20s, often owns multiple gaming platforms (45% have two, while one-third have three), plays nearly twice as much as the average player, and includes a 62% male majority. Adventure games are the most favored genre among these players, while graphics quality and survival elements play an important role in their gameplay preferences.

Console players dominate this high-spending segment, with 82% of these users having paid for games within the past six months. Social media also plays a crucial role for this group, with over 90% consuming gaming content and 73% interacting with the community. Instagram, YouTube, and Facebook serve as the primary social platforms for this audience, each engaging over 65% of users.

Payment Profile of PC / Console Gamers Who Often Seek Out New or Trending Games

Regional Trends and Emerging Markets

Newzoo’s findings indicate that players in emerging markets, particularly in Southeast Asia (SEA), the Middle East and North Africa (MENA), and Latin America (LATAM), show the highest receptiveness to new gaming projects. Key countries with strong interest include China, India, Thailand, Egypt, Saudi Arabia, and Vietnam, with additional interest in the UAE, Philippines, Brazil, Singapore, Indonesia, Taiwan, Mexico, and South Africa.

Geographic Distribution of PC/ Console Gamers

Relevance to Web3 Gaming

The 2024 Newzoo report underscores a fundamental shift in how different generations engage with games, revealing insights that are particularly relevant to the future of web3 gaming. Generation Alpha’s prioritization of gaming over social media, coupled with a growing appetite for immersive, community-driven, and social experiences, aligns well with the decentralized, user-focused vision of web3.

The engagement patterns among younger players—favoring open-world environments, social collaboration, and the discovery of new content—suggest that web3 gaming has the potential to resonate strongly with these audiences by offering personalized, player-owned ecosystems where gamers can interact, transact, and shape their own experiences.

Additionally, the strong interest in gaming from emerging markets highlights a substantial global audience that may be receptive to the financial inclusion, accessibility, and new earning models offered by web3. As web3 continues to evolve, these insights provide a roadmap for developing gaming experiences that cater to the next generation of players, blending entertainment, ownership, and community in ways traditional gaming has not. You can read the full report here.