A new report recently published in collaboration between Niko Partners and the Saudi Esports Federation has brought critical insights into the gaming landscape in the Middle East, particularly in the Gulf Cooperation Council (GCC) region. This region, which consists of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE, presents a unique set of opportunities and challenges for game developers, particularly in the areas of localization and cultural adaptation.

With over 420 million Arabic speakers globally, including 60 million people across the GCC, localization has become essential for tapping into this growing market. The importance of proper localization goes beyond language; it includes cultural nuances that resonate with players, enhancing user engagement and retention.

Niko Partners and the Saudi Esports Federation Report

Gaming Market in the GCC

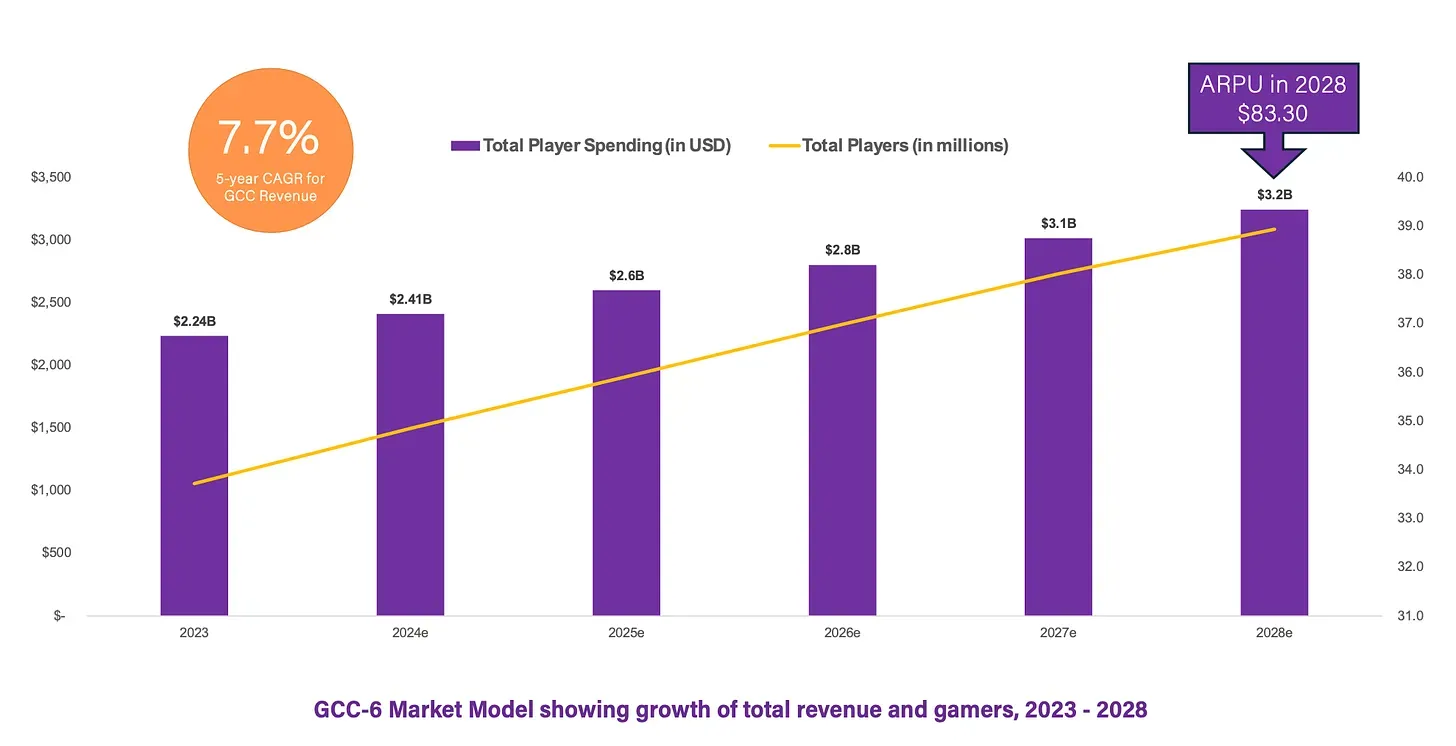

In 2023, the gaming market in the GCC countries saw significant growth. There were 33.7 million gamers in the region, contributing to a total revenue of $2.24 billion. Saudi Arabia emerged as the largest market within the region, accounting for 49.5% of the total revenue and 61.7% of the gaming population. Together, Saudi Arabia and the UAE make up nearly 80% of all gaming revenue in the region.

Niko Partners forecasts that by 2028, the gaming market in the GCC will reach $3.24 billion, with a compound annual growth rate (CAGR) of 7.7%. The number of players is expected to grow by 2.9% annually, reaching 38.9 million by 2028. The average revenue per user (ARPU) is projected to rise from $66.34 in 2023 to $83.3 in 2028.

GCC-6 Market Model Showing Growth (2023-2028)

Player Demographics and Preferences

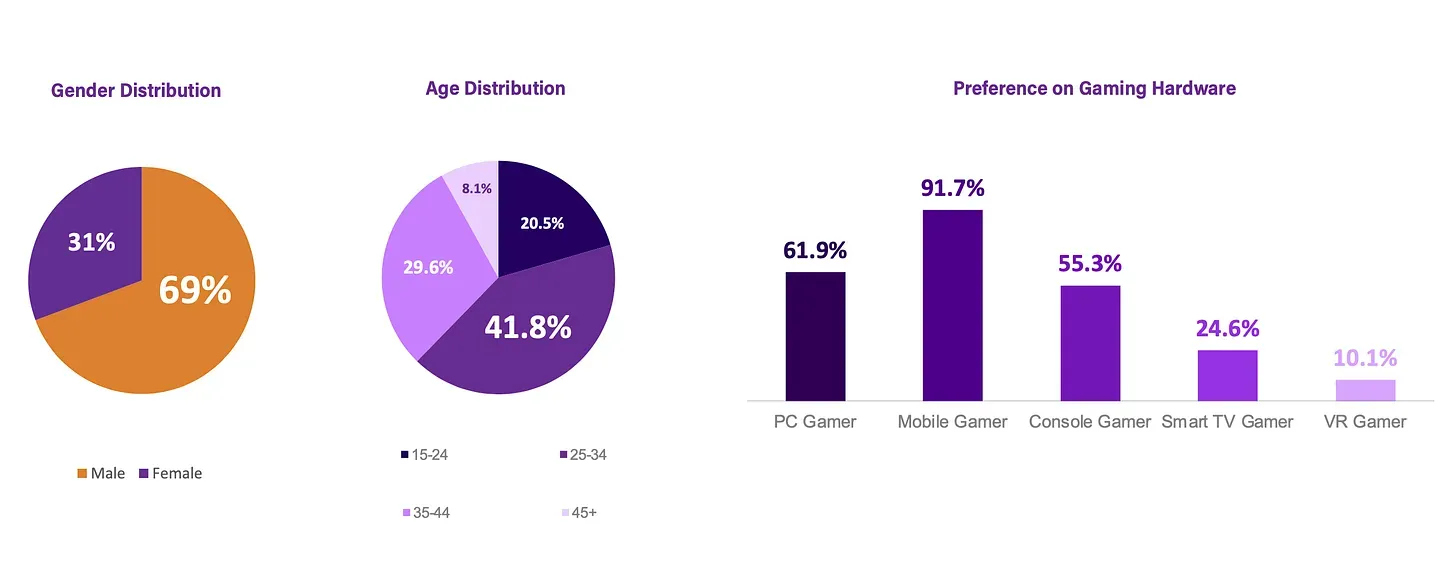

The player profile in the GCC region reflects a predominantly young and male audience. According to a survey conducted by Niko Partners in December 2023, 69% of gamers in the region are male, and 62.3% of respondents are under the age of 34. A significant majority, 91.7%, play games on mobile devices, while 61.9% also use PCs, and 55.3% play on consoles. Emerging platforms like smart TVs and virtual reality (VR) are also gaining traction, with 24.6% and 10.1% of respondents using these platforms, respectively.

Gendre Distribution and Player Preferences

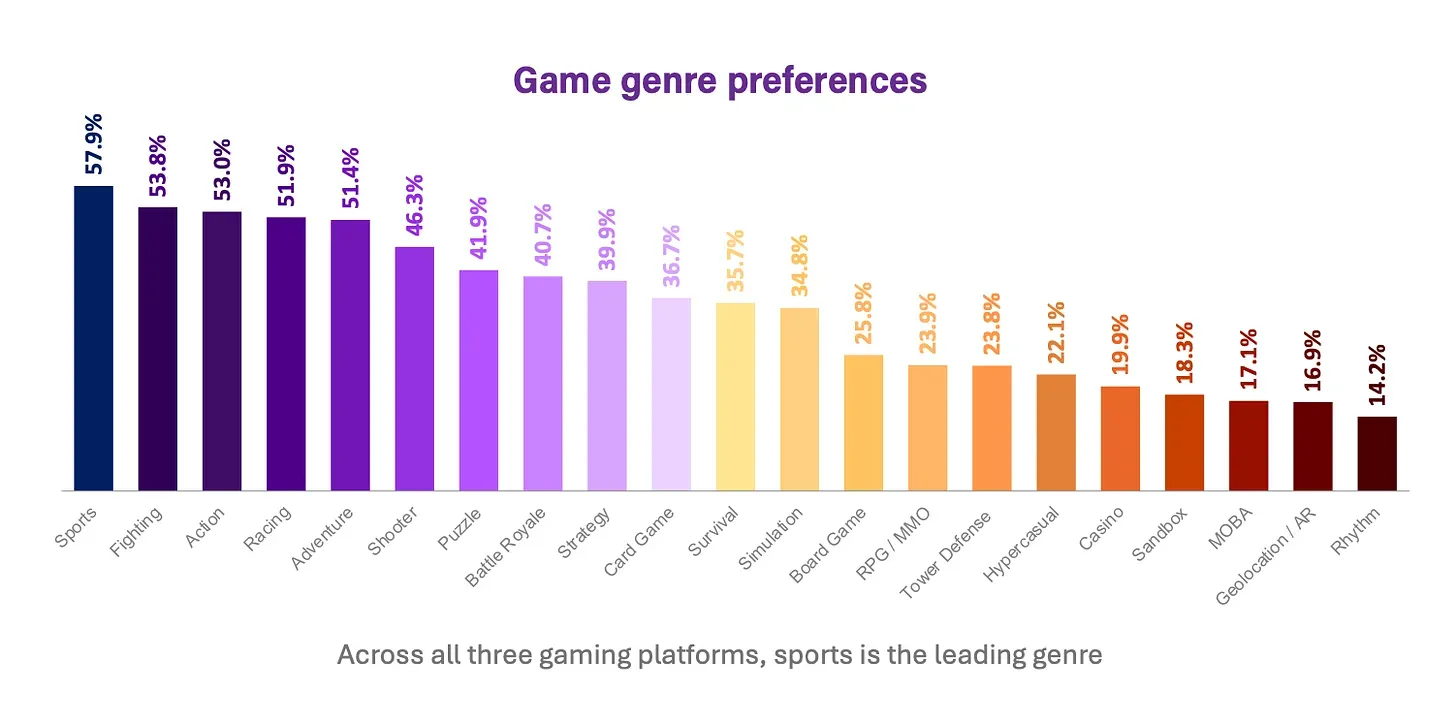

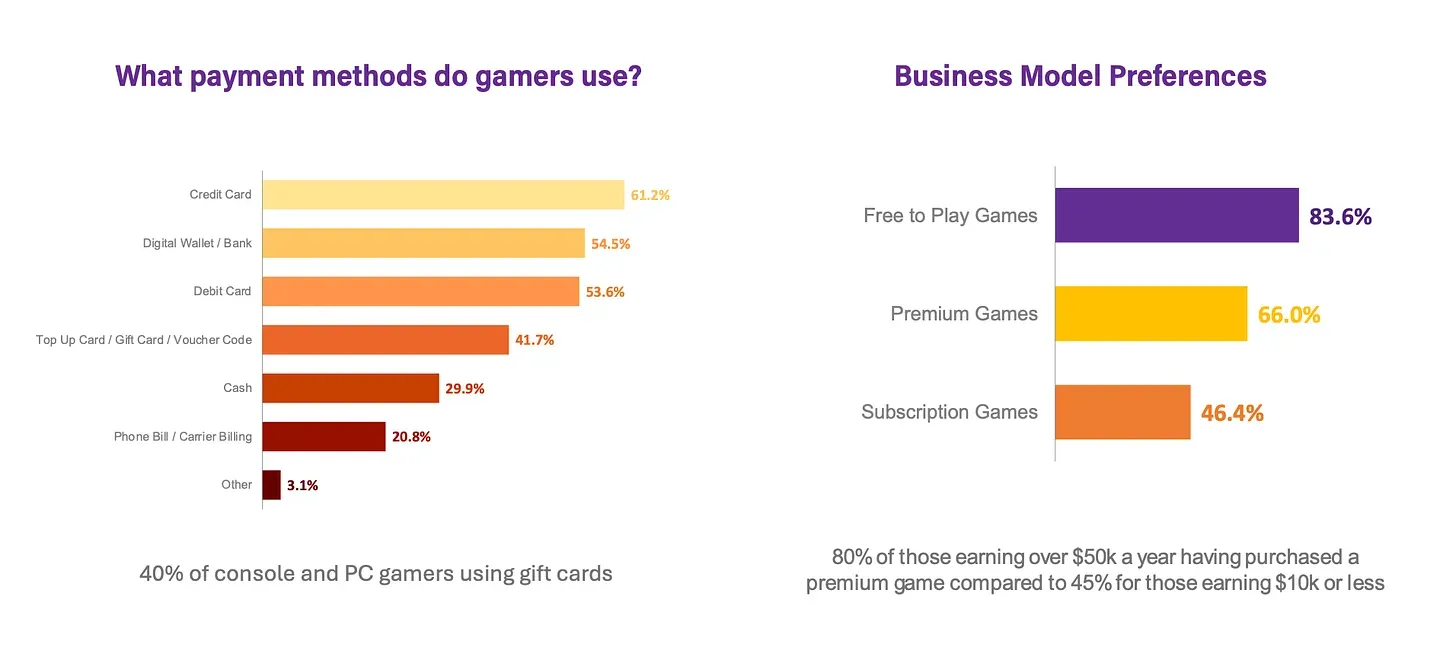

Despite the broad range of gaming platforms, the most popular genres among GCC players are sports (57.9%), fighting (53.8%), and action games (53%). Free-to-play (F2P) games dominate the market, with 83.6% of players preferring this model, followed by premium games, favored by 66% of respondents.

Game Genre Preferences

Economic Overview of Gamers

The survey also revealed insights into the economic status of players in the GCC. A majority (56.6%) of respondents earn less than $30,000 per year, while 9.4% earn over $100,000. This disparity in income has a direct impact on the types of games and payment methods used. Credit cards are the most common payment method (61.2%), followed by digital wallets (54.5%), debit cards (53.6%), and gift or top-up cards (41.7%).

Economic Overview - Payment Methods

Localization and Cultural Representation

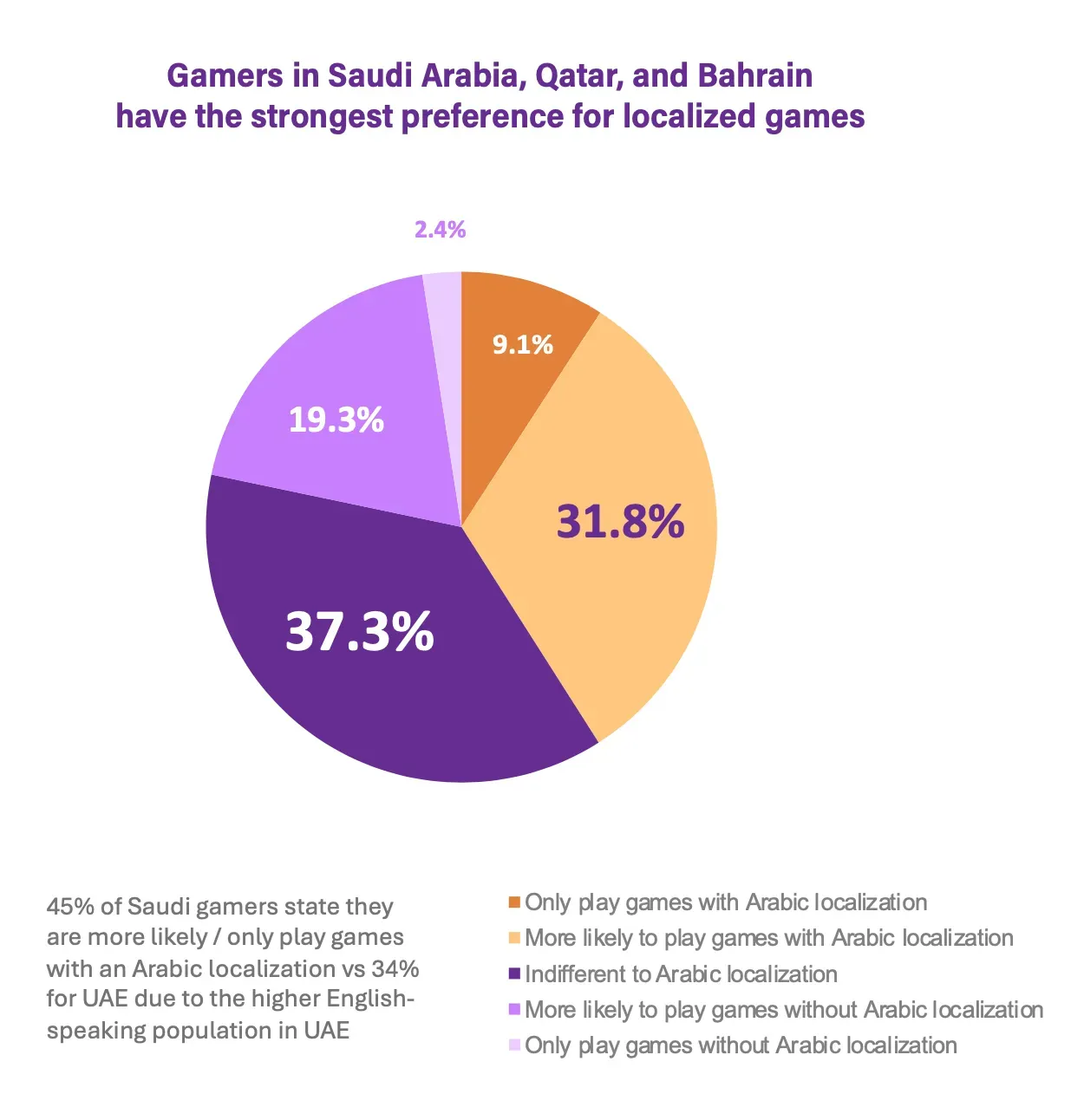

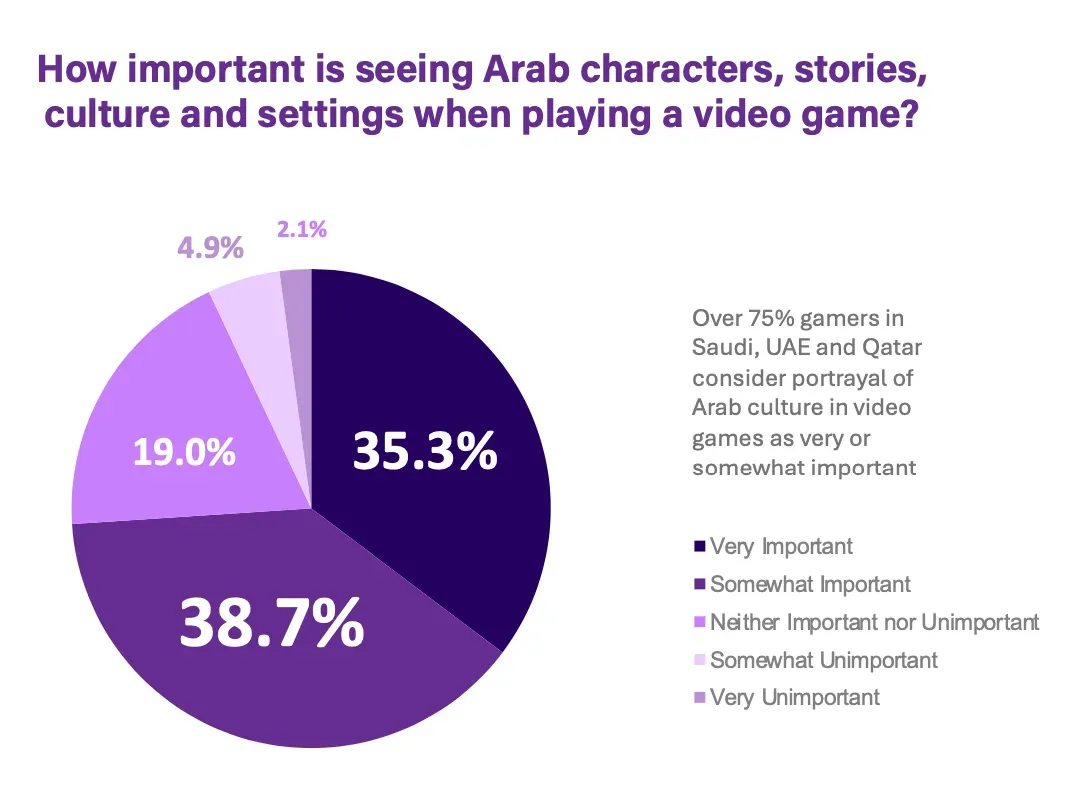

While 40.9% of players in the GCC region prioritize Arabic localization, a significant portion of players are comfortable with English. However, cultural elements are of high importance to the majority of the gaming community in the region. Approximately 75% of respondents believe that the incorporation of Arab culture into video games is essential. This cultural representation not only fosters a deeper connection with the player base but also helps developers stand out in a competitive market.

Localized Game Preferences

Future of Gaming in the GCC

As the gaming market in the GCC continues to grow, localization strategies will remain a key component of success. Developers who effectively incorporate cultural elements and tailor their games to the preferences of GCC players will be better positioned to capture and retain this expanding audience.

The partnership between Niko Partners and the Saudi Esports Federation offers game developers the insights needed to build effective strategies. The rising ARPU, coupled with increasing demand for games that reflect local culture, presents a unique opportunity for game companies looking to make a lasting impact in the region.

Importance of Arab Characters, Stories, CUlture, and Settings in Games

Final Thoughts

The GCC gaming market is poised for substantial growth in the coming years, with Saudi Arabia and the UAE leading the charge. Developers who prioritize localization, not just in language but also in cultural representation, are likely to see increased engagement and long-term success.

The report by Niko Partners and the Saudi Esports Federation provides valuable data and insights that can help shape these strategies, ensuring that game companies can effectively tap into the growing MENA market. You can read the full report here.