The global mobile market continued its upward trajectory in 2024, reaching $150 billion in in-app purchase (IAP) revenue across iOS and Google Play. According to Sensor Tower’s 2025 State of Mobile Report, this represents a 13% year-over-year increase and highlights the highest annual growth rate since 2021. This total includes revenue from in-app purchases, subscriptions, and paid apps and games. While non-gaming sectors accounted for the largest share of this growth with a 23% increase, mobile gaming also demonstrated resilience, bouncing back with a 4% rise in revenue following two years of declines.

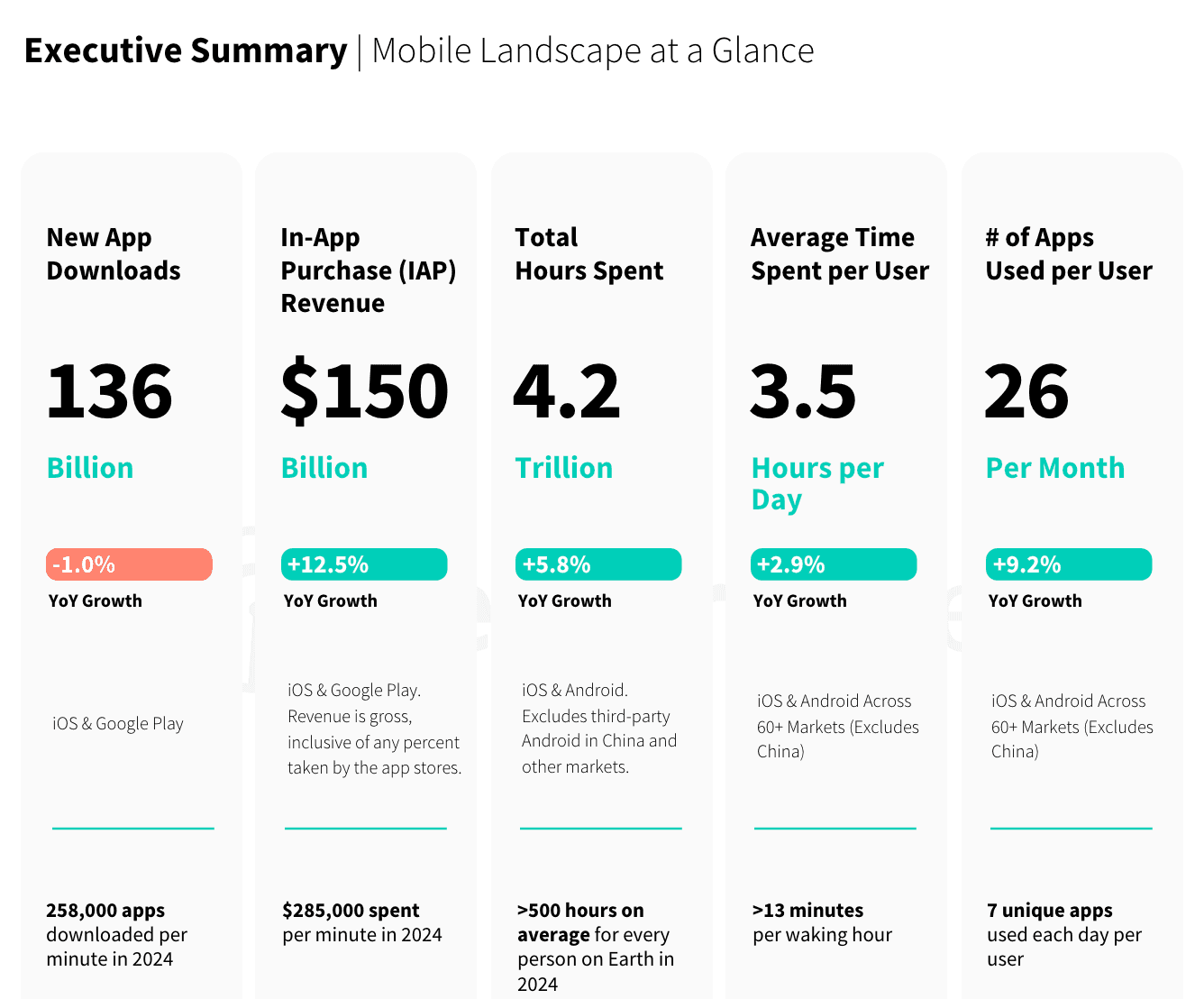

Mobile Landscape at a Glance

Over $150 Billion in Revenue

The report emphasizes the evolving strategies of app developers in monetizing their platforms. As global smartphone adoption slows and markets mature, the focus has shifted to increasing engagement and revenue from existing users. Although global app downloads remained steady at approximately 136 billion, a figure consistent since 2020, consumer spending continues to rise, driven by innovative monetization models.

Shifting Dynamics in Consumer Behavior

Consumers spent 4.2 trillion hours on mobile apps in 2024, averaging about 3.5 hours per day per user. While this represents a 5.8% increase in time spent, the growth rate has slowed compared to previous years, signaling a plateau in some markets. The report notes that digital fatigue has emerged in key regions, including the United States, Japan, South Korea, and China, where time spent on mobile devices has begun to stabilize.

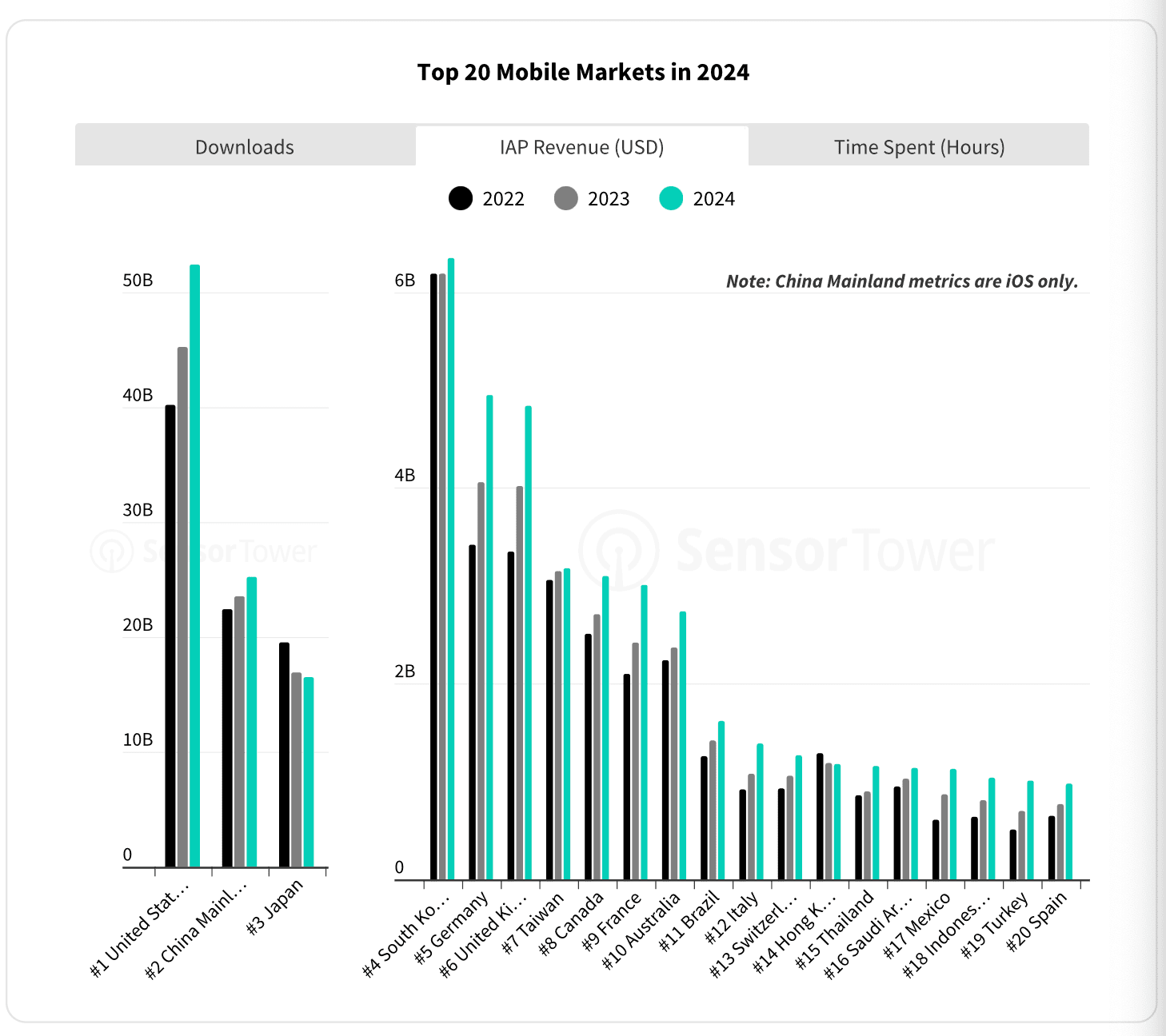

Despite these trends, the revenue potential in established markets remains robust. The United States led global IAP revenue with $52 billion in 2024, accounting for more than one-third of the global total and achieving a 16% year-over-year increase. Europe, however, outpaced the U.S. in revenue growth, with a 24% increase across major markets such as the United Kingdom, Germany, France, and Italy. These findings suggest that opportunities for monetization remain significant even as user acquisition slows.

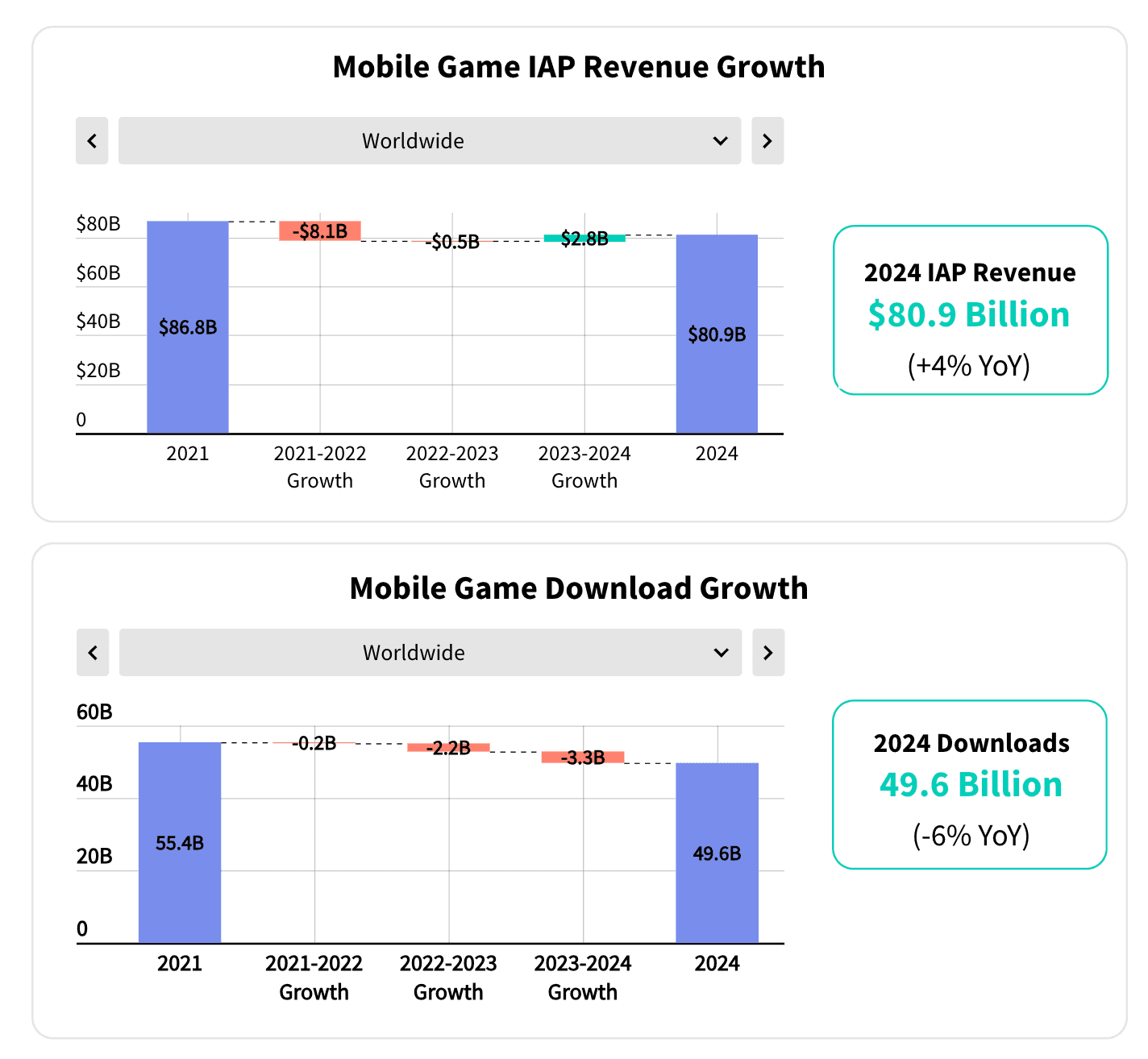

Mobile Gaming Breakdown

Resilience and Growth in Mobile Gaming

The mobile gaming sector, which has faced challenges in recent years due to inflation and regulatory changes, experienced a notable recovery in 2024. IAP revenue from mobile games climbed to $81 billion, representing a 4% year-over-year increase. While overall game downloads declined by 6% to 49.6 billion, the lowest figure since 2019, improved gaming experiences and refined monetization strategies have encouraged higher consumer spending.

Growth was particularly strong in regions such as the Americas (AMER) and Europe, the Middle East, and Africa (EMEA), while the Asia-Pacific (APAC) region, including major markets like Japan, China, and South Korea, showed a slower recovery. The report highlights the enduring appeal of mobile gaming and its capacity to adapt to changing market conditions.

Top 20 Mobile Markets by IAP Revenue

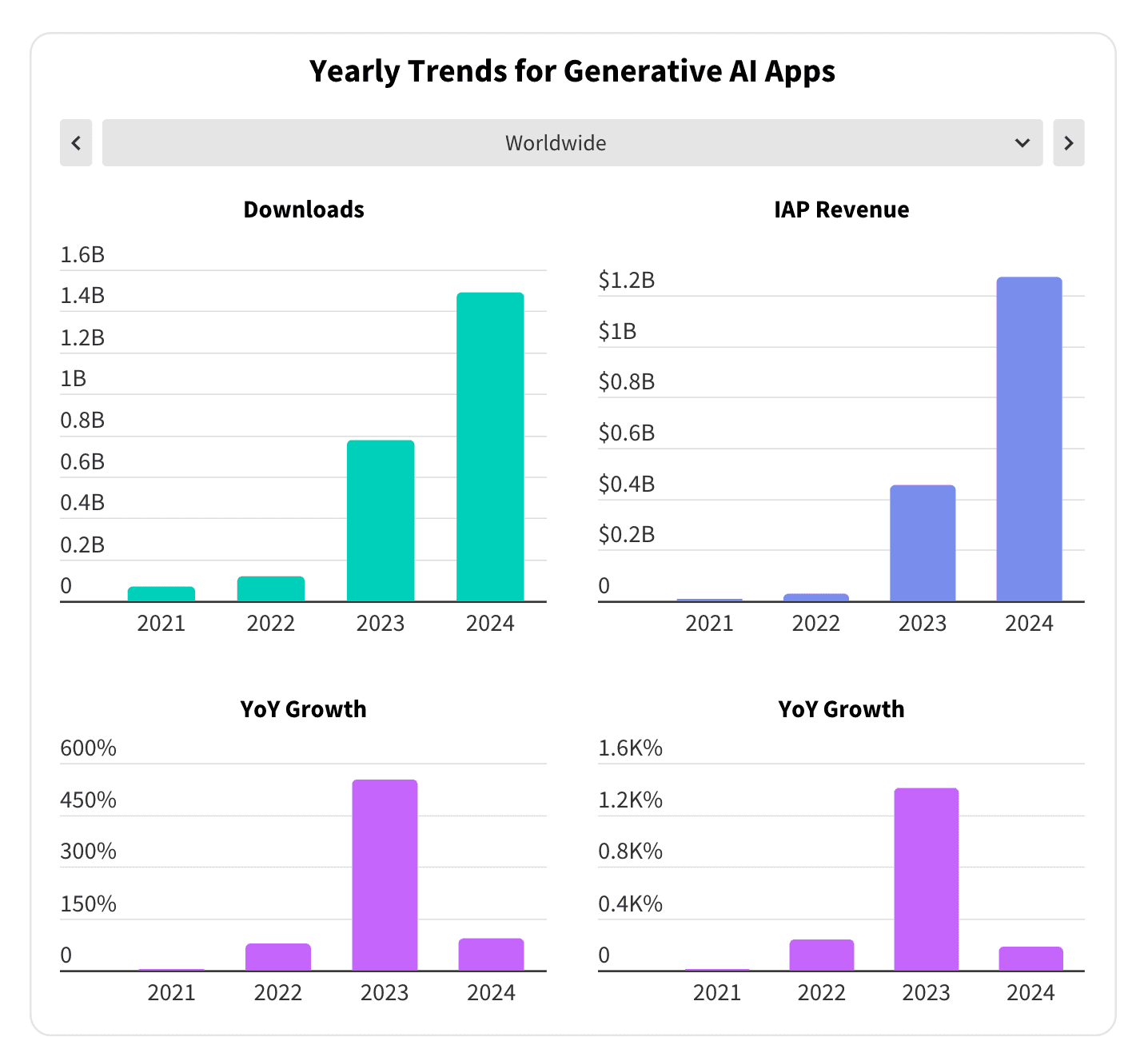

The Rise of AI in Mobile Apps

Artificial intelligence (AI) is playing an increasingly central role in shaping the mobile landscape. Revenue from AI-focused apps, including chatbots and art generators, approached $1.3 billion in 2024, with the United States accounting for 45% of this total. Other leading markets included the United Kingdom, Germany, Japan, and Canada. The popularity of generative AI apps also extended to emerging markets like Brazil, highlighting their global appeal.

Beyond dedicated AI apps, the integration of AI features across a wide range of categories underscores the technology’s growing influence. From productivity and education to lifestyle and shopping, app developers are leveraging AI to enhance user experiences and drive engagement. Major platforms such as Duolingo and Strava have incorporated AI-powered features, with many more innovations anticipated in 2025.

Trends for Gan AI Apps

Emerging Trends and Opportunities

Sensor Tower’s report also explores broader market trends that are shaping the future of mobile. Categories that connect users with in-person experiences, such as fitness, grocery, and restaurant apps, have seen significant growth as consumers seek a balance between digital and physical activities. Streaming and social media apps continue to generate substantial revenue despite slowing engagement, while cryptocurrency apps (like Telegram) have experienced a resurgence due to favorable economic conditions.

Retail competition has intensified on a global scale, with companies such as Temu and SHEIN driving innovation in the sector. These trends demonstrate the dynamic nature of the mobile market and the opportunities for businesses to adapt and thrive in a competitive landscape.

Relevance to Web3

The findings from Sensor Tower’s 2025 State of Mobile Report are particularly relevant to web3 gaming as they highlight the broader trends of resilience, innovation, and evolving monetization strategies in the mobile ecosystem. The rebound of mobile gaming revenue, despite challenges such as digital fatigue and regulatory changes, underscores the ongoing appetite for immersive gaming experiences—a demand that web3 gaming can capitalize on with its unique offerings like decentralized ownership, play-to-earn models, and enhanced player-driven economies.

Furthermore, the integration of AI features across mobile apps aligns with web3’s potential to leverage AI for personalized gameplay and dynamic, adaptive environments. As mobile markets mature, the ability of web3 gaming to engage users through community-driven ecosystems and reward mechanisms positions it as a transformative force in the next phase of mobile gaming innovation. This convergence of trends suggests that web3 gaming could become a pivotal driver of growth within the mobile sector, offering new opportunities to tap into the $150 billion global market.